- Record Surge: USA Rare Earth (NASDAQ: USAR) shares soared to an all-time high of $28.25 intraday on Oct. 3, 2025, closing up +14.3% at $25.96 that day after the company confirmed talks with the White House about a potential partnershipinsidermonkey.com. The stock exploded ~57% in one week amid frenzied volume (6× usual levels) on speculation of U.S. government backing1 .

- Market Cap & Momentum: USAR’s price has more than doubled in 2025, giving the company a market capitalization around $2.6 billionreuters.com. Year-to-date the stock is up over 100% (tripling from January levels), vastly outperforming the S&P 500. Technical momentum is strong – shares trade ~110% above their 200-day average, and the RSI ~80 signals near-term overbought conditions after the parabolic run2 .

- No Revenue (Yet):Pre-revenue stage – USAR has reported no sales to date, as it is still developing its mine and magnet plantts2.tech. The firm operates with zero debt and had ~$128 million cash (Aug 2025) after a recent funding roundts2.tech. However, it continues to incur losses (~$8–10M per quarter operating burn) while ramping up production capacity3 .

- Big Acquisition: On Sept. 29, USAR announced a $100 million acquisition of UK-based Less Common Metals (LCM) – a rare-earth alloy producer – paid in cash plus 6.74 million USAR sharests2.tech. This “transformative” deal secures an ex-China source of specialized metals for USAR’s magnet manufacturing and accelerates its mine-to-magnet strategyts2.tech. Simultaneously, USAR raised $125 million via a PIPE equity sale at $15/share to fund these expansion plans4 .

- Leadership & Projects:Barbara Humpton (former Siemens USA CEO) took the helm as USAR’s new CEO on Oct. 1ts2.techts2.tech. Under her leadership, the company is advancing a major rare-earth mine in Texas (Round Top, Sierra Blanca) and a neo-magnet plant in Oklahoma – slated to start production by H1 2026reuters.com. USAR has also signed multiple offtake MOUs (covering ~300 tons/year of future magnet output for defense, aerospace, EVs, etc.) to build a customer pipeline ahead of production5 .

- Street Sentiment: Wall Street analysts are bullish overall. Firms like Canaccord Genuity and Roth Capital rate USAR a “Buy”, recently raising price targets to $22 (Canaccord)ts2.tech – around the low-$20s, which is near current levels. The consensus 12-month target was ~$19–20 as of late Septemberts2.techts2.tech. All covering analysts maintain positive ratings (Buy/Overweight), citing USAR’s strategic role, though some flag the lofty valuation for a pre-revenue stockts2.techaol.com. Investor enthusiasm is tied to government backing prospects, but risk-averse investors are warned to stay cautious given USAR’s lack of revenue and ongoing cash burnaol.com6 .

Red-Hot Rally on White House News (October 2–6 Recap)

USAR has been on a tear in early October as excitement peaked around potential U.S. government support. The catalyst was an Oct. 2 CNBC interview in which CEO Barbara Humpton revealed USAR is “in close communication” with the Trump administration, when asked about the possibility of a federal investmentinvestopedia.com. This effectively confirmed that talks are underway between the company and the White House regarding a strategic partnership or stake.

Investors reacted swiftly: USAR’s stock jumped 23% on Oct. 2 after the interview, then climbed another ~15% on Oct. 3 to record highsinvestopedia.com. In intraday trading Oct. 3, shares hit $28.25 – a new all-time peak – before closing just under $26 (still +14% on the day)insidermonkey.com. The two-day surge made USAR one of the market’s top gainers; in fact, it was singled out as a “top performer” on that Friday as traders gobbled up shares on the White House buzzinsidermonkey.com. Trading volume was extraordinarily heavy (over 41 million shares on Oct. 3 vs. ~7 million average)finviz.com, reflecting intense investor interest and some speculative frenzy.

