New York, Jan 25, 2026, 12:55 EST — Market closed

- Quantum computing stocks plunged on Friday, with D-Wave and Rigetti taking the biggest hits.

- This week is packed with key events: the Fed’s January meeting and a slew of major earnings reports are on deck.

- January saw company-specific moves like Rigetti landing an order in India, D-Wave striking a deal with Quantum Circuits, and QCi making a play for Luminar.

U.S.-listed quantum computing stocks closed down on Friday, underscoring the sector’s continued high volatility despite steadier performance in broader indexes.

This weighs in before Monday’s open, with traders bracing for a week loaded with macro and headline risks. Small caps in the sector tend to react more to sentiment shifts than to the latest quarterly results.

Investors face a packed earnings schedule alongside the Federal Reserve’s Jan. 27-28 meeting, where bets lean toward steady rates. The key will be how the Fed discusses inflation and signals its next rate cut. “At the end of the day, earnings are the driver,” said Franklin Templeton senior market strategist Chris Galipeau, speaking to Reuters. 1

On Friday, D-Wave Quantum dropped 6.5% to $25.63. Rigetti Computing declined 5.9%, ending at $23.45. IonQ pulled back 4.3% to $47.25, and Quantum Computing Inc slipped 4.4% to $11.46, according to last reported trades.

Friday saw the Dow dip 0.6%, while the Nasdaq edged up 0.3% and the S&P 500 barely moved. The Russell 2000, a gauge for small caps, slid 1.8%—a hit that often weighs on cash-burning, barely profitable tech stocks. 2

