- Quantum stock rally: Quantum computing stocks like IonQ (IONQ), Rigetti (RGTI), D-Wave (QBTS) and Quantum Computing Inc. (QUBT) have exploded in 2024–25. For example, IonQ’s stock has jumped roughly 300% over the past year1 .

- Strong revenue growth (so far): Analysts forecast IonQ’s Q3 2025 sales around $27 million (up from $12.4M a year ago)nasdaq.com. In Q2 2025 IonQ already delivered $20.7M revenue (15% above guidance) and raised full-year 2025 guidance to $82–100M2 .

- Bullish outlook, high targets: Wall Street is generally positive on IONQ. Most firms rate it a Buy and the average 12-month price target is about $64–65barchart.comtipranks.com (versus the current ~$54). B. Riley’s Craig Ellis has set an eye-popping $100 target, citing IonQ’s “three straight years of 100% year-over-year gains” and new 99.99% two-qubit fidelity record3 .

- Sky-high valuations: The surge comes with stratospheric multiples. IonQ now trades at ~300× trailing salesfinviz.com; Rigetti’s market cap is about 1,100× its 2024 salesfinviz.com. D-Wave (QBTS) is ~335× revenuefinviz.com. By contrast, the entire sector’s combined 2025 revenue is under $100M, yet its market value tops $40Btipranks.com. Such metrics have led analysts to compare quantum stocks to late-90s dot-com mania. “This looks like a bubble,” one market strategist warned4 .

- Tech breakthroughs vs. hype: Advocates note real progress – Google claimed a 13,000× speedup on a new chip, and IonQ’s experiments with AstraZeneca/AWS/NVIDIA achieved 20× acceleration in a drug-discovery workloadbarchart.com. Large tech players (Microsoft, IBM, Amazon, etc.) are quietly pouring R&D into quantum. But quantum machines remain error-prone and narrowly useful todayreuters.com. McKinsey projects future quantum-powered pharma value of $200–500 billion by 2035finviz.com, but only if companies overcome today’s physics challenges.

- Government and Wall Street interest: Recent news has fueled the rally. A report (later denied) that the U.S. government might take equity stakes in private quantum firms sent IonQ, Rigetti, D-Wave and QUBT shares sharply higher in late Octoberreuters.com. JPMorgan also announced a $10 billion “Security & Resiliency” fund (part of a $1.5 trillion initiative) targeting frontier tech including quantumtipranks.comreuters.com. Even so, any hype may be overdone – regulators note no current talks, and stocks reversed rapidly afterward.