By Monday, October 6, the news cycle continued to fuel optimism. Reuters reported that the Trump administration’s new policy of converting grants into equity stakes in critical mineral firms explicitly includes USA Rare Earth as a candidate – listing USAR’s status as “in discussions” with the White House for a potential stakereuters.com. This affirmed that USAR is on a short list of companies in line for federal investment as part of Washington’s aggressive push to secure domestic rare-earth supply chains. While USAR’s stock pulled back slightly from Friday’s high (as some traders took profits after the massive run-up), it remains at elevated levels in the mid-$20s — roughly 3× higher than its summer lows. The White House partnership rumor has effectively put a “floor” under the stock, with investors now betting that some form of government deal (grant, contract, or equity infusion) could materialize in the near future.

Company Developments: Acquisitions, Financing & Growth Plans

USAR’s recent rally is built not only on headlines, but also on concrete company moves that set the stage for growth. The past week brought major developments in USAR’s strategy to build a fully domestic “mine-to-magnet” supply chain for rare-earth magnets:

- $100 M Acquisition of LCM: On Sept. 29, USA Rare Earth announced a definitive deal to acquire Less Common Metals (LCM), a UK-based producer of rare-earth alloys used in high-performance magnetsts2.tech. LCM is one of the few non-Chinese suppliers of critical magnet materials like neodymium-praseodymium metal. By buying LCM, USAR secures an in-house source of key inputs for its planned magnet factory – a “significant acceleration of USAR’s mine-to-magnet strategy,” according to the companyts2.tech. The deal terms include $100 million in cash plus ~6.74 million USAR shares issued to LCM’s ownersts2.tech. This roughly $200 million total value underscores the importance of LCM’s capabilities. Analysts lauded the move as “bold and transformative” for USAR’s supply chain integrationts2.tech. The acquisition is expected to close in Q4 2025ts2.tech, and in anticipation, USAR’s stock jumped ~9% pre-market when the news hit7 .

- PIPE Financing & Share Issuance: To fund the LCM purchase and other expansion, USAR simultaneously raised $125 million in new equity. It completed a private investment (PIPE) by selling ~8.33 million shares at $15.00 eachts2.tech. This capital injection boosts the company’s cash reserves without taking on debt. (Notably, this was USAR’s second large PIPE in recent memory – it raised $75 M in 2024 as well, to fund early developmentts2.tech.) The financing was led by institutional investors and advised by White & Case, and it closed on Oct. 1. USAR’s balance sheet is now strong, with roughly $120–130 M in cash on hand as of early October and no significant debt liabilitiests2.techts2.tech. This gives the company runway to build its facilities through at least initial production. Investors appeared to view the share issuance positively (despite the dilution), since it enables the transformative LCM deal and future growth – as evidenced by the stock rising on the share sale newsts2.tech7 .

- New CEO at the Helm: A leadership change came alongside these developments. Barbara Humpton assumed the role of CEO of USA Rare Earth on Oct. 1, 2025ts2.tech. Humpton is a high-profile hire – she is the former CEO of Siemens USA, with deep experience in industrial infrastructure and government projects. The board touted her “infrastructure and defense experience” as pivotal for USAR’s next phasets2.tech. Founder and outgoing CEO Josh Ballard will remain as an advisor through the transitionts2.tech. Under Humpton’s guidance, USAR is expected to sharpen its focus on executing big projects and navigating government partnerships. Indeed, it was just days into her tenure that Humpton made headlines confirming White House talks. Observers note that having a veteran executive with Washington connections could bolster USAR’s credibility as a strategic U.S. supplier.

