UiPath PATH March 2027 Options Highlight Potential High-Yield Trades

February 17, 2026, 12:01 PM EST. Investors in UiPath Inc (PATH) gained access to new March 2027 options expiring in 395 days, offering enhanced time value for sellers. A notable put option at the $8 strike holds a $1.35 bid, allowing sellers to effectively buy shares at $6.65 per share, a 27% discount to current prices, with an 80% chance the option expires worthless-translating into a 15.59% annualized YieldBoost. On the call side, the $20 strike call bids at $1.47. Selling this covered call against shares priced at $10.90 could yield a near 97% return if exercised at expiration, albeit capping upside if shares rally strongly. These contracts present strategic opportunities amid PATH's current trading dynamics and time horizons.

March 2027 Options Offer YieldBoost on C3.ai Inc Stocks

February 17, 2026, 12:00 PM EST. New March 2027 options for C3.ai Inc (Symbol: AI) have entered trading, giving investors extended time horizons to seek higher premiums. One highlighted put option at the $7.50 strike, about 27% below AI's current $10.34 price, bids at $1.20, offering a 16.00% potential return if it expires worthless – a scenario with an 81% chance according to current odds. Selling this put could effectively lower the stock purchase cost to $6.30 before commissions. Meanwhile, a call option at the $20.00 strike commands a $1.26 bid, nearly doubling the stock price, returning a potential 105.61% if exercised by March 2027. Investors selling this as a covered call must be prepared to sell shares if the stock surges. These contracts provide intriguing strategies for those betting on AI's future price dynamics.

Trimble Inc (TRMB) July 17th Options Now Trading with Notable Put and Call Contracts

February 17, 2026, 11:59 AM EST. Trimble Inc (TRMB) investors gained access to new options expiring July 17, offering about 150 days until expiration. The $65 put option trades with a $3.20 bid, allowing sellers to potentially acquire shares at an effective $61.80, roughly 1% below the current $65.65 stock price. This put contract carries a 58% probability to expire worthless, yielding an estimated 4.92% return on cash committed, annualized at 11.98%, according to Stock Options Channel's YieldBoost metric. On the calls side, the $70 strike call bids at $2.75, enabling a covered call strategy with a possible 10.81% total return if shares are called away at expiration, about 7% above the current stock price. These option premiums reflect investors' consideration of TRMB's recent trading range and potential price movements ahead of expiration.

Western Digital Corp (WDC) May 15 Options Begin Trading with Attractive Premiums

February 17, 2026, 11:58 AM EST. Western Digital Corp (WDC) options for May 15 expiration started trading today, offering new opportunities for investors. The $260 put strike is 7% below current stock price with a bid of $34.20, representing a potential 13.15% return if the option expires worthless. This trade involves selling puts, committing to buy shares at a discounted price of $225.80 after premiums. The odds of the put expiring worthless stand at 64%. On the call side, the $290 strike call bid of $40.50 offers a 17.71% total return if called away. Selling covered calls at this strike caps upside but provides income. These contracts offer yields higher than near-term options due to 87 days until expiration, attracting both yield-focused and strategic investors.

Steel Dynamics April 17th Options Highlight Put at $185 and Call at $190 Strike

February 17, 2026, 11:57 AM EST. Investors in Steel Dynamics Inc. (STLD) have new April 17th options attracting attention on both put and call sides. The $185 put contract bid at $10.30 offers a potential net share cost of $174.70 if exercised, representing a 2% discount to current $188.34 stock price. There is a 57% chance this put expires worthless, netting a 5.57% return on cash commitment, annualizing to 34.47%. On the call side, the $190 strike contract bids $11.60. Selling this covered call could yield a 7.04% return if shares are called away, while the option being out-of-the-money by about 1% means potential for premium collection without loss of shares. The article emphasizes examining the trailing twelve-month price history and business fundamentals alongside options strategies.

March 4th Options Now Trading for Amazon.com Inc (AMZN)

February 17, 2026, 11:56 AM EST.Amazon.com Inc (AMZN) introduced new options contracts expiring March 4. The $195 put option allows sellers to potentially buy shares at a 2% discount to the current price, with a 62% chance the contract will expire worthless, yielding a 2.08% return on cash committed. On the call side, the $200 strike call offers sellers a way to generate income with a 3.37% return if shares are called away, but caps upside beyond that price. Both contracts are out-of-the-money relative to the current stock price around $198.60. Investors can use these options for strategic positioning depending on their view of Amazon's near-term stock movement. Tracking of option odds and returns will be updated by Stock Options Channel.

Alphabet Inc Launches March 4th Options with Attractive Put and Call Contracts

February 17, 2026, 11:55 AM EST. Alphabet Inc (GOOGL) introduced new options expiring March 4th. Highlighted contracts include a $290 put with a $5.20 bid, offering investors a potential 3% discount on shares if exercised, with a 66% chance to expire worthless and yield an annualized 43.63% return on premium collected. On the call side, the $300 strike priced at a $7.45 bid allows covered call sellers to secure a 3.02% return if shares reach the strike price. These options present strategies for investors aiming to manage entry or generate income amid Alphabet's recent trading dynamics, with detailed charts showing the strike prices relative to the last 12 months of price movement.

November 20th Options Now Available For Huron Consulting Group

February 17, 2026, 11:54 AM EST. Huron Consulting Group Inc (HURN) investors gained access to new options expiring November 20, offering extended duration premium opportunities. The $125 strike put contract currently bids at $14.20, roughly 3% out-of-the-money, with a 64% chance to expire worthless according to risk indicators, potentially yielding an 11.36% return on cash if unexercised. Meanwhile, the $135 strike call bids at $16.30, allowing sellers to generate a 17.23% total return if shares are called away, based on the current stock price near $129.06. These longer-dated contracts, with 276 days till expiration, present attractive strategies for investors seeking either to purchase HURN shares at a discount or generate income through covered calls. Market participants should weigh potential upside limitations and fundamentals in strategy selection.

New March 4th Options Trading Now Available for NVIDIA Corp (NVDA)

February 17, 2026, 11:53 AM EST.NVIDIA Corp (NVDA) options for expiration on March 4th commenced trading, featuring notable contracts at $175 put and $185 call strikes. The $175 put, trading with a $6.00 bid, offers investors a chance to buy shares effectively at $169 after premium collection, a roughly 3% discount to current prices. The likelihood of this put expiring worthless is estimated at 62%, potentially yielding a 3.43% return. On the call side, a $185 strike priced at a $6.05 bid could generate a 5.82% total return if exercised, but caps upside gains if the stock price surges. These options provide strategic trading opportunities amid NVDA's recent $180.54 share price, with analytics such as option 'Greeks' guiding investor decisions.

Disc Medicine Inc (IRON) November 20th Options Spotlight: $60 Put and $65 Call

February 17, 2026, 11:52 AM EST. Investors in Disc Medicine Inc (IRON) saw new November 20th options launch with 276 days to expiration, offering higher premiums through increased time value. The $60 put, with a $9.50 bid, allows sellers to potentially buy shares at a net $50.50, roughly 3% below current stock price of $61.61, and has a 63% chance to expire worthless. This could yield a 15.83% return on cash, annualized to 20.94%, per Stock Options Channel's YieldBoost metric. On the call side, the $65 strike has a $9.50 bid, making covered calls attractive with a possible 20.92% return if shares are called away. Both options provide strategic entry or income paths amid Disc Medicine's price history. Traders should consider company fundamentals alongside potential premium income.

