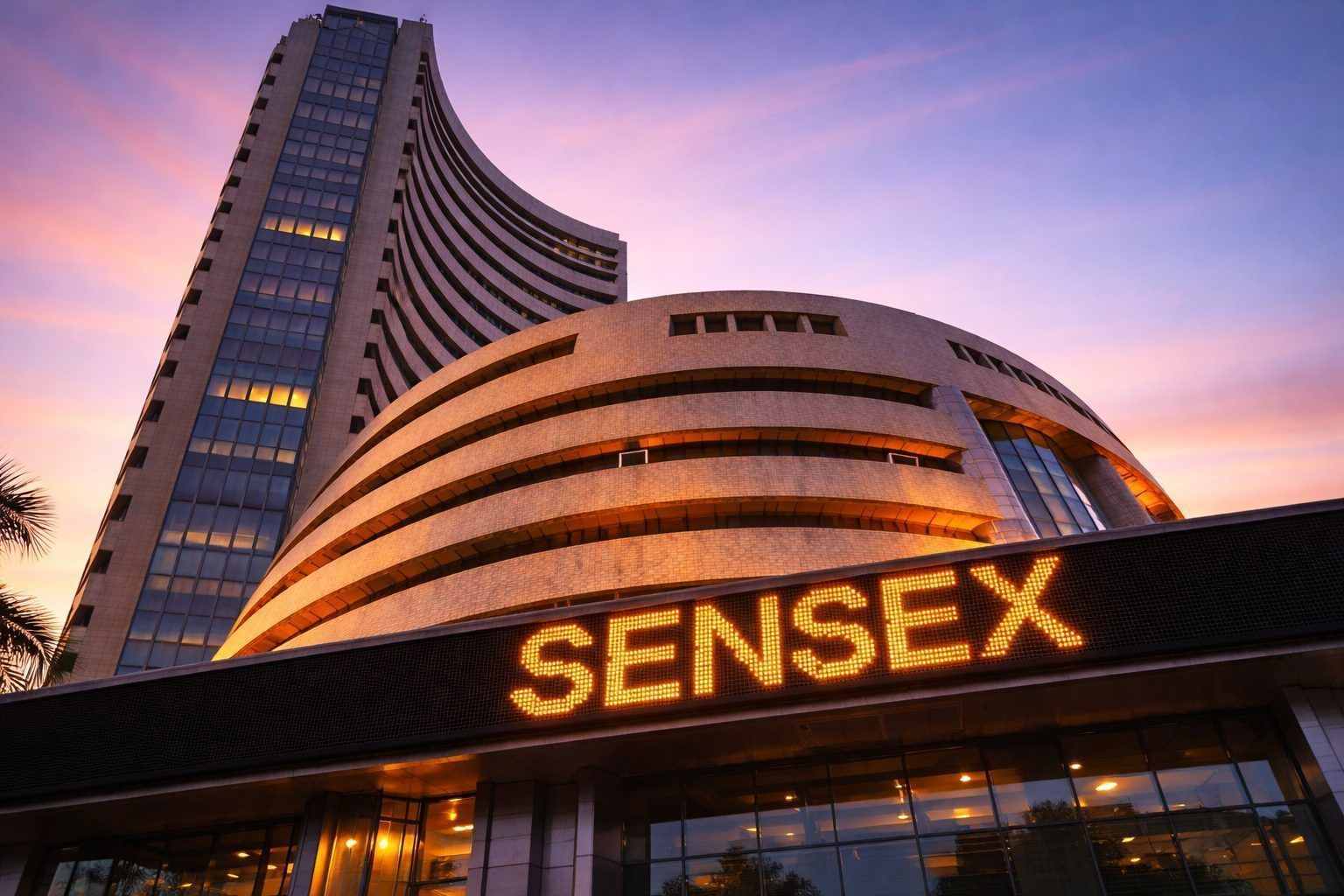

Mumbai, Jan 20, 2026, 14:32 (IST)

- Sensex dropped roughly 580 points in afternoon trading; Nifty slipped beneath 25,400, marking its lowest level since November 2025

