Key Facts – October 18, 2025

- Stock Soars: Rani Therapeutics (NASDAQ: RANI) shares skyrocketed in a single day, jumping from about $0.47 to an intraday high around $1.37 on Oct. 17 (+~190%)ts2.tech. The stock ultimately closed at $1.64 (up +248% on the day)marketbeat.com, catapulting the penny stock back above Nasdaq’s $1 minimum bid price and alleviating near-term delisting fears1 .

- $1 Billion+ Pharma Deal: The clinical-stage biotech announced a landmark collaboration with Japan’s Chugai Pharmaceutical (majority-owned by Roche) to develop an oral version of one of Chugai’s experimental antibody drugs for a rare diseasereuters.com. The deal’s terms include a $10 million upfront payment and up to $75 million in development milestones, plus up to $100 million in sales milestones for the first target therapy, along with single-digit royaltiests2.techreuters.com. Chugai also holds options to add up to five more drug targets under similar terms, making the partnership worth over $1.08 billion in total potential value2 .

- Funding Windfall & Runway: Alongside the Chugai deal, Rani raised approximately $60.3 million through an oversubscribed private placement at $0.48 per share (at-market), led by Samsara BioCapital with participation from RA Capital and other biotech investorsts2.tech. This cash infusion – together with the $10 million upfront and an expected $18 million near-term milestone payment from Chugai – is projected to fund Rani’s operations into 2028ts2.tech, dramatically extending its cash runway (the company had only about $10 million in cash by mid-2025)3 .

- Oral Biologics Breakthrough: Rani’s proprietary RaniPill technology is a novel “robotic pill” designed to deliver biologic drugs (like insulin or antibody therapies) via an oral capsule instead of injectionsts2.tech. The capsule travels intact through the stomach and then deploys a tiny needle in the intestine to inject the drug into the intestinal wall – a virtually painless process due to the lack of sharp pain receptors in the gutts2.tech. This approach could revolutionize treatment by allowing patients to take injectable-only medications in pill form.

- High-Risk, High-Reward Outlook: The Chugai partnership provides major validation for Rani’s platform and has sparked bullish sentiment, but investors remain divided on long-term prospectsts2.tech. Wall Street coverage is sparse yet optimistic – the few analysts covering RANI rate it a Buy with price targets in the ~$7–$9 range (several hundred percent above the current ~$1+ share price)ts2.tech. At the same time, Rani is still pre-revenue and unprofitable, so caution abounds: even TipRanks’ AI-based model flags “significant financial struggles” for the company and rates the stock Underperformts2.tech. Extreme volatility and a micro-cap market cap underscore that RANI remains a speculative, high-risk/high-reward biotech play4 .

RANI Stock Price Explodes on Deal News

Rani Therapeutics’ stock price erupted on Friday, Oct. 17, 2025, after the company unveiled its game-changing pharma partnership and a significant financing boost. In pre-market trading, RANI shares jumped over +150%, and the rally continued after the opening bellts2.techts2.tech. The stock — which had closed at just $0.47 the day before — briefly hit about $1.37 intraday (nearly a 3× gain) on extremely heavy volumets2.techts2.tech. By midday, RANI was still trading around $1.30, up ~180% on the day, marking a stunning one-day surge that lifted the stock out of penny-stock territory1 .

Such an explosive move was accompanied by a frenzy of trading. Approximately 70 million RANI shares changed hands on Oct. 17 – a staggering spike compared to the stock’s meager 3-month average of around 318,000 shares per dayts2.tech. This suggests intense speculative interest, as traders piled into the stock on the breaking news. Notably, even after soaring nearly 200%, RANI’s price was still down roughly 65% year-to-date and over 80% below its level one year agots2.tech, underscoring how beaten-down the stock had been before this turnaround. By closing at $1.64, Rani also regained compliance with Nasdaq’s $1.00 minimum bid requirement, easing imminent delisting worries1 .

The immediate catalyst for Rani’s eye-popping rally was a one-two punch of positive news announced early Friday morning: a major partnership with a big-name pharmaceutical company, and a sizable capital raise. “Rani Therapeutics Holdings Inc stock surged 148.3% in premarket trading Friday after announcing a collaboration agreement with Chugai Pharmaceutical and securing a $60.3 million private placement,” Investing.com reported on the dayts2.tech. This double dose of good news — a lucrative deal plus fresh funding — ignited a buying spree and sent RANI shares rocketing upward in an otherwise somber market week.

