New York, Jan 25, 2026, 13:01 (ET) — Market closed.

- Wholesale power prices surged in the U.S. data center hub after a winter storm pushed demand sharply upward.

- Shares tied to data centers closed Friday with a mixed performance, just ahead of the Fed’s announcement and a packed week of Big Tech earnings reports.

- Investors are now focused on whether AI spending will boost profits, rather than just inflate power costs.

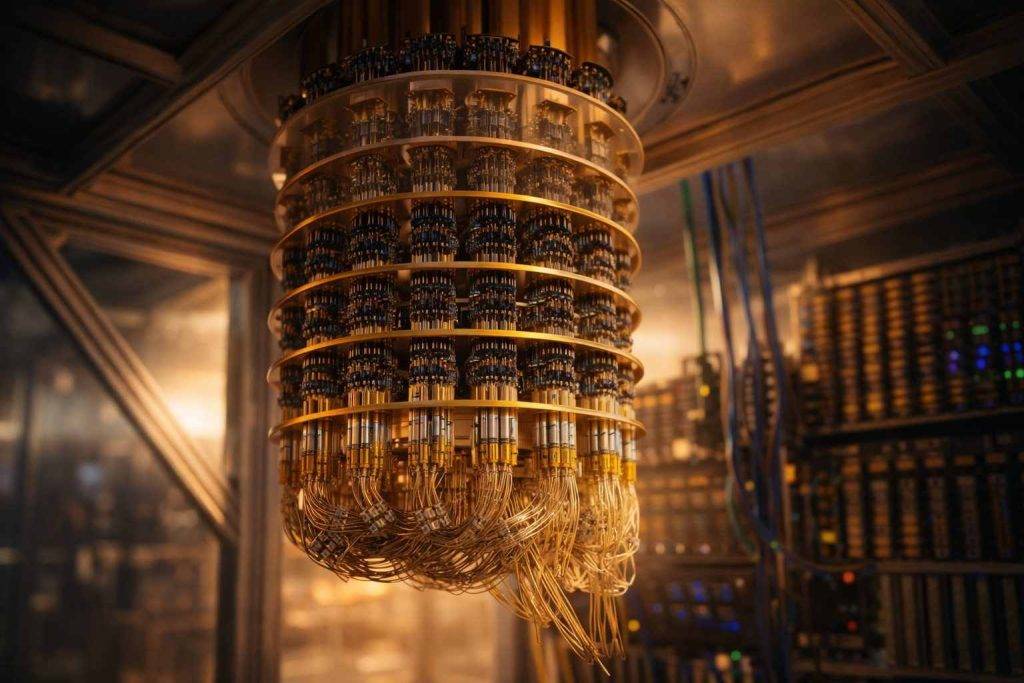

Real-time wholesale electricity prices in Dominion Energy’s Virginia service area surged past $1,800 per megawatt-hour early Sunday, pushed by Winter Storm Fern and demand that outstripped forecasts in the nation’s busiest data-center hub. That’s up from roughly $200 just a day before. PJM Interconnection expects winter demand to hit a peak of 147.2 gigawatts on Tuesday, breaking the previous January 2025 record of 143.7 GW. Data from PJM showed Dominion’s load running about 5% higher than forecast Sunday morning. 1

Data center stocks face a stark reality: electricity limits growth. When the grid strains or energy prices jump, expanding capacity stalls and margins come under pressure—even if demand for artificial intelligence (AI) computing remains robust.

The timing is tricky. The Federal Reserve is set to keep rates unchanged on Wednesday, even as roughly 20% of the S&P 500, including heavyweights Apple, Microsoft, Meta, and Tesla, report earnings. With the index trading above 22 times forward earnings, Chris Galipeau, senior market strategist at Franklin Templeton, warned, “the earnings bar had better be met.” Meanwhile, PNC’s Yung-Yu Ma noted investors want reassurance that the story isn’t “just a story of building and infrastructure.” 2

Equinix ended Friday at $791.27, slipping roughly 0.1%. Digital Realty nudged up 0.3% to $159.16. Vertiv advanced 0.8%, closing at $182.49. Nvidia, the chip sector leader, climbed 1.5%, while Broadcom dropped 1.7%.

Friday’s session delivered a stark warning for the AI supply chain. Intel plunged 17% after forecasting revenue and profit that missed estimates, citing difficulty meeting demand for server chips powering AI data centers. “We’re feeling pretty good, but mindful we might have some significant twists and turns,” said Jason Blackwell, chief investment strategist at Focus Partners Wealth. Julian McManus, a portfolio manager on Janus Henderson’s Global Alpha Equity team, added, “Going into results, we’re going to be in a show-me period.” 3

The impact varies within the group. Data center landlords like Equinix and Digital Realty, both real estate investment trusts, often see their shares behave like “bond proxies,” shifting with interest-rate moves. Suppliers like Vertiv depend heavily on build cycles — demand for power gear and cooling can surge quickly, then pause if projects get delayed.

A downside scenario isn’t difficult to outline. If volatile power prices, stricter interconnection rules, or local opposition delay new hookups, demand could remain strong but revenue timing would shift. Plus, if rates remain elevated for an extended period, higher funding costs and weaker valuations could take their toll independently.

The next clues arrive fast: PJM’s expected demand peak Tuesday, followed by the Fed’s decision Wednesday. Then traders will dig into earnings calls, hunting for shifts in AI capex talk—and signs that the data center surge is starting to boost profits.