New York, February 8, 2026, 13:45 EST — The market is closed.

- The Communication Services Select Sector SPDR ETF (XLC) slid 0.4% Friday, weighed down by declines in Alphabet and Meta.

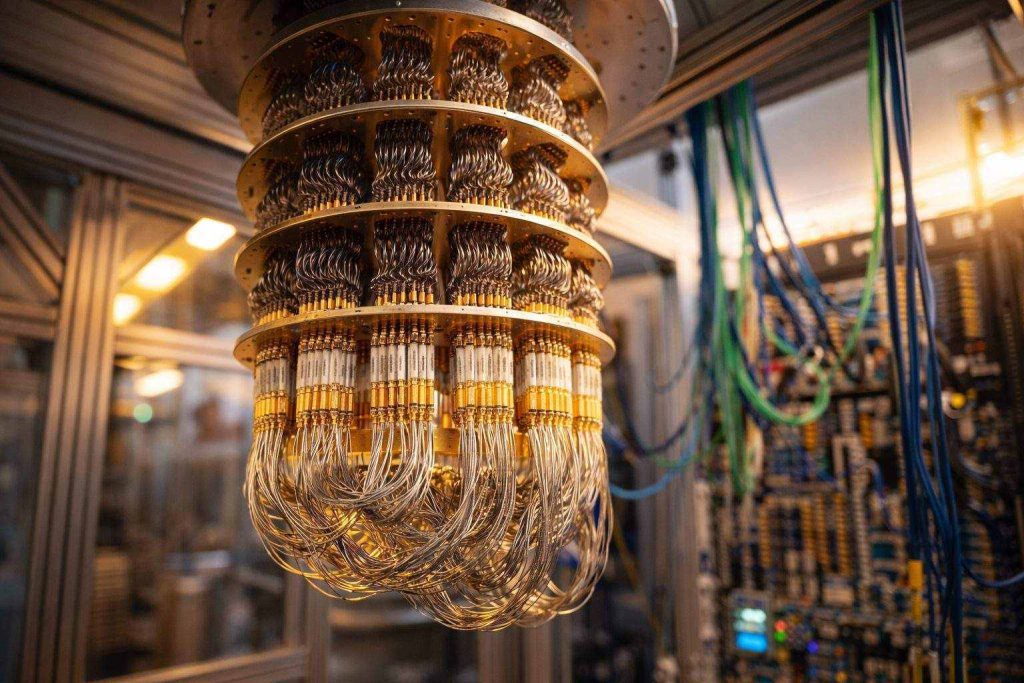

- Big Tech’s latest capital-spending moves around artificial intelligence are giving investors plenty to digest. (Reuters)

- Key events on the radar: U.S. retail sales land Tuesday, followed by January jobs data Wednesday, and CPI inflation figures dropping Friday. T-Mobile is set to report results midweek. (Investopedia)

The Communication Services Select Sector SPDR ETF (XLC) slipped 0.39% to $115.76 on Friday—out of step with a broad market rebound. Alphabet lost 2.5%, Meta dropped 1.3%. Both weighed on the sector, where online ad and platform heavyweights set the tone.

That shift is catching up with investors, who have stopped applauding “spend more” stories and now want to see what those dollars deliver. Major AI spending sprees are forcing companies to show some capital restraint—especially with mega-cap valuations stretched thin and little margin for error. (Reuters)

Communication services has moved way beyond just streaming or monthly phone bills. Meta and Alphabet now dominate XLC’s holdings, with telecom heavyweights like Verizon and AT&T, plus media players Disney and Netflix all making the top ranks. That leaves the fund exposed to fluctuations in advertising spend and the broader investment swings of Big Tech. (State Street Global Advisors)

Friday, Disney popped 3.5% and Netflix tacked on 1.6%. On the other side, telecom names lagged—T-Mobile sank 2.2%, Verizon slipped 1.7%, and AT&T edged down 0.7%.

Stocks rallied across the board, with the S&P 500 up 2.0% and the Nasdaq tacking on 2.2% Friday. Chipmakers surged—optimism over AI-driven data-center demand eclipsed pullbacks in some giant tech names. (Reuters)

Capex is the sticking point — that’s the money firms pour into assets built to last, like data centers or racks of servers. Amazon turned up the heat with its $200 billion plan for 2026. MoffettNathanson put it bluntly: “the magnitude of the spend is materially greater than consensus expected.” (Reuters)

Some investors see the AI play narrowing, with winners and losers splitting off. “This divergence is not a vote against AI,” Saxo’s chief investment strategist Charu Chanana wrote, noting markets are drawing clearer lines between enablers and those at risk. Mark Hawtin at Liontrust didn’t mince words: “The market is no longer tolerating spending for spending’s sake.” (Reuters)

Some of that wariness is cropping up in the way investors discuss both pricing and risk. “De-risking trade,” is how SanJac Alpha CIO Andrew Wells put it, arguing that the market has already “pulled forward” several years’ worth of anticipated AI revenue—yet hasn’t fully accounted for the possible pitfalls. (Reuters)

Executives are in reassurance mode. Nvidia’s Jensen Huang told CNBC the increased spending looked “appropriate and sustainable,” despite investors worrying about whether returns will actually match up with all this new infrastructure. (Reuters)

Still, the downside is hard to miss: when revenue trails the higher cost structure, top sector names may see their valuations shift fast. “The margin of error is shrinking,” MoffettNathanson analysts cautioned. Misses—whether in ad spend or cloud—hit harder these days, with the market watching every budget line. (Reuters)

U.S. markets open again Monday, and traders are bracing for a packed week: retail sales figures hit Tuesday, January’s jobs numbers drop Wednesday, and Friday brings the latest CPI data. Over in corporate news, T-Mobile lines up its earnings call for Wednesday, February 11, according to the company’s investor calendar. (Investopedia)