New York, Jan 17, 2026, 13:08 ET — Market closed.

- Micron surged after a director disclosed a $7.8 million share purchase in an SEC filing

- Chip stocks also weighed a new U.S.-Taiwan trade deal that links lower tariffs to more U.S. production

- Focus next week: U.S. markets reopen Tuesday; Intel reports results on Jan. 22

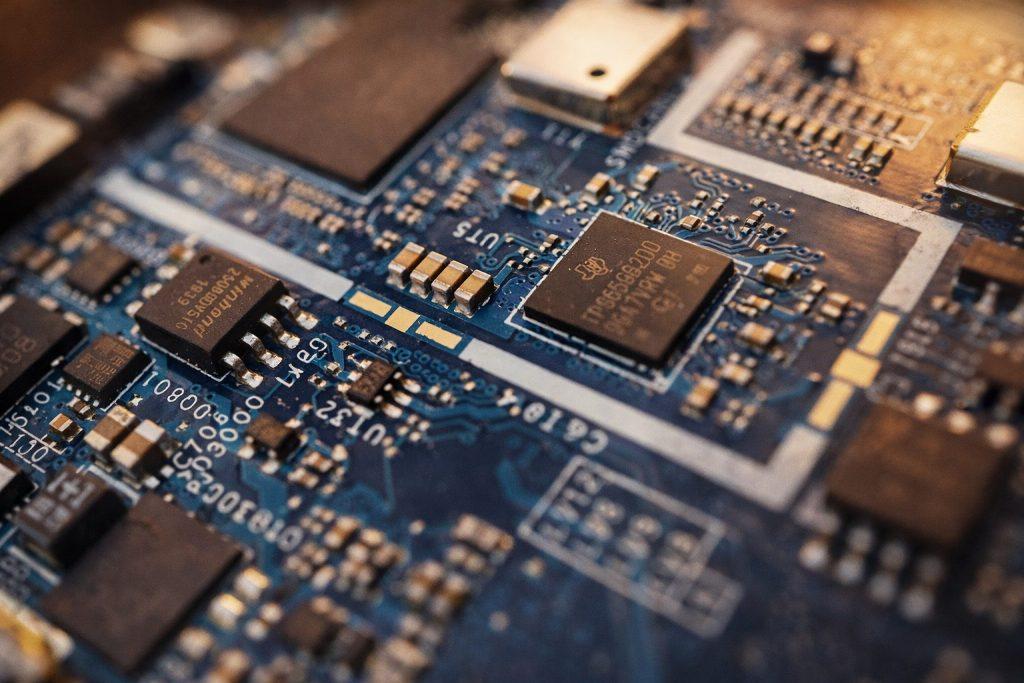

Micron Technology (MU.O) shares jumped on Friday after a Form 4 filing — the SEC disclosure insiders use for stock trades — showed director Teyin M. Liu bought 23,200 shares in open-market transactions. The purchases were priced around $337 a share and totaled about $7.82 million, the filing showed. 1

