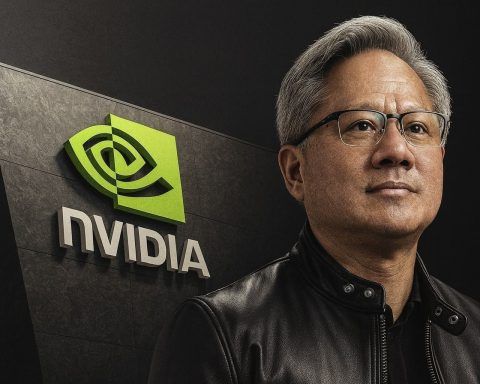

- Monday, Oct 13 Rally – U.S. stocks soared: the S&P 500 jumped +1.56%, Nasdaq +2.21%, and Dow +1.29% reuters.com. Tech and chip stocks led the charge (Nasdaq’s best one-day gain since late May reuters.com), as traders shrugged off Friday’s sell-off. Key trigger: President Trump softened his tone on China (tweeting “it will all be fine” fastcompany.com), easing fears of a trade war. Broadcom (AVGO) exploded ≈10% higher on Monday after unveiling a custom AI‐chip partnership with OpenAI reuters.com, while AMD and Nvidia also rallied. Even rare-earth and battery stocks surged on Monday (e.g. Critical Metals +36%, MP Materials +8.7%) amid bets the U.S. will shore up supply chains reuters.com.

- Tuesday’s Outlook – Early Tuesday, U.S. futures pulled back (~Dow E-minis –0.45%, S&P –0.74%, Nasdaq –0.97% reuters.com) as new U.S./China port fees rekindled trade tensions reuters.com. Traders now eye this week’s catalysts: big bank earnings (JPMorgan, Goldman, Citi, Wells Fargo report Oct 14–15 reuters.com) and Fed Chair Powell’s speech at the NABE meeting reuters.com. Those events may reveal whether tariffs are denting corporate profits.

- Speculative Frenzy – Amid the rally, CNBC’s Jim Cramer sounded the alarm that Monday’s bounce was fueled by “too many risky stocks” stockanalysis.com. He noted the rebound “gives him pause” because it’s driven by speculative names. Cramer has been warning on a host of hot stocks: he recently urged investors to “avoid buying Rivian now,” calling its grand expansion plan unsustainable ts2.tech. He’s similarly skeptical of quantum and other meme‐like stocks – labeling Rigetti’s surge pure “speculation” ts2.tech and joking that Richtech Robotics is “your speculative stock” to keep only as a small lottery ticket ts2.tech. In short, market veterans see echoes of 2000’s dot-com excess: JPMorgan’s Jamie Dimon calls current valuations “sky-high,” and many strategists warn that AI and EV hype may be overshooting the fundamentals ts2.tech ts2.tech.

- Sector Highlights – The AI and tech boom still reigns supreme. Besides Broadcom’s surge, AMD jumped ~9% Monday (extending its October rally) after revealing a multibillion-dollar AI chip deal with OpenAI ts2.tech. Morgan Stanley’s Michael Wilson and CFRA’s Sam Stovall note “AI continues to be the momentum driver,” but caution that any trade flare-up or disappointing earnings could reverse gains reuters.com fastcompany.com. Meanwhile, clean-tech and materials winners proliferated: Bloom Energy (BE) rocketed ~30% premarket on Monday after sealing a $5 billion deal to power AI data centers ts2.tech, and U.S. rare-earth miners saw another leg up on Tuesday. Even traditional industries got a boost – steelmaker Fastenal pulled back 6% after mixed earnings fastcompany.com, reminding investors that corporate reports are now in focus.

- Economic Backdrop – On Monday, the National Association for Business Economics (NABE) released its quarterly survey. Panelists raised their 2025 U.S. GDP forecast from 1.3% to 1.8% nabe.com (2026 seen ~1.7%). “Real GDP is now expected to rise 1.8% in 2025, up from 1.3%,” NABE president Emily Kolinski Morris stated nabe.com. However, inflation remains stubborn: the Fed’s preferred PCE price index is forecast at 3.0% by end-2025 (cooling only to 2.5% by late 2026) nabe.com, above the 2% target. Economists see business investment (especially in AI/data capacity) propping up growth even as tariffs bite, but jobs gains are slowing. The NABE panel now expects only one more Fed rate cut in 2025 (vs. two priced in) nabe.com, reflecting caution on sticky prices.

- Market Forecast & Analysis – With stocks near all-time highs (S&P 500 closed Monday at ~6,655 reuters.com), analysts warn of a “knife-edge” market. Technical models suggest modest upside in the near term for leaders: for example, Broadcom’s breakout past $325 opens targets toward ~$420 ts2.tech. But breadth is thin, and volatility may persist. Bank of America’s Paul Ciana and others note dismal market breadth under the surface. On Wednesday and beyond, attention will turn to Q3 earnings. Consensus expects an 8–9% earnings gain for S&P 500 companies reuters.com, but any guidance cuts could spook investors. Even AI bulls like OpenAI’s Sam Altman (who tweeted Broadcom’s chips will “unlock AI’s full potential” ts2.tech) concede that fundamentals must catch up to the hype.

- Caution Amid Optimism – The big question: is this rebound durable or a bear trap? Some strategists (like Morgan Stanley’s Michael Wilson) believe subsiding trade angst and Fed easing could sustain a “rolling recovery” into 2026 fastcompany.com. Others urge restraint. As TS2.Tech analysts note, for many high-flying names “the biggest culprit” limiting further gains has been sky-high valuations ts2.tech. AMD, for instance, has rallied nearly 100% in 2025 but trades at ~90× earnings – a level that bears warn is “overvalued” without flawless execution ts2.tech. Even with AI fueling the bull market, seasoned investors will be watching for cracks – whether in earnings or in geopolytics. In sum, Monday’s rally was impressive, but as experts like Cramer and Dimon emphasize, it’s driven by speculative euphoria as much as economic tailwinds stockanalysis.com ts2.tech. Caution and active risk management are the watchwords as markets enter this pivotal week.

Sources: Contemporary market news and analysis reports reuters.com reuters.com fastcompany.com, business news excerpts ts2.tech ts2.tech, NABE official summary nabe.com nabe.com, and financial media commentary stockanalysis.com ts2.tech ts2.tech ts2.tech ts2.tech. Expert quotes cited as given in source texts. All stock prices and forecasts as of Oct. 14, 2025.