The UK stock market ended Friday in the red, with energy heavyweights dragging the FTSE 100 lower despite benign US inflation data and a fresh rally in metals prices.

Market Close: FTSE 100 Lags Global Peers

London’s blue‑chip FTSE 100 index finished the session down around 0.5% at 9,667.01, a fall of 43.86 points. The domestically focused FTSE 250 slipped only marginally to 22,063.95, while the AIM All‑Share managed a 0.3% gain to 751.30. For the week, the FTSE 100 lost about 0.6%, the FTSE 250 0.5% and AIM 0.3%. 1

Alternative gauges told a similar story: the Cboe UK 100 fell 0.5% and the Cboe UK 250 eased 0.1%, while the Cboe Small Companies index rose 0.3%, underscoring the relative resilience of smaller stocks. 1

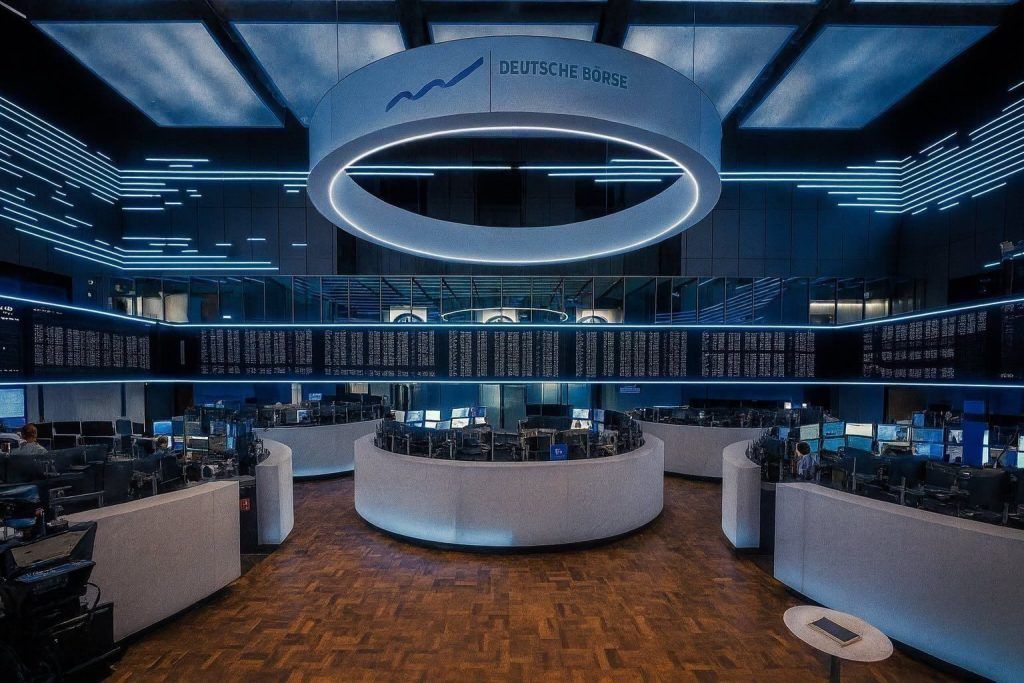

By contrast, major European and US indices were higher into the London close. Germany’s DAX climbed around 0.6% and New York’s Dow, S&P 500 and Nasdaq were all up roughly 0.3–0.5%, helped by global optimism that the Federal Reserve will cut interest rates next week. 1

TradingEconomics’ broader GB100 index also logged the move, putting the UK benchmark at about 9,668 points, roughly 0.4% lower on the day. 2

Energy Downgrades Hit BP and Shell, Wiping Out Earlier Gains

The session was a story of two very different markets.

Earlier in the day, London equities had been modestly higher. Reuters reported the FTSE 100 up about 0.2% and the FTSE 250 up 0.4% by late morning, led by a rebound in AstraZeneca and sharp gains in Ocado and Greggs ahead of key US inflation data. 3

IG’s chief market analyst Chris Beauchamp noted that a powerful rally in copper and gold pushed miners such as Antofagasta, Glencore and Anglo American to fresh highs, with the FTSE 100’s heavy commodity weighting again working in investors’ favour as metals hit record levels.

But that strength was overwhelmed as the day wore on by a broad sell‑off in the oil & gas sector. Bank of America downgraded both BP and Shell, cutting its Brent oil price forecasts for 2026 and 2027 and warning that lower energy prices and softer refining margins would squeeze sector cash flows. 1

By the close:

- BP fell about 2.6%

- Shell slipped roughly 1.4%

- Energy stocks were among the weakest sectors on the day

Both Alliance News and Investing.com flagged the combination of downgrades and subdued oil sentiment as the key drag on the blue‑chip index. 1

Biggest Movers: Rightmove, JD Sports, Greggs and Ocado vs BP, Smiths and Frasers

Despite the headline decline, there was plenty of stock‑specific action across the UK market.

