- Surging Stock: AST SpaceMobile (NASDAQ: ASTS) shares spiked roughly 10% on September 23, 2025, reaching about $54 intraday (up from a prior close of $48.85) investing.com. The stock has rallied well over 100% year-to-date, vastly outperforming the broader market. Its 52-week range extends from roughly $17.50 to $60.95 investing.com, reflecting high volatility and speculative enthusiasm.

- Major News Catalyst:Rumors of Billionaire Investment – On Sept 23, reports surfaced that Mexican telecom tycoon Carlos Slim (owner of América Móvil) is increasing his investment in AST SpaceMobile advanced-television.com. An unconfirmed report suggests a $22 billion commitment (spread over various ventures) could boost AST SpaceMobile’s expansion, potentially tying AST’s satellite service into América Móvil’s ~300 million customer base in 25 countries advanced-television.com. América Móvil had earlier scrapped a Starlink deal amid a feud between Slim and Elon Musk advanced-television.com, signaling a strategic pivot toward AST SpaceMobile if this investment materializes.

- Satellite Breakthroughs: AST SpaceMobile announced its first commercial satellite (BlueBird 6) is fully assembled and in final testing as of early September 2025 investing.com. The U.S. FCC has conditionally approved 20 AST satellites for launch investing.com, marking a crucial green-light for the company’s planned space-based mobile network. These milestones indicate tangible progress toward AST’s vision of a direct-to-smartphone satellite broadband constellation.

- Recent Performance & Financials: Despite zero commercial revenue to date, ASTS stock has been on a tear. It carries a market cap around $20 billion investing.com, fueled by optimism but tempered by financial realities. Q2 2025 earnings disappointed – EPS was –$0.41 vs. –$0.21 expected, on revenue of only $1.15 million (vs. $5.56 M expected) investing.com. Ongoing losses and frequent cash raises pose dilution risks simplywall.st. Notably, one analyst initiated coverage with a neutral Market Perform rating in light of execution risks investing.com. Short interest remains high (~17.7% of float) ainvest.com, which has at times amplified volatility via short-squeeze rallies.

- Competitive Landscape:SpaceX’s Starlink and others are racing toward direct-to-phone satellite service, creating headwinds for AST. In early September, SpaceX made waves by acquiring rights to 5G spectrum from EchoStar, signalling intent to compete directly with AST SpaceMobile’s space-to-cellular model gurufocus.com. This development prompted a UBS analyst downgrade of ASTS on Sept 9, 2025, from Buy to Neutral with a price target cut from $62 to $43 gurufocus.com. Meanwhile, AST’s leadership claims a 5–10 year head start in satellite-to-phone technology over Starlink advanced-television.com, given AST’s successful test calls and spectrum partnerships, whereas Starlink’s direct-to-device service isn’t expected to begin testing until late 2026 advanced-television.com. Traditional satellite telecom players like Iridium (satellite phones) and Globalstar (partner for Apple’s satellite texting) are also in the mix, though their services target niche uses and lower data rates compared to AST’s broadband ambitions.

ASTS Stock Performance – Sky-High in 2025

AST SpaceMobile’s stock has been on a meteoric rise in 2025, turning heads on Wall Street. On September 23, 2025, ASTS jumped about 10% during the trading day, hovering in the mid-$50s per share investing.com. This spike brought the stock near its all-time highs (~$60) and represented a dramatic climb from roughly $18 a year ago. By comparison, the S&P 500’s performance over the same period has been far more subdued, underlining ASTS’s outsized gains. Year-to-date, ASTS has more than doubled in value (up ~100–150% YTD) amid a wave of optimistic news investing.com. Such explosive growth has propelled AST SpaceMobile’s market capitalization to roughly $20 billion investing.com, a hefty valuation for a pre-revenue company.

However, the rapid ascent hasn’t been a smooth straight line. ASTS has experienced major swings – including a nearly 9–10% plunge on September 8–9 after competitive fears spooked investors gurufocus.com. In that episode, ASTS sank when SpaceX announced new spectrum plans (more on that below) and UBS issued a downgrade. These oscillations reflect AST SpaceMobile’s status as a high-volatility, sentiment-driven stock. Traders have piled in on bullish catalysts (driving big rallies) but have just as quickly cashed out on any perceived setbacks. The stock’s 52-week low of about $17.50 and high near $61 illustrate the wide trading range over the past year 1 .

