New York, January 4, 2026, 18:42 ET — Market closed

- AST SpaceMobile shares finished Friday up 14.9% after a sharp intraday swing.

- The company’s next BlueBird satellite, BlueBird 7, has arrived in Florida for launch preparations.

- Investors are watching for a launch timetable, March earnings expectations, and Friday’s U.S. jobs report.

AST SpaceMobile shares closed up 14.9% on Friday at $83.47 after swinging between $69.25 and $83.76, with about 19 million shares traded. The company’s next satellite, BlueBird 7, has arrived in Florida ahead of integration with the launch vehicle, Via Satellite reported on Sunday. 1

The move matters because AST is in a make-or-break stretch where investors want proof it can turn a handful of satellites into a repeatable launch cadence. The company is trying to build a “direct-to-cell” network — satellites that connect straight to everyday smartphones without modified hardware — a market that has become a battleground for telecom and space firms.

For traders, the near-term question is execution: can AST keep shipping, integrating and launching spacecraft on schedule without delays or in-orbit surprises. With the stock still trading like an execution story, incremental milestones have been moving the shares sharply.

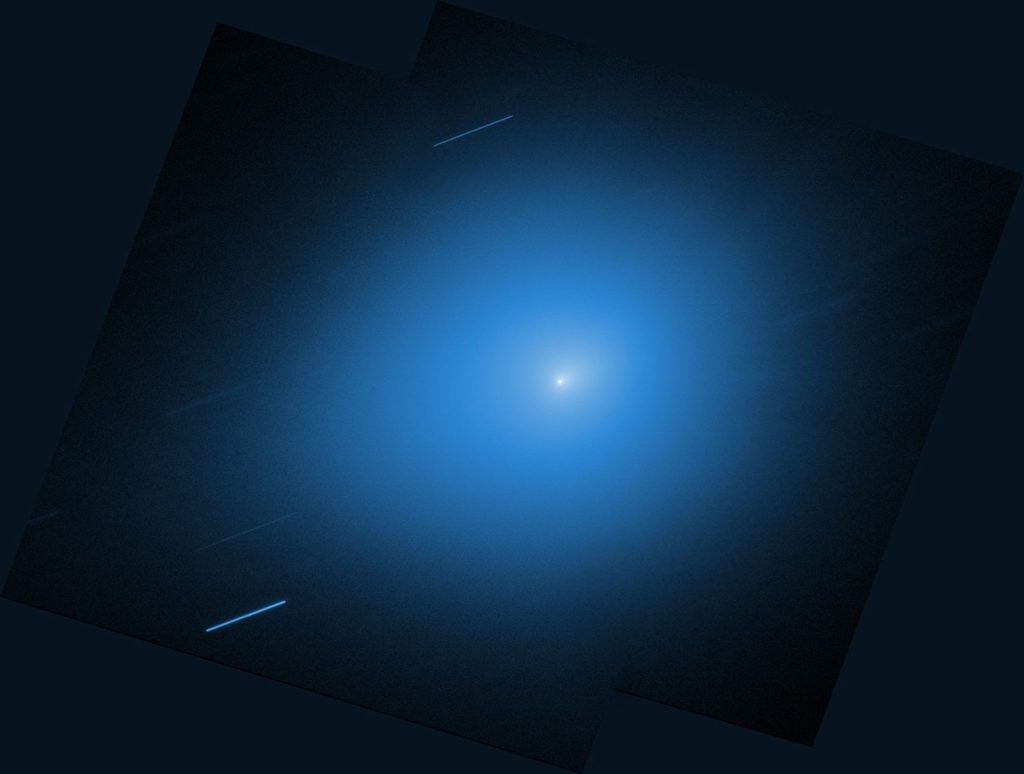

AST said last month it successfully launched BlueBird 6, which it called the largest commercial communications array ever deployed in low Earth orbit, and designed it to support space-based 4G and 5G service directly to standard phones. Chief executive Abel Avellan called the launch “a breakthrough moment,” and the company said it aims to launch 45–60 satellites by the end of 2026, with launches planned every one or two months on average. 2

Technically, the stock is sitting roughly 19% below its 52-week high of $102.79, after Friday’s bounce from the high-$60s area — a level some short-term traders view as near-term support after the latest pullback. The 52-week low is $17.50, underscoring how quickly sentiment has shifted around the company’s rollout timetable. 3

AST operates in a crowded race to marry satellite coverage with terrestrial cellular networks. Investors often group it with other satellite and spectrum plays such as Iridium and Globalstar, while privately held rivals and partnerships in the “direct-to-device” market keep pressure on timelines and performance claims.

Next up, traders are likely to focus on any disclosure that tightens the schedule for BlueBird 7’s launch and early in-orbit checks. The company has not posted an earnings date on its events calendar, and third-party calendars vary; Zacks expects the next earnings release around March 2. 4

Macro risk is also on the radar for high-volatility growth names. The U.S. jobs report for December 2025 is due at 8:30 a.m. ET on Friday, January 9, according to the Labor Department’s release schedule. 5

But the downside case remains straightforward: launch slips, deployment issues or weaker-than-expected satellite performance can quickly reset expectations for a commercial ramp, and AST may still need to manage funding needs as it scales manufacturing and launches. That mix can amplify swings if investors start to price in slower rollout or heavier dilution.

With U.S. markets reopening Monday, attention turns to whether Friday’s rebound holds — and whether AST provides any clearer timing on BlueBird 7’s next steps ahead of the January 9 payrolls report and the market’s expected March earnings window.