MUMBAI, Jan 5, 2026, 02:08 ET

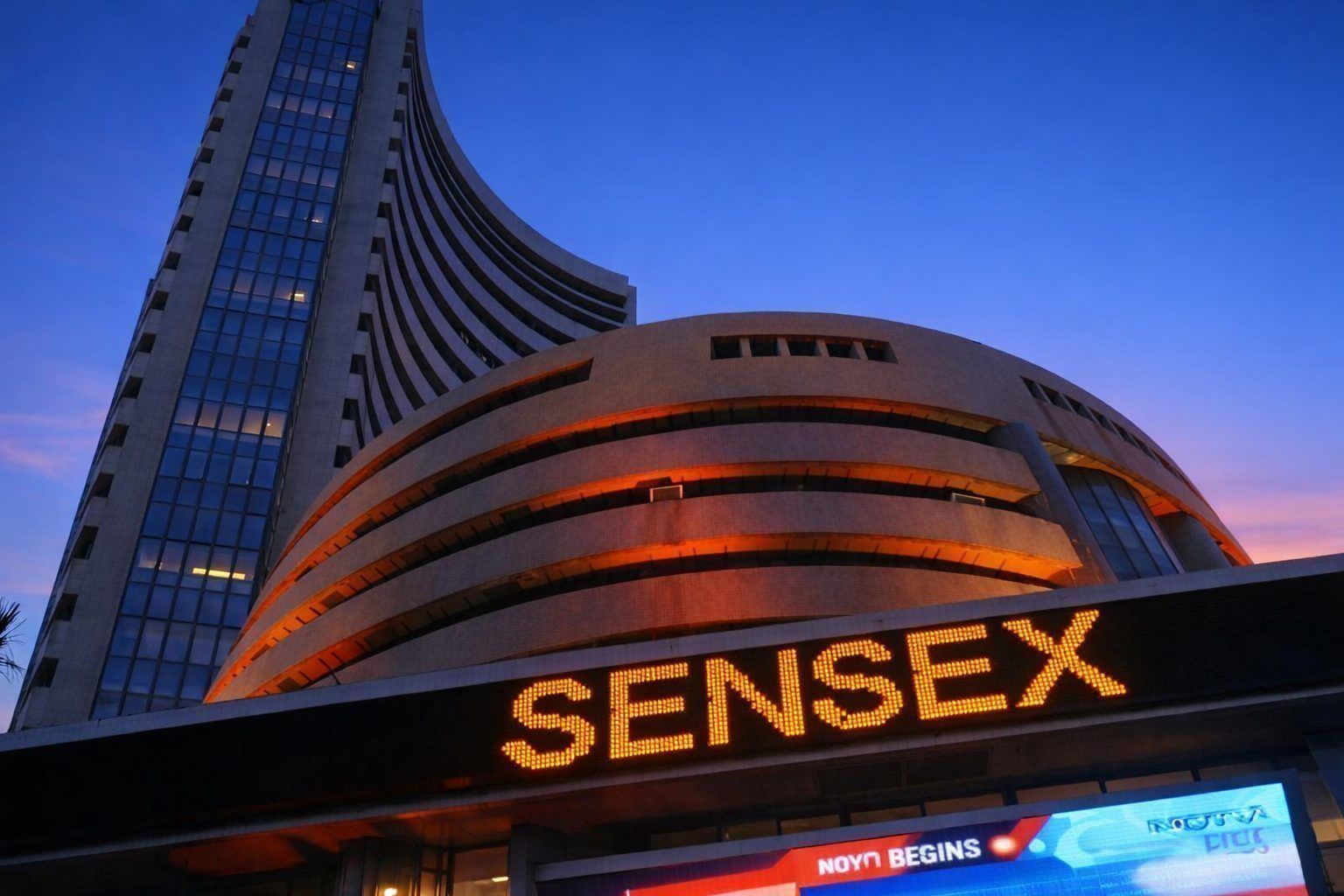

- The Nifty 50 slipped 0.13% after briefly setting a record at 26,358.25; the Sensex fell 0.16% by 10:05 a.m. IST. 1

- HCLTech dropped 3.3% and Tech Mahindra slid 2%, pulling the IT index down 2.5% after a CLSA downgrade. 1

- CSB Bank jumped 7.6% to a record high and Sobha gained 4% after upbeat quarterly business updates. 1

Indian IT shares dragged benchmarks lower on Monday after CLSA downgraded HCLTech and Tech Mahindra, blunting an early push to fresh highs. The Nifty 50 traded down 0.13% and the Sensex fell 0.16% by 10:05 a.m. IST. 1

The hesitancy matters because the Nifty still hovers near lifetime highs, and investors now need earnings to justify stretched expectations. A soft patch in IT — a key export-facing sector — can quickly change how global funds price India’s growth story. 1

IT often acts as a sentiment bellwether because it earns a large share of revenue from the U.S. A broker downgrade means an analyst cuts a rating and signals weaker performance versus peers or the market, which can prompt fast, crowded selling in large-cap names. 1

HCLTech fell 3.3% and Tech Mahindra slid 2% after CLSA cited a “lack of concrete signs” of a sector turnaround. The Nifty IT index dropped 2.5% as traders repositioned ahead of results season. 1

Citi Research said IT’s recovery will likely stay “slow and uneven” and flagged valuations as unattractive, with companies set to start reporting quarterly results next week. Investors will look for deal wins and demand commentary rather than just headline profit growth. 1

Banks offered a counterweight. State-owned lenders rose 0.9%, with Punjab National Bank and Bank of Baroda leading after quarterly updates — brief business snapshots companies release ahead of full earnings. 1

Smaller movers grabbed attention as well. CSB Bank jumped 7.6% to a record high after it reported a 21% rise in total deposits in the third quarter, while real-estate developer Sobha gained 4% after it said December-quarter sales jumped 52.3%. 1

Across the market, twelve of 16 major sectors advanced, even as the headline indexes wavered. “The underlying tone remains fragile,” said Ashish Chaturmohta, managing director and fund manager of Apex PMS at JM Financial. 1

Trade headlines kept risk appetite in check. Trump said the U.S. could raise tariffs on India if it does not curb Russian oil purchases, and Reuters reported the U.S. already imposes a 50% tariff on India; oil prices also stayed choppy as investors weighed U.S. military action in Venezuela. 1

But record levels leave little cushion if earnings guidance disappoints or tariff talk hardens into policy, especially for exporters that depend on U.S. budgets. The rupee’s slide — it traded around 90.2425 per dollar by late morning — can add another layer of unease around foreign flows. 2

Investors now watch the first big IT scorecards: TCS plans to release December-quarter earnings on Jan. 12, and HCLTech also flags Jan. 12 for its Q3 results. Infosys has a board meeting scheduled for Jan. 13–14, while Tech Mahindra has notified a board meeting on Jan. 15–16. 3