- Stock Soars:Rani Therapeutics (NASDAQ: RANI) nearly tripled in price on Oct. 17, 2025, surging over +150% in pre-market trading after announcing a landmark pharma partnership tipranks.com. Shares leapt from around $0.47 to ~$1.37 intraday (almost +190%), on trading volume dozens of times above average, signaling a frenzy of investor interest 1 .

- $1 Billion+ Pharma Deal: The clinical-stage biotech inked a collaboration with Chugai Pharmaceutical worth up to $1.085 billion, combining Rani’s oral drug-delivery tech with Chugai’s antibody for a rare disease au.investing.com globenewswire.com. Rani gets $10 million upfront, up to $75 million in development milestones and $100 million in sales milestones for the first program, plus single-digit royalties globenewswire.com. Notably, Chugai can add 5 more drug targets under similar terms, potentially pushing total payments over $1 billion 2 .

- Funding Windfall & Runway: Alongside the deal, Rani raised $60.3 million in an oversubscribed private placement led by Samsara BioCapital with participation from RA Capital and other biotech investors au.investing.com. At $0.48 per share (at-market pricing), the financing boosts Rani’s balance sheet and, together with Chugai’s upfront and expected $18 million in near-term milestones, funds operations into 2028 globenewswire.com. This cash infusion greatly extends Rani’s runway from a precarious position (cash was just ~$10 million mid-year) 3 .

