Key Facts (as of 6 Oct 2025)

- Stock price and valuation – Verizon Communications Inc. (NYSE: VZ) closed at $43.67 on 3 Oct 2025 and traded around $43.59 in pre‑market trading on 6 Oct 2025stockanalysis.com. Year‑to‑date, the stock was up ~9%, but still ~7.8% below its 52‑week high ($47.36) and ~16% above its 52‑week low ($37.59)tickernerd.com. Verizon’s price‑to‑earnings ratio of 10.1× remained below both the telecom industry average (~17×) and peers (~24.4×)simplywall.st, suggesting a discount relative to industry valuations.

- Financial performance – Verizon reported Q2 2025 revenue of $34.5 billion (+5.2% YoY) and net income of $5.1 billion with GAAP EPS of $1.18 and adjusted EPS of $1.22news.alphastreet.com. The company raised its free‑cash‑flow forecast to $19.5–20.5 billion and guided 1–3% adjusted EPS growthnews.alphastreet.com. Q1 2025 revenue was $33.5 billion (+1.5% YoY) with net income $4.88 billion and adjusted EPS $1.19news.alphastreet.com.

- Dividend – On 5 Sep 2025, Verizon raised its quarterly dividend 1.8% to $0.69 per share, its 19th consecutive annual increase, implying an annual dividend of $2.76 and a yield around 6.2% based on trading pricesmorningstar.com.

- Analyst ratings – Out of 26 Wall Street analysts tracked by TickerNerd, 12 rated VZ “buy,” 14 “hold” and none “sell,” with a median price target of $48 (range $42–$58) implying ~9.9% upsidetickernerd.com. Analysts from RBC (Sector Perform) raised their target to $46, citing stronger free cash flow and cost efficienciesinvesting.com; JPMorgan raised its target to $49, while Goldman Sachs maintained a $52 “buy” targetinvesting.com.

- Credit rating – Fitch rated Verizon A‑ (long‑term) and F1 (short‑term) as of 18 Aug 2025

fitchratings.com, reflecting strong credit quality but acknowledging high debt from spectrum purchases and pending acquisitions.

- Leadership change – On 6 Oct 2025, Verizon’s board appointed Dan Schulman, former PayPal CEO and Verizon director, as its new Chief Executive Officer. Hans Vestberg stepped down to become a special adviser until Oct 2026verizon.com. Reuters highlighted that Schulman will guide Verizon through slowing wireless growth and increasing competition while continuing heavy 5G and fiber investmentsreuters.com.

Recent News and Strategic Moves (late Sept – 6 Oct 2025)

CEO Transition & Board Leadership

Verizon surprised markets on 6 Oct 2025 by replacing CEO Hans Vestberg with Dan Schulman effective immediately. Vestberg, who had led Verizon since 2018, will remain on the board and serve as special adviser until Oct 2026verizon.com. Schulman’s appointment reflects the board’s desire for new leadership as Verizon integrates significant acquisitions and responds to fierce competition. In its news release, Verizon lauded Schulman’s success at PayPal, where he tripled revenue and guided the company’s digital payments expansionverizon.com. Reuters noted that investors reacted positively, with shares up ~1.3% in pre‑market tradingreuters.com.

Frontier Communications Acquisition

Verizon agreed in 2024 to acquire Frontier Communications for $20 billion in cash plus debt assumptionreuters.com. The deal combines Frontier’s 2.2 million fiber subscribers with Verizon’s 7.4 million, enhancing scale in fiber broadband and giving Verizon access to Frontier’s 7‑gig service and rural footprintreuters.com. The U.S. Federal Communications Commission approved the acquisition in May 2025 after Verizon agreed to scrap diversity, equity and inclusion policies; the FCC said the merger would unleash billions in new infrastructure builds and allow Verizon to deploy fiber to >1 million homes annuallyreuters.com. The deal is expected to close in early 2026reuters.com.

5G & Network Initiatives

- Private 5G networks: In June 2025, Verizon Business won a contract with Thames Freeport in the UK to deploy multiple private 5G networks covering major ports and Ford’s Dagenham plant. Private 5G will support AI‑driven analytics, predictive maintenance, autonomous vehicles and logistics. Nokia provides hardware and software for the projectreuters.com.