FTSE 100 winners

- Rightmove – The property portal was the session’s standout gainer, rising just over 3%, helped by resilient demand for UK housing data and its entrenched market position. 1

- JD Sports Fashion – The retailer added nearly 3% as investors continued to back its international expansion story ahead of the critical Christmas trading period. 1

- Smith & Nephew, 3i Group, Intermediate Capital Group (ICG) – Healthcare and alternative asset managers also featured among the top risers, benefiting from the broader rotation into quality growth and financials highlighted by several strategists this week. 1

In the mid‑cap space, Unite Group gained close to 3% and Trustpilot surged about 13% after the online reviews platform issued a detailed rebuttal of a critical short‑seller report, saying it contained factual inaccuracies and false claims. 1

FTSE 100 laggards

- Frasers Group – The retail conglomerate dropped more than 3.5%, one of the weakest performers in the UK 100 basket.

- Smiths Group – The engineering group slid around 3.5%, extending recent volatility in industrial names. 1

- BP – As noted, shares lost roughly 2.6% after the Bank of America downgrade. 1

- LondonMetric Property, Severn Trent, Airtel Africa – These also traded lower, weighing on the wider index. 1

UK consumer names in focus

Among the more eye‑catching moves:

- Greggs jumped around 5% after JPMorgan initiated coverage with an “overweight” rating, arguing that stronger‑than‑expected like‑for‑like sales and improving free cash flow could justify a re‑rating from 2026 onwards. 1

- Ocado initially leapt more than 5% after revealing it will receive a one‑off $350m cash payment from US partner Kroger for the closure of several customer fulfilment centres, though the stock closed up only modestly as investors weighed the trade‑off between short‑term cash and long‑term growth. 1

- Big Yellow fell about 4% after abandoning takeover talks with Blackstone, while Advanced Medical Solutions rallied nearly 9% on reports that private equity firm Bridgepoint is considering a bid at a substantial premium to the prior close. 1

Unilever’s Magnum Spin‑Off Adds a Structural Twist to the FTSE

Corporate reshaping also grabbed attention, particularly in the consumer sector.

Unilever confirmed that the demerger of its global ice cream arm, The Magnum Ice Cream Company NV, will complete over the weekend after a delay linked to the US government shutdown. Shares in Magnum, home to brands including Wall’s, Ben & Jerry’s and Cornetto, are scheduled to begin trading in Amsterdam, London and New York on Monday.

Euronext has set a reference price of €12.80 per share for Magnum’s direct listing. Unilever will initially retain a 19.9% stake, with plans to exit fully over the next five years.

Index provider FTSE Russell has already flagged that the demerger will feed through to FTSE indices from 8 December, meaning passive funds tracking benchmarks such as the FTSE All‑World and FTSE 100 will need to adjust their holdings after Friday’s close.

Macro Backdrop: Benign US PCE Reinforces Fed Cut Bets

Friday’s trading unfolded against a supportive global backdrop.

The Federal Reserve’s preferred inflation gauge, the US core PCE price index, rose 0.2% month‑on‑month in September and 2.8% year‑on‑year, broadly in line with expectations and slightly cooler than the headline measure. 1

That was enough to cement market expectations of a 25‑basis‑point Fed rate cut next week, with CME’s FedWatch tool putting the probability near 90%. 1

Global risk assets responded positively:

- The MSCI World index and pan‑European STOXX 600 extended their recent gains. 4

- Copper futures hit fresh all‑time highs above $11,700 a tonne, bolstered by supply worries and bullish forecasts from Citi, which now sees average prices at about $13,000 next year. 4

- Gold hovered near record levels above $4,200 an ounce, cementing its status as one of 2025’s standout performers. 4

Standard Chartered’s latest Weekly Market View, published on 5 December, noted that diversified portfolios are on track for “another year of solid returns” and highlighted the combination of strong equity markets and surging gold prices as evidence of the value of global diversification heading into 2026. 5

Policy and Valuation: Why Strategists Still Like UK Equities

Beyond the day’s moves, a growing chorus of strategists argues that UK stocks remain attractively valued.

Goldman Sachs: Budget and BoE cuts could unlock value

Goldman Sachs Research believes Rachel Reeves’ recent UK Budget has created scope for both gilts and equities to rally as investor focus shifts from fiscal worries to the medium‑term growth and inflation outlook.

