- Major Correction Risk: JPMorgan Chase CEO Jamie Dimon warns that U.S. stocks face a “significant correction” risk in the next 6 to 24 months reuters.com. He said “I am far more worried about that than others,” citing an unusually high level of uncertainty in markets 1 .

- Factors Fueling Fear: Dimon points to geopolitical tensions, heavy fiscal spending, and global military buildups as key risks creating “a lot of things out there” that make him nervous reuters.com. “All these things cause a lot of issues that we don’t know how to answer,” he told the BBC, suggesting markets may be overly complacent about these threats 2 .

- Overheated Markets? Stocks have been soaring to record highs in 2025 – the S&P 500 and Nasdaq just notched new all-time closing peaks this week investing.com. Much of the rally is driven by tech and AI hype, but Dimon cautions that some of these AI investments will “probably be lost” and sees parallels to past bubbles investing.com. He believes AI will ultimately pay off yet warns investors against “unrestrained optimism” 3 .

- Fed and Inflation: Dimon is only “mildly” concerned about inflation at this point and remains confident the Federal Reserve’s independence will hold despite political pressure to cut rates reuters.com. (He noted he’ll take President Trump “at his word” that he won’t interfere with the Fed investing.com.) His bigger worry is that easy money and large deficits have left policymakers “too comfortable” – echoing IMF and others warning fiscal policy is still too loose 4 .

- Recession Not Off the Table: Despite recent strong U.S. economic growth (GDP jumped 3.8% last quarter), Dimon isn’t convinced a recession will be avoided aol.com. He said a U.S. recession could still hit in 2026 ca.finance.yahoo.com, urging leaders not to become complacent amid today’s robust data and AI-fueled optimism. JPMorgan has been preparing for a downturn, and Dimon insists it’s prudent to “navigate any downturn” proactively rather than assume the boom will last 5 .

- Broader Warnings: Dimon’s alarm is reinforced by other experts. This week IMF chief Kristalina Georgieva cautioned that “lofty” stock markets could see large corrections, stating “don’t get too comfortable” with lax fiscal policies reuters.com. Similarly, the Bank of England flagged that AI-driven stock valuations look “stretched” and are at risk of a “sharp reversal” if investor sentiment sours investing.com. In short, some of the world’s top financial minds are sounding the alarm that the current market euphoria may be overdone.