- Innovation sessions & network slicing: A September 2025 Telecom Review Americas article said Verizon’s business innovation sessions highlighted 5G network slicing, global IoT and next‑generation wireless. Analyst Gregg Willsky noted Verizon’s 5G slicing offer had >100,000 users, while a first responder slicing offer launched in April 2025 had over 25 engagements in 13 statestelecomreviewamericas.com. Willsky emphasized that Verizon’s strong network and security capabilities position it well to support enterprise digital transformationtelecomreviewamericas.com.

- Ray‑Ban Meta AI glasses: Verizon partnered with Meta to launch Ray‑Ban Meta Display glasses with an in‑lens full‑color display and AI features like translation, navigation and hands‑free calls. The glasses can be controlled via the Meta Neural Band and will be sold exclusively through Verizon stores starting Fall 2025verizon.com. PhoneArena and StockTitan noted the glasses’ $799 price and said Verizon’s partnership underscores its ambition in wearable AIphonearena.comstocktitan.net.

- Tampa Police ‘Connected Officer’ program: StockTitan reported that Verizon supplied over 950 5G Ultra Wideband smartphones to Tampa’s police department, creating a secure network of city‑issued devices loaded with law‑enforcement apps. The program aims to improve communication, situational awareness and hurricane resilience while avoiding use of personal phonesstocktitan.net.

- Network reliability: TS2.tech highlighted that Verizon experienced its third nationwide outage in 2025 on Aug 30, leaving many phones showing “SOS only” for ~9 hoursts2.tech. The incident raised calls for stronger oversight and underlined the importance of network resiliency.

Mergers & Spectrum Auctions

- Spectrum acquisitions: CRN reported that Verizon planned to buy U.S. Cellular’s spectrum licenses for $1 billion to bolster its network after the Frontier dealcrn.com. The carrier is also rumored to be exploring a purchase of EchoStar’s AWS‑3 spectrum; a Morningstar Global News article noted EchoStar shares jumped after Bloomberg reported such talksmorningstar.com.

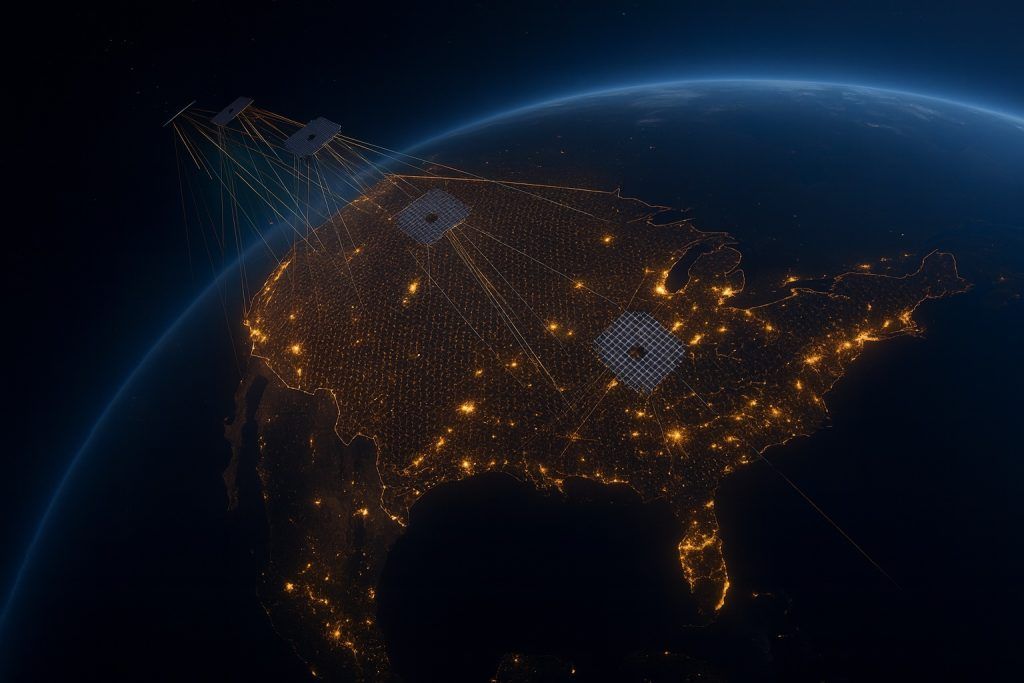

- Satellite competition: TS2.tech observed that 1.8 million users preregistered for T‑Mobile and SpaceX’s satellite‑based cell service launching Oct 1, with ~20% coming from Verizon or AT&T customersts2.tech. Verizon and AT&T petitioned the FCC to restrict power limits for satellite‑cellular services due to interference concernsts2.tech, highlighting competition from space‑based connectivity.

