As the market heads into a holiday‑shortened trading week, space and defense stocks are entering the final stretch of 2025 with unusually strong crosscurrents: a fresh wave of U.S. Space Force satellite awards, a newly signed FY2026 National Defense Authorization Act (NDAA) that locks in record policy-level defense spending, and geopolitics that can still swing sentiment overnight—from Ukraine peace talks to Taiwan arms packages.

The week ahead (Dec. 22–26) will likely be defined by two realities investors should keep in mind at the same time:

- Thin liquidity (Christmas week tends to amplify moves—up or down), with U.S. markets closing early on Dec. 24 and shutting for Christmas Day.

- News-driven catalysts in national security space and missile defense that can matter more than the macro calendar for this sector.

Below is what matters most as of Sunday, Dec. 21, 2025—and how it could shape trading in major space and defense stocks over the coming week.

The market setup: a “Santa rally” window meets a low‑volume holiday week

Reuters’ latest “Week Ahead” framing highlights two macro themes still driving U.S. equities into year-end: shifting expectations for the Fed’s 2026 rate path and lingering volatility tied to the AI trade. At the same time, the traditional “Santa Claus rally” window—the last five trading days of the year plus the first two of January—starts Wednesday, Dec. 24, and runs through Jan. 5, historically positive on average, but not guaranteed. 1

For space and defense stocks, that backdrop matters because this group can behave like a hybrid:

- Defense primes often trade as “steady compounders” (backlogs, multi‑year programs), but can still be sensitive to rates and broad risk appetite.

- Space names—especially newer public companies—can act like high‑beta growth stocks, where contract headlines and capital-market narratives (including IPO chatter) quickly reprice expectations.

The biggest sector headline: Space Force’s $3.5 billion satellite order (and why it’s a big deal)

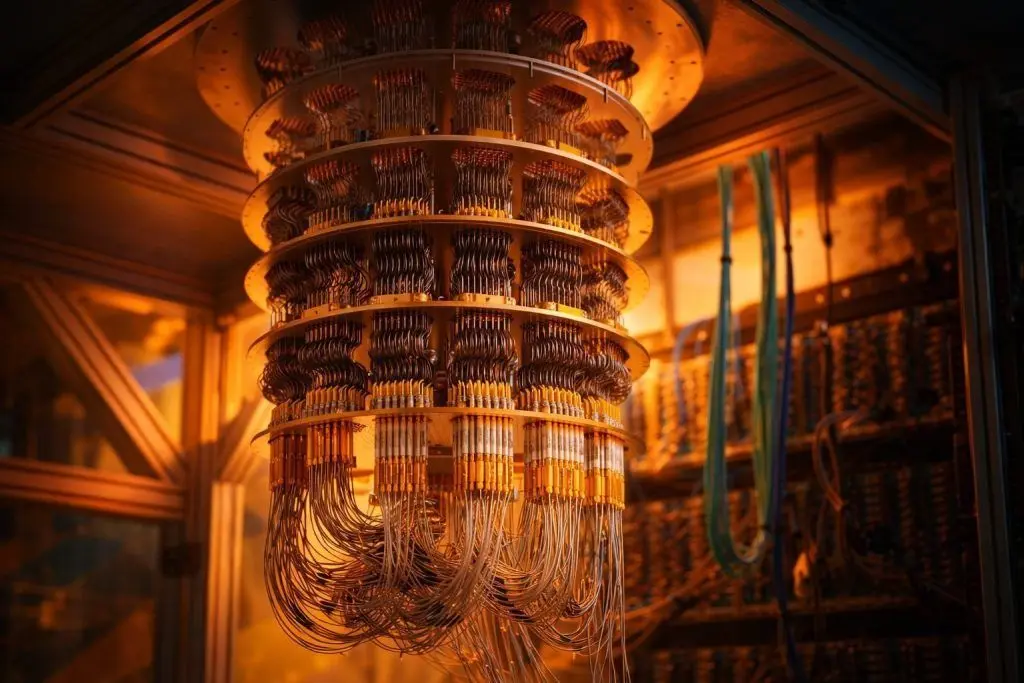

The Space Development Agency (SDA), part of the U.S. Space Force, reached agreements worth about $3.5 billion for 72 infrared satellites—a major signal that missile-warning and tracking constellations are no longer theoretical “future architectures,” but an accelerating procurement pipeline. 2

Who won the work?