In short, ASTS has delivered eye-popping returns for early believers in 2025, but its trajectory remains tethered to news flow and investor risk appetite. With the price now above many analysts’ targets (consensus ~$48 investing.com), the question is whether AST SpaceMobile’s fundamental progress can justify the lofty valuation going forward.

Major News on Sept 23, 2025 – Rumors Fueling the Rally

The big story driving ASTS on Sept 23 was an intriguing report that billionaire Carlos Slim might dramatically boost his stake in AST SpaceMobile. Slim – known as one of the world’s richest men and the owner of Latin American telecom giant América Móvil – is already an early investor in AST (his daughter sits on the board) advanced-television.com. According to industry outlet Advanced Television, Slim is “reportedly investing more cash” in AST SpaceMobile, potentially as part of a broader $22 billion telecom infrastructure push 2 .

While AST SpaceMobile has not confirmed this, the rumor alone sent excitement through the markets. Investors speculate that if Slim injects substantial capital (even a portion of that $22 B) into AST, it could turbocharge the company’s rollout and cement a strategic partnership with América Móvil’s vast mobile subscriber base advanced-television.com. For context, América Móvil operates in 25 countries and serves over 300 million customers across Latin America advanced-television.com. A deeper alliance could make AST SpaceMobile the go-to provider of space-based cellular service for those carriers, a potential game-changer for commercial adoption.

It’s notable that earlier this year Slim cut ties with Elon Musk’s Starlink, cancelling a planned Starlink internet deal for Latin America after a personal spat with Musk advanced-television.com. That falling-out left Slim openly searching for alternative satellite partners. AST SpaceMobile appears to be the prime beneficiary of that rift – Slim’s reported switch from Starlink to AST could mean preferred access to América Móvil’s enormous customer network and resources advanced-television.com. If the rumored investment comes to fruition, it would significantly strengthen AST’s hand in the global race for satellite-to-phone dominance.

The mere prospect of such backing helped boost market sentiment on Sept 23. ASTS shares popped in heavy trading, suggesting that traders see Slim’s involvement as a validation of AST’s technology and a potential solution to its hefty funding needs. That said, no official announcement has been made yet; investors are eagerly awaiting confirmation or details from the company. Until then, this remains a developing story – albeit one that has already added fuel to AST SpaceMobile’s stock momentum.

Aside from the Slim buzz, there were no major official press releases from AST SpaceMobile on that day. However, social media chatter and speculative reports can clearly move this stock. (Some online discussions on Sept 22–23 also floated the idea of new partnerships, contributing to pre-market gains, though concrete details were scarce.) In absence of formal news, ASTS’s surge seems largely driven by the Slim narrative and the overall optimistic backdrop of recent weeks’ developments, which we outline next.

