- On June 26, 2025 at Automatica 2025 in Munich, Cyngn demonstrated its DriveMod Stockchaser Gen 4 and other vehicles on NVIDIA’s Isaac platform alongside NVIDIA engineers.

- NVIDIA’s blog post named Cyngn among “a handful of robotics innovators” integrating Isaac Sim for large-scale virtual testing.

- Cyngn’s chief executive Lior Tal framed the collaboration as validation of its autonomous-vehicle mission.

- On June 26, 2025, Cyngn shares jumped to USD 29.25 within 15 minutes, a 483% intraday rise, with more than 44 million shares traded.

- On June 24, 2025, Cyngn closed at USD 5.01 as the NVIDIA blog post went live.

- Cyngn has about 11 million freely tradable shares, amplifying swings from modest inflows.

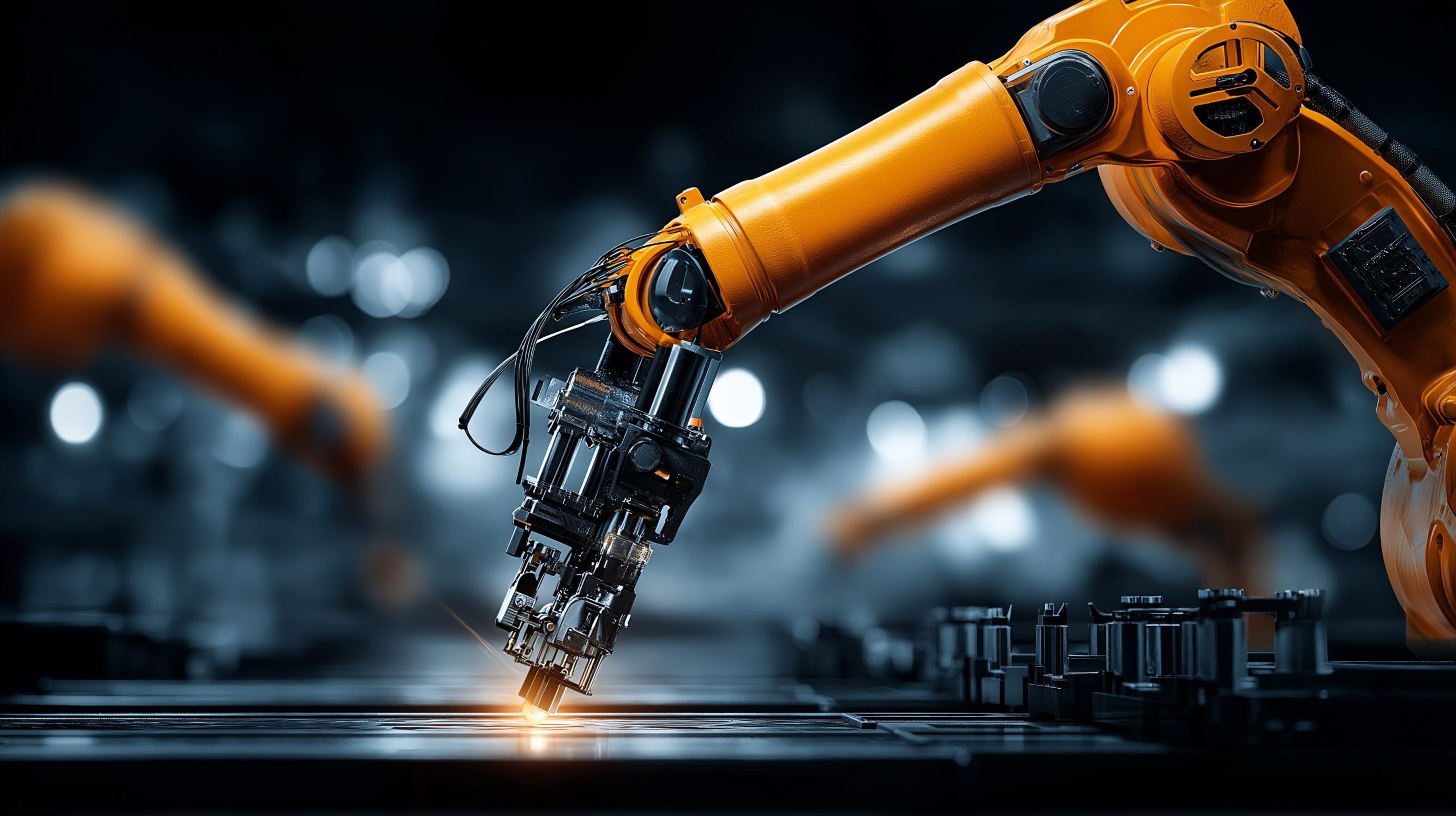

- DriveMod Stockchaser Gen 4 converts a Motrec MT-160 tugger into a 12,000-lb autonomous hauler, and Isaac Sim accelerates virtual safety validation, shaving 70% off field-testing time.

- DriveMod includes a Forklift that retrofits BYD Class I trucks for pallet-agnostic lifts, with Jetson AGX Orin handling perception and Isaac Lab fine-tuning controls.

- Cyngn’s 22nd U.S. patent, No. 12,246,733, covers a cloud-offloaded autonomy stack that cuts on-board compute cost by 40%.

- The global autonomous-vehicle market is projected to grow from USD 68 billion in 2024 to USD 214 billion by 2030, with North American revenue forecast to reach USD 74 billion by 2030.