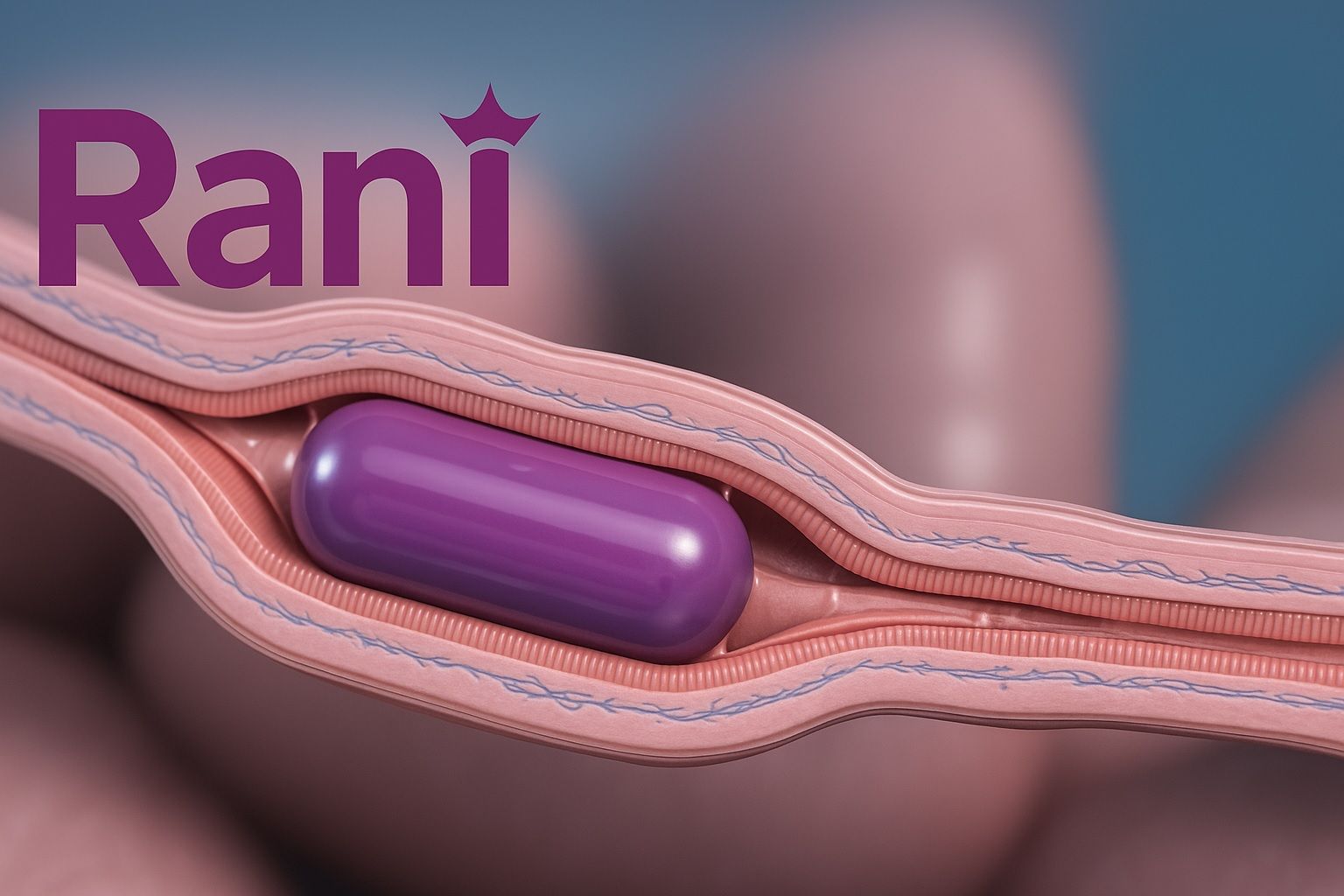

- Biotech Innovation – Oral Biologics: Rani is a pioneer in oral drug delivery technologies. Its proprietary RaniPill® capsule is a “robotic pill” designed to replace injections of biologic drugs (like insulin, antibodies) with a swallowable capsule globenewswire.com. Through multiple studies, the RaniPill has shown high reliability, safety, and injectable-level efficacy when delivering proteins and peptides orally globenewswire.com. In simple terms, Rani’s capsule travels intact through the stomach, then deploys a tiny needle in the intestine to inject the drug – a painless process due to few pain receptors in the gut.

- Market Sentiment & Outlook: This breakthrough deal has put RANI on the map, but investors remain divided on its long-term prospects. The few Wall Street analysts covering Rani rate it a “Strong Buy” with price targets ranging $7–$9 (several hundred percent above the current ~$1 level) marketbeat.com gurufocus.com, reflecting optimism about its technology. At the same time, caution abounds: Rani has no commercial revenue and ongoing losses, and even TipRanks’ AI-driven model flags “significant financial struggles” and rates the stock Underperform tipranks.com. The stock’s extreme volatility and micro-cap status underscore the high-risk, high-reward nature of this biotech play.

RANI Stock Price Explodes on Deal News

Rani Therapeutics’ stock price skyrocketed on Friday, Oct. 17, after the company unveiled a major partnership and funding news. In pre-market trade, RANI jumped about 150% and continued to rally after the market open tipranks.com. The stock, which had closed at just $0.47 the prior day, briefly hit approximately $1.37 per share – nearly a 3× gain in value google.com. By midday, shares were still trading around the $1.30 level, up almost +180% on the day. This stunning one-day move snapped RANI out of penny-stock territory and back above the Nasdaq’s $1 minimum bid price, easing near-term delisting fears.

Such a dramatic spike in price was accompanied by unusually heavy trading volume, indicating intense investor interest. About 70 million RANI shares changed hands on Oct. 17 – an astonishing jump compared to the stock’s modest three-month average of ~318,000 shares per day tipranks.com. The frenzy reflects traders piling in on breaking news. Notably, RANI had been in a long slump prior to this surge: even after the pop, shares remain down about 65% year-to-date and over 80% below their levels a year ago tipranks.com. This context shows how badly the stock had been beaten down – and how transformative the new developments appear to investors.

The immediate catalyst for Rani’s rally was a game-changing collaboration announcement with a large pharmaceutical company (details below), coupled with a significant capital raise. The twin news items hit the wire early Friday morning and quickly ignited a buying spree. “Rani Therapeutics Holdings Inc stock surged 148.3% in premarket trading Friday after announcing a collaboration agreement with Chugai Pharmaceutical and securing a $60.3 million private placement,” reported Investing.com au.investing.com. The combination of a big-name partnership and fresh funding gave the market a double dose of good news – a potent recipe for the explosive upside seen in RANI’s share price.