Satellite Technology & Service Developments – Turning Ambition into Reality

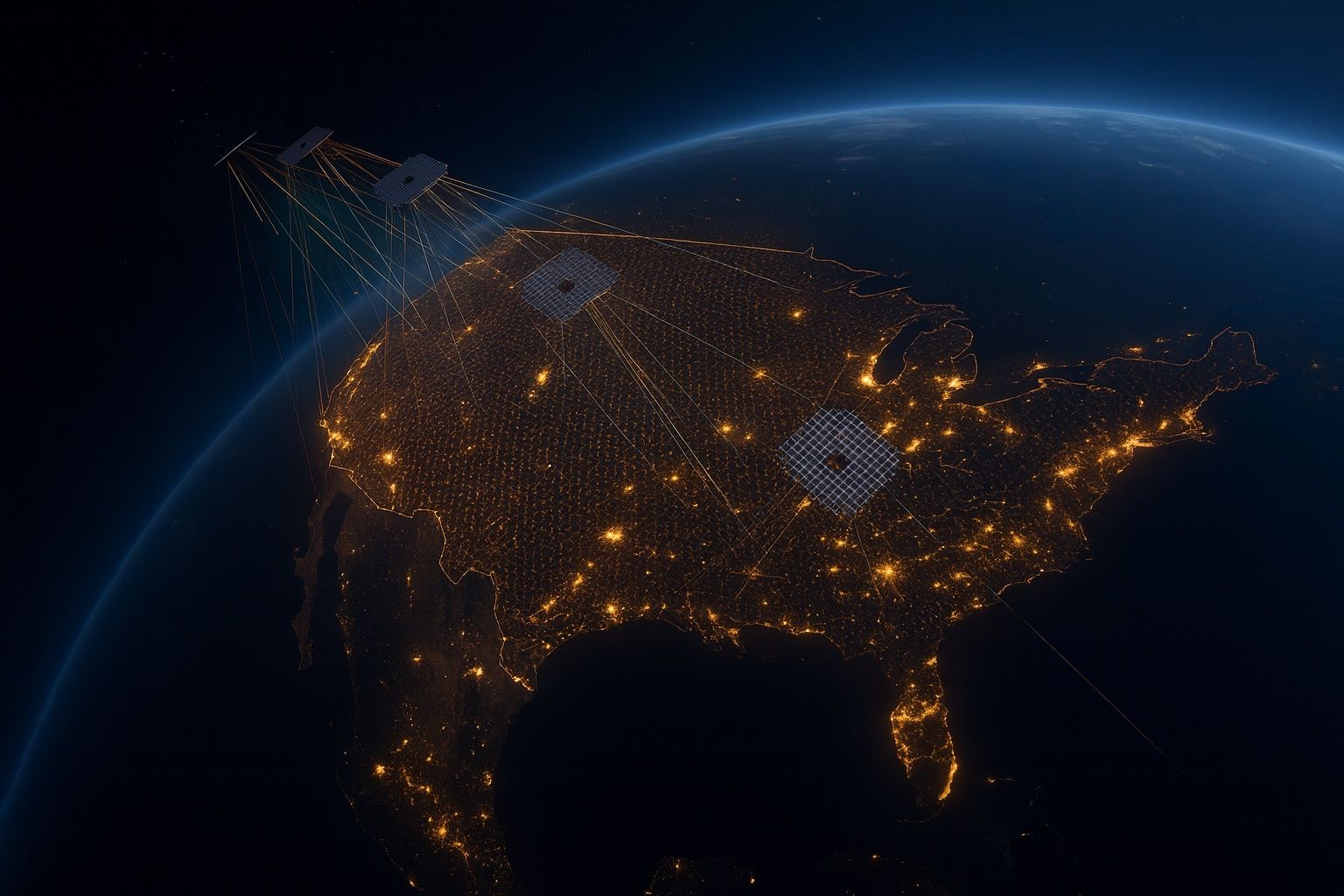

AST SpaceMobile’s core appeal is its plan to create the world’s first space-based cellular broadband network directly accessible by everyday smartphones. In 2023, the company proved the concept works – it made history by completing the first-ever direct space-to-cell phone voice call using its BlueWalker 3 test satellite and an unmodified Samsung smartphone ast-science.com. This breakthrough, achieved with partners AT&T and Vodafone, showed that a satellite in low Earth orbit could indeed connect a standard mobile phone for voice and data ast-science.com ast-science.com. That milestone gave AST SpaceMobile a head start in the race to deliver 4G/5G coverage from space.

Fast-forward to 2025, and AST is now transitioning from testing to deployment of its commercial satellite fleet. A major update came in early September 2025: the company announced that its first “Block 2” production satellite – BlueBird 6 – has been fully assembled and is undergoing final testing before shipment to the launch site investing.com. This indicates the hardware is ready to go to orbit. In the same disclosure, AST confirmed that the U.S. Federal Communications Commission (FCC) has granted approval for 20 satellites to launch, subject to certain conditions investing.com. Essentially, regulators have given a thumbs-up for AST to deploy a first wave of 20 BlueBird satellites to begin building out its constellation (a crucial step since satellite communications require spectrum licenses and orbital clearance).

Why is this important? It marks the first real instantiation of AST SpaceMobile’s network beyond just one test satellite. BlueBird 6 and its coming sisters will form the backbone of AST’s initial service. The company has stated it needs about 25 satellites for initial commercial coverage in its most lucrative markets mobileworldlive.com. With 20 now approved and at least 17 under construction as of mid-2024 mobileworldlive.com, AST is well on its way. Indeed, AST SpaceMobile signaled that it aims to ramp up satellite launches at a rapid clip – roughly one launch every month or two through 2025 and 2026 (according to a recent company update) to populate its constellation. If all goes to plan, limited beta services with carriers like AT&T and Verizon could start once the first batch of BlueBird satellites is in orbit and operational.