Landmark $1B+ Collaboration with Chugai Pharma

The centerpiece of Rani’s announcement is a sweeping collaboration and license deal with Chugai Pharmaceutical, a Tokyo-based pharma innovator (and majority-owned subsidiary of Roche)reuters.comfiercebiotech.com. Under the agreement, Rani will apply its oral drug-delivery platform (the RaniPill capsule) to one of Chugai’s experimental antibody therapies targeting an undisclosed rare diseasereuters.com. In essence, Chugai is enlisting Rani to develop an oral version of a biologic drug that would normally require injection, potentially making the treatment far more patient-friendly if successful.

Deal Terms: The Chugai partnership could be worth over $1.08 billion in total, making it truly transformational for a company of Rani’s size (even after Friday’s jump, RANI’s market cap was only on the order of ~$40–50 million before the deal)ts2.tech. For the first drug target alone, Rani will receive a $10 million upfront payment and is eligible for up to $75 million in technology transfer and development milestonests2.tech. If the oral therapy reaches the market, Rani could earn up to $100 million in sales-based milestone payments, plus single-digit percentage royalties on any future salests2.tech. Importantly, Chugai also secured options to expand the collaboration to as many as five additional drug targets under similar termsts2.tech. If Chugai exercises all options, the aggregate deal value tops $1.085 billion over timets2.tech. This massive number underscores Chugai’s confidence in Rani’s technology as well as the sizable commercial opportunity if multiple oral biologic programs advance successfully.

Strategic Rationale: For Rani, the deal not only brings in non-dilutive capital, but also serves as a strong validation of its platform by a respected industry player. For Chugai (and its parent Roche), the appeal lies in Rani’s novel approach to oral delivery of large-molecule drugs. “Rani’s innovative oral delivery technology opens up new possibilities for the administration of biologics, which have traditionally been limited to injections,” said Dr. Tomoyuki Igawa, Chugai’s Head of Research, in a statement about the alliance. “By integrating Rani’s technology with our proprietary antibody engineering technologies… we expect to create entirely new value in the form of oral therapies that are less burdensome for patients.”fiercebiotech.com This rare-disease program (specific indication not disclosed yet) will leverage Rani’s pill system to deliver Chugai’s complex antibody in oral form, potentially improving patient comfort and treatment adherence if it succeeds.

Financing Extends Cash Runway Into 2028

Concurrent with the Chugai deal, Rani revealed a much-needed capital infusion that shores up the company’s once-precarious finances. The company announced an oversubscribed private placement to raise approximately $60.3 million in gross proceedsts2.tech. Notably, the financing was led by prominent biotech investors – Samsara BioCapital and RA Capital Management – alongside other new and existing investors, including Rani’s own founder and Executive Chairman, Mir Imranir.ranitherapeutics.comfiercebiotech.com. The shares (and accompanying warrants) were sold at $0.48 per share, essentially at the market price prior to the news, reflecting investor confidence without a steep discount5 .

This cash injection dramatically improves Rani’s balance sheet and relieves immediate liquidity concerns. Prior to these developments, Rani was running very low on cash – reportedly around only $10 million remaining as of mid-2025ts2.tech – and faced substantial operating losses each quarter. According to the company, the combined proceeds from the new private placement, the $10 million Chugai upfront payment, and an expected $18 million milestone from Chugai for technology transfer will fund operations through 2028ts2.techreuters.com. In other words, Rani now has a multi-year runway to advance its pipeline and the partnered programs, whereas previously it may have struggled to finance even another year of R&D at the current burn rate.

Company leadership characterized these moves as truly pivotal. “We are pleased to have priced this additional financing from leading biotech investors, which we believe reflects growing confidence in our strategy,” said Talat Imran, Rani’s CEO, noting that upon closing, the deal “would meaningfully strengthen our balance sheet and extend our cash runway into 2028… positioning us to advance our RaniPill platform with clarity, focus, and momentum.”ir.ranitherapeutics.com He added that together with the Chugai partnership, this moment marks a turning point for Rani, enabling it to pursue its goal of oral biologic therapies with far greater resources and stability than before.

