- Stock Surge: AST SpaceMobile (NASDAQ:ASTS) stock jumped ~16% on Oct 1 and again ~16% on Oct 2, 2025, closing at ~$66.16 (market cap ≈$20–24 billion) stockanalysis.com stockanalysis.com. Trade volume was heavy (~30 M shares) as investors cheered news of its next-generation satellite program stockanalysis.com 1 .

- Satellite Milestones: The company announced on Oct 1 that BlueBird-6, its next LEO communications satellite, has completed final assembly and will ship for launch by year-end. AST also outlined delivery schedules for BlueBird-7 and satellites 8–16, aiming for ~45–60 total in orbit by 2026 advanced-television.com 2 .

- Major Deals: AST partners with 50+ global carriers (e.g. AT&T, Verizon, Vodafone) to deliver cell service from space. In Canada, Bell confirmed plans to launch AST-powered satellite-to-cell service in 2026 advanced-television.com mobileworldlive.com. Vodafone demonstrated the world’s first video call via AST’s Midland-built satellites in 2025 3 .

- Analyst Moves: Barclays lifted its ASTS price target from $37 to $60 (Overweight) after the BlueBird-6 update advanced-television.com tipranks.com. By contrast, UBS recently cut its target (to $43). Overall consensus is muted: the 12-month analyst target averages ~$45 (implying downside) stockanalysis.com 4 .

- Financials & Outlook: AST raised ~$575 M via convertible notes in July 2025 sec.gov and is acquiring valuable satellite spectrum rights (S-band) via EllioSat Ltd for ~$26–$60 M contingent on launch milestones sec.gov sec.gov. Analysts note long-term upside if AST’s network scales, but near-term cash burn and competition remain risks benzinga.com 5 .

- Industry Context: Satellite broadband is fiercely competitive. SpaceX’s Starlink and Amazon’s Kuiper are rolling out megaconstellations, and Apple/others now embed basic satellite texting in phones. AST’s “direct-to-cell” approach is unique – its large BlueBird satellites aim to communicate with ordinary 4G/5G phones cambridgemc.com. AST’s strategy leverages its operator partnerships, but it operates in a volatile, rapidly evolving market cambridgemc.com 6 .

Stock Performance (Oct 1–3, 2025)

ASTS has been on a tear. On Oct 1, 2025 the stock surged 16.0% to close at $56.94 (from $49.08 two days prior) stockanalysis.com. On Oct 2, 2025, it again rallied 16.2%, closing at $66.16 stockanalysis.com. These gains came on heavy volume (~30.0 million shares traded on Oct 2) stockanalysis.com stockanalysis.com, far above its three-month average, reflecting strong buyer interest. As of early trading on Oct 3, ASTS was around $65–66 stockanalysis.com. The stock’s market capitalization is roughly $20–24 billion (depending on the share count used) stockanalysis.com reuters.com. For context, ASTS has more than tripled since mid-2025, buoyed by its satellite developments.