$1 Billion+ Collaboration with Chugai Pharma

The centerpiece of Rani’s news is a major collaboration and license agreement with Chugai Pharmaceutical, a Japan-based pharma innovator (majority owned by Roche). Chugai is partnering with Rani to develop and commercialize an oral therapy for an undisclosed rare disease using Rani’s pill-delivery platform and one of Chugai’s antibody drugs globenewswire.com. The deal’s financial terms immediately grabbed investors’ attention:

- Upfront & Milestones: Rani will receive a $10 million upfront payment from Chugai and is eligible for up to $75 million in technology transfer and development milestones for the first target program globenewswire.com. Additionally, Rani could earn up to $100 million in sales-based milestones if the product succeeds commercially globenewswire.com. Together, these payments total $185 million potential for the initial drug candidate, plus single-digit royalties on any eventual sales 4 .

- Expansion Options: Importantly, Chugai has options to extend the partnership to as many as five (5) additional drug targets in the future under similar terms globenewswire.com. If Chugai fully exercises all options, the total deal value could reach ~$1.085 billion over time globenewswire.com. This massive headline number – over $1 billion – underscores Chugai’s belief in Rani’s technology and provides a tantalizing long-term opportunity for Rani.

Such figures are especially striking given Rani’s size: even including Friday’s stock jump, the company’s market capitalization is only on the order of ~$40–50 million. The prospect of over $1 billion in future payments represents a transformational opportunity, albeit contingent on successful development of multiple programs.

Both companies expressed optimism about the collaboration’s potential. “This partnership represents a convergence of Rani’s cutting-edge oral delivery platform and Chugai’s expertise in complex antibodies,” said Talat Imran, CEO of Rani Therapeutics, calling it a “pivotal moment for Rani” and a chance to develop “a transformative oral therapy that could redefine the treatment landscape for rare diseases globally.” globenewswire.com Chugai’s leadership echoed this enthusiasm. Dr. Tomoyuki Igawa, Chugai’s Head of Research, noted that “Rani’s innovative oral delivery technology opens up new possibilities… We expect to create entirely new value in the form of oral therapies that are less burdensome for patients. Through this collaboration, we will accelerate our challenge to realize advanced, patient-centric healthcare.” 5

In essence, Chugai is betting that Rani’s capsule can turn one of its injectable drug candidates into an oral medication – a switch that could greatly improve patient compliance and comfort for a rare disease treatment. If the initial program succeeds, Chugai can bring more of its biologic drugs into the Rani platform, potentially across immunology and rare disease indications globenewswire.com. For Rani, success would mean milestone payments, royalties, and a validation that attracts further partnerships.

Financing Boost Extends Cash Runway

Concurrent with the Chugai deal, Rani announced a much-needed capital infusion that shores up its finances. The company raised $60.3 million in gross proceeds through a private placement of equity and warrants globenewswire.com. The financing was oversubscribed and led by prominent biotech-focused investors Samsara BioCapital and RA Capital Management, alongside other new and existing shareholders (including Rani’s own Executive Chairman, Mir Imran) au.investing.com. Notably, Mir Imran – a renowned medical device inventor who founded Rani – participated in the round, a vote of confidence in the company’s direction 6 .

The deal was structured at an at-the-market price of $0.48 per share (very close to RANI’s prior closing bid) with accompanying warrants globenewswire.com globenewswire.com. This pricing indicated that investors were willing to invest on essentially the same terms as the current market price, reflecting strong demand to get in on Rani’s story despite its low share price. In fact, the offering was upsized due to high interest (“oversubscribed”), suggesting that multiple biotech VCs and institutional players wanted a stake in Rani’s potential turnaround globenewswire.com globenewswire.com. H.C. Wainwright & Co. acted as the placement agent for the transaction 7 .