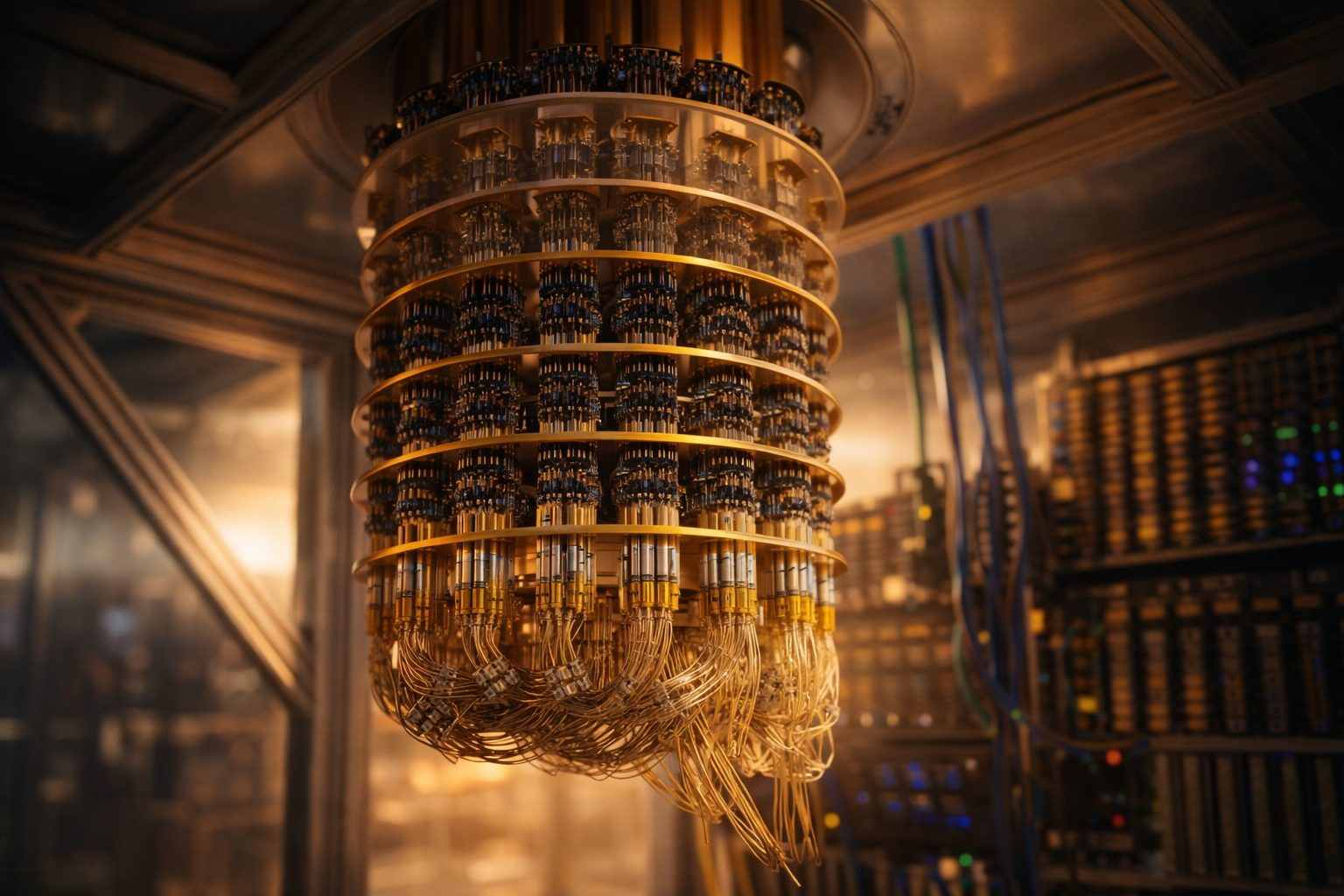

Rigetti’s January results hinge on customer updates and delivery schedules. The company announced an $8.4 million order to supply a 108-qubit on-premises quantum computer to India’s Centre for Development of Advanced Computing, with installation expected in the latter half of 2026. “We are honored that C-DAC has recognized the value of Rigetti’s quantum computing technology,” CEO Subodh Kulkarni said. 3

A recent filing revealed that Rigetti has delayed the “general availability” of its 108-qubit Cepheus system to roughly the end of Q1 2026. The company also reported hitting a median two-qubit gate fidelity of 99% on that 108-qubit machine. Fidelity, in this context, measures how frequently a quantum operation executes correctly. 4

D-Wave is pushing a two-pronged strategy. This month, it wrapped up its acquisition of Quantum Circuits, aiming to accelerate development of a gate-model quantum system—the more versatile type—while continuing to advance its annealing machines focused on optimization tasks. CEO Alan Baratz called the Quantum Circuits deal “a watershed moment.” The company also directed investors to its Qubits 2026 conference, set for Jan. 27-28 in Boca Raton, where it plans to unveil an updated roadmap. 5

IonQ is pushing further into international markets and emphasizing security. The company announced it has sealed a deal to supply a 100-qubit IonQ Tempo system to South Korea’s KISTI, which will be integrated into the nation’s largest high-performance computing cluster. This setup will allow researchers to access the quantum system via a secure private cloud. “This is a defining moment for both IonQ and South Korea,” said CEO Niccolo de Masi. 6

Quantum Computing Inc., known for its work in quantum optics and photonics, has entered deal talks. The company announced it’s the “stalking horse” bidder—setting the minimum price—in a bankruptcy auction for selected assets from Luminar Technologies. The initial bid stands at roughly $22 million, with a potential closing in the first quarter, pending court approval. CEO Yuping Huang described the move as a sign of “our conviction in the strategic fit of these assets.” 7

The downside is straightforward. Contracts often take a while to convert into revenue, product roadmaps get delayed, and deal terms can shift — particularly when auctions and court approvals come into play. For a group that moves on sentiment, a hawkish Fed or a negative response to big-tech earnings can quickly drag valuations down.

Traders are gearing up for the Fed’s policy decision due Wednesday, Jan. 28, with close attention on any guidance about future rates. The schedule is notably crowded this week: the Fed meeting spans Jan. 27-28—the exact days D-Wave plans to hold its Qubits user conference. 8