SPDR Dow Jones Industrial Average ETF (DIA) Sees $1.1 Billion Inflow; GS, MSFT, AMGN Move

February 17, 2026, 11:51 AM EST. The SPDR Dow Jones Industrial Average ETF Trust (DIA) recorded a significant $1.1 billion inflow, a 2.6% increase in outstanding units week over week. This inflow indicates strong investor demand, leading to increased purchases of the ETF's underlying assets. Key components showed mixed price action: Goldman Sachs (GS) rose 0.5%, Microsoft (MSFT) slipped 1.1%, and Amgen (AMGN) gained 0.7%. DIA trades near its 52-week high of $505.30, last at $492.88, remaining above its 200-day moving average, a key technical indicator signaling trend strength. ETF unit creation reflects buying pressure on holdings, potentially influencing individual stocks within the fund. This inflow underscores ongoing investor interest in blue-chip industrial equities amid market fluctuations.

VanEck Semiconductor ETF (SMH) Sees $2 Billion Inflow Amid Mixed Performance in Top Holdings

February 17, 2026, 11:50 AM EST. The VanEck Semiconductor ETF (SMH) experienced a notable $2 billion inflow, marking a 4.6% increase in shares outstanding week over week. This growth reflects rising investor demand, resulting in the creation of new ETF units that require purchasing underlying stocks. Among SMH's largest components, NVIDIA Corp (NVDA) fell 1.2%, Taiwan Semiconductor Manufacturing Co. (TSM) dropped 1.8%, and Broadcom Inc (AVGO) declined 0.4% during today's trading. SMH's current price stands at $401.69, close to its 52-week high of $420.60 and well above its 200-day moving average-a key technical indicator for assessing trend momentum. Movements in ETF units directly influence the trading volumes of constituent stocks, underscoring the impact of strong inflows on the semiconductor sector.

IEMG Sees $1.4 Billion ETF Inflow as PDD, NU Show Mixed Trading

February 17, 2026, 11:49 AM EST. The iShares Core MSCI Emerging Markets ETF (IEMG) recorded a significant $1.4 billion inflow, marking a 1.3% week-over-week rise in outstanding units. Among key holdings, PDD Holdings Inc gained about 0.2%, Nu Holdings Ltd dipped 0.4%, and CrediCorp Ltd remained steady. IEMG's last trade price stood at $65.71, near its 52-week high of $66.445. ETF units, unlike stocks, can be created or redeemed to meet demand, influencing the buying or selling of underlying assets and affecting component stock prices. Monitoring such flows provides insight into market sentiment toward emerging markets exposure.

Lumen Technologies (LUMN) Stock Valuation Amid Turnaround and Price Surge

February 17, 2026, 11:48 AM EST. Lumen Technologies (LUMN) shares closed at $8.39, showing a 7.8% return last week and a 70.2% gain over the past year. Despite this, valuation metrics reveal tensions: a Discounted Cash Flow (DCF) model places intrinsic value at only $1.31 per share, indicating the stock trades at a 540% premium. The DCF bases this on projected future cash flows, which fluctuate significantly through 2030. Lumen's efforts to restructure its business and manage debt are in focus, contributing to mixed signals. The price-to-sales (P/S) ratio, useful when earnings are volatile, suggests some valuation complexity as revenue growth prospects factor in. Investors should weigh the stock's recent surge against fundamental valuation disparities and ongoing business transformation.

BASF Shares Rally: Is The Stock Undervalued After Recent Gains?

February 17, 2026, 11:47 AM EST. BASF (XTRA:BAS) shares have gained 13.8% over the past 30 days, closing at €50.76. Despite the rally, a Discounted Cash Flow (DCF) model estimates an intrinsic value of €96.01, implying the stock is undervalued by 47.1%. The DCF model projects free cash flow growth out to 2035, signaling potential upside. However, BASF's Price-to-Earnings (P/E) ratio stands at 144.63, sharply above the Chemicals industry average of 22.39, suggesting market expectations are unusually high. Investors are weighing cyclical risks versus rewards amid shifting industrial demand. Simply Wall St rates BASF's valuation score at 2 out of 6, indicating caution but also opportunity. The mixed signals underscore the importance of reassessing BASF's value after its recent price rally.

Euronext Dublin Issues Notice to GOLDENTREE LOAN MANAGEMENT EUR CLO 4 DAC Noteholders

February 17, 2026, 11:46 AM EST. Euronext Dublin has issued an official notice to noteholders of GOLDENTREE LOAN MANAGEMENT EUR CLO 4 DAC. The update involves key information pertinent to holders of collateralized loan obligations (CLOs), a type of structured credit product. This notice follows regulatory standards to ensure transparency and proper communication within debt markets. Data backing this notice derive from multiple providers, including ICE Data Services and FactSet, highlighting the interconnected nature of market information sources. Investors in structured credit should review the notice carefully to understand implications for their holdings.

BMH.AX Baumart Sees Pre-Market Volume Surge Ahead of Earnings

February 17, 2026, 11:45 AM EST. BMH.AX (Baumart Holdings Limited) recorded an unusual pre-market volume surge of 507,256 shares on 18 Feb 2026, a 27.78-fold increase over average daily volume, signaling heightened trading interest before its earnings announcement on 26 Feb. Shares held steady at A$0.007 with a market cap of A$1.14 million. The jump likely reflects anticipation of corporate news or contract updates in Baumart's Basic Materials sector operations. Despite the volume spike, fundamentals remain weak: Baumart posted a negative EPS of -0.01, a trailing P/E of -0.70, a current ratio of 0.59, and debt-to-equity of 1.33, indicating liquidity stress and leverage concerns for the micro-cap. Meyka AI assigns a neutral Hold rating (57.24/100), highlighting operational value but ongoing financial risks. Technicals show a downtrend with volatile momentum at penny-stock levels.

SpaceX Considers Dual-Class Shares to Maintain Elon Musk's Control Post-IPO

February 17, 2026, 11:43 AM EST. SpaceX is reportedly planning a dual-class share structure for its upcoming IPO, allowing founder Elon Musk to retain control over the company despite selling shares to the public. This setup, granting supervoting rights to select insiders, mimics structures used by Tesla and other tech giants, helping shield Musk from activist investors. The IPO could value SpaceX at $1.5 trillion, potentially raising over $30 billion, making it the largest market debut ever. Musk's shift to lunar industrialization and his ambitious space and AI projects may rely on this control to secure long-term strategic direction. The IPO is expected as early as mid-2026, with public shareholders likely to receive limited voting power compared to Musk's supervotes.

Doubleline Income Solutions Fund DSL Ex-Dividend on Feb 18, 2026

February 17, 2026, 11:41 AM EST. Doubleline Income Solutions Fund (DSL) will trade ex-dividend on February 18, 2026, with a monthly payout of $0.11 per share. This dividend represents approximately 0.95% of its recent stock price of $11.56, suggesting shares could open nearly 1% lower on the ex-date, all else being equal. The dividend is payable on February 27, 2026. Over the past year, DSL's share price has ranged from $10.58 to $12.92, currently trading near $11.56. The fund offers an estimated annualized yield of 11.42%, with monthly dividend payments making it a notable option for income-focused investors. Shares were up about 0.5% in recent trading.

Black Stone Minerals LP (BSM) Announces Ex-Dividend Date February 18, 2026

February 17, 2026, 11:40 AM EST. Black Stone Minerals LP (BSM) is set to trade ex-dividend on February 18, 2026, with a quarterly dividend payout of $0.30 per share scheduled for February 25, 2026. This dividend translates to a yield of approximately 1.97% based on the recent stock price of $15.20. Investors can expect the share price to adjust downward by this percentage on the ex-dividend date. BSM's annualized dividend yield stands at an estimated 7.89%, reflective of its recent payout history. The stock has traded between $11.78 and $15.52 in the past year, closing near its 52-week high at $15.11. Shares edged up 0.6% in Tuesday trading.