- Project Pipeline & Partnerships: USAR’s core mission is to establish a fully domestic rare-earth magnet supply chain – from mining to processing to magnet manufacturing. It owns 80% of the Round Top rare-earth deposit in Texas (with partner Texas Mineral Resources owning 20%), which hosts both light and heavy rare earth elements. It is also building a neodymium-iron-boron (NdFeB) magnet plant in Stillwater, Oklahoma, targeting production start in 2026reuters.com. Even before production, USAR has been busy lining up future customers. As of Q2 2025, the company had signed 12 memoranda of understanding (MOUs)/joint development agreements with various companies – representing potential demand of ~300 tons per year of magnets across sectors like defense, aerospace, automotive EV, and even data centersts2.tech. For example, in August 2025 USAR inked an MOU to supply U.S.-made magnets for smart pipeline inspection devices (“pigs”) used in the oil & gas industryts2.tech. These agreements indicate robust interest in a domestic source of rare-earth magnets and could convert to real revenue once USAR’s facilities come online. In terms of recent financials, as expected for a development-stage firm, USAR’s Q2 2025 earnings showed no revenue and a net loss (reported –$142.7 M, mostly due to accounting charges)ts2.tech. Excluding one-time items, the quarterly operating loss was ~$7.8 Mts2.tech, reflecting R&D and build-out costs. Thanks to the new capital raises, the company can sustain this investment phase; management has stated they have sufficient cash to reach initial production by 2026, though additional funding may eventually be needed for full commercializationts2.tech8 .

In short, USAR has dramatically strengthened its strategic position in recent weeks – adding a critical alloy subsidiary (LCM), bolstering its cash coffers, and bringing in experienced leadership. These steps help validate USAR’s ambition to be a one-stop domestic source of rare-earth magnets. They also set the backdrop for why investors have piled into the stock, anticipating that USAR’s integrated model (mine + processing + magnet production) will make it a prime beneficiary of U.S. government support for critical minerals.

Government Tailwinds and Rare Earth Market Factors

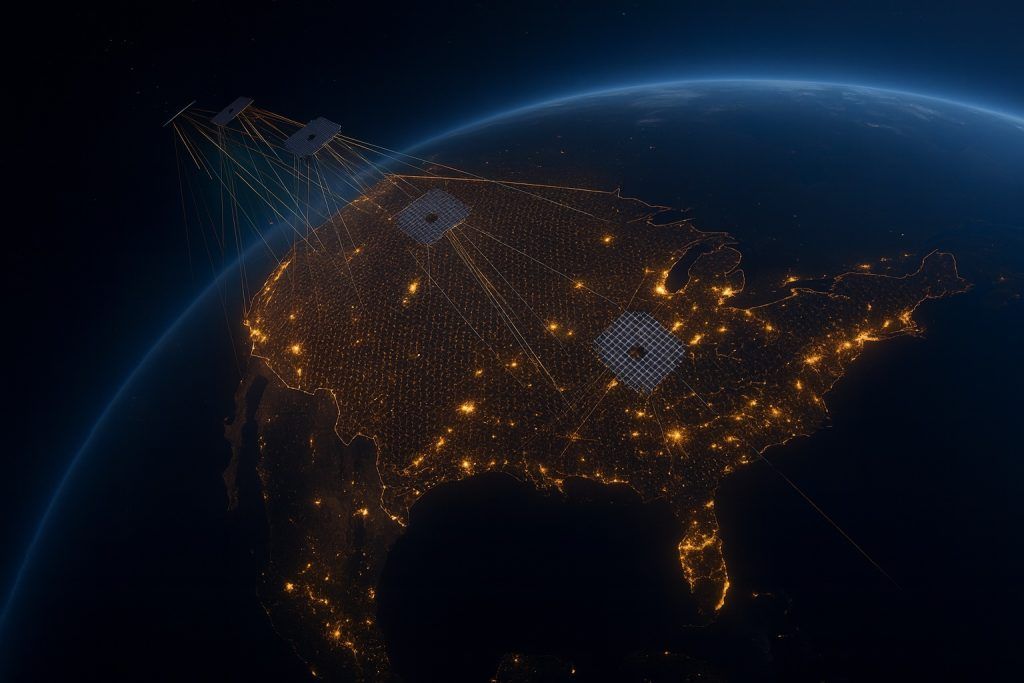

The story of USAR’s rise cannot be separated from the geopolitical and market forces driving the rare-earth sector. In 2025, rare earth elements – especially those needed for permanent magnets – have become a strategic priority for the U.S. government, given their importance in everything from electric vehicles and wind turbines to fighter jets and missiles. USA Rare Earth’s sudden popularity with investors stems largely from its positioning amid these macro trends:

