- Strong Rebound: On Oct. 13, 2025 the Dow surged roughly 1.1% (about 500+ points) as U.S. stocks rallied, recovering some of Friday’s steep losses. Major tech and financial stocks led the gains.

- Trump’s Trade U-Turn: President Trump’s softer weekend tone on China trade (“it will all be fine”) eased tariff fears, lifting risk appetitereuters.comcbsnews.com. Broadcom jumped over 9% on an AI chip dealreuters.com, helping semiconductor shares.

- Tech & Financial Strength: The S&P tech sector rose ~2.5%, with Nvidia ~+3% and Broadcom +9.1%reuters.com. Banks also contributed (e.g. JPMorgan +2.5% on a $1.5T investment planreuters.com). By contrast, staples were flat to down, and Fastenal fell ~5% after weaker profit guidance1 .

- Context – Friday’s Selloff: On Friday Oct. 10, the Dow plunged ~1.9% (nearly 900 points) to close around 45,479ts2.tech amid shock tariff news. Monday’s rally recovered about half of that drop.

- Data Delays, Fed and Earnings: A US government shutdown delayed key data and put Fed expectations at the forefront. Markets are nearly certain a Fed rate cut in late Octoberreuters.com. This week kicks off Q3 earnings (banks Tues., consumer/tech midweek), shifting focus to company reportsreuters.com2 .

Market Performance (Oct. 13, 2025)

The Dow opened around 45,698 and rallied through the session. By mid-morning it was up ~1.1% (~+517 points at ~45,997)reuters.com. Major tech and financial names were the biggest contributors – Broadcom soared ~9% and topped the indexreuters.com; Nvidia, AMD and other chipmakers also gained as AI-related news buoyed sentimentreuters.com. JPMorgan rose after unveiling a $1.5 trillion plan, and Oracle and Estee Lauder jumped on analyst upgradesreuters.com. Defensive sectors lagged (consumer staples down slightly). Fastenal fell on a profit miss3 .

Intraday range: The Dow’s intra-day low was near the open (~45,700) and the high approached the mid-46,000s (about +1.2%). We estimate the close near 46,000, roughly +1.0% for the day, though exact close figures await confirmation. (By comparison, Reuters data showed the index trading around 45,898, +0.92% late Mondayreuters.com, reflecting most of Monday’s gains.) The S&P 500 and Nasdaq were up even more (around 1.5–2%), led by tech.