Gladstone Capital Corp (GLAD) Ex-Dividend Reminder for Feb 18, 2026

February 17, 2026, 11:39 AM EST. Gladstone Capital Corporation (GLAD) will trade ex-dividend on February 18, 2026, paying a monthly dividend of $0.15 per share. This dividend represents approximately 0.81% of GLAD's recent stock price of $18.54 and translates to an estimated annual yield of 9.71%. Shares are expected to open around 0.81% lower on the ex-dividend date, all else equal. GLAD's 52-week trading range is $18.48 to $29.54, with the stock last trading at $18.71. On the day noted, shares declined about 1.3%. Gladstone Capital, known for monthly dividends, remains on watch for income-focused investors seeking high-yield stocks.

DoubleLine Yield Opportunities Fund (DLY) Declares Monthly Dividend Ahead of Ex-Dividend Date

February 17, 2026, 11:38 AM EST. DoubleLine Yield Opportunities Fund (DLY) will trade ex-dividend on February 18, 2026, with a monthly dividend of $0.1167, payable on February 27. This dividend represents approximately 0.78% of DLY's recent stock price near $14.95. Dividends typically result in a share price adjustment, so DLY shares may open about 0.78% lower on the ex-dividend date. The fund's estimated annual yield is around 9.37%, reflecting steady dividend expectations. Over the past year, DLY's share price has ranged between $13.70 and $16.38, with last trade near $14.96. Investors closely watch such dividend-paying funds for income opportunities amid market fluctuations.

Gladstone Land Corp (LAND) Ex-Dividend Date Set for February 18, 2026

February 17, 2026, 11:36 AM EST. Gladstone Land Corp (NASDAQ: LAND) will trade ex-dividend on February 18, 2026, for its monthly payout of $0.0467 per share, payable on February 27. This amounts to roughly 0.42% based on the recent share price of $11.19. LAND's annualized dividend yield stands around 5.01%, reflecting the company's steady income distribution pattern. The stock's 52-week range spans $8.47 to $11.93, with the last trade near $11.34. In recent trading sessions, shares rose about 3.3%, signaling renewed investor interest. Monthly dividends like LAND's offer consistent income streams, but their sustainability depends on company performance and market conditions.

Natural Gas Services Group Ex-Dividend Reminder on Feb 18, 2026

February 17, 2026, 11:35 AM EST. Natural Gas Services Group Inc (NGS) will trade ex-dividend on February 18, 2026, distributing a quarterly dividend of $0.11 per share, payable March 4, 2026. Based on its recent stock price of $37.11, the dividend represents a yield of approximately 0.30% for the quarter and an annualized yield near 1.19%. NGS shares have traded between $16.73 and $37.70 over the past year, closing near the high. The stock was up about 2% in Tuesday trading. Investors often look at dividend history and stock performance to gauge the sustainability of payouts, with NGS's recent metrics suggesting a modest but consistent income stream.

Genie Energy Declares Quarterly Cash Dividend Ahead of Ex-Dividend Date

February 17, 2026, 11:34 AM EST. Genie Energy Ltd (GNE) will trade ex-dividend on February 18, 2026, with a quarterly cash dividend of $0.075 per share payable on February 26, 2026. The dividend represents approximately 0.51% of GNE's recent stock price of $14.60. Investors should expect shares to open roughly 0.51% lower on the ex-dividend date, all else being equal. GNE's annualized dividend yield currently stands near 2.05%, based on the recent payout. The stock has fluctuated between $13.05 and $28.47 in the past 52 weeks, closing recently at $14.63. Shares were up about 3.4% during Tuesday's trading session. Historical dividend patterns may help gauge the dividend's future sustainability, though payouts can vary.

DHT Holdings Announces Quarterly Dividend Ahead of Ex-Dividend Date

February 17, 2026, 11:33 AM EST. DHT Holdings Inc (DHT) will trade ex-dividend on August 23, 2024, offering a quarterly dividend of $0.27 per share payable on August 30. This dividend represents roughly 2.40% of DHT's recent stock price of $11.23, implying a potential price adjustment accordingly. The annualized dividend yield stands near 9.62%, reflecting strong income potential for investors. Over the past year, DHT shares have fluctuated between $8.595 and $12.80, with a current price near $11.17. On Wednesday, shares rose approximately 1.1%, indicating market interest ahead of the dividend date. Investors seeking stable dividend opportunities may find DHT's consistent payout history and current yield notable.

Alexandria Real Estate Executive Chairman Marcus Buys $1.3M in Stock

February 17, 2026, 11:32 AM EST. Joel S. Marcus, Executive Chairman of Alexandria Real Estate Equities Inc (ARE), purchased 25,000 shares valued at approximately $1.3 million at an average price of $53.92 per share on Feb. 12, 2026. The move signals confidence from top management, often viewed as an insider signal. ARE shares recently traded at $52.90, up 4.2%, and dipped as low as $51.01 on the same day, below Marcus's purchase price. The stock's 52-week range spans from $44.10 to $105.14. Alexandria Real Estate currently offers an annualized dividend of $2.88 per share, about a 5.5% yield, paid quarterly. Insider buying often indicates expectations of undervaluation or growth potential, which investors may see as a positive sign.

Dow Jones Movers: Walt Disney Gains, Caterpillar Declines in Early Trading

February 17, 2026, 11:31 AM EST. Shares of Walt Disney (DIS) rose 1.4% in early Tuesday trading, leading gains among Dow Jones Industrial Average components despite a 6% year-to-date loss. Caterpillar (CAT) fell 1.7%, marking the worst performer of the session, though the heavy equipment maker has gained 32.8% so far this year. International Business Machines (IBM) slipped 1.3%, while Travelers Companies (TRV) edged up 1.3% during the day's trading. Investors watch closely as the Dow components show mixed signals amid ongoing market volatility.

Ferguson Enterprises Inc's P/E Ratio Suggests Mixed Investor Expectations

February 17, 2026, 11:29 AM EST. Ferguson Enterprises Inc. (NYSE:FERG) stock closed at $257.38, down 1.52% in the latest session, yet up 6.08% over the last month and 41.41% annually. The company's price-to-earnings (P/E) ratio, a valuation metric comparing share price to earnings per share (EPS), stands at 26.45. This slightly exceeds the Trading Companies & Distributors industry average of 26.44. A higher P/E ratio indicates investors expect stronger future performance, though it can also signal potential overvaluation. While Ferguson's P/E suggests optimism about future growth and dividends, investors should weigh whether the recent stock price sufficiently reflects its performance outlook compared to industry peers.

Dana (DAN) Earnings Preview: Expectations and Stock Performance Ahead of Q1 2026 Report

February 17, 2026, 11:28 AM EST. Dana (NYSE:DAN) is set to report quarterly earnings on February 18, 2026, with analysts forecasting earnings per share (EPS) of $0.36. Investors are hopeful for results that exceed estimates and optimistic guidance for the next quarter, which could influence stock price movement. Dana's shares have risen sharply by over 100% in the past year, trading at $33.39 as of February 16. The company missed EPS by $0.23 last quarter, triggering a 3% decline in its share price post-announcement. Market watchers note that future outlooks often drive stock prices more than past results. Analysts' consensus ratings and price targets remain undisclosed, leaving some uncertainty ahead of the release.

Innovacell Targets $92M Tokyo IPO to End Biotech Drought

February 17, 2026, 11:27 AM EST. Japan-based cell therapy firm Innovacell plans a $92 million initial public offering (IPO) on Tokyo Stock Exchange on Feb. 24, aiming to break a recent dry spell in biotech listings. The Tokyo company will offer 8.4 million shares priced at 1,350 yen each, with additional shares available through overallotment. Innovacell's co-CEO Colin Lee Novick cited strong Nikkei market performance and late-stage trials of its regenerative medicine ICEF15 as drivers for going public. The company spun out from Austria's Medical University of Innsbruck and raised 7.3 billion yen in its August 2025 series D funding. This IPO comes amid a quiet 2025 for Japanese biotech IPOs but signals renewed investor interest in biotech commercialization after years of development risk.