IonQ’s Growth, Technology and Partnerships

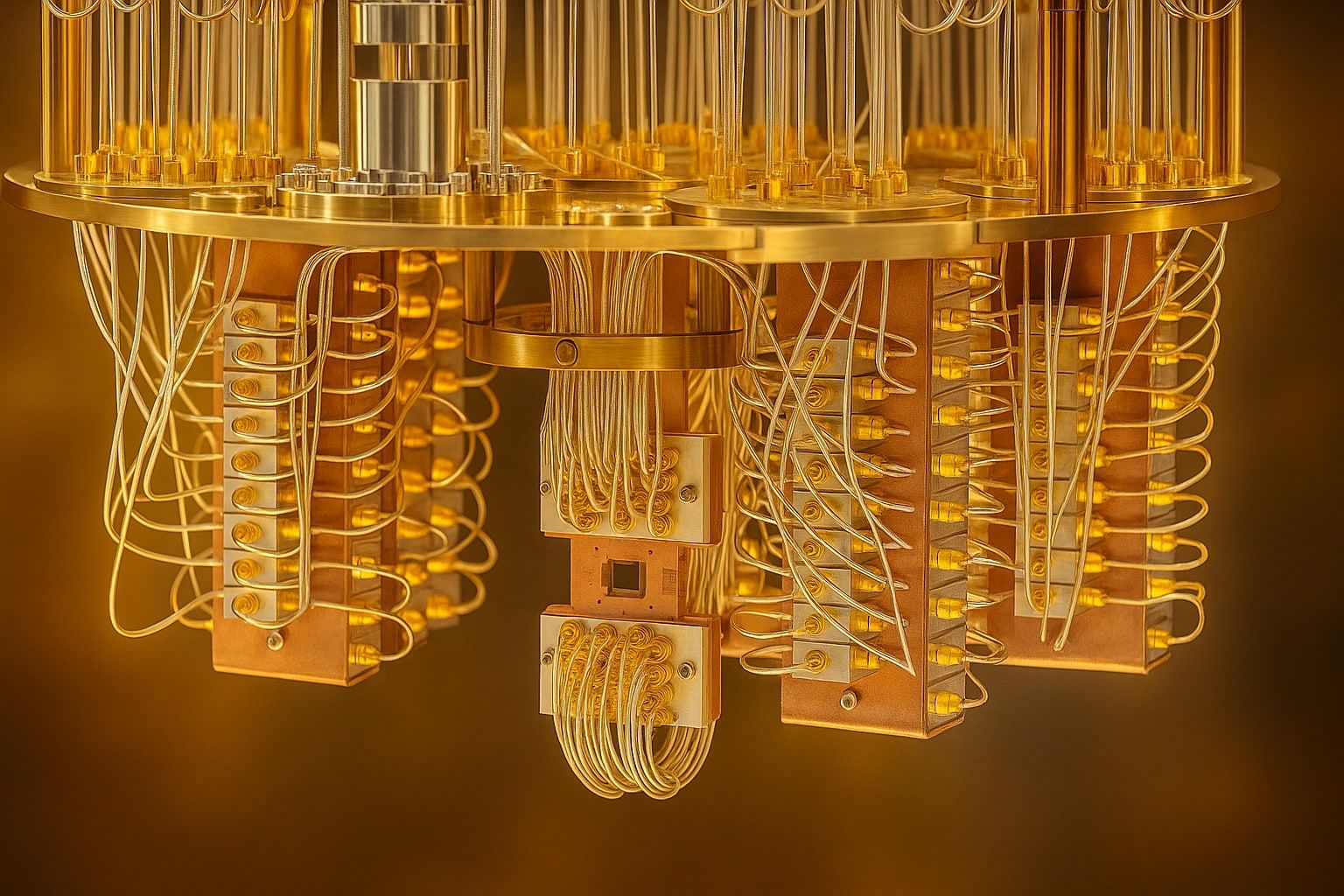

IonQ (NYSE: IONQ) is the best-known pure-play quantum company. Based in Maryland, it builds trapped-ion quantum computers accessible via the cloud (AWS, Azure, Google Cloud)barchart.com. It also markets quantum networking products – including quantum key distribution (QKD) devices and single-photon detectors – for ultrasecure communicationsbarchart.combarchart.com. IonQ’s current systems (code-named Forte and Forte Enterprise) have helped partners like Amazon Web Services, AstraZeneca and NVIDIA achieve notable speedups in simulation tasks5 .

Behind the scenes, IonQ has been bulking up rapidly. In September 2025 it closed its acquisition of Oxford Ionics (a UK trapped-ion startup), adding new IP and a European R&D baseoxionics.com. Earlier it bought space- and ground-based networking firms (Lightsynq, Capella Space), and took a major stake in QKD leader ID Quantiqueoxionics.com. These moves aim to expand IonQ’s quantum cryptography and networking – for example, enabling global quantum key distribution services – in addition to accelerating computing power. CEO Niccolo de Masi called Oxford Ionics “a pivotal step… to advance more powerful and scalable quantum systems, with unit economics that will underpin standardization on our ecosystem”6 .

On the financial side, IonQ has been burning cash on R&D but growing revenue fast. The company spent $170M more than it took in during 2024 (Q2’25 results), yet management is confident: after Q2’s beat, IonQ guided for $82–100M total 2025 revenuebarchart.com. Analysts expect Q3’s sales around $26–29M (roughly +118% YoY)nasdaq.com. Even so, IonQ will report a larger loss per share (around $0.44 vs $0.24 a year agonasdaq.com), reflecting heavy R&D and expanded staffing.

Valuation Debate: Bubble or Breakthrough?

Investor enthusiasm has driven quantum stock prices parabolic. But that has stoked a heated debate. Critics point out that current stock prices are based on very speculative futures. For example, in late 2025 IonQ’s $22.4 billion market cap assumes years of near-uninterrupted growthfinviz.com. “This [$22 billion] valuation still prices in decades of explosive growth,” notes Motley Fool analysisfinviz.com. Similarly, Rigetti’s $11.5B market cap is on only an estimated $21.5 M of 2026 salesfinviz.com. As TipRanks highlights, “the total market value of the sector is now above $40 billion, while the combined annual revenue of its top companies is under $100 million”4 .

On the flip side, proponents argue the hype is justified by unique factors. Unlike 1999’s dot-coms, today’s quantum startups have real technology and powerful backers. Hyperscale companies (Nvidia, Microsoft, Alphabet, Amazon) are quietly building quantum teams and chipsfinviz.com. Governments treat quantum as strategic (e.g. the U.S. commerce secretary has championed a $10B DARPA-like initiative). McKinsey estimates quantum could unlock hundreds of billions in value in industries like pharma and materials sciencefinviz.com. As Motley Fool puts it, “current valuations assume a $100 billion market within a decade.” If those assumptions hold – driven by breakthroughs in error correction and scale – today’s prices might look modest in hindsight7 .

In practice, neither camp is fully dominant. Recent news exemplifies the tension: headlines of government “stake talks” and JPMorgan funding sent shares surging (fueling optimism)reuters.comtipranks.com. But the Commerce Dept’s denial and a sharp sell-off underscored the fragility of this optimism. “Investors face a choice between long-term promise and short-term risk,” notes TipRankstipranks.com. One strategist aptly warned, “It looks like a bubble.”tipranks.com If quantum hardware or sales growth disappoint, prices could tumble; but if companies hit major technical or commercial milestones, the upside could be enormous.

