MUMBAI, Jan 4, 2026, 14:40 ET — Market closed

- Oil markets are bracing for fresh volatility after U.S. moves in Venezuela, a key risk for oil-importing India.

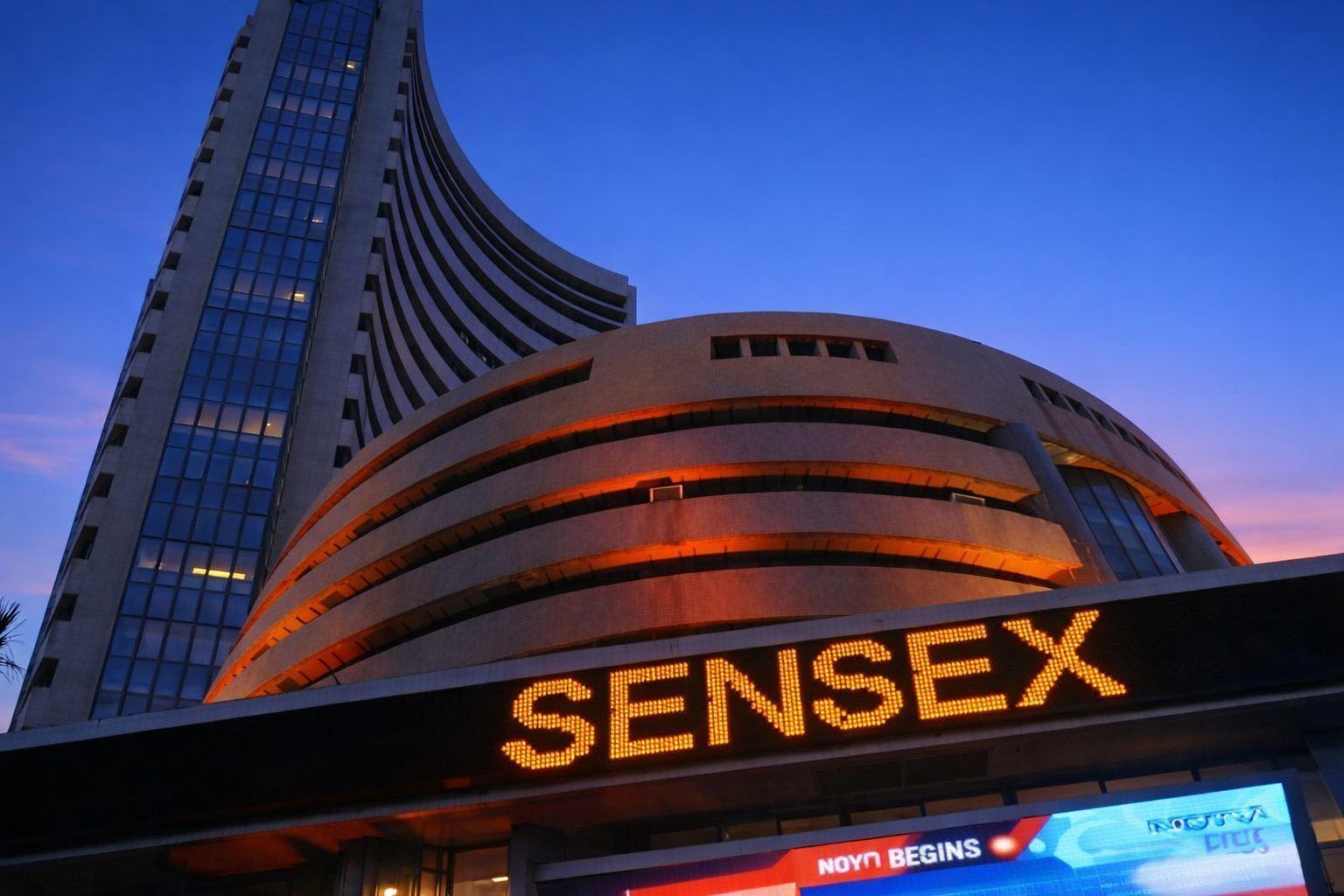

- Nifty 50 and Sensex ended Friday at record highs, leaving little room for negative global surprises.

- Traders this week watch services-sector data, foreign flows and the next U.S. jobs report.

Oil is back in focus for Indian markets ahead of Monday’s open after Washington’s weekend moves in Venezuela revived supply worries and set the stage for a jump in crude when trading resumes. 1

That matters now because India imports most of its crude, and higher oil typically feeds into inflation expectations and weighs on the rupee, tightening conditions for equities. With benchmarks already at all-time highs, traders are likely to treat any oil-led risk-off swing as a direct test of this rally’s staying power.

India’s Nifty 50 ended Friday up 0.70% at a record close of 26,328.55, while the Sensex rose 0.67% to 85,762.01. Energy, realty and metal stocks led, while FMCG was the key drag, underscoring the market’s sensitivity to both commodity moves and consumer cost pressures.

Over the weekend, OPEC+ — the Organization of the Petroleum Exporting Countries and allies led by Russia — kept output policy unchanged after a brief meeting, reaffirming a pause in planned output increases through March, according to Reuters. “Right now, oil markets are being driven less by supply–demand fundamentals and more by political uncertainty,” said Jorge Leon, head of geopolitical analysis at Rystad Energy.

Global cues were mixed going into the weekend. The S&P 500 ended Friday up 0.19%, while the Nasdaq slipped 0.03%, and the U.S. 10-year yield ticked up to 4.191% — a reminder that higher bond yields can compete with equities for investor money. Brent settled at $60.75 a barrel and U.S. crude at $57.32, both down on the day before the Venezuela headlines hit. 2

Back home, investors are turning to the week’s domestic calendar and early earnings positioning. Traders are watching the final HSBC services PMI and composite PMI readings — survey-based gauges where a number above 50 signals expansion — and the start of the December-quarter results season from Jan. 12, with Tata Consultancy Services and HCL Technologies scheduled to report, Times of India said. It also reported foreign institutional investors (FIIs) — overseas portfolio investors — were net buyers on Friday, a support point for near-term sentiment. 3

In Monday’s session, desks will be watching whether exporters and oil-linked counters react first to any crude repricing and whether bank-heavy benchmarks hold firm if bond yields extend their rise. The rupee’s opening tone will be another quick read on risk appetite, especially if crude spikes.

But the downside scenario is straightforward: a sharper-than-expected jump in oil, alongside a firmer dollar and higher U.S. yields, could trigger profit-taking after the Nifty’s record close. A quick reversal in foreign flows would amplify that pressure.

The next hard catalyst for global risk sentiment is Friday’s U.S. payrolls report on Jan. 9, a datapoint that can move bond yields and the dollar — and by extension, emerging-market equities such as India. 4