Beyond the satellites themselves, AST has been locking down critical spectrum and partnerships to make its global service viable. In August 2025, the company announced a key spectrum acquisition: an agreement to purchase global S-band frequency rights (1980–2010 MHz and 2170–2200 MHz) from an entity under the International Telecommunication Union stocktitan.net. This deal, valued at $64.5 million stocktitan.net, gives AST up to 60 MHz of mid-band spectrum worldwide to augment its service stocktitan.net stocktitan.net. In practical terms, owning S-band rights means AST can expand capacity and coverage in regions where partnering with local mobile operators’ spectrum might be challenging. AST’s CEO Abel Avellan noted these S-band airwaves could enable peak data speeds up to 120 Mbps directly to users’ phones in many countries stocktitan.net. Combined with AST’s existing strategy of leveraging standard cellular bands (like AT&T’s 850 MHz in the U.S.), this spectrum play would significantly broaden AST SpaceMobile’s global reach and network capacity.

On the commercial front, AST SpaceMobile’s list of partner mobile network operators (MNOs) keeps growing. The company has strategic collaboration agreements with Vodafone, AT&T, Rakuten (Japan), Orange, Telefónica and several others to eventually offer satellite-based mobile coverage to their subscribers. For example, in spring 2023 Vodafone and AT&T participated in AST’s test calls as both investors and future customers ast-science.com. The potential market is enormous – AST and its partners aim to fill coverage gaps and extend connectivity to the nearly 50% of the global population currently without reliable mobile broadband ast-science.com (think remote rural areas, oceans, developing regions where cell towers are impractical). AST’s satellites effectively act as cell towers in space, connecting directly to ordinary 4G/5G smartphones. This could enable users off the grid to get voice calls, messaging, and data service where no terrestrial signal exists.

Overall, 2025 has been about proving technical readiness and clearing regulatory hurdles for AST SpaceMobile. With the first production satellite built and launch approvals in hand, the company is closer than ever to flipping the switch on a revolutionary service. The next critical phase – executing satellite launches and scaling up a commercial network – will be the true test of AST SpaceMobile’s ambitious plan.

Investor Sentiment & Analyst Views – High Hopes vs. High Risks

Investor excitement around AST SpaceMobile is undeniable, but so are the debates over its valuation and competitive risks. Wall Street’s sentiment on ASTS is mixed, reflecting a tug-of-war between the stock’s sky-high potential and its significant uncertainties.

On one hand, bulls are enthused by AST’s first-mover advantage in an entirely new telecom frontier. They point to AST SpaceMobile’s successful demonstrations, growing backlog of carrier partnerships, and recent regulatory wins as signs that the company could be on the cusp of a lucrative breakthrough. Some analysts remain optimistic – about half of the 10 analysts covering ASTS rate it a “Buy”, seeing further upside in the long term investing.com. Even after ASTS’s steep rally, community-sourced valuations show a wide range of opinions, with some retail investors believing the stock could eventually be worth multiples more if AST becomes a dominant global mobile provider simplywall.st. The sheer size of the addressable market (billions of mobile users worldwide) means AST SpaceMobile’s revenue could ramp up very quickly if it achieves even modest adoption via its partner carriers.

On the other hand, skeptics and recent analyst downgrades urge caution. A clear example came on September 9, when UBS analyst Chris Schoell downgraded ASTS from Buy to Neutral and slashed his price target from $62 down to $43 gurufocus.com. UBS cited intensifying competition and a long road to commercialization as key concerns. This downgrade came hot on the heels of news that SpaceX (Starlink) is muscling into AST’s territory by acquiring crucial spectrum – a development UBS warned could “squeeze” AST SpaceMobile out before it even gets started nasdaq.com. The market reacted swiftly: ASTS stock tumbled ~9% on that day gurufocus.com, reflecting how sensitive the stock is to competitive threats and analyst sentiment.