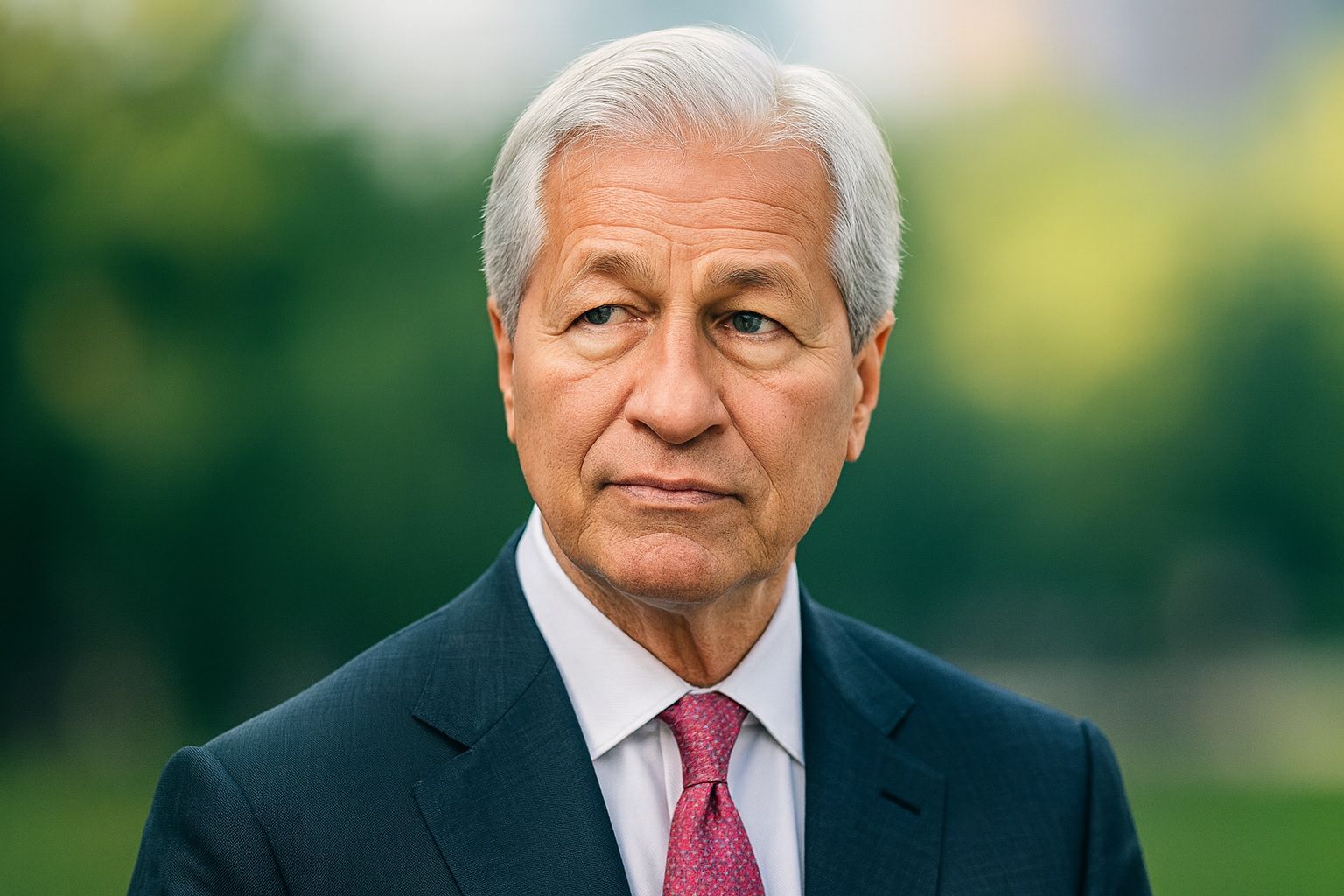

Dimon Sounds the Alarm on a “Serious” Market Correction

Jamie Dimon – one of Wall Street’s most influential bankers – is ringing alarm bells about the soaring U.S. stock market. In an interview with the BBC, the JPMorgan CEO warned that U.S. equities could suffer a major correction within 6 months to 2 years reuters.com. “I am far more worried about that than others,” Dimon admitted, making clear he sees a greater risk of a significant pullback than the average investor right now reuters.com. According to Reuters, he even pegged the odds of a substantial downturn at roughly 30% finviz.com – a striking statement from the long-time banking chief.

What’s behind Dimon’s concern? He points to a confluence of unprecedented risk factors swirling around the global economy. Geopolitical tensions are high – from war and conflicts to superpower rivalries – creating uncertainty that markets may be underestimating. Heavy fiscal spending and debt are another worry: after years of stimulus and large deficits, Dimon fears governments have limited room to maneuver if growth falters reuters.com. He also cites “global remilitarization”, noting that many countries are ramping up defense and military investments amid a more volatile world reuters.com. “All these things create issues we don’t yet know how to answer,” Dimon said, suggesting the unknown consequences of these risks make the future especially hard to predict reuters.com. In his view, the level of uncertainty should be “higher in most people’s minds” than normal – but right now, markets seem to be ignoring a lot of it 6 .

Crucially, Dimon is not forecasting an immediate crash on a specific date – but rather warning that the probability of a serious market correction is uncomfortably high. He’s effectively urging investors and policymakers to stay alert. Market corrections (typically defined as a drop of 10%+ from recent highs) happen regularly, but Dimon’s language (“significant correction” within 6–24 months) implies he anticipates an unusually sharp downturn could be on the horizon. Notably, he highlights a 6-month to 2-year window for when this reckoning could occur reuters.com. That suggests anytime between now and 2027, we might see stocks give back a lot of their gains. Whether it’s triggered by a geopolitical shock, a policy mistake, or something else, Dimon clearly believes the market’s downside risks have grown.