Rani’s Oral Biologics Technology: Pills Instead of Needles

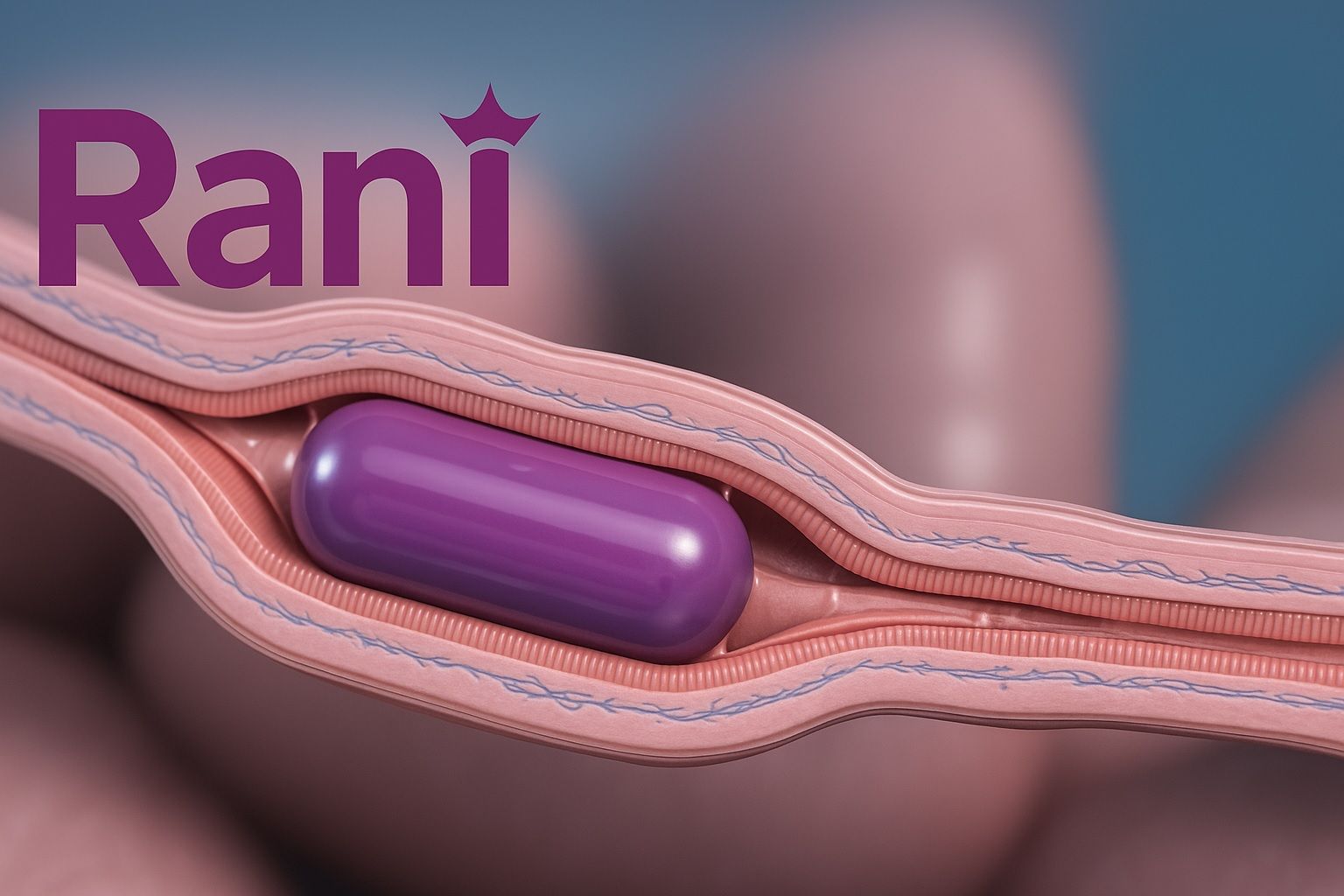

Figure: Rani Therapeutics’ proprietary RaniPill capsule enables the oral delivery of injectable biologic drugs by deploying a tiny injector inside the intestine. The ingestible “robotic pill” travels intact through the stomach and then painlessly injects the drug into the intestinal wall using a small needle, a process that doesn’t cause discomfort due to the lack of sharp pain receptors in the gutts2.tech. This technology offers a potential breakthrough for patients, who could take treatments like insulin or antibody therapies in pill form instead of enduring regular injections.

