New York, Jan 20, 2026, 06:25 (EST) — Premarket

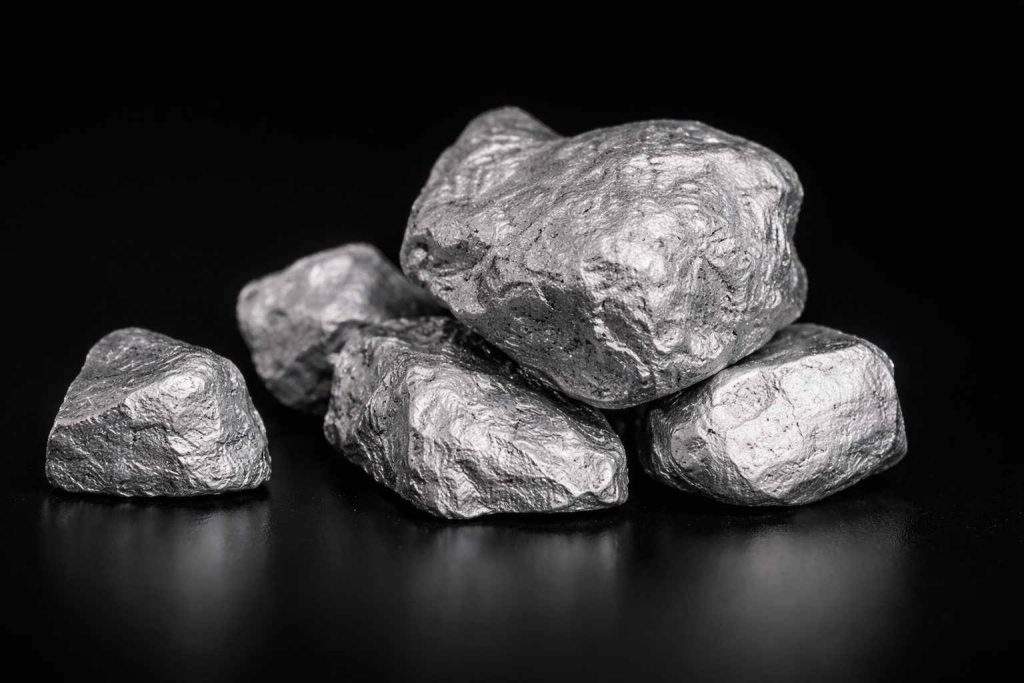

Gold prices blasted through $4,700 an ounce on Tuesday, hitting fresh highs as investors flocked to the safe haven. Spot gold gained 1.3% to $4,727.99 per ounce by 0910 GMT, after briefly touching $4,731.34. U.S. gold futures surged 3% to $4,734.10. Silver edged up 0.7% to $95.34, just below its record $95.488. “Tariff threats and the push for lower U.S. rates are pushing gold to fresh highs,” said UBS analyst Giovanni Staunovo. The metal has jumped 9.5% in the first 20 days of 2026 and climbed more than 70% since Trump’s second term began. 1

The move comes after Trump threatened new import tariffs on Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland, and Britain unless the U.S. secures Greenland. Tariffs start at 10% on Feb. 1 and jump to 25% by June 1 if no deal is reached. With U.S. cash equity markets closed Monday for Martin Luther King Jr. Day, initial reactions played out in futures and overseas trading; gold jumped to $4,689 and silver hit $94.08 amid the rush. “There is obviously a response in financial markets to the new tariff threats,” said George Lagarias, chief economist at Forvis Mazars. 2

European stocks edged lower again early Tuesday, while the dollar fell for a second straight day and U.S. Treasury yields hit a four-month high amid rising fears of a new U.S.-Europe trade clash. The dollar index dropped 0.6% to 98.485, with the euro pushing up 0.7% to $1.1726. EU leaders are preparing for an emergency summit in Brussels on Thursday to consider possible retaliation, including a paused 93-billion-euro tariff plan. “For the moment it remains relatively contained, there is no panic,” said Amelie Derambure, senior multi-asset portfolio manager at Amundi. 3

Gold serves as a “safe-haven” asset, drawing investors during times of political or market unrest. Because it doesn’t pay interest, it gains appeal particularly when expectations for falling interest rates push returns on cash and bonds down.

Investors are zeroing in on Washington as the U.S. Supreme Court prepares to hear arguments Wednesday in a case tied to Trump’s attempt to remove Federal Reserve Governor Lisa Cook. Fed Chair Jerome Powell plans to be there—a rare step that’s raising alarms about potential threats to the Fed’s independence and the possible impact on future interest rate decisions. 4

Traders are rushing to hedge against early February in currencies, highlighting growing concern over the looming tariff deadline. Euro two-week implied volatility jumped close to 6%, while sterling’s hit a two-month high at 6.464%, Reuters data shows. 5

Talk of a broader “Sell America” trade has resurfaced, with some investors worried that new tariff threats could push foreign money out of U.S. assets. “A lot of people are fairly aghast … and thinking about how they hold their assets,” said Francesca Fornasari, Insight Investment’s head of currency solutions. Deutsche Bank’s George Saravelos has warned that cracks within the Western alliance might curb overseas demand for U.S. investments. Yet, analysts note the market’s response is still muted compared to the April “Liberation Day” shock, suggesting many expect some pullback. 6

Charu Chanana, chief investment strategist at Saxo, said the Greenland dispute adds complexity to pricing tariff risks since it’s driven by geopolitics rather than typical trade matters. “When tariffs are tied to geopolitics, the odds increase that they’ll be used as leverage beyond trade disputes,” she said. Analysts at ANZ and Mizuho also highlighted a growing political risk premium in the dollar as Europe debates its response. 7

With U.S. markets set to open in just a few hours, gold traders are watching closely to see if the rally holds as Treasury trading picks back up and risk assets find their footing.

Gold’s recent surge has been steep and might unwind quickly once the headlines lose steam. Prices could slip if Washington backs off on tariff threats or if climbing bond yields raise the opportunity cost of keeping bullion.

Up next: the U.S. cash open, Wednesday’s Supreme Court hearing, and emergency EU talks set for Thursday. The Feb. 1 tariff deadline is still the main focus. Watch for the dollar and bond yields to lead the reaction to any sign of a deal—or a breakdown—before gold shifts.