Recent Corporate News

BlueBird Satellite Fleet Expansion

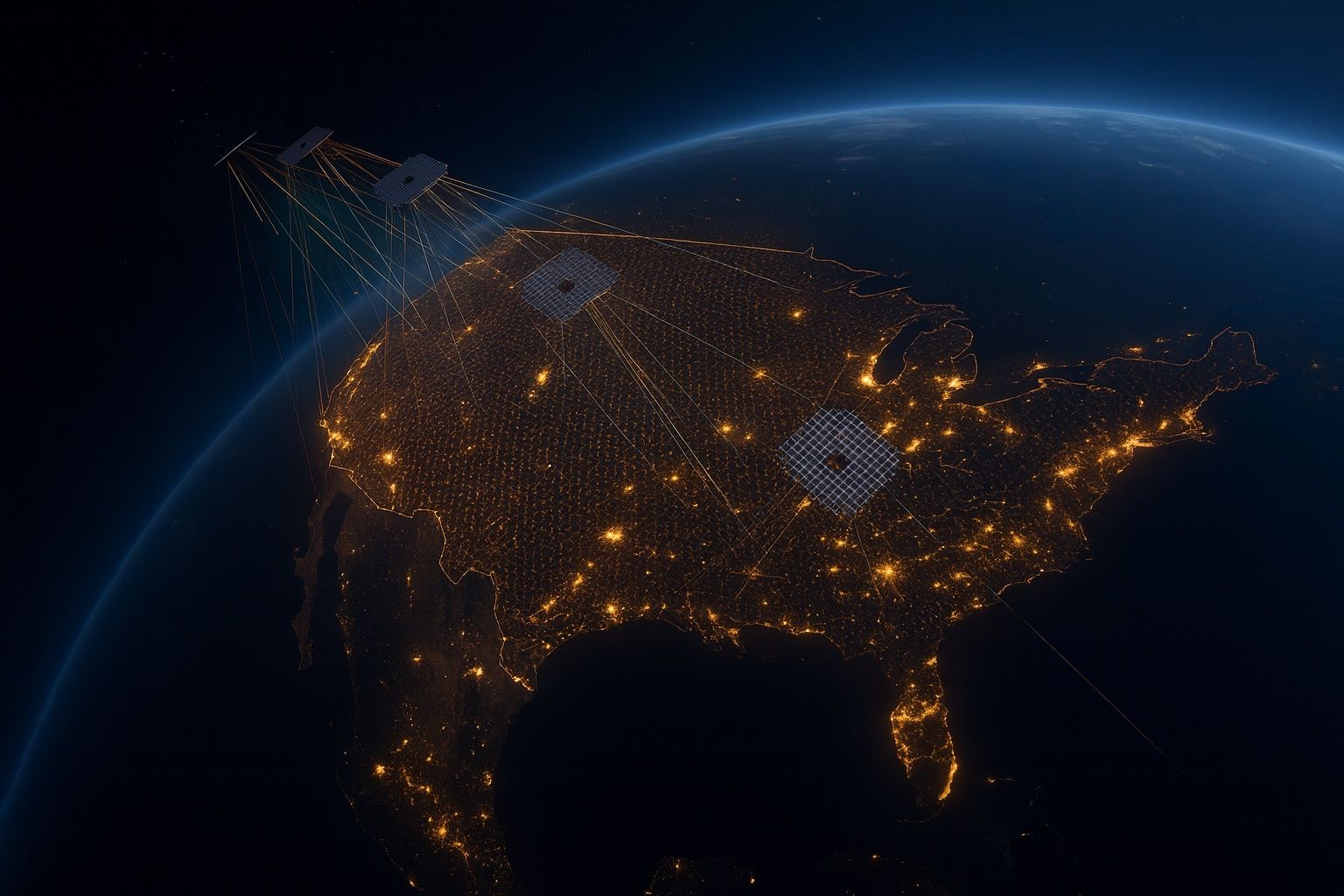

AST SpaceMobile continues to ramp up its Block-II “BlueBird” satellites. In early October, the company announced BlueBird-6 (aka FM1) has finished assembly and testing and will be shipped for launch (to India) by mid-October advanced-television.com tipranks.com. AST plans to launch BlueBird-6 before Christmas 2025, followed shortly by BlueBird-7 (shipping to Cape Canaveral in October) tipranks.com. In all, AST now has 40 phased-array modules built (enough for 46 satellites) and targets 45–60 satellites in orbit by end-2026 advanced-television.com tipranks.com. The company emphasized these will be the largest LEO telecom satellites ever, each with a 2,400 sq ft antenna array and bandwidth up to 10,000 MHz 7 .

This progress is a key reason for recent investor optimism. AST’s president noted that successive satellite launches (8–16, then beyond) are planned at a cadence of every 1–2 months through 2026 advanced-television.com tipranks.com. In summary, AST’s near-term “launch campaign” is now underway, and BlueBird-6’s completion marked a tangible milestone.

Partnerships & Tests

AST’s business model hinges on deals with mobile carriers worldwide. A standout partnership news came on Oct 3, 2025: Bell Canada announced it will deploy AST’s LEO satellites to provide direct-to-cell service in rural/remote Canada starting 2026 advanced-television.com mobileworldlive.com. Bell successfully demonstrated space-based VoLTE calls, video, SMS and data via AST satellites. Mark McDonald (Bell EVP/CTO) said these tests build on Bell’s earlier investment in AST, offering “significant possibilities… in sectors like natural resources, energy and the environment,” and enabling “new efficiencies” for Canadian businesses mobileworldlive.com. McDonald expects Bell to “start rolling out the service” in 2026 with customer trials that year 8 .