Analysts Weigh In: Ratings and Targets

Most analysts remain bullish on IonQ, albeit with caution on valuation. All nine major analysts tracked by one survey rate IONQ as a Buy/Strong Buy (average price target ≈$64.60)barchart.com. As TipRanks reports, “Wall Street analysts expect IonQ to report negative EPS of $0.44 for Q3” (wider loss) but revenues rising ~100% to $26.9Mtipranks.com. In other words, the topline is expected to continue surging. IonQ’s own guidance for Q3 ($25–29M) is in line with this. Beyond Q3, analysts see rapid growth: one model projects IonQ revenue expanding from $43M in 2024 to $775M by 2029barchart.com (while losses shrink from -$214M to -$72M).

Individual bulls highlight achievements. B. Riley’s Craig Ellis (five-star analyst) reiterated a $100 target on Nov 2025, noting IonQ’s world-record 99.99% two-qubit gate fidelity and a growing pipelinetipranks.com. He and others point to partnerships turning into paying customers – for instance, deals announced with Japan’s AIST, South Korea’s KISTI, and an $22M quantum hub in Tennesseenasdaq.com – all of which should boost hardware usage. Benchmark’s David Williams (five-star) raised his IonQ target to $75, praising “steady execution, growing commercial traction, and leadership in gate-based quantum systems”8 .

However, analysts also stress the flip side: IonQ’s forward EV/Sales ratio is 231.7, versus a sector average of just 3.66tipranks.com. TipRanks warns that such a lofty multiple “suggests investors are pricing in exceptionally high future growth expectations,” leaving little margin for errortipranks.com. In other words, many are betting that IonQ will very likely grow at the double- or triple-digit rates implied – a bet some say carries “downside risk if the company fails to deliver”9 .

Other Quantum Players and Market Trends

IonQ isn’t alone. D-Wave (NYSE: QBTS), which sells quantum annealing systems, also saw a recent jump in orders (e.g. its first U.S. bank sale of quantum-secured hardware)nasdaq.com. D-Wave is due to report Q3 on Nov 6; analysts forecast about $3.1M revenue (up ~67% YoY) and a small lossnasdaq.com. Rigetti (NASDAQ: RGTI), which just demoed a new 36-qubit chip (Cepheus-1-36Q) with 99.5% fidelitynasdaq.com, will report on Nov 10 (consensus: ~$2.4M revenue, flat YoYnasdaq.com). Quantum Computing Inc (NASDAQ: QUBT) has shifted to photonic chips and operates a new foundry; Q3 (Nov 14) is expected to show only ~$100k revenue as it ramps foundry production10 .

Notably, these smaller stocks all sold off sharply on Nov 4: IonQ closed Nov 4 at $53.38 (down ~8.6%)investing.com, D-Wave (QBTS) at $29.74 (-10.1%)stockanalysis.com, Rigetti (RGTI) $35.18 (-10.1%)stockanalysis.com, and QUBT $13.71 (-10.9%)stockanalysis.com. All four have since ticked up slightly in pre-market trading Nov 5. The broad selloff appears driven by rotation out of volatile tech, not by any company-specific negative news – but it highlights how sensitive these richly-valued stocks are to market sentiment.

By contrast, tech giants implicated in quantum have steadier valuations. Microsoft (via topological qubits) and Nvidia (via tooling) are often mentioned as “blue-chip” ways to play long-term quantum. Indeed, one Motley Fool analyst argued Microsoft’s quantum progress (and vastly lower P/S) makes it a safer quantum betwebull.com. Still, the pure-play quantum ETFs (e.g. Defiance QQQ) are up 30–40% year-to-date, and many portfolio managers are racing to understand which of these early players can deliver.

Long-Term Outlook: Potential and Peril

The quantum computing field is at an inflection point. Experts note we are not yet at “Q‑day” where a computer breaks today’s cryptography, but practical applications are emerging. For example, IonQ’s AstraZeneca collaboration is already hinting at real-world speedupsbarchart.com. Governments see strategic value – the U.S., UK and EU have announced multibillion-dollar quantum R&D programs.

If even one company achieves a durable commercial advantage (in drug design, materials, finance, or secure communications), its stock could justify today’s premium. However, if progress in error correction or scaling stalls, the market could turn harsh. As Motley Fool puts it, “It will look like a bubble if error rates do not fall, scale does not arrive, and customers do not pay.” Conversely, “it will look justified if fault tolerance improves, useful problem sizes appear, and revenue compounds.”7 .

In summary: Quantum computing stocks have delivered spectacular gains on technological promise and big money buzz. Yet they also carry rarefied valuations. Savvy investors will balance the headline grabs (new funding, partnerships, record-setting experiments) against the cautionary data (sales still modest, losses deep, fundamentals unproven). As one strategist advised, watch the execution – the promise is vast, but the path is riskyfinviz.com4 .

Sources: Industry press and analysis including company releasesoxionics.cominvestors.ionq.com, market research firms (Zacks, TipRanks)nasdaq.comtipranks.com, Barchart/Finviz/Motley Fool commentarybarchart.comfinviz.com, and Reuters news reportsreuters.com. All figures and quotes are as reported in early November 2025.