For a bit of context, Dimon has seen his share of crises – from 1987’s crash to 2008’s meltdown – and he’s generally an optimist about America’s economy in the long run. So when “America’s top banker” (as the BBC calls him economictimes.indiatimes.com) expresses this level of worry, it grabs attention. It’s worth noting that Dimon’s warning comes at a time of market euphoria, not panic – which may be precisely why he’s speaking out now. There’s an old investing adage: “be fearful when others are greedy.” Right now, many investors are very greedy, pouring money into stocks at record highs. Dimon seems to be taking the opposite stance, effectively saying: be careful, things aren’t as rosy as they appear.

Interestingly, Dimon also quantified his concern to some degree. MarketWatch reported that he sees about a 1-in-3 chance of a major correction hitting markets in the near term finviz.com. That doesn’t mean a crash is a certainty (there’s roughly a 70% chance it doesn’t happen by that math), but it’s a high enough risk that he feels compelled to raise a red flag. In his words, there are a “lot of things out there” making him nervous, and investors would be wise to “not get too comfortable” in this environment 7 .

Why Are Risks Rising? Geopolitics, Debt & “Unknowns”

Dimon’s cautionary message centers on the idea that multiple risk factors are converging to make the future especially unpredictable. He called out three in particular:

- Geopolitical Tensions: We’re in an era of heightened global strife. There’s the ongoing war in Ukraine, which has disrupted energy and commodity markets, and new conflicts emerging (for example, a major flare-up in the Middle East in October 2025). U.S.-China strategic rivalry is also intensifying, with trade restrictions and tech wars. These kinds of geopolitical flashpoints create economic spillover risks – from oil price shocks to supply chain disruptions – that can spook markets. Dimon implied that such tensions add a layer of fragility: unpredictable international events could knock sentiment or growth off course 8 .

- Heavy Fiscal Spending & Debt: Governments responded to recent crises (pandemic, etc.) with massive spending, and many continue to run large deficits. U.S. federal debt has ballooned above $35 trillion, and budget deficits remain high. While stimulus propped up growth, Dimon worries about long-term consequences: high debt can lead to higher interest rates, inflation pressures, or constrain future stimulus if needed. “All that fiscal spending” might also be inflating asset prices – essentially, too much money chasing stocks reuters.com. The IMF’s Georgieva echoed this, warning that many countries’ fiscal policies are “too lax” right now, which could be fueling asset bubbles and inflation reuters.com. Her advice: “don’t get too comfortable” when governments are splurging – it might feel good now, but it can sow the seeds of a correction later 7 .

- Global Remilitarization: Dimon used this striking term to describe how countries worldwide are bolstering their defense and military capabilities reuters.com. This trend is partly a response to the geopolitical conflicts mentioned, and it represents a major shift in global priorities (after decades of relatively low defense spending post-Cold War). While greater defense spending can stimulate certain industries, it is fundamentally a reaction to a more dangerous world. Dimon’s concern here is twofold: economic strain (guns vs. butter – money funneled to military might add to government debt and deficits) and the implied instability (if nations feel compelled to arm up, it suggests higher odds of conflict or at least a less stable international order). In fact, Dimon has stressed the need for stronger defense preparedness in the U.S., warning earlier that the country could even “run out of missiles” in a conflict economictimes.indiatimes.com. He bluntly stated he’d rather see the world “stockpiling bullets, guns, and bombs” than cryptocurrencies, given today’s dangers economictimes.indiatimes.com. Those comments highlight how seriously he takes geopolitical risk – and how it feeds back into economic risk.

Beyond those specific factors, Dimon suggests an overall sense of the unknown. “These things… we don’t know how to answer,” he said of the assorted geopolitical and policy dilemmas reuters.com. It’s a recognition that we’re in somewhat uncharted territory – whether it’s navigating post-pandemic economics, de-globalization, or rapid tech shifts – and that makes him uneasy about the stock market’s rosy assumptions. Essentially, investors hate uncertainty, and Dimon sees a lot of it on the horizon.

Another subtle point in Dimon’s warning: he hinted that market participants are underestimating these risks. He said the level of uncertainty “should be higher in most people’s minds” than what is reflected in market prices economictimes.indiatimes.com. In other words, stocks might not be properly pricing in the chance that something could go wrong. If everyone is overly optimistic and something bad happens, the adjustment could be abrupt and painful – hence his fear of a sharp correction.