- Broad selling dragged down sectors and smaller stocks amid rising volatility and a weaker rupee

- Tariff news and foreign outflows stirred a volatile earnings season, spotlighting IT stocks

Indian shares dipped for a second straight day on Tuesday. The BSE Sensex fell 578.59 points to 82,667.59 in afternoon trading, while the Nifty 50 slid 0.81% to 25,378.05—dropping below 25,400 for the first time since November 2025. The selloff extended beyond headline stocks. 1

The move takes on added weight as global risk appetite turns skittish amid tariff chatter. Foreign investors have been pulling money out of Indian equities, just as quarterly earnings kick off, setting the stage for the market’s next move. Traders are also bracing for volatile swings linked to derivatives positions. 2

Selling pressure hit across the board, dragging every sector index into the red. The India VIX, which measures volatility through options pricing, climbed close to its highest level in two months. Meanwhile, the rupee slipped toward the 91-per-dollar mark in early trading.

Foreign institutional investors, the overseas funds that frequently fuel major daily moves, offloaded 3,262.82 crore rupees worth of equities on Monday, pushing their net outflows deeper this month. The rupee dropped 8 paise to 90.98 per dollar, weighed down by importer demand and continued foreign selling.

Overseas signals offered little relief. Japan’s Nikkei, Hong Kong’s Hang Seng, and China’s Shanghai Composite all slipped, even as South Korea’s Kospi edged up. Wall Street futures dropped over 1% after U.S. President Donald Trump revived tariff threats.

“U.S. stock futures slipped following President Donald Trump’s threat to impose new tariffs on NATO allies,” said Devarsh Vakil, head of prime research at HDFC Securities, highlighting growing geopolitical tensions just before major corporate earnings reports.

VK Vijayakumar, chief investment strategist at Geojit Investments, warned that “volatility is likely to persist in the near term” until the U.S.-Europe tariff dispute—tied in reports to Greenland—clears up. He added that geopolitics and “geoeconomic issues” have returned to the forefront.

Earnings offered little relief. Wipro’s cautious near-term outlook dragged sentiment in IT, making the sector index one of the top losers. ITC Hotels reported a 9.3% jump in consolidated profit to 235 crore rupees on revenues of 1,231 crore rupees, yet the wider risk-off mood kept focus fixed on the index’s decline.

Pressure mounted elsewhere. Brent crude inched higher to $64.01 a barrel, a level that often stokes inflation fears in an oil-importing nation. PSU banks dropped over 1%, with Central Bank of India and Punjab & Sind Bank leading the declines.

Tuesday’s Nifty weekly expiry added to the volatility, with index derivatives contracts rolling off. That unwind often intensifies intraday swings, even in the absence of strong news.

Anand James, chief market strategist at Geojit Investments, pointed to the Nifty’s bounce after hitting the lower Bollinger Band as “encouraging.” Bollinger Bands outline a usual trading range, but James warned that if the index slips below 25,550, it could limit any short-term upside.

The downside scenario is straightforward. Investors are bracing for a possible U.S. Supreme Court verdict on Trump-era tariffs. Vijayakumar warned that a negative ruling could hit markets hard, though the timing and outcome remain uncertain. Should foreign selling persist and tariff news intensify, expect the rupee and volatility to deteriorate sharply before the close.

Monday’s trading set a clear tone. The Sensex dropped 324.17 points, closing at 83,246.18, while the Nifty lost 108.85 points to finish at 25,585.50. Wipro tumbled 8.21%, Reliance Industries slipped 3.07%, but InterGlobe Aviation (IndiGo) climbed 4.16%, and Tech Mahindra added 2.39%. Exchange data showed foreign institutional investors offloaded 4,346.13 crore rupees on Friday, with domestic institutions snapping up 3,935.31 crore rupees. 3

Traders are focused on two main factors for the remainder of the day: upcoming earnings reports and any shifts in foreign investment flows. Tariff news and the rupee’s movement remain in play, while expiry-related volatility could churn up the final hour.