Another area of concern is AST SpaceMobile’s financial position. The company is essentially pre-revenue (just $1.15 M in Q2 sales, likely from engineering services) investing.com, yet it must spend hundreds of millions of dollars to build, launch, and operate its satellite network. AST’s Q2 2025 report underscored the challenge: the company massively missed revenue expectations and posted larger losses than anticipated investing.com. It has been funding development through a combination of cash on hand, strategic investments, and issuing new equity (e.g. via public offerings or warrant exercises). In fact, AST has a history of raising cash that has diluted existing shareholders – a necessary evil for a capital-intensive space startup. Analysts note that “repeated equity issuances” and ongoing high burn rate pose a risk to investors, especially if market conditions turn and funding dries up simplywall.st. AST itself disclosed it might need to raise an additional ~$275–325 million to fund operations and the first 20 satellites in orbit mobileworldlive.com. The silver lining is that AST had over $440 M in cash (pro forma) as of mid-2024 after some warrant redemptions mobileworldlive.com, and management has said they don’t plan another public equity offering at least until end of 2025 mobileworldlive.com. Still, the specter of future dilution or debt hangs over the stock.

Market sentiment also reflects these risks: despite recent positive news, ASTS has a consensus 12-month price target of around $47–48 investing.com, actually below the current trading level in the mid-$50s. That implies analysts collectively see the stock as fairly valued or slightly overvalued after its huge run-up. Half of coverage is at “Hold” or equivalent ratings investing.com, suggesting many analysts recommend waiting to see more execution before buying. For example, William Blair initiated coverage with a neutral stance (Market Perform) and not long ago Zacks Investment Research highlighted that ASTS had fallen 25% since the prior earnings amid the mixed results finance.yahoo.com, urging caution given the “lackluster” quarter.

There is also a strong retail investor and trader contingent in ASTS (evidenced by its popularity on Reddit and high message-volume days). The stock’s high short interest (~17–18% of float) ainvest.com means it’s prone to short squeezes – rapid climbs when good news forces short-sellers to cover positions. This dynamic likely amplified ASTS’s 2025 gains, as each positive milestone (FCC approval, Slim speculation, etc.) triggered additional buying from shorts unwinding their bets. Conversely, any stumble could see an exaggerated sell-off as momentum buyers rush for the exits. Investors thus should be prepared for continued volatility.

In summary, the investment community is split: believers see AST SpaceMobile as a potential 10x opportunity that could revolutionize global connectivity (hence justifying a rich valuation), whereas critics see a company still in early stages with zero revenue, heavy cash burn, and heavyweight competitors on its tail. Both sides acknowledge that the next 1–2 years – as AST launches satellites and (hopefully) starts generating service revenue – will be pivotal in determining which narrative wins out.

Competition Heats Up – Starlink, Iridium, and the Race to Connect the Unconnected

AST SpaceMobile isn’t operating in a vacuum; it’s in a space race of its own against other companies aiming to deliver connectivity from orbit. Understanding the competitive landscape is key to evaluating ASTS’s prospects.

SpaceX Starlink – from Wi-Fi to Phone Service: SpaceX’s Starlink is the most prominent satellite internet network today, with over 7 million broadband users via its low-Earth-orbit satellites advanced-television.com. Until now Starlink has focused on fixed user terminals (dish antennas on homes/vehicles), not ordinary cell phones. But SpaceX has made it clear it intends to enter the direct-to-mobile arena, which directly overlaps with AST SpaceMobile’s domain. In fact, SpaceX announced in September that it will acquire 5G wireless spectrum from EchoStar Corp (a satellite operator) to enable Starlink satellites to communicate with regular handsets gurufocus.com. This deal, reportedly worth $17 billion in spectrum value ainvest.com, was a wake-up call: a tech giant with deep pockets is gearing up to compete head-on with ASTS’s satellite-phone service. SpaceX CEO Elon Musk had previously inked a partnership with T-Mobile to eventually use Starlink for text messaging on T-Mobile’s network, and is now taking further steps to support voice/data to phones.

That said, AST may have a window of opportunity. Starlink’s president Gwynne Shotwell admitted just days ago that Starlink has “little or no chance” of offering voice/text services to standard phones for at least two more years advanced-television.com. The challenge lies in developing special chipsets and deploying a new generation of satellites equipped for direct phone links. SpaceX hopes to start launching those next-gen direct-to-device Starlink satellites by 2027, with initial test service perhaps in late 2026 advanced-television.com. In contrast, AST SpaceMobile’s solution works with existing 4G/5G phones (no new chips needed) and is rolling out now. At the World Space Business Week conference in Paris (Sept 2025), AST’s president Scott Wisniewski remarked that AST has a “five to ten year advantage” in this niche advanced-television.com. He attributed this lead to AST’s head start in technology (years of R&D, the BlueWalker 3 demo) and its deliberate spectrum strategy of securing long-term licenses around the world advanced-television.com. In his view, even if SpaceX can catch up technically, AST will have locked in spectrum and carrier partnerships that entrench its position.

