NEW YORK, Jan 4, 2026, 13:00 ET — Market closed

- The Philadelphia Semiconductor Index jumped 4% on Friday, outpacing broader U.S. stocks.

- Nvidia, Intel and AMD ended higher as investors rotated back into chipmakers.

- CES appearances on Monday and the U.S. jobs report on Jan. 9 are the next near-term catalysts.

Semiconductor stocks led Wall Street’s first session of 2026, with the Philadelphia Semiconductor Index — a benchmark for major U.S.-listed chipmakers — up 4% on Friday as the Dow rose 0.66% and the S&P 500 gained 0.19%. The Nasdaq slipped 0.03% as investors rotated back into chip names after a late-December pullback. “Buy the dip, sell the rip” is the mindset right now, Charles Schwab trading strategist Joe Mazzola said. 1

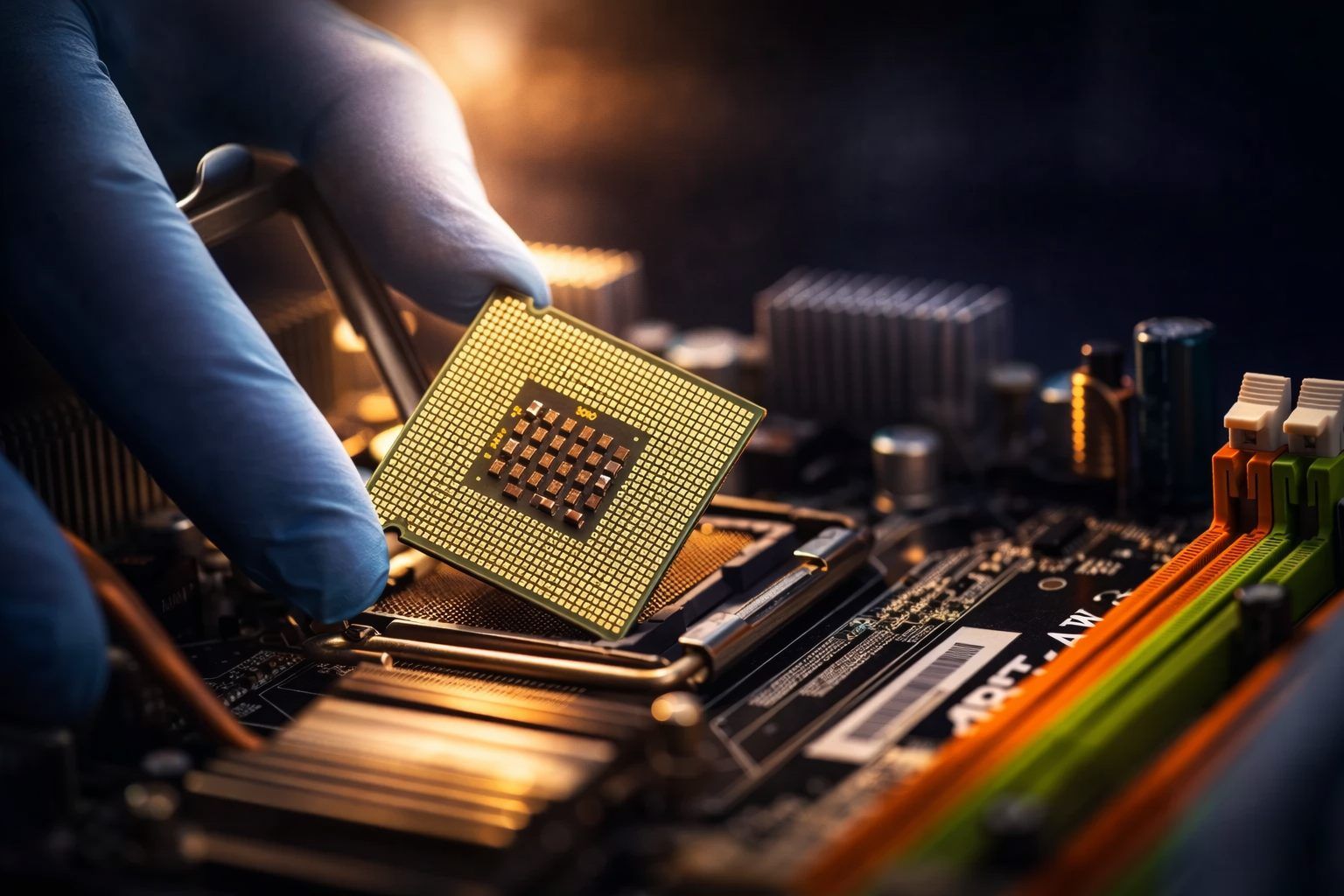

With U.S. markets shut on Sunday, chip stocks sit near the center of the next week’s risk-on trade. The group supplies the processors that power data centers and artificial intelligence, making it a quick read on corporate tech spending.

Chip shares also tend to move with interest-rate expectations because much of their profits are expected further out — the “long-duration” effect that makes growth stocks sensitive to Treasury yields. Investors head into the week still trying to gauge whether the Federal Reserve can ease policy later in 2026 without reigniting inflation.

Nvidia rose about 1.2% on Friday to $188.85, Intel jumped 6.7% to $39.38 and Advanced Micro Devices gained 4.3% to $223.47, according to market data.

The next catalyst comes fast: Nvidia Chief Executive Jensen Huang is due to speak at CES in Las Vegas at 1 p.m. local time on Monday (4 p.m. ET), while AMD Chief Executive Lisa Su has a keynote scheduled for 9:30 p.m. ET. 2

Traders will look for demand signals on AI accelerators and server chips, and for any read-through on the consumer PC cycle heading into 2026. Any hint on supply constraints or pricing power can ripple across the sector because chipmakers sit deep inside each other’s supply chains.

Washington also put chip deal scrutiny back in focus. President Donald Trump blocked photonics firm HieFo Corp’s $3 million acquisition of assets in New Jersey-based Emcore, citing national security and China-related concerns, and ordered divestment within 180 days. The Treasury Department said the Committee on Foreign Investment in the United States, which reviews foreign deals, identified a national security risk. 3

But the rebound leaves little room for disappointment. A stronger-than-expected jobs report or hotter wage data can push yields higher — a headwind for richly valued chip stocks — while any fresh trade or national-security actions can sour sentiment quickly.

In the near term, traders are watching whether Nvidia can hold near the $190 area and whether Intel can stay above $39 after Friday’s surge. A slip back under those round-number levels would suggest the move was more about positioning than new fundamentals.

Markets reopen on Monday with CES headlines in focus, but the bigger macro test comes Friday, when the Labor Department releases the December employment report at 8:30 a.m. ET. For chip stocks, the direction of yields after that data may matter as much as any product announcement. 4