Euronext Dublin Releases GEM Notice Under REG Framework

February 17, 2026, 11:26 AM EST.Euronext Dublin issued a GEM notice as part of its regulatory (REG) obligations. The update involves market and reference data sourced from ICE Data Services and FactSet. Additionally, the announcement references data rights involving FactSet Research Systems Inc., the American Bankers Association, and TradingView, Inc. This notice is significant for investors tracking the Dublin exchange, ensuring transparency and compliance with regulatory disclosure standards.

Vanguard Forecasts Bond ETF to Outperform U.S. Stocks Over Next Decade

February 17, 2026, 11:19 AM EST. Vanguard projects U.S. bonds to yield 3.8% to 4.8% annually over the next 10 years, potentially outperforming U.S. stocks, which it forecasts at 4% to 5% returns. The Vanguard Total Bond Market ETF (BND) is highlighted for providing broad exposure to over 11,000 investment-grade bonds with a very low expense ratio of 0.03%. Despite recent tech stock weaknesses, Vanguard warns of increased risk in AI-driven equities and recommends diversification, especially into high-quality bonds. Historically, bonds have rarely outpaced stocks long-term, but current conditions may favour bonds for investors seeking steady income and risk mitigation.

Wedbush Lowers Disc Medicine (NASDAQ:IRON) Price Target to $88

February 17, 2026, 11:17 AM EST. Investment firm Wedbush cut its price target for Disc Medicine (NASDAQ:IRON) to $88 from $110, signaling a pessimistic forecast despite maintaining an 'outperform' rating. The new target implies a potential 47% upside. Contrasting views from other analysts include Morgan Stanley's $120 target and Weiss Ratings' 'sell' rating. Disc Medicine's stock currently trades around $59.83, with a market cap of $2.26 billion. Insider selling is notable; CEO John D. Quisel and Director Kevin Bitterman recently sold significant shares, reducing their holdings substantially. The stock shows a 52-week range between $30.82 and $99.50, with a moderate buy consensus overall. Wedbush's revision underscores growing caution amid mixed analyst sentiment regarding the firm's outlook.

S&P 500 ETF Dips as Analysts Eye NVIDIA Earnings Boost

February 17, 2026, 11:16 AM EST.S&P 500 faced pressure with the SPDR S&P 500 ETF (SPY) dropping 0.23%. Tech stocks like NVIDIA (NVDA) fell 0.74% ahead of earnings on Feb. 25. Despite recent declines, Citi affirmed a buy on NVIDIA, citing an attractive valuation and expected outperformance in the second half of 2026. Baird initiated an outperform rating on AI player Tempus (TEM), pointing to its underpenetrated market. Bank of America upgraded lithium producer Albemarle (ALB) to buy amid rising lithium prices. JPMorgan analysts highlighted conflicting fears around AI's impact on software firms, suggesting these dynamics are influencing tech sell-offs. NVIDIA's upcoming earnings will likely set the tone, with high demand noted for its new data center products and increased AI spending from hyperscalers supporting the sector outlook.

IOV.AX Ion Video Ltd Falls 18.99% Pre-Market on ASX, Tests Support at A$0.32

February 17, 2026, 11:11 AM EST. IOV.AX shares of Ion Video Ltd fell sharply by 18.99% in pre-market trade to A$0.32 on the ASX on February 18, 2026. The small-cap technology stock opened at A$0.40 but slipped, amid broader weakness in the Technology sector showing year-to-date losses of -8.48%. Trading volume was near average, reflecting typical liquidity rather than panic selling. Negative earnings per share and a trailing price-to-earnings ratio of -4.62 underpin the pressure on the stock. Technical indicators suggest the stock is testing critical support at A$0.32, with risk of further decline if this level breaches. Meyka AI rates the stock a B grade with a hold suggestion. Model forecasts show significant upside potential but come with typical risks of volatility and thin liquidity in small-cap tech.

JPMorgan Identifies Stocks Insulated from AI-Driven Market Sell-Off

February 17, 2026, 11:09 AM EST. The stock market faces waves of AI-driven sector sell-offs. Software, financials, office real estate, and trucking stocks have taken significant hits amid fears AI will reduce demand. Goldman Sachs described last week as playing 'AI Whac-a-Mole' in equities. However, JPMorgan released a list of 'mispriced' stocks showing resilience against AI disruption. Affirm and Carvana stand out despite recent price drops. Affirm shows strong growth in gross merchandise value and improving operating margins. Carvana's integrated infrastructure offers a moat against AI impact. Other resilient names include Roku, Spotify Technology, and CrowdStrike. JPMorgan's analysis provides investors options to navigate the volatile AI influence on markets.

Gemini Crypto Exchange Sees Departures After IPO and Market Downturn

February 17, 2026, 11:08 AM EST. Gemini Space Station Inc., founded by Cameron and Tyler Winklevoss, announced the immediate departure of three top executives, including COO Marshall Beard, CFO Dan Chen, and Chief Legal Officer Tyler Meade. This leadership shakeup follows earlier layoffs of up to 25% of its workforce and a strategic retreat from the UK, EU, and Australia. Gemini, which went public in September 2023 just before Bitcoin's significant price drop, has seen its shares plunge from a high of $45.89 to $6.50. The move echoes a broader crypto market contraction following Bitcoin's fall of over 40% since October. The Winklevosses plan no immediate COO replacement, with President Cameron Winklevoss taking on more duties amid ongoing industry challenges.

Lean Hog Futures Post-Holiday Movement as USDA Reports Mixed Data

February 17, 2026, 11:05 AM EST. Lean hog futures returned to trading after the President's Day holiday with Friday's session closing mostly lower, except for the expiring February contract which gained 20 cents. Open interest fell by 3,791 contracts, signaling ongoing long liquidation. USDA's national base hog price slightly increased to $85.24, while the CME Lean Hog Index rose 37 cents to $86.89 on Feb. 11. Pork carcass cutout values improved by $1.69, boosted by rising primal cuts, but slaughter numbers dipped by 24,000 from last week. CFTC data showed managed money increasing net long positions by 4,424 contracts, highlighting varied market sentiment ahead. April and May contracts declined, reflecting trader caution amid mixed supply and demand signals.

Lean Hog Futures Drop as USDA Reports Lower Prices and Slaughter Numbers

February 17, 2026, 11:04 AM EST. Lean hog futures extended losses Friday, with most contracts declining 50 to 75 cents, except February rising 20 cents. April contracts fell $6.67 for the week. The USDA reported a national base hog price of $85.22, down $1.73 from Thursday. The CME Lean Hog Index rose 37 cents to $86.89 on Feb 11. Pork carcass cutout values dropped 49 cents to $95.16 per hundredweight. Ham prices were the only primal cut to increase. Federally inspected hog slaughter estimates fell to 2.497 million head, down 88,000 from last week and 24,237 below last year. Managed money net long positions rose by 4,424 contracts to 133,281, reflecting market positioning ahead of the President's Day holiday and further volatility in hog futures trading.

Soybeans Slip Tuesday Amid Mixed Futures and Export Data

February 17, 2026, 11:03 AM EST. Soybeans declined 2 to 4 cents in early Tuesday trading following a week of varied futures movements. March soybean futures closed last week up 17 ¾ cents, while open interest increased by 6,846 contracts. The national average cash price dropped 4 ¼ cents to $10.67 ¼. Soymeal futures rose by up to $1.30, and soy oil futures fell 40 to 47 points. Managed money positions surged by 94,316 contracts as of February 10, reaching a net long of 123,148 contracts, according to CFTC data. USDA reports soybean export sales down 20% year-over-year, hitting 81% of projections, lagging the 5-year average. Brazilian harvest is behind pace at 21% completed. Market watchers await NOPA data on January crush and soybean oil stocks on Tuesday.