The reality is likely that both AST SpaceMobile and Starlink can coexist by targeting different segments or geographies (and indeed they’ve publicly taken jabs at each other – Musk and AST’s CEO traded barbs on social media in the past about whose approach is superior). But SpaceX’s entry does raise the competitive bar. It means AST will need to execute flawlessly and scale quickly before Starlink (or others like Amazon’s Project Kuiper, which is also eyeing satellite connectivity services) can flood the sky with their own satellites. On the upside, AST now potentially has allies like Carlos Slim on its side, whereas SpaceX’s Starlink recently lost the support of Slim’s América Móvil advanced-television.com – illustrating how competitive dynamics can shift in AST’s favor too.

Iridium, Globalstar, and legacy satellite networks: It’s worth noting that space-based phone connectivity isn’t entirely new – Iridium Communications (NASDAQ: IRDM) has operated a satellite phone constellation for decades, and Globalstar (GSAT) provides low-bandwidth satellite links used in devices like Apple’s iPhone emergency SOS feature. However, these legacy systems differ from AST SpaceMobile’s vision. Iridium relies on specialty handsets or hotspot devices (the classic brick-like sat phone) and offers relatively slow data speeds suitable for voice and basic messaging. Globalstar’s network is being leveraged for one-way emergency texting on smartphones, but not full two-way broadband service. In contrast, AST’s satellites are designed for broadband connectivity (up to 4G/5G speeds) and two-way service on normal smartphones stocktitan.net. This is a far more challenging technical feat, but also a far bigger market if it succeeds.

That said, AST could face indirect competition from these incumbents in specific niches. For instance, Apple partnered with Globalstar to provide satellite SOS on iPhones – an area AST might also target for revenue (direct consumer satellite messaging). Similarly, Iridium has partnered with some smartphone makers (e.g. some Android devices can send texts via Iridium satellites with an add-on) to offer limited off-grid communication. Moreover, established players have orbital assets and licenses that new entrants must navigate around. AST’s approach of working with terrestrial mobile operators (rather than bypassing them) is somewhat unique, whereas Iridium/Globalstar historically sold services directly to end-users or enterprise/military clients. AST is effectively trying to complement carriers (filling coverage gaps for them) rather than compete against ground networks.

In the broader satellite comms industry, many eyes are on regulatory decisions and spectrum battles. For example, in some countries regulators are hesitant about allowing non-local satellite operators to offer direct phone service (concerns over spectrum rights, security, etc.). India recently put hurdles in place, delaying Starlink and possibly any foreign direct-to-device services until they go through proper licensing advanced-television.com. AST SpaceMobile will have to navigate varying rules country by country – but having partners like Vodafone, Rakuten, etc., gives it an entry point with local telecom authorities.

Bottom line on competition: AST SpaceMobile has the first-mover advantage in space-to-phone broadband, but it is not alone for long. SpaceX’s Starlink is a looming giant with plans to join the fray (though a couple of years behind), Amazon’s Project Kuiper could explore direct-to-device in the future given Amazon’s telecom ambitions, and smaller startups like Lynk Global are also testing satellite text messaging to phones. Meanwhile, incumbents like Iridium and Globalstar ensure that AST is not the only game in town for satellite mobile services, even if their offerings differ in capability. The encouraging news for AST is that the total addressable market is massive – industry analysts estimate the Direct-to-Device satellite connectivity market could be a $100–200 billion opportunity in coming years advanced-television.com, enough room for multiple players if executed well. AST SpaceMobile’s challenge (and opportunity) is to maintain its technological lead, rapidly scale its constellation, and convert partnerships into paying subscribers before competitors catch up.

Market Conditions & Outlook – High Stakes in a Frontier Market

AST SpaceMobile’s rise comes against a backdrop of both optimism and caution in the market. In 2025, investors have shown a strong appetite for speculative technology plays, especially those with transformational potential. The concept of space-based mobile broadband – connecting the unconnected half of the world – certainly fits the bill of a bold, disruptive narrative. This broader market optimism for space and satellite stocks (aided by high-profile success stories like SpaceX and growing public interest in satellite telecom) has provided a tailwind for ASTS. Notably, macroeconomic conditions like stabilizing interest rates have also helped; as borrowing costs peaked and started easing in 2025, high-growth companies with future-weighted profits became slightly more attractive again. Such an environment has allowed AST SpaceMobile to raise capital when needed and investors to look farther out on the horizon in valuing the company.