AI & IoT Investments

- Verizon has been actively investing in IoT and artificial intelligence. The Telecom Review session highlighted that the global IoT market could grow from 1.3 billion connections in 2024 to 3.6 billion in 2030, with satellite IoT reaching 22.7 million connections at a 12% CAGRtelecomreviewamericas.com. Verizon’s robust network and security make it a key enabler of this growthtelecomreviewamericas.com.

- The Ray‑Ban Meta AI glasses partnership signals Verizon’s entry into AI wearables, broadening its consumer offerings and aligning with Meta’s emphasis on wearable computingverizon.com.

Financial Performance & Outlook

Q2 2025 Results and Q3 Preview

Verizon’s Q2 2025 results beat expectations. Revenue of $34.5 billion grew 5.2% year‑on‑year as wireless service revenue rose 2.2% to $20.9 billionnews.alphastreet.com. Net income reached $5.1 billion with $1.22 adjusted EPS, up 3.4% YoYnews.alphastreet.com. Verizon raised its free‑cash‑flow guidance to $19.5–20.5 billion and expected 1–3% adjusted EPS growthnews.alphastreet.com. The company added 278,000 fixed wireless broadband customers and 65,000 wireless retail postpaid net additions (42,000 of which were postpaid phone additions), though business revenue fell 0.3%crn.com.

Analysts viewed the results favorably. MarketWatch noted that shares jumped 5.2% after Verizon boosted its free‑cash‑flow outlook and emphasised that sustained subscriber growth must align with its financial framework focusing on service revenue, free cash flow and EBITDAmorningstar.com. CRN compared Verizon to AT&T, noting that while both carriers experienced business revenue declines, Verizon’s fixed‑wireless broadband momentum and its pending Frontier acquisition positioned it to extend its fiber footprintcrn.com.

Balance Sheet and Credit

Verizon continues to carry high debt from its C‑band spectrum purchases and pending Frontier acquisition, but Fitch Ratings maintained an A‑ long‑term rating, citing predictable cash flows and disciplined financial policyfitchratings.com. The Frontier deal includes assuming $11.25 billion of Frontier’s debt and paying $38.50 per share—a 37% premium—prompting concerns about leveragereuters.com. Verizon countered by raising free‑cash‑flow guidance and targeting cost efficiencies to preserve dividend payments, which remain a priority.

Dividend Sustainability

The 1.8% dividend hike to $0.69 per share in Sep 2025 marked Verizon’s 19th annual increase and underscores management’s confidence in its cash‑flow generationmorningstar.com. With a yield exceeding 6% and a payout ratio around 55%, the dividend is a key attraction for income investors. Analysts caution that high leverage and capital expenditure requirements for 5G and fiber could limit future increases.

Analyst Opinions & Forecasts

- Undervalued Stock? Simply Wall St’s discounted cash‑flow model valued Verizon at ~$134.86 per share, implying a 67.6% discount to the Oct 3 price of $43.67simplywall.st. They noted that Verizon’s low PE ratio (10.1×) vs. peers (24.4×) suggests undervaluationsimplywall.st.

- Analyst ratings – As of Oct 6 2025, Wall Street sentiment was moderately positive with no sells and a median price target of $48tickernerd.com. RBC raised its target to $46 citing cost efficiencies and a higher free‑cash‑flow outlookinvesting.com. JPMorgan raised its target to $49, while Goldman Sachs maintained a $52 “buy” target, expecting improved earnings growthinvesting.com. UBS and KeyBanc kept neutral/sector‑weight ratings. Morningstar’s fair value estimate (not accessible via citation but widely reported) is ~$82.

- Credit – Fitch’s A‑ rating signals confidence but warns that additional debt from acquisitions could pressure leverage

fitchratings.com.