Wheat Prices Fall on Tuesday Led by Chicago SRW Futures

February 17, 2026, 11:02 AM EST.Wheat prices slipped across key U.S. markets on Tuesday, with Chicago SRW futures leading losses. Despite gains last week, March contracts fell 3.75 to 11.5 cents. Managed money increased net short positions in Chicago and Kansas City wheat futures, signaling bearish sentiment. USDA export sales showed a 16% rise year-over-year, with South Korea buying 50,000 MT of U.S. wheat. Meanwhile, French crop conditions remain strong, estimated 91% good/excellent. Russia's 2026 wheat crop forecast rose to 91 million metric tons. Market watchers note active carnivals in speculative bets and open interest shifts amid fluctuating global supply indicators.

Cotton Prices Slide Amid Lower Export Sales and Increased Stock Levels

February 17, 2026, 11:01 AM EST. Cotton futures fell Tuesday morning, down 17 to 36 points following Friday's 15-20 point losses despite March contracts gaining 105 points for the week. USDA reported cotton export commitments at 8.034 million running bales (RB), 12% below last year and only 71% of USDA's revised export target, signaling weaker demand. Speculative net short positions increased by 3,856 contracts to 75,602 as of Feb. 10, according to Commodity Futures Trading Commission data. Certified cotton stocks on ICE rose by 3,808 bales to 106,040. The Cotlook A Index, an indicator of cotton prices, rose 25 points to 73.55 cents per pound last Thursday. Meanwhile, crude oil prices edged down 3 cents, and the U.S. dollar index declined slightly to 96.770, adding pressure to commodity markets overall.

Live Cattle Futures Resume Mixed Trade After Monday Holiday

February 17, 2026, 11:00 AM EST. Live cattle futures resumed trading Tuesday at 8:30 am CST after Monday's holiday, showing mixed results. February contracts rose 57 cents Friday and closed $5.32 higher for the week, buoyed by cash trade settling at $244-$245 in the North and up to $248 in the South. Feeder cattle futures mostly slipped, with March down $1.27 for the week despite a 42-cent gain Friday. The CME Feeder Cattle Index ticked up 4 cents to $373.91 on February 12. Managed money reduced net long positions in live cattle by 5,897 contracts and feeder cattle by 273 contracts. USDA reported Monday's cattle slaughter at 87,000 head, above last week but below last year. Wholesale boxed beef prices were mixed, with Choice boxes down $3.30 and Select boxes down $2.19.

Corn Prices Slip as Market Resumes After Long Weekend

February 17, 2026, 10:59 AM EST. Corn futures fell by 2 to 3 ½ cents on Tuesday after modest gains on Friday. March contracts closed the week up 1 ½ cents, with open interest increasing by 5,808 contracts. Managed money speculators reduced their net short positions by 20,576 contracts as of February 10, now holding a net short of 48,210 contracts. USDA export sales report shows corn commitments at 60.805 million metric tons (MMT), 31% higher than last year, matching the average pace toward the USDA's yearly export forecast. Brazil's first corn crop harvesting lagged behind last year's pace at 22% complete, while second crop planting stood at 31%, below 2025 levels. Nearby cash corn price edged up to $3.98 1/4, though futures later retreated.

Euronext Dublin Issues Notice to Noteholders on Security 635400OAHAFDXP9HQR46

February 17, 2026, 10:45 AM EST. Euronext Dublin has issued a notice to noteholders concerning the security with identifier 635400OAHAFDXP9HQR46. The notice, referenced in document 88690, relates to developments impacting holders of these notes on the exchange. Market and reference data underpinning this disclosure are provided by ICE Data Services and FactSet, with additional securities information accessible through the CUSIP database and SEC filings. These resources offer investors updated and reliable information for informed decision-making.

Israeli AI Drone Startup XTEND to Hit Nasdaq at $1.5 Billion Valuation via Merger

February 17, 2026, 10:44 AM EST. Israeli autonomous drone system developer XTEND will enter Nasdaq through an all-stock merger with New York-listed JFB, valuing the combined entity at $1.5 billion. The deal includes a $152 million strategic investment from notable backers such as Eric Trump and Protego Ventures. Post-merger, XTEND shareholders will control 70% of the new company, to be named XTEND AI Robotics, trading under the ticker XTND. The transaction, expected to close by mid-2026, aims to boost U.S. domestic manufacturing in Tampa and speed deliveries to customers in the U.S., NATO, and Asia. XTEND leverages its XOS operating system for multi-drone management in defense and security, targeting a growing market for unmanned and remote-operated systems amid rising global security concerns.

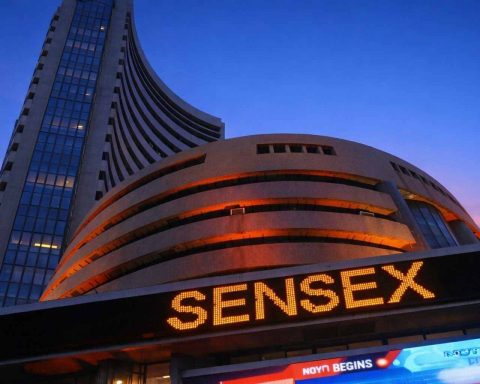

Indian Markets Rally as Sensex Gains 650 Points on Power and Banking Demand

February 17, 2026, 10:43 AM EST. Indian stocks rebounded sharply on Monday with the BSE Sensex climbing 650.39 points (0.79%) to 83,277.15, led by strong demand in power and banking sectors. The NSE Nifty also advanced 211.65 points (0.83%) to 25,682.75. PowerGrid surged 4.45%, while major banks like HDFC Bank and Axis Bank buoyed the rally. The rupee's stability and steady crude prices amid US-Iran talks supported investor confidence. Market capitalization rose by Rs 311,982.13 crore to Rs 4.69 quadrillion (USD 5.17 trillion). PSU bank stocks gained after increased mutual fund allocations. Sectoral gains included Power (up 2.40%) and Utilities (up 2.15%), while consumer discretionary and auto sectors lagged. Asian markets showed mixed performance. Analysts cite fragile sentiment due to weakness in technology stocks yet overall positive momentum in heavyweight sectors.

Wall Street Steadies as US Stocks Show Mixed Trading Post AI-Driven Volatility

February 17, 2026, 10:42 AM EST. U.S. stocks opened mixed Tuesday following a quiet holiday weekend, with the S&P 500 nearly flat, the Dow up slightly, and the Nasdaq down 0.1%. General Mills shares dropped 5.4% after lowering its 2026 profit forecast amid weakening consumer confidence amid inflation concerns and tariff worries. Genuine Parts stock slid 10.9% after reporting weaker-than-expected quarterly results and announcing a 2027 split into two firms focusing on auto and industrial parts. Market losses were limited by a 2.8% rise in Warner Bros. Discovery amid a bidding war with Netflix and Paramount. Big Tech losses were moderate, with Tesla down 1.4% and Microsoft down 0.5%. Treasury yields remained steady, with the 10-year yield at 4.05%, reflecting calmer market conditions after last week's sharp AI-related sell-offs.

Royal Gold Earnings Preview: What Investors Expect Ahead of Q4 Report

February 17, 2026, 10:41 AM EST. Royal Gold (NASDAQ:RGLD) is set to release its quarterly earnings on February 18, 2026, with analysts forecasting an earnings per share (EPS) of $2.63. Investors are keen on whether the gold royalty company will surpass these estimates and offer optimistic guidance for the next quarter, a key factor influencing stock prices. Shares of Royal Gold have surged 86.59% over the past year, trading at $286.10 as of February 16. The previous quarter saw a 2.11% share price drop after missing EPS estimates by $0.15. Market watchers await analyst ratings and price targets to gauge future momentum.