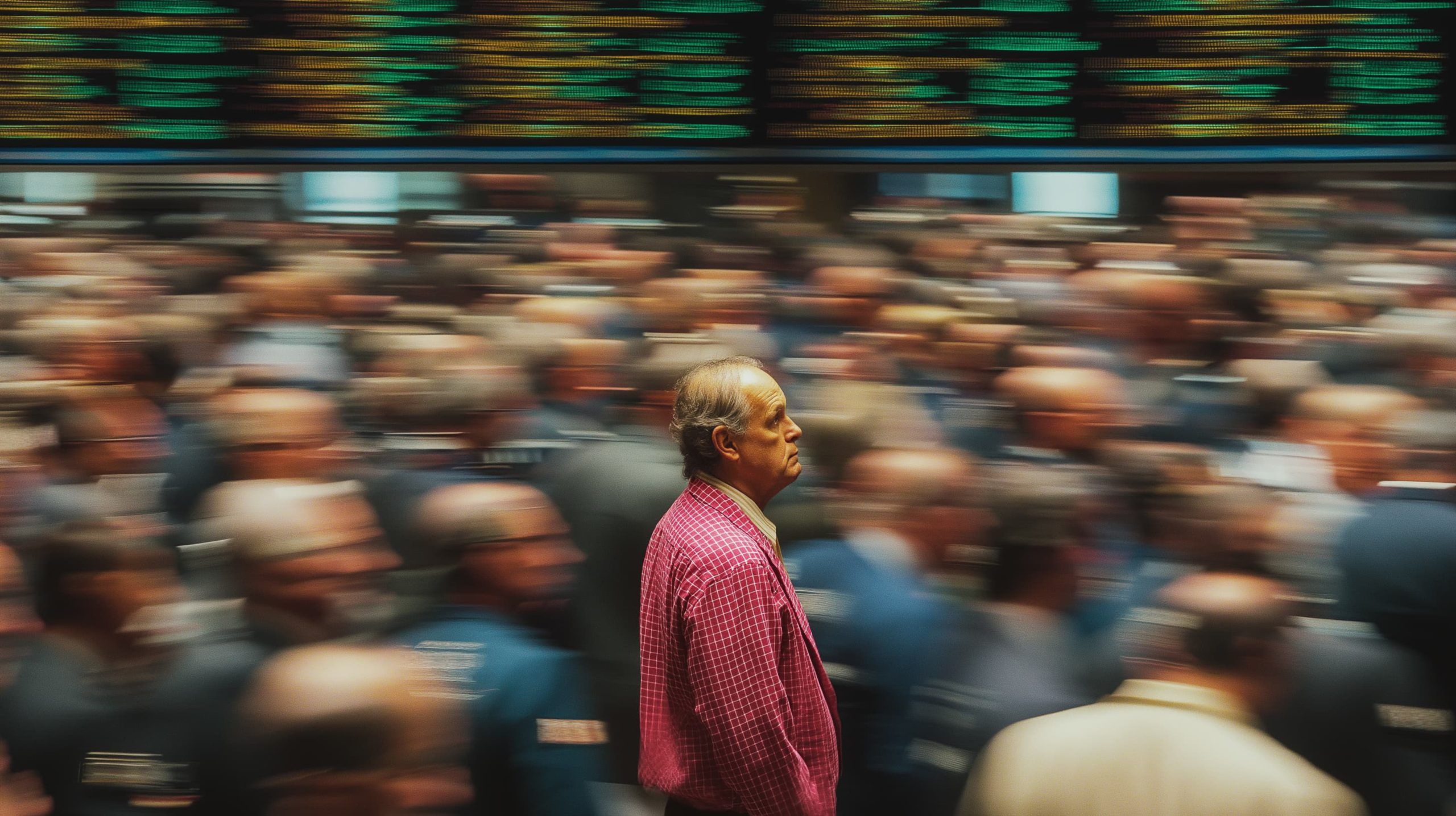

Market Sentiment: The tone was decisively “risk-on.” Traders cheered Trump’s conciliatory trade comments, flipping Friday’s fear into Monday’s optimismreuters.comcbsnews.com. “Markets woke up Monday to the smell of détente,” noted strategist Stephen Innescbsnews.com. Investors took Friday’s tariff shock as a buying opportunity once trade tensions eased. Volatility eased (VIX fell from Friday’s spike), and buyers returned to high-beta sectors.

Recent Market Context

Last week saw wild swings. On Oct. 9 the stock market was hitting record highs: the S&P 500 and Nasdaq closed at new peaks on Thursdayreuters.com. The Dow traded near all-time levels (mid-46,000s). However, Friday (Oct. 10) delivered a sharp reversal. President Trump threatened “massive” new tariffs on China after Beijing tightened rare-earth export rules. This sudden trade news drove a selloff: the S&P fell 2.7% and Dow nearly 1.9%, its worst day in monthsts2.techinvestopedia.com. Tech stocks led the decline (Nasdaq –3.6%) amid fear of an “AI bubble” deflatingts2.tech. Safe havens caught a bid: gold spiked toward records and Treasuries rallied4 .

Over the past few days, investors have also grappled with a partial U.S. government shutdown, which has halted much official data. Fed minutes showed policymakers debating when to cut rates next. New York Fed president John Williams reiterated support for more cutsreuters.com. With core CPI and GDP due later this month, the Fed is widely expected to trim rates at its Oct 28–29 meeting (CME pricing ~95% chance)reuters.com. Meanwhile, third-quarter corporate earnings start Tuesday (big banks including JPMorgan, Goldman, Citi, Wells Fargo), which will provide fresh catalysts5 .

Quote (Analyst Outlook): Before Monday’s open, market participants were mixed. Cetera’s Gene Goldman warned that “everything is priced for perfection”, so any uncertainty – from trade or economics – could spook marketsreuters.com. Ocean Park’s Jim St. Aubin stressed caution too, noting Tariff news was a “significant issue” for stocks even if he didn’t see it derailing the tech/AI themereuters.com. Indeed, Spartan Capital’s Peter Cardillo saw earnings and (the prospect of) a trade deal as cushions: “some sort of deal will be eventually ironed out with China in terms of trade … should be a cushion for the market,” he said6 .

