NEW YORK, Jan 7, 2026, 15:17 EST — Regular session

- D-Wave Quantum shares fell in afternoon trade after it agreed to buy Quantum Circuits for $550 million

- The move deepens D-Wave’s push into gate-model quantum systems alongside its annealing business

- Traders are watching deal mechanics, dilution risk and the next company update later this month

Shares of D-Wave Quantum (QBTS) were down about 1.1% at $30.93 on Wednesday afternoon, after the company agreed to acquire Quantum Circuits in a $550 million cash-and-stock deal. The stock swung between $32.15 and $30.44 earlier in the session, with roughly 29 million shares traded.

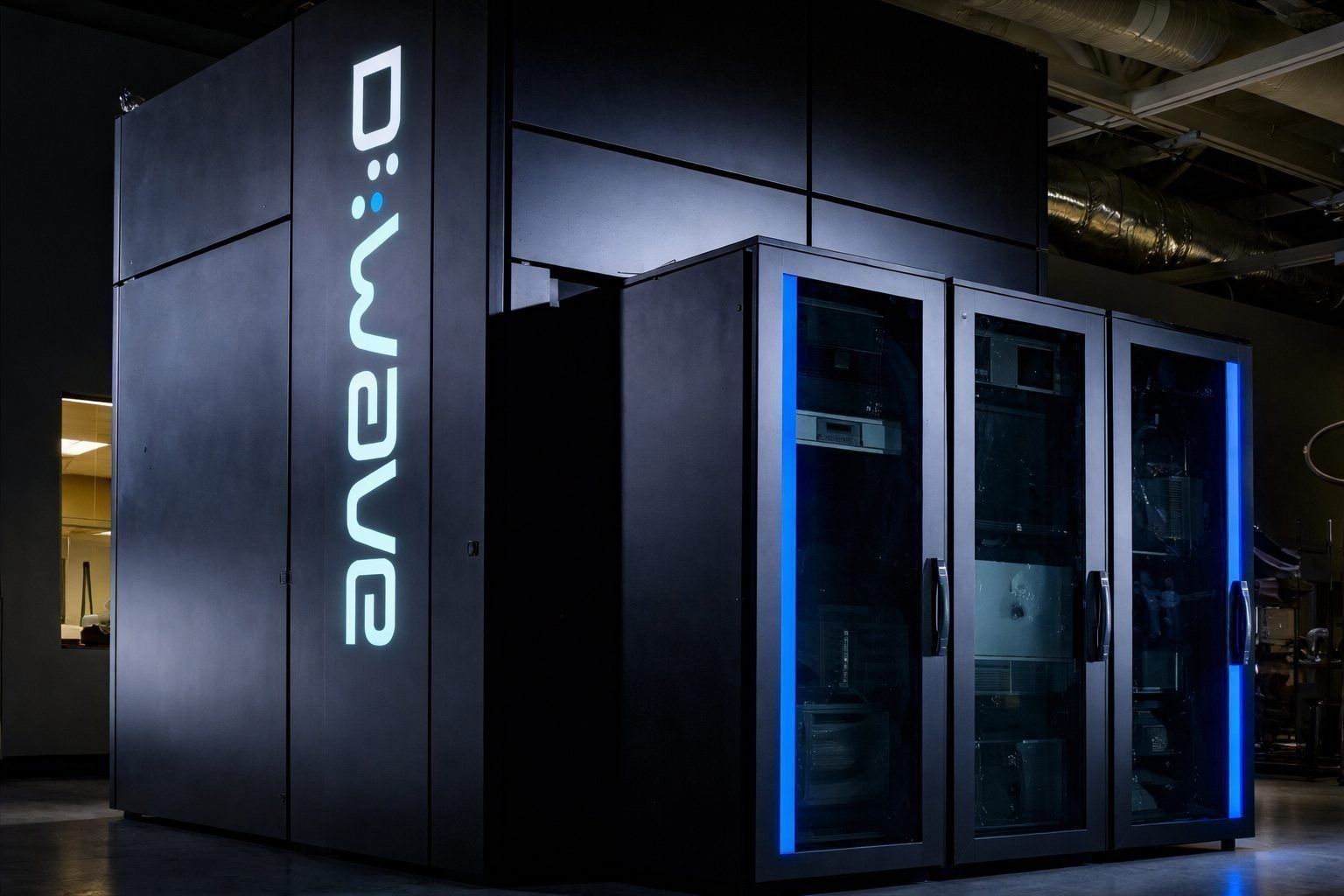

The acquisition puts D-Wave, best known for quantum annealing systems used for optimization problems, closer to gate-model machines that run sequences of operations — the “gates” — and are viewed as more general-purpose. D-Wave said the $550 million price includes $300 million in stock and $250 million in cash, and it expects an initial “dual-rail” system to be generally available in 2026. CEO Alan Baratz said the deal should help bring gate-model products and services to market in 2026. 1

The timing is not subtle. A day earlier, D-Wave said it had demonstrated scalable on-chip cryogenic control of gate-model qubits — quantum bits — aimed at cutting the wiring needed to run larger systems without hurting “fidelity,” or accuracy. “Controlling more qubits with less wiring enables us to build larger processors,” chief development officer Trevor Lanting said. 2

A filing showed the stock portion of the Quantum Circuits purchase will be set using a 10-day volume-weighted average price — a measure that weights trades by size — with a collar that caps and floors the price used to calculate shares at $39.03 and $22.30. The deal can be terminated if it has not closed by April 6, 2026, and it is subject to U.S. antitrust review and NYSE listing approval for the shares to be issued, among other conditions. 3

Quantum-computing stocks were mixed on the day. IonQ (IONQ) was down about 0.6%, while Rigetti Computing (RGTI) rose about 1.0% and Quantum Computing Inc (QUBT) fell about 2.6%.

But the deal brings its own set of questions. The $250 million cash component and the share issuance could put pressure on the balance sheet and raise dilution worries, and the regulatory timeline can still shift. The broader risk is simpler: commercial demand for quantum computing remains uncertain, and the stocks tend to reprice fast on headlines.

Next up, investors are likely to focus on the company’s next update on integration and timelines — and on quarterly results expected on March 12, according to MarketBeat’s earnings calendar. 4