Crucially, this influx of capital extends Rani’s cash runway significantly. Prior to the deal, Rani’s resources were dwindling – as of June 30, 2025, the company reported only $10.2 million in cash on hand globenewswire.com after burning over $11 million in the second quarter globenewswire.com. Rani’s quarterly net losses have been in the ~$11–13 million range globenewswire.com, so the company likely had under one year of funding left, raising concerns about dilution or debt. The new $60M financing, plus the $10M upfront from Chugai and an expected $18M milestone in the near term, collectively are “expected to fund the Company’s operations into 2028.” globenewswire.com This is a dramatic improvement in Rani’s solvency outlook. It means management can focus on executing Rani’s R&D programs for the next 2–3 years without worrying about running out of cash, assuming budgets stay on track. The balance sheet boost also positions Rani to negotiate from a stronger position in any future partnerships or trials.

“Together, this financing and our strategic partnership with Chugai mark a pivotal moment for Rani,” CEO Talat Imran commented, “positioning us to advance our RaniPill® platform with clarity, focus, and momentum.” globenewswire.com He noted that the capital raise from leading biotech funds “reflects growing confidence” in Rani’s strategy globenewswire.com. Indeed, the participation of notable investors (like RA Capital, which specializes in life sciences ventures) suggests that savvy biotech financiers see renewed promise in Rani’s platform now that it has a big pharma partner on board.

It’s worth noting that Rani did incur some dilution with this raise – the company issued roughly 42.6 million new shares at $0.48 and an even larger number of warrants globenewswire.com globenewswire.com. However, much of the warrant exercise is contingent on shareholder approval and future stock price performance globenewswire.com. For existing shareholders, the short-term dilution pain is clearly being offset by the huge stock price gain and the long-term benefits of Rani being well-capitalized. The “funded into 2028” guidance shows that Rani’s balance sheet is no longer a near-term Achilles heel. With financial survival secured, the spotlight shifts to Rani’s core value driver: its drug-delivery technology and pipeline.

Rani’s Technology: Pills Instead of Needles

At the heart of Rani Therapeutics’ appeal is its drug delivery platform – an innovative approach that could spare patients from painful injections. Rani is “focused on advancing technologies to enable the development of orally administered biologics and drugs,” meaning the company develops pills for medicines that traditionally can only be given by needle globenewswire.com. The flagship invention is the RaniPill® capsule, a patented oral capsule capable of delivering large therapeutic molecules (proteins, peptides, antibodies, etc.) that normally would be destroyed in the stomach or not absorbed if swallowed globenewswire.com. In simple terms, Rani has built a tiny “robotic pill” that carries a drug payload and injects it directly into the intestinal wall after you swallow it globenewswire.com – turning a shot into a pill.

How does it work? The RaniPill is ingeniously engineered to navigate the digestive tract and deploy its drug in the intestine. The capsule’s special coating survives stomach acid and dissolves only in the higher-pH environment of the small intestine. There, an internal reaction inflates a balloon that painlessly presses the drug-filled microneedle into the intestinal lining newatlas.com newatlas.com. Because the intestine lacks sharp pain receptors, the patient doesn’t feel the injection. The drug is rapidly absorbed through the intestinal wall’s rich blood supply, and the used capsule is later passed naturally newatlas.com newatlas.com.

The RaniPill’s design has been validated in numerous preclinical studies and several early human trials. In a recent Phase 1 study, Rani’s capsule was used to orally deliver octreotide (a peptide drug for acromegaly) to 52 volunteers, while a control group received injections newatlas.com. Remarkably, over 70% of each oral dose reached the bloodstream in the RaniPill group – a strong bioavailability result, given that an intravenous injection yields 100% by definition newatlas.com. No serious side effects were reported. “We have demonstrated that we can safely and effectively deliver biologic drugs orally using the RaniPill platform,” said Mir Imran, Rani’s Chairman, adding that the goal is to make “recurring injections for chronic diseases a thing of the past.” newatlas.com These early human data, combined with extensive animal studies (1000+ capsules tested in animals), have impressed experts. A Rani board member and physician, Dr. Dennis Ausiello of Harvard Medical School, has called oral biologics “the holy grail of drug delivery,” praising Rani for “methodically and significantly de-risking its platform” and noting the potential to benefit patients in diabetes, arthritis, hemophilia, and other diseases if this technology succeeds ir.ranitherapeutics.com 8 .