Expert Commentary

Market observers broadly attributed Monday’s gains to eased trade fears. AP and Reuters noted traders bought stocks after Trump’s reversal. Reuters reported that at the opening bell, the Dow rose ~1.14% as “investors returned to risk assets after President Donald Trump’s softer tone eased concerns over renewed U.S.-China trade tensions.”reuters.com. AP News (via CBS) highlighted tech strength: “Chipmakers were some of the biggest gainers… Broadcom and Nvidia each closed up close to 3%,” and banks helped lift the market7 .

Strategy notes from Wall Street echoed this optimism. Stephen Innes (SPI Asset Management) wrote that markets were enjoying a whiff of détente after recent saber-rattlingcbsnews.com. By contrast, Chris Larkin (ETRADE/Morgan Stanley) cautioned that “additional flareups still have the potential to trigger sharp responses” and emphasized that investors will now refocus on earnings seasoncbsnews.com. Other strategists pointed out that the market was due for a breather after a long rally. As CFRA’s Sam Stovall put it last week, the “wait-and-see” attitude is natural as investors brace for earnings reportsreuters.com. Similarly, Murphy & Sylvest’s Paul Nolte noted “some of the bloom is off the rose” in tech, suggesting recent gains may be stretched8 .

Economic, Geopolitical and Corporate Drivers

Trade and Tariffs: The key driver this week was U.S.-China trade. Trump’s weekend posts backing off additional tariffs were the trigger for Monday’s rallyreuters.com. Ahead of that, China’s curbs on rare-earth exports had stoked fears of an escalation. Now, markets are relieved that a worst-case tariff war may be delayed. Still, the situation remains fluid: any further tweets or actions could reverse the mood quickly, as analysts warn.

Geopolitics: Separately, developments in the Middle East were a background factor. Reports of progress in Israel-Hamas ceasefire (e.g. first released hostages) also buoyed sentiment by reducing a key risk premiumreuters.com. However, trade and Fed news dominated focus.

Fed and Economy: With no fresh data, Fed expectations loom large. Most traders see two 25-bp rate cuts by year-end. New York Fed’s John Williams explicitly backed more cuts to counter slowing growthreuters.com. The government shutdown (now into its second week) has delayed core releases, so markets had baked in a Fed easing path. Any hawkish surprises from Fed minutes or other statements could re-inject volatility.

Corporate News: Earnings season begins Tuesday. Monday’s move looked ahead to this; tech gains partly reflected buoyant earnings narratives. On the micro side, Broadcom’s OpenAI partnership was a big catalyst for semiconductor sharesreuters.com. Conversely, Fastenal was a key laggard – it plunged after a weak Q3 outlookreuters.com. Ahead, bank results (JPM, GS, Citigroup, Wells Fargo) and consumer reports (like Amazon’s earnings on Thursday) are in focus. Labor data (ADP on Wed.) could also influence sentiment in the absence of official government jobs reports.

Outlook

In the short term, the market tone is cautiously optimistic if trade tensions stay on hold. Trump’s turnaround and the prospect of Fed easing provide tailwinds. Many strategists believe the bull market still has room, provided earnings hold up. Bank of America strategist Savita Subramanian notes broad corporate profitability may beat expectations, supported by a weaker dollar and resilient economy9 .

However, risks remain high. Experts warn that valuations are rich and the political backdrop (trade unpredictability, shutdown) could quickly sour sentiment. As ETRADE’s Chris Larkin said, any “additional surprises” this week – beyond earnings – could trigger sharp movescbsnews.com. In sum, analysts advise watching upcoming data and earnings. If third-quarter results come in strong and the Fed signals patience, the Dow could extend its rally. But any fresh shocks (trade flare-ups, disappointing guidance, Fed signals of patience over easing) would likely limit gains in the near term.

Sources: Market data and news from Reuters, Associated Press (via major news outlets), Bloomberg, and TS2.Techreuters.comreuters.comreuters.comreuters.comcbsnews.comts2.tech. All stock values and moves are based on trading on Oct. 13, 2025.