- U.S.–China Tensions: China has long held a near-monopoly on rare earth mining and refining. In March 2025, China abruptly halted exports of rare earths as part of a trade dispute with the U.S., sending shockwaves through global supply chainsreuters.comreuters.com. This embargo (though partially eased in June) underscored U.S. vulnerability and lit a fire under Washington’s efforts to develop domestic rare-earth sources. President Donald Trump responded by invoking emergency powers in March to boost critical mineral production, treating rare earths as vital to national securityreuters.com. These moves created a policy environment extremely favorable to companies like USAR that promise to localize the supply chain. It’s no coincidence that USAR’s stock first began rallying in late Q3 as news of U.S. government initiatives trickled out. For instance, when reports in September suggested the administration was eyeing direct investments in rare-earth firms, speculative money flowed into USAR and peers.

- Federal Investments in Sector: The U.S. government in 2025 moved from talk to action by taking equity stakes in key critical mineral projects. Earlier in the week of USAR’s spike, the Department of Energy (DOE) announced it would take a 5% ownership stake in Lithium Americas (a lithium developer) and a parallel 5% stake in that company’s Thacker Pass mine JVreuters.com. Back in July, the Department of Defense (DoD) struck a deal to invest ~$400 million in MP Materials (NYSE: MP) – acquiring about 15% of MP and becoming its largest shareholderinvestopedia.comreuters.com. MP is the only existing U.S. rare-earth miner (at Mountain Pass, CA), and that high-profile investment sent MP’s stock +50% higher in Julyts2.tech. The message from Washington is clear: to reduce reliance on China, the feds are willing to directly back U.S. rare-earth ventures with cash. This paradigm shift – from grants/loans to actual government ownership stakes – has significantly boosted investor confidence across the critical minerals space. It suggests companies like USAR might not have to shoulder all the risk and capital cost alone; Uncle Sam could become a shareholder/partner. Indeed, Reuters’ Oct. 6 fact-sheet on the strategy explicitly lists USA Rare Earth as in discussions for a potential government stakereuters.com, alongside an 8% stake being discussed in Critical Metals (a firm developing a Greenland rare-earth project)reuters.com. Simply put, USAR is now at the center of the U.S.’s rare-earths policy efforts, a status that significantly raises its profile (and, in investors’ eyes, its future revenue prospects via government contracts or funding).

- Rare Earths Boom (and Volatility): Beyond geopolitics, the market demand for rare earth metals remains robust. Neodymium-praseodymium (NdPr) prices – used in magnet production – have been elevated due to EV demand. Green tech and defense applications are driving a long-term secular growth trend for rare-earth magnets. This has attracted market interest to the sector broadly: for example, Investing.com noted a “rare earths rally” in late September that lifted multiple stocksts2.tech. However, the sector isn’t without volatility. When China temporarily flooded the market by exporting a surge of rare-earth oxides in mid-2025 (up 69% year-over-year in July), U.S. rare-earth equities pulled back sharplyts2.techts2.tech. In fact, USAR saw an ~8% dip on Aug. 18 after data showed a spike in Chinese exports, though analysts noted the long-term thesis was “far from broken” despite short-term swingsts2.tech. This highlights a key risk: policy and trade developments can whipsaw rare-earth prices and, by extension, rare-earth stocks. USAR’s valuation could fluctuate with each headline about China trade talks or tariff changes. That said, the overall trajectory in late 2025 has been upwards. Prices for critical rare metals and magnets are underpinned by multi-year demand from EV manufacturers, renewable energy projects, and military suppliers. Additionally, the DOE in August announced $135 million in new grants to support U.S. rare-earth processing and magnet projectsts2.techts2.tech, part of a broader ~$1 billion initiative. All these factors contribute to a sense that USAR is riding a powerful policy-driven wave.

