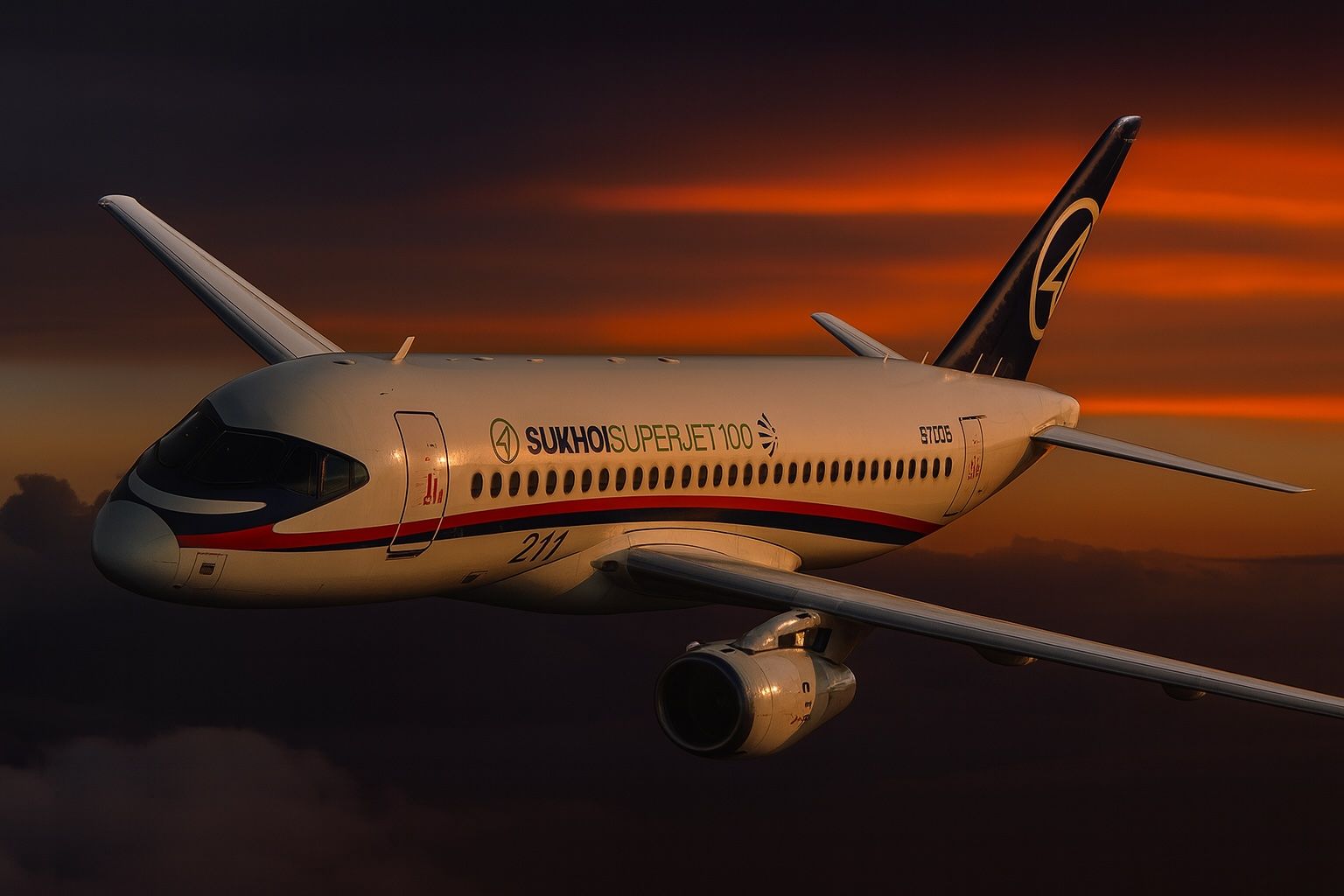

- Historic Pact: On Oct 27, 2025 India’s Hindustan Aeronautics Ltd (HAL) and Russia’s United Aircraft Corp (UAC) signed an MoU to produce the 100-seat Sukhoi Superjet-100 (SJ-100) in Indiaflightglobal.commoneycontrol.com. HAL will have exclusive rights to build the SJ-100 for domestic airlines. The deal was inked in Moscow and formally announced Oct 28, 2025. HAL notes this is “the first instance wherein a complete passenger aircraft will be produced in India” – the last being the Avro HS-748 (built 1961–1988)1 .