FTSE 100 Hits Record High; US Stocks Slide on AI Concerns

February 17, 2026, 10:40 AM EST. The FTSE 100 reached all-time highs as UK and European markets gained on Tuesday, driven by hopes of a Bank of England interest rate cut after weaker jobs data. The UK unemployment rate rose to 5.2%, the highest in five years, prompting expectations of looser monetary policy. Meanwhile, US stocks fell, with the Nasdaq down 0.9%, as fears over artificial intelligence (AI) disrupting industries continue to weigh heavily on Wall Street. The Dow and S&P 500 declined for the fourth week in five, reflecting investor caution ahead of key economic data, including the Personal Consumption Expenditures index. Mining stocks in London dropped, led by Antofagasta, amid falling precious metals prices. The pound weakened sharply against the dollar, pressured by domestic economic weakness.

Costco Stock Forecast 2026-2030: Analyst Price Targets and Outlook

February 17, 2026, 10:32 AM EST. Costco Wholesale Corporation (COST) trades near $1,018 amid varied analyst forecasts for 2026. Recent fiscal results showed $67.3 billion revenue in Q1 2026 and 6.4% sales growth. Brokers provide mixed 12-month price targets: Mizuho raised its target to $1,065, citing sustained sales momentum; DA Davidson holds a neutral $1,000 target, noting valuation concerns; Bernstein projects $1,155, factoring in membership growth. TradingKey reports a consensus near $1,009 with a 'Moderate Buy' rating. Analysts focus on comparable sales expansion, membership income resilience, and Costco's valuation multiples relative to peers. These forecasts are opinions, not guarantees, reflecting the company's performance and retail environment uncertainties.

Intensity Therapeutics Plans 1-for-25 Reverse Stock Split to Meet Nasdaq Rules

February 17, 2026, 10:31 AM EST. Intensity Therapeutics Inc., a biotech firm based in Shelton, announced its board has approved a 1-for-25 reverse stock split of its common stock. The move aims to boost the stock price and regain compliance with Nasdaq listing requirements, which often mandate a minimum share price. Reverse stock splits reduce the number of shares outstanding by consolidating them, effectively increasing the share price. This step reflects the company's efforts to stabilize its market presence amid regulatory scrutiny and maintain investor confidence.

Live and Feeder Cattle Futures Show Mixed Close on Friday

February 17, 2026, 10:30 AM EST. Live cattle futures closed mixed, ranging from 22 cents higher to 40 cents lower on Friday. February contracts dropped $2.025 week-over-week, with cash trade prices between $200 and $205 per hundredweight in key regions. Feeder cattle futures saw gains of 5 to 32 cents in front months but declines in deferred contracts; January rose $1.15. The CME Feeder Cattle Index fell $1.25 to $277.06 on January 16. Large speculators increased net long positions in both live and feeder cattle futures and options. USDA reported mixed boxed beef wholesale prices with Choice boxes rising 28 cents to $333.69/cwt and Select up 45 cents to $319.83. Cattle slaughter was 603,000 head this week, slightly higher than last year.

Lean Hog Futures Show Mixed Movement Amid Strong Pork Export Sales

February 17, 2026, 10:28 AM EST. Lean hog futures display mixed action at midday with July contracts rising 40 cents while other near-term months fall 50 to 80 cents. The USDA National Base Hog price dipped 72 cents to $89.48, placing futures below cash prices but still near the CME Lean Hog Index at $89.45. Pork export sales surged to 59,083 metric tons the week ending June 27, the highest weekly total since March 2021, supporting market firmness. The USDA Pork Cutout Value increased sharply by $3.22 to $96.85 with rises in butt and belly cuts offsetting a drop in ribs. Hog slaughter estimates show an uptick to 479,000 head, raising weekly totals above last year amid an earlier holiday. July contracts lead gains, while August and October futures lag, reflecting varied market sentiment.

Omnicom Group Earnings Preview: Analysts Expect $2.80 EPS on Feb 18

February 17, 2026, 10:23 AM EST. Omnicom Group (NYSE: OMC) is scheduled to report quarterly earnings on Feb 18, 2026, with analysts projecting an earnings per share (EPS) of $2.80. Investors are watching closely for the company to beat estimates and offer optimistic guidance for the next quarter, a key factor influencing stock prices. Previously, Omnicom surpassed EPS forecasts by $0.08, boosting shares by 3.2%. However, its stock has declined nearly 18% over the past year, trading at $69 as of Feb 16. This negative trend may weigh on investor sentiment ahead of the report. Market participants should monitor Omnicom's earnings release, available via Benzinga's earnings calendar, for shifts in outlook and share performance.

Wall Street Slides in Premarket as Tech Stocks Face Downward Pressure

February 17, 2026, 10:09 AM EST. Wall Street opened lower in premarket trading Monday, led by declines in technology stocks which appear set for further losses. Investors remain cautious amid ongoing concerns about tech sector valuations and potential regulatory scrutiny. Key tech giants experienced early weakness, dragging indices downward. Market participants are watching for updates on earnings and economic data this week, which could influence the trajectory of stocks. The selloff in tech shares added pressure on broader market sentiment, as technology continues to be a bellwether for overall investor confidence in equities.

Expeditors Q4 Earnings Preview: Mixed Outlook Ahead of Feb 24 Report

February 17, 2026, 10:06 AM EST. Expeditors International of Washington (EXPD) is set to report Q4 2025 earnings on Feb. 24 before market open. Analysts forecast earnings per share (EPS) of $1.46, down 13.1% year-over-year, and revenues of $2.8 billion, a 5.4% decline. Despite this, 2025 revenue is expected to grow 3.9% to $11.01 billion with EPS rising 3.5%. The airfreight segment may see gains boosted by export tonnage from Asia, but ocean freight is under pressure due to capacity oversupply and weak demand, particularly from ongoing U.S.-China trade tensions. Expeditors' recent strong earnings streak may falter as their model does not predict an earnings beat this quarter. Investors will watch for impacts of freight challenges and geopolitical factors on performance.

Ceva Meets Q4 Earnings Estimates, Posts $0.18 EPS on $31.29M Revenue

February 17, 2026, 10:05 AM EST. Ceva reported Q4 earnings of 18 cents per share, matching expectations, up from 11 cents a year ago. Revenue stood at $31.29 million, slightly above forecasts. The chip design firm showed a mixed trend in earnings surprises over the past year and a modest stock gain of 5.3% year-to-date, outpacing the S&P 500. Despite the solid quarter, Ceva holds a Zacks Rank #3 (Hold), reflecting moderate near-term growth prospects. For the next quarter, analysts anticipate earnings of 11 cents on $28.58 million revenues. The company operates in the Internet – Software sector, ranked in the top 36% by Zacks Industry Rank, indicating favorable industry conditions. Investors await management commentary to gauge future momentum.

Ceragon Networks Q4 Earnings Miss Estimates, Shares Rise 7.6% in 2025

February 17, 2026, 10:04 AM EST. Ceragon Networks (CRNT) reported Q4 earnings of $0.02 per share, missing the Zacks Consensus Estimate of $0.03 and down from $0.09 a year ago. The earnings surprise was -20%, marking the company's second consecutive quarter of earnings misses. Revenue topped estimates at $82.33 million, a 1.02% beat but down from $106.93 million last year. Despite disappointing earnings, shares have gained 7.6% year-to-date, outperforming the S&P 500's 0.1% decline. The stock holds a Zacks Rank #4 (Sell) due to unfavorable earnings estimate revisions ahead of the report. The Wireless Non-US industry, where Ceragon operates, ranks in the top 37% of over 250 Zacks industries, indicating sector strength. Investors will watch upcoming earnings guidance and estimate revisions for clues on future performance.

