New York, Jan 19, 2026, 13:03 EST — Market closed.

- U.S. stock markets remain closed Monday for Martin Luther King Jr. Day, reopening for trading Tuesday.

- On Friday, quantum computing stocks saw trading activity, with IonQ and Quantum Computing Inc. leading the gains.

- Investors face a bunch of late-January deadlines, spanning deal timelines and product roadmaps.

U.S.-listed quantum computing stocks remained flat Monday while Wall Street was closed for the Martin Luther King Jr. Day holiday. 1

IonQ climbed 6.8% to $50.80 in the latest session. Rigetti also advanced, rising 3.7% to $25.62, and Quantum Computing Inc ticked up 4.0% to $12.70. D-Wave saw minimal movement, edging 0.5% higher to $28.83.

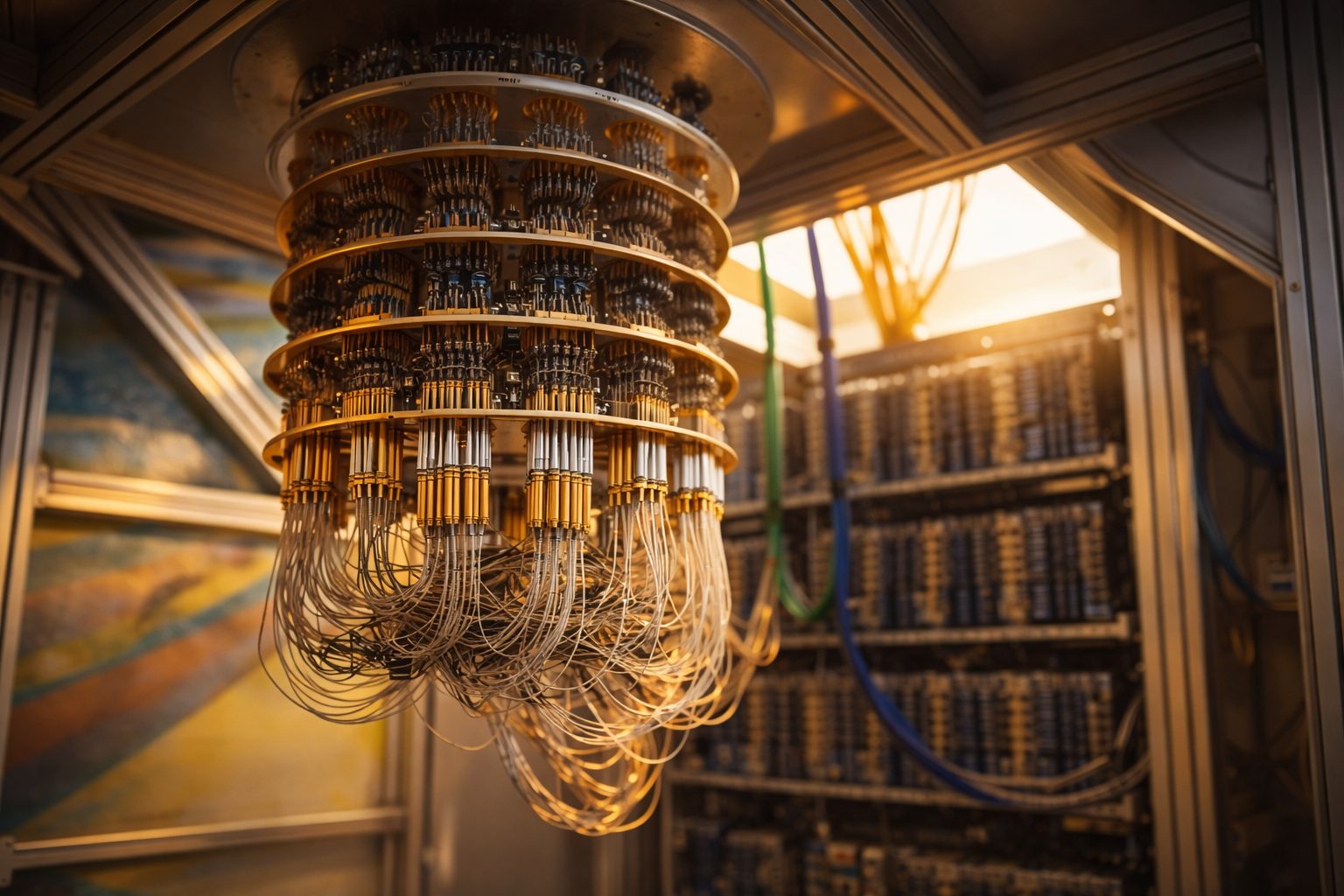

These developments are crucial since the sector now serves as a quick gauge of risk appetite in early-stage tech, where one update can flip the narrative. Quantum computers rely on quantum bits, or qubits, to tackle calculations that would overload classical machines, though both the engineering challenges and the business models remain under scrutiny.

D-Wave announced it has agreed to acquire Quantum Circuits for $550 million, with $300 million paid in stock and $250 million in cash. The deal is expected to close in late January, pending usual conditions like antitrust approval. CEO Alan Baratz described the move as one that “cements” D-Wave’s leadership in superconducting quantum computing. 2

Quantum Computing Inc has linked its immediate plans to a legal process. The company announced it was chosen as the stalking horse bidder for select Luminar Technologies assets, with a bid around $22 million. The deal hinges on bankruptcy court approval and an auction. CEO Yuping Huang described the move as a “strategic fit” to develop a scaled photonics platform. 3

Rigetti, for its part, signaled a delay on the lab front. The company revealed in a filing that general availability of its 108-qubit Cepheus system is now expected near the close of Q1 2026. This comes as it aims for 99.5% median two-qubit gate fidelity, up from the current 99% on the same system. CEO Subodh Kulkarni pointed to “complexities” with tunable couplers as the main hurdle.

IonQ is beefing up its leadership team. The company announced that Katie Arrington, a former Department of War technology official, will step in as chief information officer starting Monday. Chairman and CEO Niccolo de Masi emphasized that quantum computing stands as “one of the most consequential technologies” for national defense and competitiveness. 4

Investors are also factoring in how crowded the “pure play” space might become. Honeywell revealed last week that it aims to spin off its majority-owned quantum unit Quantinuum through an IPO, having confidentially filed draft papers with U.S. regulators. The company noted that Quantinuum was valued at around $10 billion in a recent funding round. 5

The downside is straightforward. Deal timelines might slip, regulatory or court procedures could drag on, and hardware roadmaps might fall short. These companies often burn through cash, raising dilution risks if capital markets tighten.

As U.S. markets reopen Tuesday, eyes turn to whether the recent surge in quantum stocks can sustain through the holiday-shortened week. A key date on the calendar: D-Wave’s Qubits 2026 user conference, scheduled for Jan. 27-28 in Boca Raton, Florida. The company has promised to outline its product roadmap at the event. 6