Rani’s pipeline leverages the RaniPill for specific therapeutic targets. The company’s programs include:

- RT-101 and RT-102: oral versions of parathyroid hormone (PTH) for osteoporosis treatment (RT-102 has completed a Phase 1 trial showing successful delivery) 9 .

- RT-111: an oral ustekinumab biosimilar (Stelara® is an injectable antibody for autoimmune diseases) – Rani reported positive Phase 1 results for RT-111, delivered via RaniPill, demonstrating clinically meaningful drug levels 10 .

- RT-114: an oral GLP-1/GLP-2 receptor agonist for metabolic and gastrointestinal disorders. This is a novel bispecific peptide intended for obesity treatment. In preclinical tests (canine models), Rani showed that RT-114 delivered via RaniPill achieved bioavailability equivalent to subcutaneous injection globenewswire.com – a big achievement in proving the capsule’s effectiveness. Based on these results, Rani is set to begin a Phase 1 trial of RT-114 in late 2025 globenewswire.com, aiming to create an oral alternative to popular injectable GLP-1 drugs (like Ozempic®) in the weight-loss market.

- Collaboration programs: The newly announced Chugai-partnered program (for a rare disease antibody) will add another pipeline candidate (not yet publicly named, due to Chugai’s preference). Rani also previously had early research collaborations – for instance, with Novartis and Shire (prior to Shire’s acquisition by Takeda) ir.ranitherapeutics.com – which validated interest in the platform from big pharma. Those earlier partnerships were exploratory; the Chugai deal appears to be the most extensive and concrete alliance to date, targeting specific clinical outcomes.

The big picture is that Rani’s technology could potentially revolutionize how certain biologic drugs are delivered. Many blockbuster therapies – from insulin to monoclonal antibodies – require frequent injections or IV infusions. If RaniPill capsules can reliably deliver these drugs via oral dosing, it would improve patient comfort and compliance (no needles, no clinics) and possibly lower healthcare costs. This promise is what underlies the investor excitement around Rani now. However, turning promise into reality will require continued scientific and clinical execution in the coming years.

Breaking News Spurs Investor Excitement

The recent Chugai deal and financing have clearly raised Rani’s profile in the biotech and investor community. Market sentiment has swung positive in the short term – RANI was one of the top gainers across the entire U.S. stock market on Oct. 17. The stock’s momentum could attract day traders and speculative buyers in the days ahead, though it may also be volatile as early investors or traders who bought the rumor take profits on the news. Rani’s leap is reminiscent of other small biotechs that have soared overnight on major partnerships or buyouts. For example, earlier this week Omeros Corporation (OMER) shares jumped over 150% in one day after securing a $2.1 billion licensing deal with Novo Nordisk ts2.tech. These outsize moves show how a single big-pharma deal can dramatically alter the outlook (and valuation) for a tiny biotech.

Despite the euphoria of the moment, longer-term investors are approaching Rani with cautious optimism. On one hand, Rani’s breakthrough in landing a billion-dollar partner validates its platform and could be the first of more deals – success with Chugai might entice other pharma companies to explore Rani’s technology for their own drugs. Rani’s management even hinted that the Chugai collaboration “could transform into a long-term strategic partnership as we advance our pipeline”, suggesting they see this as a stepping stone globenewswire.com. With a cash runway into 2028, Rani is also now in a position to negotiate future partnerships or even a potential acquisition from a position of strength, rather than desperation. Bulls argue that the stock remains cheap relative to its opportunity: even a single successful oral biologic product could justify a far higher valuation than $1 per share. Wall Street’s official analyst coverage, while limited, skews very bullish – all four analysts listed on one stock analysis site rate RANI as a Buy/Strong Buy, with an average 12-month price target around $7–8 marketbeat.com marketscreener.com. That would imply upside of several hundred percent from current levels, if those predictions pan out.

