New York, January 15, 2026, 20:41 EST — Market closed.

- Lumentum shares climbed 3.4% on Thursday, recouping some of the losses from Wednesday

- Late Thursday, the company announced new laser platforms it will unveil at Photonics West in San Francisco

- Upcoming events to watch: Photonics West from Jan. 20-22, followed by fiscal Q2 earnings on Feb. 3

Lumentum Holdings Inc. (NASDAQ: LITE) shares ended Thursday 3.4% higher, closing at $343.27. The stock fluctuated between $330.32 and $353.86 during the session.

The rebound is significant since the stock now behaves like a high-stakes wager on optical demand linked to data centers and factory automation, with sharp daily swings that leave no space for tepid news.

On Friday (Jan. 16), traders will be focused on whether the recent bounce can sustain itself after a volatile week marked by sharp reversals and heavy volume. Attention will also be on whether the broader tech rally continues to lift so-called “AI plumbing” stocks.

After markets closed, Lumentum announced it plans to unveil new ultrafast and UV (ultraviolet) laser platforms along with 3D sensing products at SPIE Photonics West 2026 in San Francisco, set for Jan. 20-22. 1

Matt Philpott, vice president of business development at Lumentum, said in the release that “manufacturers are being pushed to achieve tighter tolerances” while also boosting throughput and uptime. 1

U.S. stocks closed modestly higher Thursday, with the S&P 500 gaining 0.26% and the Nasdaq edging up 0.25%, based on Reuters market data. 2

Lumentum’s drop followed its steepest fall among S&P 500 stocks on Wednesday, plunging 8.22%. The move underscored just how swiftly market bets can reverse. 3

The company will release its fiscal second-quarter results on Tuesday, Feb. 3, after the market closes, followed by a webcast at 5 p.m. ET. 4

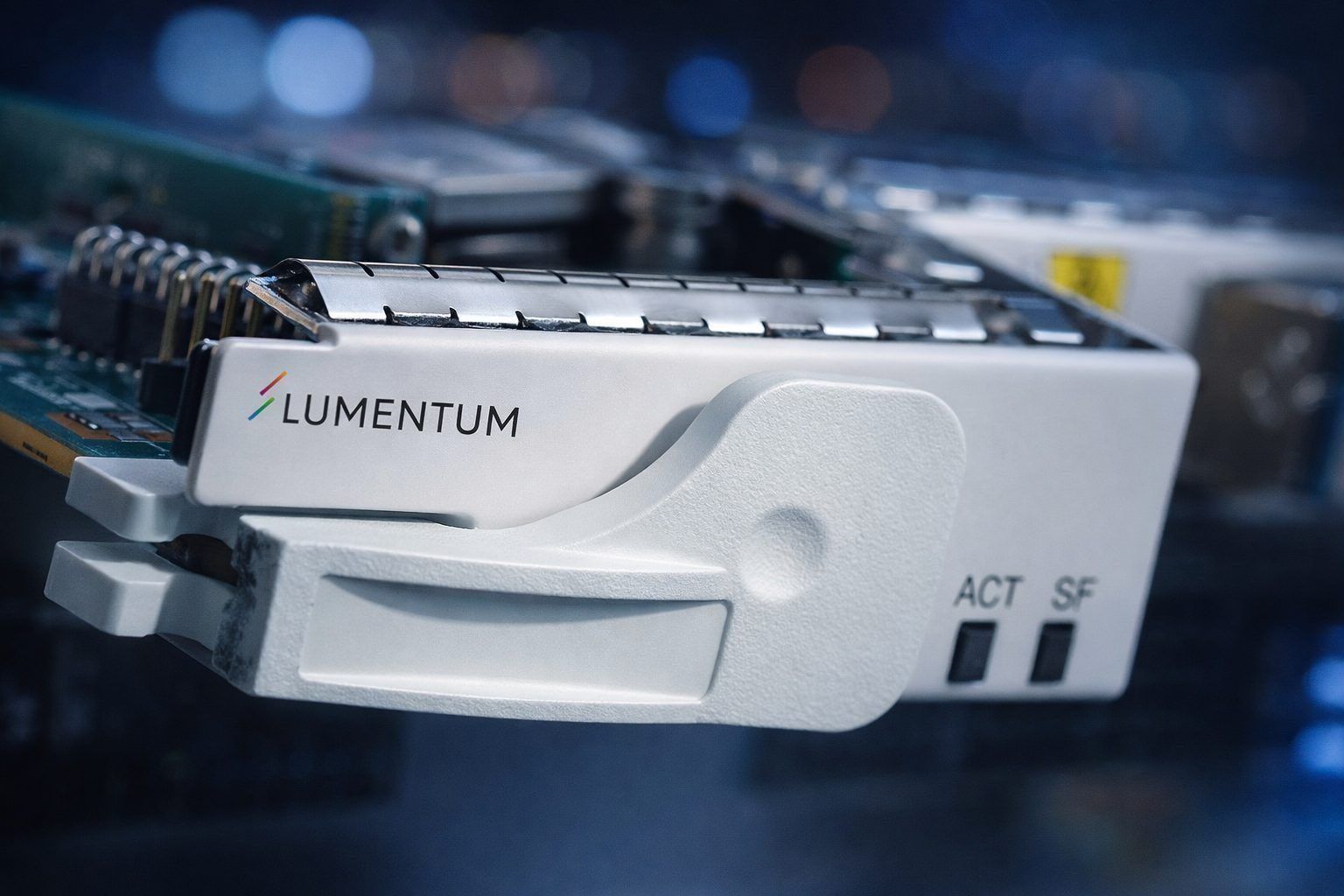

Lumentum manufactures optical and photonic components for telecom, enterprise, and data center networks. The company also produces lasers for industrial uses, according to its Reuters profile. 2

Still, the stock’s volatile swings highlight the risk: any slowdown in customer spending or guidance that misses expectations behind the recent surge could quickly send shares tumbling.

Investors will eye any signals from Photonics West, running Jan. 20-22, before turning their attention to the Feb. 3 earnings report for fresh insights on demand, pricing, and shipments.