However, the market is also mindful of risk factors. One key concern is the availability of funding for space ventures. Building a satellite network from scratch is extremely capital-intensive, and AST will likely require additional financing rounds or strategic investments (like the rumored Slim deal) to fully deploy its constellation and fund operations until revenue ramps. Should credit markets tighten or equity markets sour, AST could face a cash crunch. This is why the potential of a deep-pocketed backer like Slim is so significant – it might de-risk AST’s financing needs.

Another broad factor is regulatory and geopolitical risk. Telecommunications is a sensitive industry; satellite communications even more so, given spectrum allocations are managed on a global scale by bodies like the ITU. Any hiccup in regulatory approvals (for example, if certain countries deny AST landing rights or if international spectrum coordination fails) could slow the company’s expansion. In the U.S., the FCC’s conditional approval of 20 satellites is a positive sign investing.com, but AST will eventually need approvals for hundreds of satellites if its network grows as planned. Internationally, AST must work within each region’s rules – some nations may prefer domestic solutions or impose restrictions on foreign satellite operators. Investors will be watching how AST navigates these complexities, as they could impact the timeline for revenue generation.

The broader stock market’s volatility also inevitably affects ASTS. Being a high-beta, high-flying stock, ASTS tends to amplify market moves. On strong market days, it can soar; on risk-off days, it can sink disproportionately. For instance, on a day when the S&P 500 was modestly up 0.3%, AST SpaceMobile shares plunged nearly 9.5% on company-specific news gurufocus.com, indicating that general market strength alone can’t support ASTS if there’s a negative development. Conversely, in bullish periods, ASTS can climb almost irrespective of the market – driven by its own catalysts and trader momentum.

Looking ahead, the outlook for AST SpaceMobile stock will hinge on execution. In the near term (the next 6–12 months), a few milestones could make or break sentiment:

- Satellite Launches: Successful launch and deployment of the first batch of BlueBird satellites (perhaps 5 at a time via SpaceX Falcon 9 rockets, according to earlier plans) will be critical. Any delay or failure would hurt confidence, while timely launches (possibly starting by late 2025 or early 2026) would validate AST’s operational capabilities.

- Service Initiation: If AST can begin a beta service – even limited texting or voice in certain areas – by 2025 or 2026 as hinted, it will be a huge validation. Initial customer feedback, ARPU (average revenue per user) from pilot programs, and expansion of carrier agreements to commercial contracts will be closely watched.

- Financial Health: The company’s cash burn and fundraising will stay in focus. Investors will favor ASTS if it secures non-dilutive funding (e.g. strategic investments, perhaps from partners like Slim’s América Móvil or others) or if it demonstrates a pathway to break-even with existing cash. Conversely, a surprise secondary stock offering or major jump in expenditures could spook the market.

- Competitive Moves: Developments from rivals – say, if SpaceX accelerates its direct-to-phone timeline or if another tech giant enters the fray – could quickly change the narrative. AST will need to keep touting its advantages and signing up partners to fend off competitive concerns.

In conclusion, AST SpaceMobile sits at the intersection of excitement and execution risk. The stock’s run in 2025 reflects a euphoric bet that AST may revolutionize mobile connectivity and capture a significant slice of a new market. The company’s recent achievements (regulatory approvals, satellite readiness, big-name interest) have added credibility to that story investing.com advanced-television.com. Yet, with great promise comes great responsibility – AST must now deliver on the grand vision to justify its $50+ stock price. For public investors, ASTS is an opportunity to get in on the ground floor of a potentially world-changing technology, but not without enduring turbulence and acknowledging the formidable challenges ahead.

Sources: Official AST SpaceMobile filings and press releases; financial data from Investing.com investing.com investing.com; news reports from Advanced Television advanced-television.com advanced-television.com, GuruFocus gurufocus.com, AInvest ainvest.com ainvest.com, and others detailing recent events, analyst commentary, and competitive landscape information. All information is up-to-date as of September 23, 2025.