However, risks abound and skeptics urge caution. Rani remains a clinical-stage company with no revenue (aside from possible collaboration payments) and a history of net losses – in Q2 2025, it lost $11.2 million and had negative profit margins in the thousands of percent gurufocus.com. The success of the Chugai collaboration is not guaranteed: the partnered antibody still has to be formulated into a RaniPill and prove effective and safe in trials. If it fails to meet milestones, Rani would not receive those contingent payments. Even if the science works, regulatory hurdles await – Rani will eventually need FDA approvals for any drug/device combination it brings forward, a complex process. Competition is also a factor: other companies are exploring alternatives for oral biologics (including Oramed in diabetes and Novo Nordisk itself for oral GLP-1 pills, albeit using different techniques). Rani will need to move quickly and demonstrate a clear advantage.

Financially, while Rani now has cash, it likely will need that money to fund years of R&D and multiple clinical trials (which can easily cost tens of millions). GuruFocus, in a stock analysis, noted that “the recent capital infusion provides a temporary lifeline, but the company’s long-term viability will depend on its ability to achieve operational efficiencies and improve its financial metrics.” gurufocus.com In other words, Rani must use this cash wisely to generate tangible progress – it bought time, but not guaranteed success. The stock remains highly volatile as well. RANI’s 5-year beta was recently around -0.3 (an unusual negative correlation to the market) with a very high volatility score (~59% annualized) gurufocus.com. This means the stock can swing wildly on news or speculation, independent of broader market moves. Investors should be prepared for price swings in both directions. Indeed, RANI had been on a downward trajectory for months before this week’s jolt – a reminder that sentiment can sour if milestones aren’t met on schedule.

Expert opinions reflect a mix of excitement and realism. “The oral delivery of biologics is considered the holy grail of drug delivery,” noted Dr. Ausiello in a prior discussion of Rani’s approach, “Rani has generated impressive data… while de-risking its platform. [Now] Rani is poised to benefit patients [across many diseases].” ir.ranitherapeutics.com This captures why many in the biotech field are rooting for Rani – the upside for medicine is enormous if they succeed. On the financial side, however, one can find as much skepticism as optimism. TipRanks’ new AI-based analyst “Spark” currently gives RANI an Underperform rating, citing the company’s “no revenue and consistent net losses” and cautioning about its cash burn tipranks.com. Before this deal, some human analysts had even set modest targets (e.g. Oppenheimer at $4.00 tipranks.com) given the company’s challenges. It will take actual execution – successful trials, regulatory approvals, or new partnerships – to convince the broader investment community that Rani’s valuation should be markedly higher.

Conclusion: A Turning Point for Rani – But Journey Just Beginning

For now, Rani Therapeutics has electrified its shareholders with a burst of good news. The Chugai partnership puts Rani on the map as an emerging player in drug delivery, and the financing ensures it can push forward on multiple fronts. The stock’s addition to Google News trending tickers and the influx of retail trading interest highlight that investors love a comeback story – and RANI’s one-day leap has indeed been a dramatic comeback from all-time lows.

Going forward, the key things to watch will be execution and news flow: early milestones in the Chugai program (technology transfer success, preclinical results), the start of the RT-114 obesity pill’s first human trial, and any additional partnerships or data readouts from Rani’s other programs. Positive developments on these fronts could continue to buoy the stock and validate those bullish analyst targets. Conversely, any significant delays or disappointments could see the stock give back gains, given the speculative money now in the name.

Bottom line: Rani Therapeutics has made headlines by securing the kind of deal small biotech dreams are made of – one that brings in cash, a top-tier partner, and validation of its technology. It’s a breakthrough moment that has justifiably sent the stock soaring. The challenge now is to turn this proof-of-concept into proof-of-product. If Rani can translate its novel “pill instead of injection” concept into approved therapies, early investors believe the upside could be enormous – not just in share price, but in a new era of medicine where patients take pills for conditions that once required injections. It’s a high-stakes endeavor, but for the first time in a while, Rani and its investors have real reason to hope.

Sources: Rani Therapeutics press releases globenewswire.com globenewswire.com; Investing.com au.investing.com; TipRanks tipranks.com tipranks.com; GuruFocus gurufocus.com gurufocus.com; Rani Q2 2025 report globenewswire.com globenewswire.com; TS² Tech (TechStock²) News ts2.tech; New Atlas newatlas.com newatlas.com; Company website and filings globenewswire.com 11 .