AST’s Chief Commercial Officer Chris Ivory called the Bell tests a “breakthrough achievement” in their mission to “bring the benefits of cellular broadband to Canadians” mobileworldlive.com. Bell already holds the necessary spectrum and is finalizing regulatory approvals in Canada to use AST’s satellites. (Neighboring Rogers also recently beta-launched satellite-to-phone messaging.) This Bell deal is AST’s first announced commercial launch partner in North America beyond its existing test agreements.

Another key partner is Vodafone. In January 2025, Vodafone UK used AST satellites to make the first-ever live video call from space to a standard smartphone mrt.com. Vodafone’s CEO Margherita Della Valle celebrated the milestone (AST was a Vodafone spin-out and remains partly owned by the carrier). AST’s CEO Abel Avellan emphasized that this “historic milestone… took us one step closer to our mission to eliminate connectivity gaps” mrt.com. AST now has five of its early BlueBird satellites in orbit (launched Sept 2024 by SpaceX space.com) dedicated to testing with Vodafone. Vodafone plans to launch this direct-to-phone broadband service commercially across Europe during 2025–26 3 .

Financial and Regulatory Updates

AST SpaceMobile has been raising capital to fund its expansion. On July 29, 2025, AST completed a $575 million private offering of 2.375% convertible notes (due 2032), which included a $75M over-allotment sec.gov. These notes carry a conversion price ~20% above the stock’s late-Jul 2025 level ($≈72/share), reflecting investor appetite and AST’s need for cash to build satellites.

In August 2025, AST also agreed to acquire EllioSat Ltd., a firm owning priority S-band spectrum licenses (1980–2010 & 2170–2200 MHz for LEO satellites) sec.gov sec.gov. The deal pays $26M upfront, another $20M in later installments, and up to ~$18.5M more tied to the successful launch/operation of an S-band satellite. Acquiring these licenses strengthens AST’s spectrum assets for mobile service.

Executive moves: AST’s leadership is unchanged since going public in 2023 (CEO Abel Avellan, CTO Kumar Navulur, etc). However, insiders did sell shares recently (per filings) to fund operations. For example, CTO Huiwen Yao and other executives sold portions of their stock in 2025. (Insider sales – not included in sources – were reported by QuiverQuant, but no major departures have been announced.)

Analyst and Industry Commentary

Analysts and industry watchers have reacted strongly to these updates. Following the BlueBird-6 announcement and Bell news, Barclays raised its price target on AST from $37 to $60 and maintained an Overweight rating advanced-television.com tipranks.com. Barclays’ analyst cited AST’s enhanced medium-term outlook after adjusting for satellite launch delays. Notably, a Wall Street note pointed out that with carriers like T-Mobile and Starlink now offering basic text-only satellite service, AST’s full-service product (broadband plus voice/text) could command premium pricing tipranks.com. In other words, AST could capture more value per user than current “emergency SOS” services on phones.

By contrast, some analysts remain cautious. UBS downgraded AST in Sept 2025, cutting its target to $43 quiverquant.com, noting uncertainty if AST can monetize its network quickly. As of early Oct, consensus among ~10 analysts was a “Hold” rating, with an average 12-month target around $45 stockanalysis.com marketbeat.com – implying limited upside from the current price. MarketBeat confirms the consensus target is ~$45 (median of highest $60 and lowest ~$30) 5 .

Investor sentiment on social media (e.g. Twitter/X) is mixed. Retail investors largely cheered the news of satellite milestones and higher targets (citing the $60 upgrade). Some forums note volatility: ASTS dipped notably in early Sept 2025 and competition from SpaceX/Starlink looms large. Overall, however, most pundits see ASTS as a high-risk, high-reward play. A recent industry post summarized the chatter: AST’s progress and analyst upgrades are generating “excitement” about its space-to-cell network, though some caution that execution challenges remain quiverquant.com 9 .