- Global Supply Chain Moves: It’s worth noting the U.S. isn’t alone in seeking alternative rare-earth supplies. For instance, Benzinga reported that Pakistan just sent its first-ever shipment of rare earth elements to the U.S. under a new $500 million agreementtimesofindia.indiatimes.com. That deal, involving a company called U.S. Strategic Metals, underscores how countries allied with Washington are stepping up to provide critical minerals. While not directly involving USAR, such developments show the urgency in diversifying supply chains. For USAR, more non-China supply (like from Pakistan or Australia) could mean competition in the long run, but in the near term it simply reinforces the strategic importance of rare earths and the willingness of governments to invest large sums in securing them.

In summary, USAR’s meteoric stock rise is tightly interwoven with government policy and rare-earth market dynamics. The company has become a prime beneficiary of U.S. industrial policy – its fortunes have risen as the White House doubles down on reshoring critical mineral production. This alignment with national priorities gives USAR a tailwind that few small-cap miners enjoy. Of course, it also means USAR’s stock may react sharply to any news (good or bad) out of Washington or Beijing. This makes for an exciting but potentially bumpy ride for investors.

Wall Street Insights: Analyst Quotes, Ratings & Forecasts

Market experts and analysts have been quick to weigh in on USAR’s prospects amid its sudden surge. The consensus is optimistic about the company’s strategic value, but there are also notes of caution about execution and valuation. Here’s a look at what the experts are saying:

- Key Analyst Endorsement: “USA Rare Earth is one of the more significant emerging U.S. neo-magnet manufacturers, and any reshoring strategy should include them,” says Subash Chandra, an analyst at The Benchmark Companyreuters.com. Chandra, who has a Buy rating on USAR, emphasized that while a government investment’s exact form is uncertain, “there’s still a missing piece to the mines-to-magnet strategy” that USAR could fillreuters.com. This sentiment – that USAR is a critical piece of the puzzle for America’s supply chain – underlies many bullish takes on the stock.

- Analyst Ratings & Targets: Coverage on USAR is relatively new (the stock IPO’d in mid-2023), but several boutique firms have initiated with positive ratings. Canaccord Genuity reiterated a Buy in late September and raised its 12-month price target to $22 (from $21) after the LCM acquisition newsts2.tech. Canaccord cited the strategic nature of the deal and USAR’s unique vertical integration as justification for a higher valuationts2.tech. Benchmark Co. (Chandra’s firm) likewise maintains a Buy, though with a more conservative $15 target, reflecting a cautious outlook on rare-earth pricingts2.tech. As of the end of Q3 2025, the average analyst target (across 4–5 analysts) stood around $19–20/sharets2.techts2.tech. Notably, USAR’s latest market price (~$26) is above this consensus range, meaning the stock has already exceeded many analysts’ near-term expectations. No major Wall Street bank has a Sell on USAR – the ratings are unanimously Bullish (Buy/Overweight) – but the upside to targets appears more limited after the recent rally. We may see analysts update their models if a concrete government deal emerges; for now, most targets suggest the stock is at or slightly beyond “fair value” based on fundamentals.