SDA said Lockheed Martin (LMT), L3Harris (LHX), Northrop Grumman (NOC), and Rocket Lab (RKLB) signed fixed-price contracts to build 18 satellites each. 2

What are these satellites for?

SDA’s statement emphasizes near-continuous global coverage for missile warning and tracking, with payloads capable of producing fire-control-quality tracks for missile defense—directly aligned with the Pentagon’s shift toward space-based sensing against maneuvering and hypersonic threats. 2

Why investors care (beyond the headline number):

- Fixed-price, multi-year scale: This is not an R&D pilot; it’s structured procurement at tranche scale.

- A “refresh cycle” model: SDA’s goal of launching new tranches every two years is effectively a recurring upgrade cadence, more like tech refresh than legacy satellite programs. 2

- A long runway but clear milestones: SDA expects Tranche‑3 launches in 2029 for these satellites. That’s far out—yet markets often price the direction of travel (and competitive positioning) well before revenue recognition. 2

Rocket Lab’s $816 million prime award: a watershed moment for “new space” in defense

Rocket Lab’s SDA win is particularly notable because it’s not just about launch anymore—it’s about moving deeper into prime contractor territory in national security space.

Rocket Lab announced it received a $816 million prime contract to design and manufacture 18 satellites for SDA’s Tracking Layer Tranche 3 program. The company broke down that figure as a $806 million base plus up to $10.45 million in options. 3

Rocket Lab also pointed to additional subsystem opportunities supplying other Tranche‑3 primes that could bring total “capture value” to ~ $1 billion, depending on how much of its component portfolio it ultimately provides across the broader program. 3

For the week ahead, this matters in three ways:

- Momentum + narrative: Rocket Lab is explicitly positioning itself as a vertically integrated disruptor versus legacy primes. Whether investors buy that story will influence how the stock trades around any additional SDA follow-on headlines.

- Peer read-through: If Rocket Lab is accepted as a credible defense-space prime, it can lift sentiment for adjacent space manufacturers and subsystem providers.

- Execution scrutiny rises: Once a company wins prime work at this scale, the market’s tolerance for schedule slips, margin surprises, or production bottlenecks tends to drop.

Rocket Lab also highlighted (on the same release page) a Dec. 21 company update that it ended 2025 with 21 launches and 100% mission success, reinforcing the operational-execution narrative heading into year-end positioning. 3

FY2026 NDAA: record authorization locks in tailwinds for primes, missiles, and space architectures

The FY2026 NDAA is now signed into law, authorizing a record $901 billion in annual military spending—$8 billion more than requested, according to Reuters. 4

Key elements with potential stock implications:

- Ukraine support: Reuters reported the NDAA includes $800 million for Ukraine over two years—$400 million in each of the next two years—through the Ukraine Security Assistance Initiative (which pays U.S. companies for weapons). 4

- Europe posture provisions: The law limits the Department of Defense’s ability to reduce U.S. forces in Europe below 76,000, an example of how force posture politics can reinforce long-cycle procurement assumptions. 4

- Missile defense emphasis: The White House’s signing statement says the act supports advancing homeland missile defense by “fully supporting” the Golden Dome for America plan, among other security priorities. 5

Why the NDAA matters for the coming week:

Even if immediate revenue doesn’t change overnight, the NDAA provides a policy-level “floor” under multiple spending themes that investors use to justify higher multiples in this group—especially air and missile defense, munitions replenishment, and space-based sensing.

Geopolitics remains the swing factor: Ukraine peace headlines can still move defense stocks fast

On Sunday, Reuters reported the Kremlin said European and Ukrainian changes to U.S. proposals did not improve prospects for peace, while talks among envoys continued. 6

Why that matters to investors, even during a holiday week:

- Defense stocks often sell off on “peace deal optimism.” Europe has seen this pattern repeatedly in 2025, with defense indices reacting sharply to headlines—then stabilizing when investors refocus on structural rearmament and budget realities.

- Headline volatility is amplified by thin liquidity. With fewer participants, even modest flows can push defense baskets more than fundamentals justify.