Peer Comparison

AT&T and T‑Mobile

- AT&T vs Verizon – A MarketWatch article noted that AT&T’s stock traded at its highest premium to Verizon in nearly two decades. Barclays downgraded AT&T to hold because its valuation left little upside relative to Verizon and the telecom sectormorningstar.com. CRN reported that AT&T’s Q2 2025 revenue grew 3.5% and that it was acquiring Lumen’s fiber business for $5.75 billioncrn.com. Both carriers face declining business service revenue, but Verizon’s fixed‑wireless broadband growth and pending Frontier acquisition may provide greater scale.

- T‑Mobile & satellite competition – T‑Mobile’s partnership with SpaceX’s Starlink to deliver satellite‑cellular service drew 1.8 million preregistrants (20% from Verizon or AT&T), highlighting consumer interest in new connectivity modelsts2.tech. Verizon petitioned the FCC to limit power for satellite‑cellular networks due to interference concernsts2.tech. While T‑Mobile leads in subscriber growth, Verizon’s strategy emphasizes network quality, fixed‑wireless broadband and enterprise services.

Cable & Other Competitors

Comcast and Charter continue to steal wireless customers via their mobile virtual network operator (MVNO) offerings over Verizon’s network. The Frontier acquisition aims to reclaim some lost broadband share by adding fiber capacity in rural markets.

Strategic Outlook & Risks

Opportunities

- Integration of Frontier and spectrum acquisitions will expand Verizon’s fiber footprint to roughly 10 million subscribers and provide additional C‑band and 850 MHz spectrum. The deal should enable Verizon to compete more effectively with cable operators and T‑Mobile in both urban and rural broadband markets.

- 5G private networks, network slicing and IoT services offer high‑margin revenue opportunities in enterprise markets. Contracts like the Thames Freeport project, the Tampa connected officer program and global IoT initiatives could grow Verizon’s business segment once integration is complete.

- AI wearables and consumer innovation – Partnering with Meta to sell Ray‑Ban AI glasses positions Verizon as a conduit for future wearable computing products. Such partnerships diversify consumer revenue beyond traditional wireless plans.

Risks

- High leverage & capital needs – The Frontier acquisition and spectrum purchases elevate debt levels. Fitch warns that additional borrowings could pressure credit metrics

fitchratings.com. Debt reduction will depend on free‑cash‑flow growth and cost discipline.

- Competitive pressure – T‑Mobile’s aggressive pricing and satellite strategy threaten market share. Cable companies offering mobile bundles via Verizon’s network create further pressure. AT&T remains a formidable competitor with its own fiber expansions.

- Regulatory & DEI issues – The FCC’s approval of the Frontier deal required Verizon to abandon diversity, equity and inclusion programsreuters.com, sparking criticism from stakeholders and potential reputational risk. Additionally, recurring network outages highlighted by TS2.tech illustrate operational vulnerabilities that could draw regulatory scrutinyts2.tech.

Conclusion

As of 6 Oct 2025, Verizon Communications stands at a crossroads. A historic CEO transition places Dan Schulman at the helm just as the company embarks on its biggest acquisition since the early 2000s. Financially, Verizon delivered solid Q2 results, raised its free‑cash‑flow outlook and increased its dividend, reinforcing its attractiveness to income investors. Yet the stock still trades at a discount relative to peers, partly because heavy capital spending and high leverage leave limited flexibility. Strategically, Verizon is investing in 5G, fiber, AI and IoT to defend and expand its customer base. Success will hinge on integrating Frontier’s network, maintaining network reliability and out‑innovating competitors like T‑Mobile and cable operators. With a robust dividend, improving free cash flow and an undervalued valuation, Verizon could offer investors a balanced mix of income and potential capital appreciation. However, the path forward is not without risks, making careful monitoring of execution, regulatory developments and competitive dynamics essential.

In summary, the report offers a thorough snapshot of Verizon’s position as of October 6, 2025, highlighting a resilient financial performance with revenue growth and a boosted free‑cash‑flow outlook despite industry pressuresnews.alphastreet.com. The surprise appointment of Dan Schulman as CEO, combined with a 19th consecutive dividend increase, signals confidence in future strategy while acknowledging the leverage risks tied to the ambitious $20 billion Frontier acquisitionverizon.commorningstar.com.