Financial Outlook and Forecasts

AST SpaceMobile is still pre-revenue but planning for commercial service in 2026–2027. Analysts focus on whether the company can deliver on its ambitious rollout. The Barclays $60 target assumes AST eventually leverages its partner network and perhaps higher service pricing. Other forecasters see more moderate growth: for example, MarketBeat (10 analysts) gives ASTS a consensus Hold with an average 1‑year target ~$45 stockanalysis.com. The range of targets (from QuiverQuant data) spans $30–$60 10 .

On fundamentals, AST’s near-term P/S ratio is extremely high (~4,205× using trailing sales reuters.com, since actual service revenue is essentially zero). Its balance sheet shows significant debt (56% debt/equity) reuters.com from financing satellites. The recent convertible note offering pushed long-term debt up but also provided cash runway. Analysts will watch AST’s Q3 (Nov 2025) results and any guidance on operating costs. In its SEC filings, AST warned that its future hinges on building a large constellation and signing commercial contracts with carriers 11 .

No major brokerage consensus upgrades are currently public beyond Barclays. Some stock-market newsletters (Seeking Alpha) have re-rated AST as a speculative buy based on execution progress stockanalysis.com. However, skeptical analysts cite competition: Elon Musk’s SpaceX is already offering global “direct-to-cell” trials and has orders for its own satellites, and Amazon’s Kuiper plans are in the works. Traditional satcom players (OneWeb/Eutelsat, SES) are also vying for this market. Thus analysts caution there is “no margin for error” stockanalysis.com for AST to stay ahead.

Industry Context

AST operates in the emerging “space-to-cellular” niche of satellite communications. Traditionally, satellite internet (e.g. HughesNet, Viasat) required special dishes. The new generation – Starlink, OneWeb, Kuiper – offer broadband but typically through terminals or fixed antennas. AST’s pitch is unique: use huge LEO satellites to link directly with unmodified smartphones on existing networks (4G/5G). In this landscape, smartphone-makers and standards bodies are starting to accommodate this. For instance, Apple’s iPhone 14 introduced satellite SOS, and next-gen iPhones can send texts via satellites.

An industry overview notes that AST has already secured major carrier partners and a partial Vodafone ownership stake, aiming to provide broadband anywhere cambridgemc.com. The same source points out that SpaceX’s latest Starlink satellites are being built with direct-to-device capability as well cambridgemc.com. In other words, AST’s model is validated by the broader trend: every major player wants to bring connectivity to places beyond cell towers.

However, barriers remain. Satellite launches have become much cheaper (SpaceX Falcon 9 reuse, Apple cross-subsidizing) cambridgemc.com space.com, which lowers entry costs. But AST’s satellites are exceptionally large and complex, raising their build time and cost. Analysts note that global low-orbit capacity pricing has plunged over the last 5 years cambridgemc.com, so AST will face pressure to monetize at high rates. On the flip side, a study by Cambridge MC highlights how rising defense budgets and the need for resilient communications boost demand for satellite networks 6 .

In summary, AST is part of a “satellite gold rush”: billions are flowing into constellations, and telecom companies want to plug coverage gaps via space. AST’s competitive moat is its first-mover status in direct-to-phone service and existing MNO partnerships. That said, heavyweights like Starlink and new entrants keep the race intense.

Conclusion

AST SpaceMobile’s stock rally in early October 2025 reflects concrete operational progress (BlueBird-6 ready, Bell partnership, capital raises) and growing investor conviction. The company is finally moving from R&D to deployment, and analysts are split between bullish medium-term potential and concern over execution risk. For long-term investors, ASTS represents a bet on the future of universal connectivity – but one that must overcome stiff competition and financial hurdles.

Sources: Stock & market data from Reuters and financial websites stockanalysis.com reuters.com. AST corporate announcements and regulatory filings advanced-television.com sec.gov sec.gov. News reports from industry press mobileworldlive.com advanced-television.com mrt.com. Analyst commentary from Barclays, Benzinga, market consensus data advanced-television.com stockanalysis.com. Industry context from satellite consultancy analysis cambridgemc.com. All figures as of Oct 3, 2025.