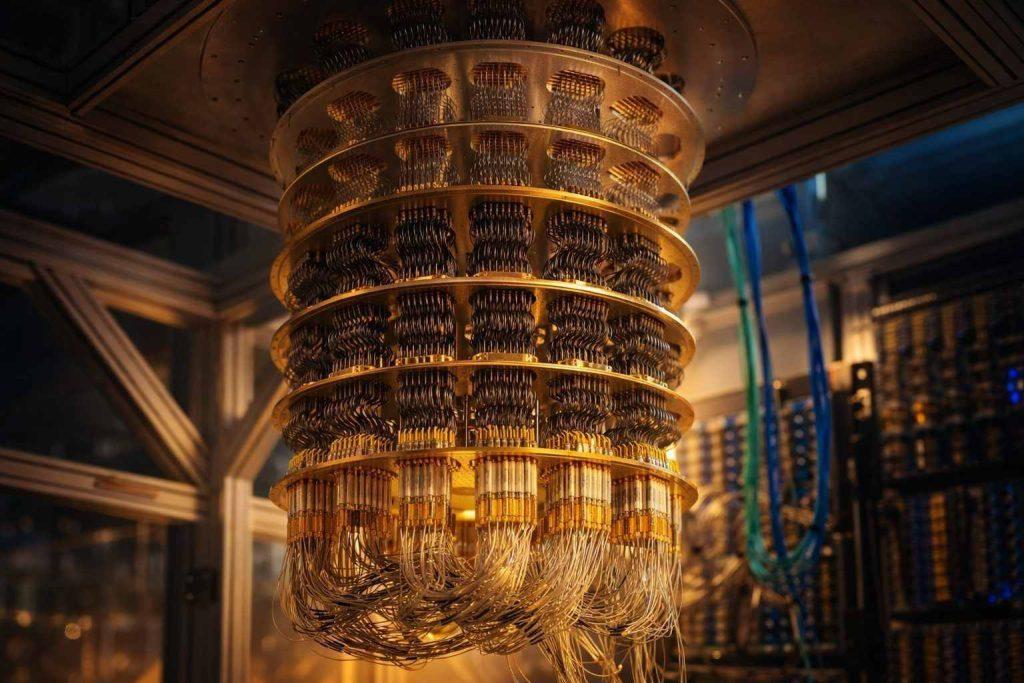

Chip stocks now head into a holiday-shortened week with tariffs and U.S. buildout plans back in focus after the United States and Taiwan clinched a trade deal that cuts broad tariffs on most Taiwanese exports to 15% from 20% and offers lower semiconductor tariffs for firms that expand U.S. production. In exchange, Taiwanese companies will invest $250 billion in U.S. semiconductors, energy and artificial intelligence, according to the Commerce Department; Commerce Secretary Howard Lutnick said the goal was to bring 40% of Taiwan’s chip supply chain to the U.S. and warned, “if they did not build in the U.S., the tariff was likely to be 100%.” 2

U.S. markets are shut on Monday for the Martin Luther King Jr. holiday, leaving traders to reset on Tuesday as earnings season starts to roll beyond the big banks. Some options investors are bracing for choppy trading after Friday’s monthly options expiry, when many derivatives contracts expire. 3

Semiconductor funds ended Friday higher: the iShares Semiconductor ETF (SOXX.O) rose 1.6% and the VanEck Semiconductor ETF (SMH.O) gained about 1.0%. Micron closed up 7.8%, while Nvidia (NVDA.O) slipped 0.5% and Intel (INTC.O) fell 2.8%; Taiwan Semiconductor’s U.S.-listed shares (TSM.N) were little changed and Applied Materials (AMAT.O) climbed about 2.5%.

TSMC this week pointed again to expanding U.S. capacity, including completing the purchase of a second parcel of land in Arizona to support its expansion plan. The chipmaker has said its U.S. investment totals $165 billion, and its second Arizona fab is slated for tool move-in and installation in 2026, Reuters reported. 4

TSMC’s upbeat tone helped drive a chip rally on Thursday, when the Philadelphia semiconductor index climbed 1.8% and U.S.-listed TSMC jumped 4.4%. “That’s been kind of squashed this morning with the news from Taiwan Semiconductor,” Alan Lancz, president of Alan B. Lancz & Associates, said of valuation worries around tech. 5

But policy risk is still the overhang for the sector. The U.S. Supreme Court is expected to issue its next rulings on Jan. 20, with a closely watched case over Trump’s sweeping global tariffs still pending — a potential volatility trigger for chip supply chains that stretch across Asia, Europe and the United States. 6

Investors also have Intel’s fourth-quarter and full-year results on deck on Thursday, Jan. 22, after the close, along with management commentary on its foundry business — contract chipmaking for outside customers. Intel said it will host an earnings call at 2 p.m. PT that day. 7