Tech Stocks Drag Major Indexes Lower Amid Inflation, GDP Data Week

February 17, 2026, 10:01 AM EST. Tech stocks pressured stocks as the Nasdaq dipped slightly Tuesday, with chipmakers Broadcom, Micron, and AMD falling over 2%. The Nasdaq posted its worst week of 2026 last week, driven by concerns over AI disruption in software and IT services. Apple and Amazon showed modest gains, while Nvidia, Microsoft, and Meta slid. Paramount Skydance shares rose on Warner Bros. Discovery's plan to resume acquisition talks, challenging Netflix's bid. Markets await the December Personal Consumption Expenditures price index on Friday, a key inflation gauge for Federal Reserve policy. Treasury yields inched up to 4.06%, while gold and silver futures dropped sharply. Bitcoin retreated from weekend highs near $70,000, and the U.S. dollar index rose 0.5% to 97.40.

TFS Financial (TFSL) Faces Overvaluation Concerns Amid Recent Price Gains

February 17, 2026, 10:00 AM EST. TFS Financial (TFSL) has seen share price gains with a 5.51% rise over one month and an 18.62% total return across a year, sparking investor interest. However, the stock trades at a high price-to-earnings (P/E) ratio of 46.6x, well above the US Banks industry average of 11.9x and peer average of 14.9x, suggesting a possible overvaluation. Simply Wall St's discounted cash flow (DCF) model estimates an intrinsic value of $1.29, far lower than the current price of $14.93, indicating the market may have priced in excessive growth expectations. Investors face risks if earnings or sentiment towards high-priced bank stocks weaken, potentially compressing the P/E multiple. Decisions hinge on whether price momentum can justify the premium or if a correction looms.

BHP Group Shares Surge but Valuation Concerns Emerge: Is It Too Late to Buy?

February 17, 2026, 9:59 AM EST. BHP Group's shares have rallied strongly, closing at A$52.74 with a 34.3% gain over the past year and 66.6% over five years, drawing investor attention. However, valuation analysis using a Discounted Cash Flow (DCF) model, which estimates intrinsic value by discounting future free cash flows, suggests the stock trades 36.3% above its fair value estimate of A$38.70. The current rating scores 3 out of 6 on valuation metrics, signaling mixed signals about its price attractiveness despite strong returns. Investors weigh the firm's solid cash flow projections against its premium price to determine potential entry points amid robust market performance.

Lithium Americas Share Rebound and Valuation Analysis

February 17, 2026, 9:58 AM EST. Lithium Americas (TSX:LAC) saw a 2.3% single-day share rise after a challenging 30-day decline of 23.9%. The company, focused on lithium projects including the Thacker Pass site in Nevada, reported a 44.9% total shareholder return over one year, highlighting longer-term investor interest. Trading at around 3 times price-to-book (P/B) value, below the industry average of 3.6x and peer average of 14.4x, the stock appears undervalued. However, Lithium Americas faces risks from no current revenue, a net loss of CA$242 million, and dependency on early-stage project development. Investors should weigh these factors alongside the company's growth potential amid fluctuating recent performance.

AI Disrupts Software Stocks; Investors Eye 7.5%+ Dividend Funds

February 17, 2026, 9:53 AM EST.AI advancements are shaking up software giants like Microsoft and Salesforce, sending their shares lower amid concerns that AI could replace traditional software purchases. Despite this short-term turmoil, experts highlight the AI-driven productivity surge expected to boost U.S. GDP by up to 3.7% by 2075, signaling long-term growth prospects. In face of increased market volatility, investors are turning to two closed-end funds offering 7.5%+ dividends through covered-call strategies, which generate income by selling options on a portion of their portfolios. These funds, including Nuveen's S&P 500 Dynamic Overwrite Fund (SPXX), provide diversified exposure to large-cap stocks with the potential for steady income and downside insulation in a rapidly evolving market environment.

S&P 500 and Nasdaq Slide as AI Fears Weigh on Market Sentiment

February 17, 2026, 9:52 AM EST. The S&P 500 and Nasdaq opened lower on Tuesday amid investor concerns over potential disruptions from artificial intelligence (AI). The Dow Jones Industrial Average bucked the trend, rising 24.4 points or 0.05% to 49,525.37 at the open. The S&P 500 fell 16.3 points or 0.24%, opening at 6,819.86, while the Nasdaq Composite dropped 151.9 points or 0.67% to 22,394.756. Market participants also monitored developments in U.S.-Iran nuclear talks, which added to the cautious sentiment. Investors remain wary as AI's impact on industries fuels uncertainty about future market dynamics.

Labcorp Holdings Q4 Earnings Beat Estimates; Shares Rally 12.7% in 2025

February 17, 2026, 9:45 AM EST. Labcorp Holdings (LH) reported Q4 adjusted earnings of $4.07 per share, surpassing the Zacks Consensus Estimate of $3.95 and up from $3.45 a year prior, reflecting a 2.98% earnings surprise. The medical laboratory company's revenue reached $3.52 billion, slightly missing estimates by 0.97%, but grew from $3.33 billion annually. Labcorp has exceeded earnings estimates in the past four quarters, demonstrating consistent performance. Despite a mixed trend in earnings estimate revisions and a Zacks Rank #3 (Hold), shares have risen approximately 12.7% in 2025, outperforming the S&P 500's 0.1% decline. Investors will watch upcoming management commentary and industry outlook closely as Medical Services ranks in the lower 42% among 250 Zacks industries, influencing Labcorp's near-term prospects.

Genuine Parts (GPC) Q4 Earnings Miss Estimates Despite Revenue Growth

February 17, 2026, 9:44 AM EST. Genuine Parts (GPC) reported Q4 earnings of $1.55 per share, falling short of the Zacks Consensus Estimate of $1.79 per share, marking a 13.6% earnings surprise miss. Revenue rose to $6.01 billion but also missed estimates narrowly by 0.43%. The company has outperformed the S&P 500 year-to-date with a nearly 20% stock price gain. Despite the latest earnings miss, GPC holds a Zacks Rank #2 (Buy), supported by a favorable trend in earnings estimate revisions. The upcoming earnings outlook projects $1.99 EPS on $6.16 billion revenue for the next quarter and $8.42 EPS on $25.23 billion revenue for the fiscal year. Investors will watch closely for management's commentary and industry conditions impacting future performance.

Serve Robotics Expands U.S. Urban Reach Amid Rising Demand for Autonomous Delivery

February 17, 2026, 9:43 AM EST. Serve Robotics Inc. SERV is broadening its autonomous sidewalk delivery network across major U.S. cities, hitting a milestone of 2,000 deployed robots by 2025. The expansion covers 110 high-density neighborhoods, boosting delivery activity and robot utilization without sacrificing reliability. Despite positive operational trends, SERV shares trade at a high forward price-to-sales ratio of 24.19, exceeding the industry average of 13.4. The stock has risen 6.5% over three months, outperforming peers Leidos and BigBear.ai but trailing Vertiv. Zacks Consensus estimates indicate a forecast 15% earnings per share decline in 2026, reflecting ongoing challenges amid urban market adoption. The growth in urban footprint underlines increasing demand for cost-efficient last-mile delivery, although long-term acceptance remains under scrutiny.

Vulcan Materials Q4 Earnings and Revenues Miss Estimates, Shares Rise Despite Weak Outlook

February 17, 2026, 9:42 AM EST. Vulcan Materials (VMC) reported Q4 adjusted earnings of $1.08 per share, falling short of the Zacks Consensus Estimate of $1.29, marking a 16.28% earnings surprise to the downside. Revenues reached $1.73 billion, missing estimates by 4.81% but up from $1.61 billion a year ago. Despite this, VMC shares have risen 11.6% year-to-date, outperforming the S&P 500's 8% gain. Management's outlook remains cautious with unfavorable revisions in earnings estimates, contributing to a Zacks Rank #4 (Sell) rating. The construction materials sector, particularly Building Products – Concrete and Aggregates, ranks in the bottom 16% by Zacks Industry Rank, signaling potential challenges ahead. Consensus EPS estimates stand at $0.79 for the next quarter and $6.53 for the full fiscal year, reflecting tempered investor expectations.