- Connectivity Game-Changer: HAL calls the SJ-100 a “game changer” for India’s regional UDAN air-connectivity schememoneycontrol.com. Industry projections estimate India will need over 200 regional jets in the next decade (plus ~350 more for nearby international routes)flightglobal.comtribuneindia.com. By comparison, only about a dozen regional jets currently fly in India (mainly Embraer 175s)flightglobal.com. In its press release HAL tied the project to Prime Minister Modi’s “Aatmanirbhar Bharat” vision, saying the pact “fulfills the dream of ‘Aatmanirbhar Bharat’ in the civil aviation sector”reuters.com2 .

- Challenging the Duopoly: BJP IT cell chief Amit Malviya hailed the deal as India’s entry into the Boeing-Airbus duopolyreuters.com. Indian officials note this is India’s first self-assembled passenger jet, aiming to break reliance on foreign aircraft. HAL itself pointed out that over 200 SJ-100s are already in service worldwide and over 16 airlines operate themflightglobal.com. While those existing Superjets flew almost exclusively in Russia, the HAL-UAC pact could give Indian carriers a domestically-built alternative to imported narrowbodiesmoneycontrol.com3 .

- Historical Ties with Russia: HAL has long built Russian planes under license (MiG-21/27, Sukhoi Su-30MKI, etc.)flightglobal.com, but this is its first civilian aircraft program. Earlier joint projects – like the Su-57-based FGFA fighter and an Il-276 transport – stalled in the 2010sflightglobal.com. Russian UAC will supply technology and possibly engines; United Aircraft is already flight-testing a new SJ-100 variant with homegrown PD-8 turbofans (older versions used Safran PowerJet SaM146 engines)flightglobal.com. The SJ-100 has 71 firm orders to date (45 with Red Wings)flightglobal.com, so the India deal signals a possible new export market.

- Geopolitical Note: UAC is under U.S./EU/UK sanctions, since it is tied to Russia’s military-industrial complexreuters.com. Reuters warns the pact “risks stoking tensions with Western countries trying to punish Russia”reuters.com. Western officials have noted UAC’s status on sanction lists, but India insists it won’t be swayed by unilateral bans. As Reuters observes, India “does not subscribe to unilateral sanctions” and argues that trade with Russia should not be limitedreuters.com. In short, the deal is purely civil‑aviation on paper, but it involves a sanctioned firm – a diplomatic balancing act.

- Market Reaction – HAL Stock: Investors took note. HAL’s share price (NSE: HAL) was around ₹4,724 on Oct 28, 2025 (a slight ~0.7% intraday dip on the news)moneycontrol.com. This is near its 52-week peak (~₹5,165). Earlier in June 2025, HAL stock jumped 1.6% to a record ₹4,980 after winning the government’s new small-satellite launcher contractreuters.com. Analysts remain bullish: 19 recent forecasts give an average 12-month price target of about ₹5,610 for HALin.investing.com (roughly +15% upside). (For comparison, global aviation giants Boeing (NYSE: BA) and Airbus (EPA: AIR) have seen strong share gains on defense spending and production lifts.)

- Analyst Outlook: Financial experts say the HAL-UAC deal could be positive for long-term growth. HAL’s entry into commercial aircraft manufacturing may unlock new revenue streams. Many brokerage reports (e.g. Citi, CLSA) now list HAL as a Buy, citing its pivotal role in India’s expanding aerospace sector. However, they caution that timelines are unclear: HAL has not yet given details on production schedules or which factory will build the jetsflightglobal.comtimesofindia.indiatimes.com. It may be years before an Indian-made SJ-100 flies. Execution risk remains – but if successful, this project could transform India’s aviation manufacturing base.

- Strategic Context: The pact comes amid India’s broader aerospace push. As TS2 notes, HAL has typically been a components supplier – e.g. to ISRO – rather than an independent aerospace makerts2.techts2.tech. The SSLV (rocket) contract win earlier this year already showed HAL moving up the value chaints2.techreuters.com. Now, by venturing into passenger jets, HAL is claiming a slice of a market long dominated by outsiders. Industry commentators highlight that India’s UDAN initiative and growing regional travel are creating huge demand for narrow-body jetsflightglobal.comtribuneindia.com. This partnership could position HAL to capture a share of that future – provided it overcomes regulatory, technical and supply-chain hurdles.

Sources: HAL and government statements and press reportsmoneycontrol.comtimesofindia.indiatimes.comflightglobal.comflightglobal.com; industry analysis and market datareuters.comflightglobal.comin.investing.com; stock market data (Moneycontrol)moneycontrol.comreuters.com; TS2 technews analysists2.techts2.tech. All facts verified up to Oct 28, 2025.