The AI Boom – Blessing or Bubble?

One reason stocks have been soaring in 2023–2025 is the massive enthusiasm around Artificial Intelligence (AI). Tech giants and chipmakers have seen their stocks skyrocket on hopes that AI will revolutionize business (and drive big profits). This “AI rally” has been a major driver of U.S. market gains this year investing.com. But Dimon is wary that investors might be overestimating short-term payoffs from AI, drawing parallels to past tech manias.

He acknowledged that AI is very real and will ultimately “pay off” in a big way, just as transformative technologies of the past eventually did investing.com. However, he cautioned that “most investors in those [new] industries didn’t do well” even if the technology itself succeeded economictimes.indiatimes.com. This is a reference to history: for example, during the dot-com boom of the late 1990s, the internet did change the world (just like AI is expected to) – but many internet stocks crashed and never recovered, wiping out unwary investors. Some AI investments will “probably be lost,” Dimon warned pointedly 9 .

He’s not alone in raising a flag here. The Bank of England just this week highlighted that valuations of AI-focused companies appear “stretched” and could be primed for a “sharp correction” investing.com. In fact, the BoE explicitly linked its concern to AI hype – basically suggesting there’s a bit of an AI bubble forming. If sentiment on AI shifts or if the tech doesn’t deliver profits as quickly as hoped, these high-flying stocks could tumble.

We’ve already seen some eyebrow-raising moves: Tech titans like Nvidia have more than tripled in value in a year on AI optimism, and price/earnings ratios for many AI-exposed stocks are at extreme levels. Comparisons to the late 1990s are becoming more common. Reuters notes that many investors are uneasy about “circular dealmaking” in the AI space and have begun drawing parallels to the dot-com boom and bust era 10 .

Dimon’s message is essentially: don’t get caught up in the hype. He’s not dismissing AI’s potential – far from it. But he is urging caution about the stock market’s unrestrained euphoria around AI. When asked about the AI-driven market boom, he agreed “AI is real and will pay off overall – just like cars and TVs did – but…” (there’s always a but) “…most investors in those industries didn’t do well.” economictimes.indiatimes.com. In other words, being right about a technology’s future is not the same as making money off it in stocks – timing and valuation matter.

To illustrate this, consider that in the 1920s radio was the hot new tech – radio did change the world, but most radio-related stocks went bust. The AI sector today could see a similar shakeout: some big winners, but a lot of losers too. Dimon is effectively warning that the current market may be “overheated” by the AI frenzy 2 .

This concern comes as stock indices are hitting record highs largely thanks to AI excitement. The Nasdaq Composite (packed with tech companies) has exploded past 23,000 points for the first time investing.com, and the S&P 500 benchmark is around 6,750, also at an all-time peak investing.com. (Both indexes have logged fresh record closes in early October 2025.) Even the venerable Dow Jones Industrial Average is flirting with new highs, recently trading near 46,700 investing.com. It’s precisely this euphoric environment that has Dimon and others worried – when markets price in perfection, even a small hiccup can lead to a big selloff.

One more aspect Dimon touched on is the importance of the Federal Reserve’s independence in this context. Why would a banker bring up the Fed’s independence when talking about market risks? Likely because he’s concerned about political pressure to juice the economy. President Trump has loudly criticized Fed Chair Jerome Powell and pushed for interest rate cuts investing.com. If politics were to unduly influence the Fed (for example, forcing premature rate cuts to pump markets or the economy), it could undermine confidence and ultimately backfire – possibly stoking inflation or new bubbles. Dimon said he’s “willing to take Trump at his word” that he wouldn’t interfere with the Fed investing.com, but the fact he addressed it shows it’s on his mind. The Bank of England also flagged Fed independence as a concern – essentially warning that if investors suspect central banks might cave to politics, it could unsettle markets reuters.com. All of this ties into the theme: complacency and meddling could set the stage for a rough correction.

Market Peaks Amid Warnings: Is Complacency High?