A useful reference point: Reuters has previously highlighted that European aerospace and defense shares can swing hard on peace-talk developments, even while analysts argue rearmament plans are unlikely to reverse quickly. 7

Taiwan arms package: a direct demand signal for rockets, missiles, and drones

Reuters reported the U.S. announced an $11.1 billion arms package for Taiwan—the largest ever—covering eight items including HIMARS, howitzers, Javelin anti‑tank missiles, loitering munition drones, and parts. The package must still be approved by Congress. 8

From a stocks perspective, this is the kind of “demand visibility” event that can:

- reinforce confidence in precision fires and missile-related production lines, and

- keep investor attention on companies with exposure to rockets, guidance systems, munitions, and ISR.

It also underscores Taiwan’s stated push toward “asymmetric warfare” approaches—generally supportive of drones, mobile launchers, and distributed sensors. 8

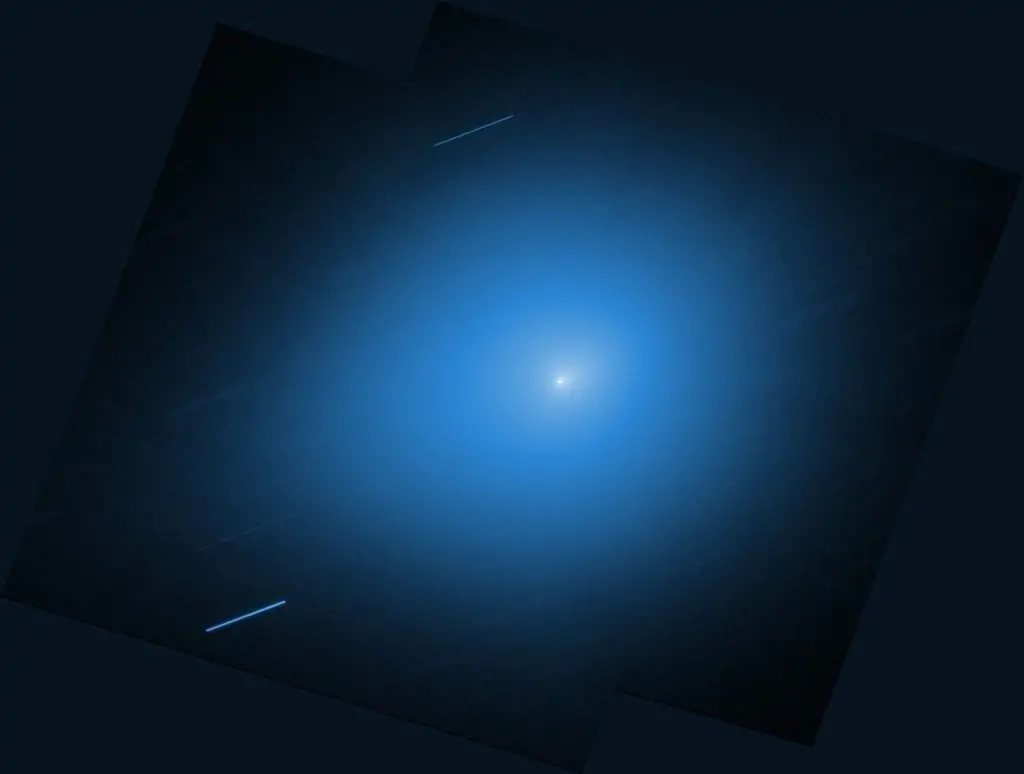

Space policy adds another tailwind: “Ensuring American Space Superiority”

Two closely timed policy moves are shaping the space investment narrative into year end:

- A sweeping space policy order

Reuters reported an executive order calling for a 2028 Moon landing, space security strategy work, and demonstrations of missile-defense technologies under the Golden Dome program, among other items. 9 - The White House executive order text

The published order explicitly sets priorities including returning Americans to the Moon by 2028 via Artemis, establishing initial elements of a lunar outpost by 2030, and developing and demonstrating prototype next-generation missile defense technologies by 2028. 10

For publicly traded space and defense names, these policies tend to support a “both/and” thesis:

- Civil + national security space are increasingly intertwined (launch cadence, satellite manufacturing, communications, cislunar security).