Cyngn Inc.’s one‑paragraph press release announcing a showcase of its DriveMod‑powered autonomous vehicles on NVIDIA’s Isaac robotics platform at Automatica 2025 set off a chain reaction: the stock rocketed as much as 483 % in a single session, trading volume smashed annual records and analysts suddenly began to treat the once‑obscure firm as a credible contender in industrial autonomy. This report reconstructs how the news broke, why the market responded so violently, what the technical collaboration actually entails and where the company fits inside a rapidly expanding global autonomous‑vehicle market forecast to exceed USD 214 billion by 2030. timesofindia.indiatimes.com m.economictimes.com cyngn.com blogs.nvidia.com stocktitan.net tipranks.com 1

1. Breaking the News: From Booth to Blog to Wall Street

Cyngn’s 26 June press release, issued from Automatica 2025 in Munich, confirmed that its fourth‑generation DriveMod Stockchaser and other vehicles would be demonstrated on the show floor alongside NVIDIA engineers. cyngn.com Within hours, NVIDIA expanded the announcement with a detailed blog post naming Cyngn among “a handful of robotics innovators” integrating Isaac Sim for large‑scale virtual testing. 2

The company’s chief executive, Lior Tal, framed the tie‑up as validation rather than a one‑off cameo:

“This collaboration with NVIDIA helps reinforce our mission to build cutting‑edge autonomous vehicles that deliver real‑world ROI to industrial operators.” cyngn.com 3

2. Market Whiplash: Anatomy of a 500 % Intraday Rally

2.1 Timeline of the Surge

- Tuesday, 24 June — NVIDIA blog post goes live; Cyngn closes at USD 5.01. 2

- Late Wednesday — social‑media chatter escalates; pre‑market volume builds. 4

- Thursday open, 26 June — shares gap to USD 29.25 within 15 minutes, a 483 % spike on >44 million shares (vs. 30 k three‑month average). 5

- Session high — +500 % before closing on a still‑staggering +345 % print recorded by MarketWatch’s real‑time tape. 6

2.2 Drivers Behind the Move

- NVIDIA “halo effect.” Prior episodes (e.g., Navitas Semiconductor) show a single Jensen Huang shout‑out can trigger algorithmic buying. 4

- Free‑float squeeze. With only ~11 million freely tradable shares, modest dollar inflows create exaggerated swings. 7

- Retail momentum. Social feeds on Stocktwits labelled $CYN “the next ASML,” fanning FOMO. 8

3. Technology Deep‑Dive: DriveMod + Isaac

| Component | What it Does | Why NVIDIA Matters | Commercial Status |

|---|---|---|---|

| DriveMod Stockchaser (Gen 4) | Converts a Motrec MT‑160 tugger into a 12,000‑lb autonomous hauler | Isaac Sim accelerates virtual safety validation, shaving 70 % off field‑testing time | Pilots running at two U.S. tier‑1 auto‑parts plants blogs.nvidia.com cyngn.com |

| DriveMod Forklift | Retrofits BYD Class I trucks for pallet‑agnostic lifts | Jetson AGX Orin handles perception; Isaac Lab fine‑tunes controls | Limited release under non‑disclosure contracts blogs.nvidia.com stocktitan.net |

Cyngn is steadily widening its moat: it secured its 22ⁿᵈ U.S. patent (No. 12,246,733) for a cloud‑offloaded autonomy stack that cuts on‑board compute cost by 40 %. 9

4. Expert Views

- William White, TipRanks senior writer: “Cyngn was chosen by NVIDIA among several peers—investors read that as a de‑risking signal.” 7

- Sam Francis, Robotics & Automation News (via MENAFN): “Europe’s first industrial AI cloud will give partners like Cyngn sovereign, centralized horsepower for simulation‑heavy workloads.” 10

- TOI Tech Desk analysis: The rally shows “how Nvidia’s halo can override fundamentals”—Cyngn had reported just USD 47 k in Q1‑25 revenue before the spike. 5

5. Market Size and Competitive Context

The global autonomous‑vehicle sector is projected to swell from USD 68 billion in 2024 to USD 214 billion by 2030 (CAGR ≈ 20 %). grandviewresearch.com Commercial and industrial vehicles are the fastest‑growing slice: North American revenue alone is forecast to hit USD 74 billion by 2030. 11

Cyngn competes with:

- Seegrid on warehouse AMRs;

- Ouster & Clearpath on lidar‑first tuggers;

- Bastian Solutions (Toyota) on integrated AGV fleets.

Yet few rivals are publicly traded micro‑caps with pure‑play exposure, a detail that amplifies volatility when positive news lands.

6. Risk Factors

- Revenue gap. Cyngn posted USD 0.37 million FY 2024 sales vs. USD 23 million operating loss. 5

- Dilution overhang. A shelf registration to raise USD 15 million sits active after the spike. 12

- Execution. Scaling from pilot fleets to hundreds of units will stress supply‑chain and certification processes.

7. Outlook

NVIDIA’s public endorsement has bought Cyngn priceless credibility and opened the door to Tier‑1 European manufacturers visiting Automatica — but sustaining the valuation will require booked orders, not blog posts. If the company converts its patent‑backed cloud autonomy architecture into a subscription‑style fleet service, the margin profile could mirror SaaS robotics peers now trading at 8‑10× forward sales. Investors should watch for:

- Signed production contracts in H2‑2025;

- Proof of ISO 3691‑4 safety certification across multiple vehicle form factors;

- Follow‑up NVIDIA integrations (e.g., GR00T models or Omniverse digital‑twin tie‑ins).

On balance, Cyngn has shifted overnight from penny‑stock obscurity to a credible, if still speculative, participant in a USD 200‑billion market wave. Whether the share price can hold its newfound altitude now depends less on Jensen Huang’s next line and more on Cyngn’s ability to ship autonomous forklifts and tuggers at scale.