It might seem counterintuitive that these grim warnings are coming even as market indexes reach historic highs. After all, the Dow, S&P 500, and Nasdaq are at or near record levels – shouldn’t that be a sign of strength? In fact, the U.S. stock market has been on a tear in 2025, defying many skeptics. The economy’s been resilient (more on that later), tech innovation is booming, and investors have been riding a wave of optimism.

However, history shows that extreme optimism often precedes a pullback. There’s a reason Wall Street veterans talk about “climbing a wall of worry” – markets tend to do well when investors are cautious (climbing the wall), and conversely, when virtually no one is worried is when you should watch out. Right now, we might be closer to the latter scenario. Investor sentiment indicators in late 2025 have shown bullishness at multi-year highs, and measures of market volatility are relatively subdued. The VIX (volatility index) has been hovering in a low-to-moderate range (~15–17), reflecting a lack of fear in the market.

Dimon’s message – “be worried” – is almost the antidote to complacency that he feels is pervading the market. And he’s not the only one. This week, global financial leaders openly voiced concerns about market froth. The IMF’s Managing Director, Kristalina Georgieva, specifically warned that the world economy faces risk from “potentially large corrections in lofty stock markets” reuters.com. When the head of the IMF is cautioning about asset prices on the same day the world’s largest bank CEO is doing so, it feels like a coordinated reality check for investors. Georgieva also highlighted that many governments are still running easy fiscal policies – basically pumping money – which can inflate asset bubbles. Her comment “don’t get too comfortable” was directed at policymakers, but it might as well be aimed at investors reveling in the rally 7 .

The market’s reaction to these warnings has been subtle but telling. On Thursday, Oct 9, after Dimon’s and Georgieva’s remarks circulated, global stocks actually paused their advance reuters.com. Major indices that had been climbing took a breather; some edged slightly lower as traders digested the warnings. Gold – a traditional safe haven – held firm near multi-year highs (above $4,000/oz, according to Reuters reuters.com), suggesting some investors were hedging bets by moving into safer assets. It’s as if the market collectively said, “Wait a second, should we be worried?”

To put the current market in perspective: as of early October 2025, the S&P 500 index is up dramatically year-to-date, driven by enormous gains in a handful of mega-cap tech stocks. Companies like Apple, Microsoft, Google, and Nvidia – the so-called “Magnificent Seven” – have propelled the indices upward on AI enthusiasm and strong earnings. The Nasdaq Composite (heavy in tech) has gained over 30% in 2025, and the S&P 500 isn’t far behind. Many of these big stocks are trading at rich valuations, with price-to-earnings ratios well above historical averages. Market breadth has been a concern – meaning the rally is somewhat narrow, reliant on those few giants, while many other stocks lag behind. Such a configuration can be vulnerable: if the leaders stumble, the whole market can quickly correct.

All this is to say, the backdrop for a correction is present: high valuations, lots of good news priced in, and emerging risks that could disrupt the narrative. As Mike Dolan of Reuters wrote, a “series of warnings about excessive stock valuations” has begun to reverberate just as markets sit at peaks reuters.com. When IMF, BoE, and JPMorgan’s Dimon are all waving yellow flags, investors would be wise to pay attention. It doesn’t mean a crash is certain, but it means the upside might be more limited and the downside risk is growing.

2026 Recession? Dimon Isn’t Convinced We’re Safe

What about the broader economy? Part of Dimon’s caution extends beyond just the stock market. He’s also eyeing the possibility of a U.S. recession in 2026, even though recent data has been surprisingly strong. In a Fortune interview (as reported via Yahoo Finance), Dimon said a U.S. recession could still occur in 2026, despite GDP growing 3.8% last quarter ca.finance.yahoo.com. This is noteworthy because 3.8% GDP growth is quite robust – it suggests the economy as of mid-2025 is humming along. Yet, Dimon is effectively saying: “Don’t be fooled, we’re not out of the woods.”

