New York, Feb 7, 2026, 12:51 EST — Market closed.

- Space and defense stocks climbed Friday, with sector ETFs and major U.S. primes leading the way.

- Focus swings to a Pentagon list that might restrict buybacks and dividends for contractors missing performance targets.

- Traders want to see just how broadly this net gets thrown, and if the policy actually holds up.

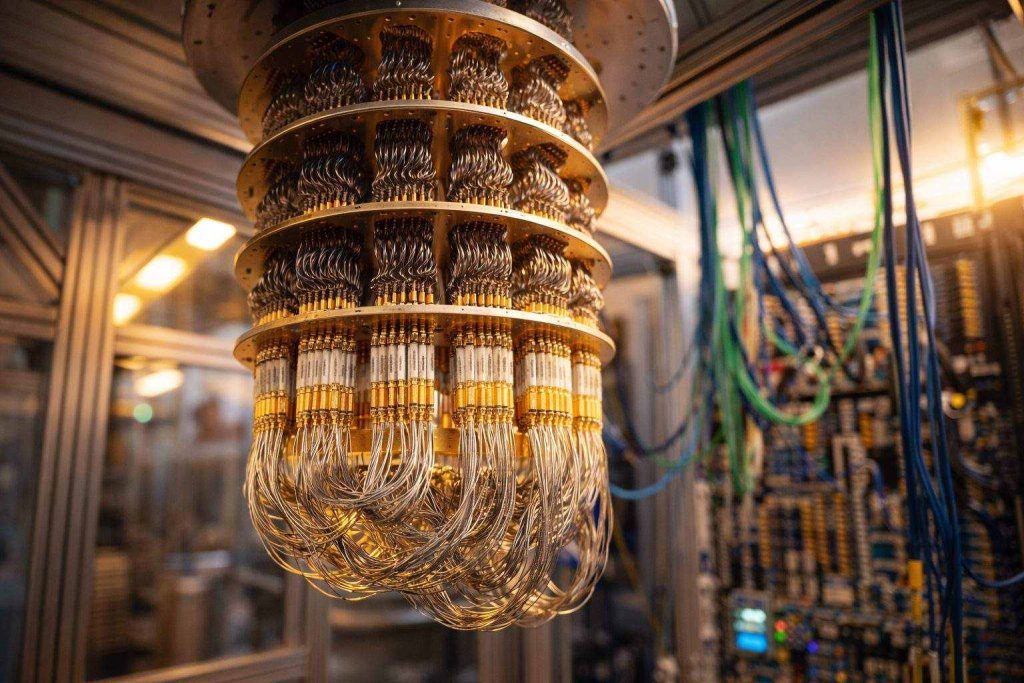

Space and defense names trading in the U.S. finished in the green Friday. The market’s focus, though, has shifted—earnings aren’t the spark this time, nor is fresh demand for missiles. Instead, investors are eyeing an upcoming Pentagon list that threatens to restrict buybacks and dividends for contractors failing to meet delivery targets.

Why it matters now: Buybacks and dividends have long underpinned the bull case for legacy defense stocks, offering steady payouts to shareholders. But with Washington signaling a tougher stance, what’s usually a reliable income play could quickly shift into headline risk territory—at least for the next few sessions.

The iShares U.S. Aerospace & Defense ETF climbed 3.5% Friday. SPDR S&P Aerospace & Defense ETF posted a stronger move, up 4.8%, while Invesco Aerospace & Defense ETF ticked 3.3% higher. Lockheed Martin finished 2.4% ahead; Northrop Grumman put on 1.8%, and RTX added 1.4%. General Dynamics pushed 2.3% higher, L3Harris closed up 2.1%. GE Aerospace surged 4.7%. On the space side, Planet Labs and AST SpaceMobile each rallied roughly 9%. Iridium picked up about 4.5%.

The Pentagon’s working on a list of defense contractors that might soon see curbs on share buybacks and dividends, following President Donald Trump’s January 7 executive order. The move links future payouts to how well companies stick to contract terms and delivery deadlines. Pentagon spokesperson Sean Parnell said the review is taking longer than expected and signaled the department won’t hesitate to enforce the rules if progress lags. Once named, firms would get 15 days to turn in remediation plans signed off by their boards. The order also tells the SEC to weigh restrictions on some repurchase-related protections. 1

Some investors and financial advisers warn the policy could squeeze shareholder returns and muddy executive incentives. David Sowerby, managing director at Ancora Advisors, described the move as “three-quarters of a step back” in capital allocation, criticizing what he sees as micromanagement. Charles Lieberman, chief investment officer at Advisors Capital Management, pushed back as well, saying “cash flow is not a constraint” and that capacity depends on demand, not payouts. Consultant Richard Aboulafia added that tighter dividends might turn sentiment in favor of “the new guys.” RTX CEO Christopher Calio, meanwhile, maintains the company isn’t wavering on its dividend. 2

Lockheed’s board on Friday cleared a $3.45 per-share dividend for the first quarter of 2026, set for payment on March 27 to holders registered by March 2. 3