- Momentum & Investor Sentiment: Beyond traditional analysts, momentum traders and retail investors have taken a keen interest in USAR. On forums and social media, USAR has trended as a “rare earth play” tied to U.S. policy. Some experts caution that such sentiment-driven spikes can reverse quickly. The Motley Fool noted that while USAR’s week-long run-up (~+57%) was triggered by government stake rumors, the company still has no revenue, and “investors with low tolerances for risk should avoid the stock at this point”aol.com. In other words, this is still a speculative story – the promise is great, but unproven. Seeking Alpha contributors have echoed that guarded view; one recent analysis argued that USAR may offer trading opportunities but “is not a long-term hold” given the likelihood of future rare-earth oversupply once multiple projects (including possibly USAR’s) come onlineseekingalpha.com. This contrarian take warns that today’s high rare-earth prices (and exuberant valuations) could eventually normalize if supply catches up to demand. Bulls, however, counter that the demand for magnets will outstrip supply for years, and that USAR has a first-mover advantage among new U.S. producers.

- Institutional Interest: There are signs that smart money is accumulating USAR despite the volatility. Fintel/Nasdaq data shows institutional holdings of ~12.9 million shares recently – a 679% increase over the last quarterts2.tech. Some hedge funds and strategic investors appear to be betting that USAR will play a key role in a U.S.-backed supply chain, and that any government investment or offtake agreements will significantly de-risk the company’s path to profitability. Such accumulation often lends credibility to a small-cap stock’s story, though it can also mean heavy profit-taking if those funds decide the thesis has played out.

- Technical & Short-Term Outlook: Technically, the stock’s surge has put it in overbought territory. The 14-day RSI around 79–80 is well above the typical threshold of 70, suggesting a potential pullback or at least consolidation could be duefinviz.com. USAR’s price is also far extended above its moving averages (as noted, ~+67% above its 50-day, +110% over its 200-dayfinviz.com). Some traders may view this as a “blow-off top” in the short term, meaning the recent peak might be followed by volatility or a correction as the hype cools. On the other hand, strong news or confirmation of a government deal could provide another leg up. Options activity (for those watching it) has been elevated, implying traders are paying a premium for upside calls – a sign of bullish speculation. But volatility cuts both ways; new investors should be prepared for swift moves.

Overall, analysts acknowledge USAR’s compelling long-term narrative – securing a non-Chinese rare-earth supply chain – and that has yielded a wave of Buy ratings. Price forecasts cluster in the high-teens to low-20s, which is roughly where the stock traded just before the White House news brokets2.techts2.tech. That implies that at ~$25+ per share, the market is already baking in a substantial “strategic premium” on hopes of government contracts or subsidies. Future upgrades (or downgrades) will likely hinge on concrete developments: e.g. if the White House invests, analysts may raise targets; if, conversely, progress stalls or China trade tensions ease (reducing urgency), the stock could be reevaluated downward. For now, Wall Street’s tone is optimistic but measured – bullish on USAR’s concept and management, yet mindful that the company must execute on building its facilities and eventually converting MOUs into revenue.

Investor Outlook – High Hopes vs. Key Risks

As of October 6, 2025, USA Rare Earth’s stock embodies both excitement and uncertainty. The excitement is palpable: USAR is at the nexus of powerful trends (clean energy, defense tech, de-globalization of supply chains) and could become a domestic champion in an industry critical to the 21st-century economy. The recent rally reflects a narrative of national security meets profit opportunity – few small-cap stocks get to trade with that kind of story behind them. Bulls believe that USAR’s integration of mining, processing, and magnet manufacturing positions it to capture outsized value once operations begin. The U.S. government’s evident support for the rare-earth sector only adds fuel to that fire. If the White House indeed takes a stake or provides major contracts, USAR’s path to first revenue in 2026 would be smoothed, and the company could scale faster with federal backing.

However, investors should also weigh the risks and timeline. Despite the recent euphoria, USAR is still pre-commercial – it has no current earnings or product sales, and the first magnets from its Oklahoma plant won’t roll off the line until mid-2026 (assuming no construction delays)reuters.com. That leaves a long runway where many things must go right: completing plant construction, successfully mining and processing ore at Round Top, integrating the LCM unit, and actually achieving the quality and volume targets for magnet output. Any hiccups in these complex projects could rattle investor confidence. Additionally, future funding needs are a consideration. Even with ~$125 M raised now, building a mine and processing facility is capital-intensive. USAR’s filings acknowledge it may need to raise additional capital or partner with larger firms to fully realize its plansts2.techts2.tech. Equity dilution or debt raise down the road could pressure the stock if not offset by new revenues.