Why would he suggest a recession might hit in 2026? A few plausible reasons, reading between the lines of his comments and other indicators:

- Lagged Impact of Interest Rates: The Federal Reserve raised interest rates sharply in 2022-2024 to combat high inflation. Those rate hikes work with a lag – often 12-24 months before the full effect is felt. By 2025, inflation has cooled (hence Dimon’s only “mild” concern on that front reuters.com), but the flip side is that higher rates could bite harder in 2026. High borrowing costs can slow business investment, cool off housing markets, and squeeze consumers (e.g. higher mortgage and credit card rates). It’s possible Dimon expects the cumulative drag of tight monetary policy to show up by 2026, tipping the economy into a mild recession.

- Credit Tightening: Dimon’s bank (JPMorgan) is at the center of the credit markets. He likely has a pulse on lending conditions. After some regional bank turmoil in 2023 and the Fed’s hikes, banks broadly have tightened lending standards. This doesn’t immediately cause a recession, but over time, if loans are harder to get (for businesses or consumers), economic activity can slow. By 2026, credit tightening from prior years could restrain growth enough to contract the economy.

- Consumer Savings and Spending: U.S. consumers powered through the pandemic recovery with help from stimulus and savings, but by 2025 those excess savings have been drawn down. If consumer spending (which is ~70% of the economy) decelerates as savings dry up and job growth slows, that can lead to a downturn. We don’t have Dimon’s detailed thoughts here, but as a banker he watches consumer health closely. He might be warning that consumer finances could weaken in late 2025 into 2026, especially if student loan payments (just resumed in late 2025) and other headwinds hit.

- External Shocks: Any of the geopolitical risks mentioned earlier could also trigger an economic downturn. A major oil price spike, for instance, can precede recessions (as happened in the 1970s). With today’s geopolitical climate, one can’t rule out such a shock in 2025 or 2026 that hurts growth.

Dimon’s phrasing was that he’s “not taking a recession off the table” for next year aol.com. He’s essentially saying the odds of a 2026 recession are significant enough to plan for. This aligns with a number of forecasters who, throughout 2024-25, have been pushing out their recession predictions. (For example, Goldman Sachs in mid-2025 still put roughly a 30% chance on a U.S. recession within 12 months reuters.com – not a base case, but not negligible either.) Dimon seems to be in the camp that while a “soft landing” (no recession, just slowing inflation) is possible, we shouldn’t bank on it. He wants JPMorgan – and by extension, everyone – to be prepared if a downturn hits.

Indeed, he has emphasized that his bank is prepared to navigate any downturn aol.com. JPMorgan has likely been building up reserves for potential loan losses and stress-testing its balance sheet against recession scenarios (standard practice for big banks, but something Dimon pays extra attention to). When he speaks publicly about recession risk, it’s both a message to the market and a reflection of how he’s managing the bank’s strategy (cautiously).

In that Fortune interview, Dimon also “called for policy stimulus upsides” – meaning he acknowledged there could be positive surprises if policy responses are effective. This might refer to the idea that if a recession looms, governments and central banks still have tools to fight it. For instance, if inflation is truly under control by 2026, the Fed could cut interest rates to stimulate growth, and Congress might consider fiscal stimulus if unemployment jumps (though the high debt levels make that trickier). There’s also ongoing investment from the 2021 infrastructure bill and 2022 CHIPS Act, which could provide some cushion by creating jobs and spending. So it’s not all doom and gloom – there are possible upsides that could soften a recession or maybe prevent one if used wisely. Dimon’s point, however, is that we shouldn’t assume we’re invincible. As he put it, he isn’t ruling out weakness ahead in the economy aol.com, despite recent strength.

One small silver lining Dimon noted: some policy moves in recent years have had positive effects. He gave credit, for example, to pressure that led NATO allies in Europe to boost defense spending and tackle competitiveness issues – partly spurred by U.S. prodding economictimes.indiatimes.com. This suggests that even tumultuous times can yield improvements (in this case, Europe getting its act together on defense). It’s a reminder that the future isn’t all bleak. However, such policy “upsides” don’t erase the near-term risks he sees; they’re more like long-term benefits that come out of challenges.