- The administration’s emphasis on integrating commercial capabilities and enabling new entrants can be interpreted as supportive for “new space” primes and suppliers—though the actual budget execution is what ultimately matters. 10

SpaceX IPO buzz: private-market gravity that can pull public space multiples

Even though SpaceX is private, it sets the tone for investor appetite across launch, satellites, and national security space.

Reuters reported that Morgan Stanley is the front-runner to lead a SpaceX IPO, with discussions described as preliminary and timing uncertain. 11

Why that matters to publicly traded space stocks this week:

- IPO chatter can lift the whole category in thin markets, especially if investors rotate into “the closest public comps.”

- It can also raise scrutiny on fundamentals: margins, contract quality, and capital intensity.

Space risks to watch: orbital incidents and regulatory scrutiny

Not all the recent space headlines are purely bullish.

Starlink anomaly highlights congestion and debris risk

Reuters reported SpaceX lost communication with a Starlink satellite after an anomaly that created a “small number” of debris, with a space-tracking firm detecting “tens” of debris pieces. 12

While that’s not directly a defense-stock driver, it reinforces a growing investor theme: space traffic management and safety will increasingly influence regulation, insurance, and constellation economics.

Spectrum is strategic—and political

Reuters reported two U.S. lawmakers raised concerns about EchoStar’s spectrum deals involving AT&T and SpaceX, urging regulatory scrutiny and arguing the transactions could reduce competition and entrench dominance in wireless and satellite markets. 13

For space investors, the big takeaway is that spectrum and satellite connectivity are becoming more politically regulated—and headlines can create short-term volatility even when long-term demand remains intact.

Wall Street outlook: “value” in defense heading into 2026, but stock selection matters

Analysts are not treating defense as a monolith going into 2026—stock selection is increasingly the game.

Morgan Stanley, in an outlook note summarized by Investing.com, argued U.S. defense stocks offer attractive value heading into 2026, with valuations not reflecting continued U.S. defense budget growth. The firm upgraded L3Harris and General Dynamics and downgraded Lockheed Martin, while keeping Northrop Grumman as its top pick. 14

This is important for the week ahead because in a low‑news, low‑liquidity environment, analyst note flow and year-end rebalancing can have outsized influence—especially on mega-cap primes.

Week-ahead calendar: what can move space and defense stocks (Dec 22–26)

The holiday schedule matters as much as the data.

- Monday, Dec. 22: No major U.S. economic releases scheduled. (Expect positioning and low-volume trading.) 15

- Tuesday, Dec. 23: A cluster of releases including initial Q3 GDP, durable goods, industrial production/capacity utilization, and consumer confidence. Rates and risk appetite can spill into defense and space baskets. 15

- Wednesday, Dec. 24:Initial jobless claims, plus early close (stocks at 1 p.m. ET; bonds at 2 p.m. ET). Expect the thinnest liquidity of the week. 15

- Thursday, Dec. 25: U.S. stock and bond markets closed for Christmas. 15

- Friday, Dec. 26: No major U.S. economic releases scheduled. 15

Stocks in focus: what investors are likely to watch most closely

If headlines drive the tape, these are the names most exposed to the current narrative:

Large-cap defense and space primes

- Lockheed Martin (LMT): Space sensing exposure and a key “valuation vs. growth” debate as analyst sentiment turns more selective.

- Northrop Grumman (NOC): Beneficiary of missile defense and space architectures; often treated as a top “pure-play” on national security modernization.

- L3Harris (LHX): Positioned for ISR, space payloads, and systems integration; upgraded tone from some strategists into 2026. 14

- RTX (RTX): Air and missile defense exposure is central to the broader demand cycle, especially when geopolitics intensifies.

Public “new space” with defense traction

- Rocket Lab (RKLB): Now has an SDA prime award measured in the hundreds of millions, plus the possibility of additional subsystem revenue across other primes. 3

Europe: strong trend, headline-sensitive

European defense shares have been among 2025’s strongest performers, and Reuters reported the STOXX 600 hit a record high recently with aerospace and defense leading gains—yet peace-talk headlines can still trigger quick pullbacks. 16