At the heart of Rani’s value proposition is this novel drug delivery platform, which the company has been testing in various early-stage trials. In multiple preclinical and clinical studies, the RaniPill has demonstrated an ability to deliver large protein drugs (which normally would be destroyed by stomach acid) into the bloodstream with high bioavailability, similar to an injectionts2.tech. Essentially, the capsule protects the drug as it passes through the stomach, then at a programmed time releases a dissolvable micro-needle that painlessly injects the drug into the intestinal tissue where it can be absorbed. After delivering its payload, the capsule dissolves and is passed through the digestive tract. Rani has shown proof-of-concept for this approach with substances like insulin and hormone treatments, and is now extending it to monoclonal antibodies through partnerships like the new Chugai deal. If successful, Rani’s platform could eliminate the need for many needle-based injections, improving patient comfort and compliance in a range of diseases.

Market Sentiment and Analyst Outlook

The dramatic Chugai deal and funding news have clearly galvanized investor interest in Rani, but what comes next? Market sentiment in the short term has swung positive – the stock’s huge one-day gain indicates traders see these developments as potentially transformative. In the biotech community, the partnership is viewed as a strong external validation of Rani’s technology. It also doesn’t hurt that Roche (a pharma giant) is indirectly involved via its majority stake in Chugai, lending big-industry credibility to tiny Rani. All of this has put RANI firmly on the radar after a long period of obscurity and decline.

Wall Street analysts, though few in number, have generally been bullish on Rani Therapeutics, and the latest news reinforces their optimism. As of this writing, only a handful of brokerages cover RANI, but most rate it a Buy/Outperform. The consensus 12-month price target is around $7–8 per share, with some high estimates at $9ts2.techmarketbeat.com. For context, that represents hundreds of percent upside from the ~$1.50 level – reflecting expectations that Rani’s pipeline (and the Chugai-partnered program) could create significant value in the coming years. MarketBeat reports an average target of $7.33 among 4 analysts, even after the post-deal rally, and notes the consensus rating as a “Moderate Buy”marketbeat.com. For example, H.C. Wainwright – one of Rani’s early coverage firms – has maintained a high target (around $9) on the stock, anticipating successful development of the oral biologics platform. Such rosy forecasts underscore that some experts believe RANI is still fundamentally undervalued if its technology works as hoped.

That said, risks remain abundant, and not everyone is convinced. Rani Therapeutics is still a clinical-stage company with no approved products or revenue, and it continues to incur substantial losses each quarter. The partnership with Chugai is exciting but will take time to bear fruit – the first oral antibody program must still go through clinical trials and regulatory approval, and there’s no guarantee of success. If the program falters or fails to meet milestones, much of that potential $1 billion+ deal value would not materialize. Rani will also need to execute on its other internal candidates to deliver value long-term. Acknowledging these challenges, even an algorithmic analysis by TipRanks recently flagged Rani’s weak financial health, citing “significant financial struggles,” and assigned the stock an Underperform rating despite the latest newsts2.tech. In fact, prior to the Chugai deal, Rani’s cash burn and sub-$1 share price had put it on a dire trajectory – one analyst had even slapped a Sell rating on the stock, reflecting concerns of dilution or bankruptcy if no rescue came. Those concerns have now been partially alleviated by the new cash and the vote of confidence from Chugai, but Rani’s high volatility and micro-cap status will likely persist.

In summary, Rani Therapeutics has electrified its shareholders with a burst of good news that appears to be a genuine turning point for the company. The roughly $1 billion Chugai partnership provides both funding and validation, giving Rani a shot at proving that pills can replace needles for delivering complex biologic drugs. The stock’s meteoric surge indicates that the market sees new hope for Rani’s once-fading vision. Looking ahead, investors will be watching closely as Rani and Chugai initiate their collaboration program – early progress or data from that could further sway sentiment. Additionally, Rani’s management now has the capital to advance other pipeline projects, so any updates on those (or additional partnerships) will be catalysts to monitor. Analysts generally argue that if Rani’s technology succeeds, the upside could be massive, which is why they’ve placed lofty price targets on this tiny stockts2.tech. However, RANI remains a speculative bet. It faces the typical risks of biotech development, and its recent spike could retrace if execution falters or market hype fades. For risk-tolerant investors, Rani Therapeutics offers a high-risk, high-reward opportunity at the frontier of biotech innovation – just be prepared for a bumpy ride, as the journey from revolutionary idea to commercial reality is only just beginning4 .

Sources: Rani Therapeutics press releases and SEC filings; Reutersreuters.comreuters.com; TechStock² (ts2.tech)ts2.techts2.tech; Investing.comts2.tech; FierceBiotechfiercebiotech.com; Company investor presentation; MarketBeatmarketbeat.com; TipRanks.