In sum, Dimon’s view on the economy can be summarized as: hope for the best, prepare for the worst. JPMorgan is preparing, and he’s implicitly advising others to do the same. That doesn’t mean dumping all stocks or predicting a specific crash date – it means stress-testing your plans and recognizing that the next couple of years could bring some economic storm clouds. Many CEOs and investors were caught off guard in previous cycles by assuming good times would roll on (think of 2006-07 before the financial crisis). Dimon is determined not to be caught off guard in that way.

What’s Next: Expert Outlook and How to Prepare

With all these warnings swirling, what should investors and the public make of it? It’s important to strike a balance: not every warning materializes into a crash or recession, but when multiple credible voices raise concern, it’s wise to pay attention. Here are some key takeaways and forecasts from experts, including Dimon, and how one might interpret them:

- Volatility Ahead: Expect the currently calm markets to get choppier. When valuations are high and risks lurk, volatility (ups and downs) tends to increase. We might not know the trigger – it could be a Fed policy meeting, a piece of geopolitical news, or an earnings shock – but sudden dips (or even corrections) should not come as a surprise. As one analysis on TS2.tech put it, investors should be prepared for extreme swings and not assume prices will only go up in a straight line ts2.tech. In practical terms, that means don’t panic, but don’t be complacent: if you’re investing, be ready for the possibility that your portfolio could swing 10-20% in value in either direction as the market sorts through these uncertainties.

- The 2025–2026 Forecast Range: Many strategists have begun issuing more conservative forecasts for late 2025 into 2026. Some see the S&P 500 continuing to rise modestly if earnings come through and AI delivers gains, but almost everyone acknowledges elevated downside risks. For instance, Morgan Stanley’s analysts (known bears recently) have suggested the S&P could fall back into correction territory if earnings falter or if the economy weakens in 2026. On the flip side, optimists like Fundstrat’s Tom Lee (a perennial bull) argue that if inflation keeps dropping and the Fed starts cutting rates next year, stocks could surprise to the upside despite these warnings. In short, the forecasts are wide-ranging – a sign of the uncertainty Dimon highlighted. When the outlook is this clouded, it often makes sense to plan for multiple scenarios rather than bet the farm on a single outcome.

- Recession Odds: Economists are somewhat divided, but a plurality see growth slowing in 2025 and a higher chance of recession by mid-2026. For example, a recent Bloomberg survey of economists put the probability of a U.S. recession in the next 12 months around 1 in 4 – not a base case, but significant. Dimon’s own implied odds (he thinks there’s a meaningful chance, say around 30%) line up with this cautious view finviz.com. If a recession hits, most expect it to be mild to moderate, not a 2008-style meltdown. Why? Banks are better capitalized, there aren’t obvious systemic bubbles as in housing (aside from possibly pockets of the stock market), and the Fed could respond by easing policy. However, even a mild recession can cause the stock market to drop 20% or more in the short term. So the risk to assets is real even if the economy’s contraction is modest.

- What could avert the worst? As mentioned, policy responses will be key. If inflation remains under control (currently U.S. inflation has come down to ~3% in 2025 from ~9% in 2022), the Fed has room to cut rates if needed, which could cushion any downturn. Fiscal policy is trickier given high debt, but targeted measures (like unemployment benefits, infrastructure spending already in pipeline) could help. Also, there’s the chance that AI and productivity gains actually start boosting corporate earnings significantly, which would justify some of the market’s optimism. If, say, corporate America sees a surge in efficiency from AI tools in late 2025 into 2026, it might allow profits to stay strong even if the economy slows – a scenario that could enable a soft landing after all. Investors are basically in a tug-of-war between these bullish possibilities and the bearish risks we’ve outlined.

- Expert Quotes: To gauge sentiment, look at some recent quotes:

- Kristalina Georgieva (IMF): “Downside risks are rising. Don’t get too comfortable.” reuters.com – She’s essentially advising governments (and by extension all of us) to prepare for tougher times ahead, even though things look fine now.

- Mike Dolan (Reuters) on market mood: “Warnings about excessive stock valuations and overly loose policy are reverberating through markets.” reuters.com This captures the turning tide: the narrative is shifting from unbridled optimism to a more cautious tone.