Key takeaways from their latest note include:

- UK GDP is expected to grow 1.1% in 2026, with inflation easing to 3.4% in 2025 and 2.3% in 2026.

- The bank expects the Bank of England to cut rates in December, followed by three additional cuts in the first half of 2026, taking Bank Rate down to around 3% by next summer.

- 10‑year gilt yields are forecast to fall from roughly 4.45% at the end of November to 4.25% by year‑end 2025 and 4% by end‑2026, easing the discount rate on UK equities.

Goldman also points out that domestic UK stocks and mid‑caps are trading at a historically wide valuation gap, with mid‑cap dividends yielding about 1 percentage point more than the FTSE 100. That, combined with the Budget’s tweaks to ISA rules that favour stocks and shares over cash, could encourage a gradual rotation into higher‑risk assets.

Fund managers: “UK stocks aren’t going backwards”

On the active management side, JO Hambro’s James Lowen told Trustnet that sentiment towards UK equities is finally starting to thaw after years of post‑Brexit and post‑pandemic gloom. His JOHCM UK Equity Income fund has delivered about 20% returns in each of the past two years, and he argues that the market is “far from going backwards”. 6

Lowen highlights three core pillars to his bullish stance:

- Normalised earnings – focusing on what companies can earn over a 3–5 year horizon rather than next year’s depressed forecasts.

- Value discipline – buying “very cheap” stocks that meet strict valuation metrics, such as house‑builder supplier Forterra, where he sees the potential for earnings – and the share price – to more than double as rates fall and housing activity normalises. 6

- Improved corporate quality – he argues that UK corporate management is stronger than around the time of the global financial crisis, and that banks and insurers now benefit from more “normal” interest rates rather than the 0% environment of the 2010s. 6

His fund is heavily overweight financials, industrials and basic materials – sectors that stand to gain if the combination of lower rates, fiscal incentives and stronger global demand continues into 2026. 6

Structural Tailwinds: Bank Resilience, Capital Rules and Pensions

The Bank of England’s December Financial Stability Report added a more structural underpinning to the UK equity story.

The Financial Policy Committee (FPC) concluded that UK banks remain well‑capitalised, with robust liquidity and strong asset quality. Results from the 2025 stress tests suggest the system can continue to support households and businesses even under scenarios materially worse than current expectations.

To support growth without compromising stability, the FPC has lowered its benchmark for system‑wide Tier 1 capital requirements from around 14% of risk‑weighted assets to about 13%, reflecting improvements in risk management and the reduced systemic importance of some institutions. 7

The report also highlights progress on the Mansion House Compact, with signatories increasing their allocations to unlisted UK equities from 0.36% of assets in 2024 to 0.6% in 2025 – small in absolute terms but an important signal that domestic institutional capital is slowly tilting back towards productive UK investments. 8

If that trend continues, it could help address one of the UK market’s long‑running challenges: the relatively low level of domestic pension and insurance money invested in UK shares compared with other major markets.

Technical Picture: FTSE 100 Rangebound but Bias Still Up

Technicians remain cautiously optimistic on the FTSE 100.

OANDA’s MarketPulse team notes that the index has held above its 100‑day moving average since late November, a sign of underlying bullish momentum even as prices move sideways. Immediate support is seen around 9,686, 9,661 and 9,610, with resistance near 9,750, 9,800 and 9,850.

In other words, the UK benchmark is grinding higher within a relatively tight range. A decisive break above the upper band could trigger a year‑end “catch‑up” move versus global peers, while a slip below the 100‑day average would warn that recent underperformance is set to continue.

What UK Investors Are Watching Next

Looking beyond today’s close, several catalysts could sway the UK market in the coming days:

- Federal Reserve meeting – Markets are pricing a near‑certain quarter‑point rate cut next week; any surprise on pace or guidance could ripple through global equities and the pound. 4

- Other central banks – Rate decisions are also due from the Reserve Bank of Australia, Bank of Canada and Swiss National Bank, among others, shaping the global liquidity backdrop. 1

- US data – Further readings on inflation, consumer sentiment and durable goods will help confirm whether the “soft landing” narrative remains intact.

- UK corporates – Results from names such as Ashtead Group and house‑builder Berkeley Group later in the week will offer a more granular view of domestic demand and investment.

With the FTSE 100 still lagging Wall Street’s record‑watching indices but supported by high dividend yields, sector‑by‑sector divergences and a slowly improving policy backdrop, UK stocks remain in the spotlight for value‑oriented investors heading into the final stretch of 2025.

This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research or consult a regulated adviser before making investment decisions.