Market risks remain as well. The stock’s current valuation – around $2.5 B for a company with zero revenue – is fundamentally based on anticipated 2026+ cash flows and strategic value, rather than present performance. This makes it sensitive to macro sentiment. For example, if U.S.–China relations improve unexpectedly, the urgency around domestic rare earths could diminish, which might deflate some of USAR’s premium (similar to how a hint of easing trade tensions in mid-2025 caused rare-earth stocks to dip)ts2.tech. Conversely, any escalation (trade war, export bans) could send USAR and peers higher again. It’s a bit of a geopolitical proxy. Commodity price fluctuations (NdPr oxide, etc.) will also factor in – if rare-earth prices were to slump due to global oversupply or recessionary demand drop, that would hurt the economics of USAR’s project and likely its stock. Bulls argue the structural demand (EVs, etc.) should keep prices firm, but history shows this market can be cyclical.

From a stock perspective, after such a torrid rise, some consolidation would be healthy. It wouldn’t be surprising to see USAR trade in a range or even pull back in the coming weeks as the initial White House hype is digested. Insider reports indicate some early investors or insiders took the opportunity to trim holdings into the rally (SEC filings in coming weeks may reveal if any insiders sold into strength, which could be a factor to watch). On the flip side, short interest is modest (~9–10% of float)finviz.com, so there hasn’t been an extreme short squeeze factor – meaning the price action has been more about genuine buying. If the story stays positive, shorts may continue to stay away.

Bottom Line: USAR offers a high-risk, high-reward profile at this juncture. The company has made savvy moves (acquiring LCM, securing cash, onboarding a seasoned CEO) and finds itself in the right place at the right time as U.S. policy turns in its favor. Those are strong positives that could translate into substantial revenue and profit by the latter half of this decade. The stock’s 2025 rally – up over 140% year-to-date and ~5× from its IPO pricereuters.com – reflects that promise. Going forward, investors will be looking for tangible progress: factory construction updates, pilot production results, any confirmed government contracts or grants, and eventually the first sales orders. Each milestone could be a catalyst.

However, new investors should also be prepared for volatility and potential setbacks. Any delay in project timelines, changes in political winds, or dilution events could introduce downside. At ~$26, USAR is not the “hidden gem” it was a few months ago; it’s now a well-known play in a trendy sector, and priced accordingly. As one market analyst aptly summarized, the stock’s recent peak “reflects enthusiasm but also implies limited short-term upside” after such a fast runts2.tech. Over the longer term, USAR’s success will hinge on execution – delivering on its mine and magnet plant – and on the continued support of big customers (including Uncle Sam). With a cash-rich balance sheet and a favorable policy backdrop, the company is arguably better positioned than ever to achieve those goals. Yet, given the uncertainties, a balanced approach is warranted: enthusiastic optimism for USAR’s future, tempered by an understanding of the risks that come with pioneering an entire supply chain from scratch. Investors will be watching closely to see if USA Rare Earth can turn today’s hype into tomorrow’s revenue – and thereby justify the lofty valuation that its stock now commands.

Sources: Recent media coverage and filings have been used in this report for accuracy and context. Key references include Reuters (on USAR’s White House talks and critical minerals policy)reuters.comreuters.com, Insider Monkey/Yahoo Finance (on the stock’s record highs)insidermonkey.com, Investopediainvestopedia.com and Barron’s for market analysis, GlobeNewswire and SEC filings for company announcementsts2.techts2.tech, and ts2.tech for consolidated insights on USAR’s financials and analyst viewsts2.techts2.tech. These sources, among others, provide a comprehensive picture of USAR’s current status, recent developments, and the road ahead in the rare-earth arena.