- Ray Attrill (National Australia Bank): He warned that if a “major stock market correction” happens, it will test even other markets like crypto, potentially causing them to “crash in tandem” ts2.tech. This is a reminder that in a true risk-off event, correlations often go to 1 – meaning almost all assets (stocks, crypto, even corporate bonds) can fall together as everyone rushes for safety. It underlines why diversification across asset classes and holding some safe assets (like cash or Treasuries) can be wise late in a cycle.

- Investment Strategy Adjustments: Financial advisors often say that while you can’t time the market, you can manage your risk. With these warnings, we may see some investors rotating out of the hottest, most expensive stocks into more defensive areas. Defensive sectors like healthcare, utilities, or consumer staples (companies that tend to be stable even in downturns) might get more love. Value stocks (cheaper, steadier companies) could outperform high-flying growth stocks if a correction hits. We’re already seeing a bit of that – in recent weeks, energy and utility stocks have begun to pick up after lagging, and small-cap stocks (which suffered earlier) have shown some life, which can sometimes happen when the market starts pricing in an economic slowdown. It’s as if smart money is quietly rotating to prepare for a bumpier road.

For the average person – maybe a 401(k) investor or someone saving for retirement – the best course is usually not to panic but to stay diversified and avoid heavy bets on the most overhyped assets. Dimon’s warning is a call to review one’s financial plan. Ensure you’re comfortable with the potential ups and downs. If you’d lose sleep at night if your portfolio fell 20%, that’s a sign you might be taking on too much risk and perhaps should rebalance. The goal is to be able to weather a correction or recession without derailing your long-term objectives.

It’s worth emphasizing that market corrections are normal. On average, a 10% dip happens about once every 1-2 years in stocks. We haven’t had a sizable correction in a while during this recent bull run, so one could even be considered healthy to prevent excesses. Dimon’s alarm, though, is about a particularly sharp correction – something more in the 20%+ category, possibly accompanied by a recession. Those are less frequent (perhaps once a decade events for a 20-30% drop, outside of pandemics or crises). They do happen, and when they do, they reset valuations and set the stage for the next recovery.

Consider this: if a serious correction does hit, it might actually present opportunities for savvy investors. As Warren Buffett famously advises, “Be greedy when others are fearful.” If the market tumbles and you have cash or steady income, you could pick up fundamentally strong stocks at a discount. So one actionable insight from all this is: have a plan. If you’re concerned like Dimon, maybe raise a bit of cash or allocate a bit more to bonds as dry powder. Then, if the correction comes, you’re not forced to sell in panic; instead, you can potentially buy quality assets at lower prices.

In closing, Jamie Dimon’s warning is a reminder that good times don’t last forever – cycles turn, and being unprepared can be costly. Right now, the party is still going on Wall Street, but the lights have flickered a bit. The best outcome, of course, would be if these warnings prove to be just that – warnings, not prophecy – and we manage a soft landing with only mild market hiccups. That’s possible. But as Dimon and others stress, now is the time to stay vigilant. In his own blunt words, “the level of uncertainty should be higher in people’s minds” than it is economictimes.indiatimes.com. By acknowledging that and planning accordingly, we can hope to navigate whatever lies ahead – whether it’s a minor stumble or a serious correction – without undue harm. In the end, markets reward patience and resilience, and those qualities are easiest to muster when you’re not blindsided by risks. Thanks to voices like Dimon’s, fewer investors will be blindsided now. As the saying goes, forewarned is forearmed. Stay safe and strap in for a potentially bumpy 2026, even as we enjoy the tail end of 2025’s bullish ride.

Sources:

- Reuters – Dimon interview summary reuters.com reuters.com 11

- Investing.com – Analysis of Dimon’s BBC remarks and market context investing.com investing.com 12

- BBC/Reuters via Morningstar & FinViz – Dimon’s quoted odds of correction 13

- Fortune (via Yahoo Finance) – Dimon on recession risk for 2026 ca.finance.yahoo.com 5

- Reuters – Morning Bid column on global warnings (Georgieva, BoE, Dimon) reuters.com reuters.com 14

- Economic Times (ETMarkets) – Extended quotes from Dimon on AI and defense risks economictimes.indiatimes.com 15

- TS2.tech – Crypto market analysis echoing stock correction caution (Attrill quote) ts2.tech 16