Jones Trading Lowers Franklin BSP Realty Trust (FBRT) Target Price to $12, Keeping Buy Rating

February 17, 2026, 9:41 AM EST. Jones Trading cut its target price for Franklin BSP Realty Trust (NYSE: FBRT) from $13.00 to $12.00, projecting a 35.52% upside from current levels despite retaining a buy rating. Other analysts remain mixed, with three analysts buying and two holding, to a consensus moderate buy. FBRT shares opened at $8.86 on Tuesday, trading below its 50- and 200-day moving averages. The real estate investment trust focuses on single-tenant net leased commercial properties, holding a market cap of $722.66 million and moderate leverage with a debt-to-equity ratio of 3.33. Institutional ownership stands near 60%, with recent activity from several hedge funds increasing stakes. The company's P/E ratio sits at 13.84, with shares ranging from a 12-month low of $8.42 to a high of $13.58.

Pan American Silver Earnings Preview: Analysts Expect EPS of $0.90

February 17, 2026, 9:37 AM EST. Pan American Silver (NYSE:PAAS) is set to report quarterly earnings on February 18, 2026, with analysts forecasting an earnings per share (EPS) of $0.90. The company's shares have surged 138.2% over the past year, trading at $57.93 as of February 16. Investors closely watch the earnings guidance, a key factor that often influences stock price movements. In the previous quarter, Pan American Silver slightly missed EPS estimates by $0.02 but still saw a 1.77% rise in its share price the following day. Analyst consensus and price targets remain important signals for investor sentiment heading into this release.

Prudential plc Cancels 248,071 Repurchased Shares Post LSE Buyback

February 17, 2026, 9:36 AM EST.Prudential plc (NYSE: PUK) announced it has repurchased 248,071 of its ordinary shares on February 16, 2026, through JP Morgan Securities plc. The shares were bought at an average price of £10.8855 each and will be cancelled. Following the transaction, Prudential's outstanding shares total 2,538,077,956, which will be used to calculate shareholders' voting rights under UK and Hong Kong regulatory frameworks. The repurchase complied with the authority granted at the company's 2025 AGM and adhered to the London Stock Exchange Listing Rules as well as Hong Kong's on-market share buy-back code. This move reduces share count, often aimed at enhancing shareholder value by concentrating ownership and potentially supporting the stock price.

Adobe Shares Show Potential Value After Sharp Multi-Year Decline

February 17, 2026, 9:30 AM EST. Adobe's stock has fallen sharply, dropping 43.1% over the past year and 23.9% over three years. The shares closed at $263.97, reflecting a 51.5% discount to intrinsic value based on a discounted cash flow (DCF) analysis, which estimates fair value at $544.61 per share. The DCF model estimates free cash flow growing from $9.77 billion to $13.02 billion by 2030. While investor sentiment has cooled amid broader tech sector growth concerns, Adobe scores 5 out of 6 on a valuation framework, indicating potential undervaluation. Price-to-earnings (P/E) ratios and other metrics support renewed attention on Adobe's future cash flow expectations amid shifting market risk appetite.

Itron Q4 CY2025 Sales Beat Estimates Despite Decline

February 17, 2026, 9:29 AM EST. Itron (NASDAQ:ITRI) reported Q4 CY2025 sales of $571.7 million, down 6.7% year on year but beating analyst estimates by 1.7%. Adjusted earnings per share (EPS) were $2.46, exceeding forecasts by 12.4%. The company's adjusted EBITDA margin rose to 17.3% while operating margin improved to 13.8%. Free cash flow margin nearly doubled to 19.5%. However, Q1 CY2026 revenue guidance at $570 million missed analysts' estimates by 1.8%, with a projected 6.1% sales decline year on year. Long-term, Itron's 5-year revenue growth is a moderate 1.7% compounded annual rate, though the last two years showed acceleration at 4.4%. Product segment revenue declined while service segment revenue grew 14%, reflecting shifting demand in Itron's utility management solutions.

Motley Fool CEO Tom Gardner Shares 6 Stock Picks for Next 5 Years

February 17, 2026, 9:28 AM EST. Motley Fool co-founder and CEO Tom Gardner highlights six stock ideas poised for growth over the next five years. He praised TransMedics, citing its stock rising from around 15-20 to 145 and projecting a further 3-fold increase in 6-7 years. Gardner emphasizes the importance of companies undergoing a cultural shift towards AI, labeling winners as those fully adopting AI, similar to how previous winners were 'Internet native.' He warns that AI-driven companies can drastically reduce workforce size while increasing efficiency, indicating a fundamental transformation in business models. These themes emerged during a podcast conversation with Motley Fool CIO Andy Cross, reflecting ongoing market dynamics and investment strategies.

JFB and XTEND to Merge in $1.5 Billion Deal Creating Nasdaq-Listed AI Defense Robotics Leader

February 17, 2026, 9:25 AM EST. JFB Construction Holdings and AI defense software company XTEND are merging in a $1.5 billion all-stock transaction to form XTEND AI Robotics, set to trade under Nasdaq ticker 'XTND'. The combined firm will focus on AI-powered autonomous defense and security systems, leveraging XTEND's XOS robotic operating system and JFB's infrastructure capabilities. Strategic investors include Eric Trump and Unusual Machines (NYSE: UMAC). The merger aims to boost US-made production at XTEND's Tampa facility and accelerate delivery to US, NATO, and Asian customers. XTEND CEO Aviv Shapira highlighted growing demand for operator-safe systems amid global security challenges. JFB CEO Joseph Basile praised XTEND's scalable AI platform. The deal enhances domestic defense tech and market access in a shifting security landscape.

Top 10 Stock Market Highlights to Watch on Tuesday, Feb. 17

February 17, 2026, 9:24 AM EST. Stocks are set for a lower open on a holiday-shortened week, with tech names under pressure due to artificial intelligence disruption concerns. Palo Alto Networks plans to acquire Israeli startup Koi. Elliott Management took a more than 10% stake in Norwegian Cruise Line, lifting shares 6%. Melius upgraded Chevron citing growth in Venezuela. Apple invites press to a March 4 event rumored to unveil new products. Netflix granted Warner Bros. Discovery a waiver amid a hostile takeover bid by Paramount. General Mills cut full-year forecasts, shares fell 3.5%. Morgan Stanley named Citigroup a top pick and upgraded Truist. UBS upgraded Southwest Airlines. Rothschild upgraded Dollar Tree but downgraded Dollar General. Medtronic beat earnings estimates.

Moody's Earnings Forecast Ahead of 2026 Q1 Report

February 17, 2026, 9:23 AM EST. Moody's (NYSE:MCO) is scheduled to report its quarterly earnings on February 18, 2026, with analysts forecasting an EPS of $3.45. The company previously exceeded estimates by $0.23, positively influencing its stock price by 1.38% the next day. Shares currently trade at $426.44, down 17.88% over the past year, reflecting investor concerns. Market watchers await whether Moody's can beat forecasts and issue optimistic guidance amid this decline. Understanding analyst consensus and price targets is crucial as investors prepare for potential volatility around the earnings release.

Louisiana-Pacific Q4 Earnings Beat Estimates Despite Revenue Miss

February 17, 2026, 9:12 AM EST. Louisiana-Pacific (LPX) reported adjusted Q4 earnings of $0.03 per share, surpassing the Zacks estimate loss of $0.06 per share and delivering a 148% earnings surprise. However, revenue fell 6% short of expectations, at $567 million versus $681 million a year prior. The home construction supplier has exceeded earnings forecasts in three of the last four quarters. Despite the revenue miss, LPX shares have gained 15.9% year-to-date, outperforming the S&P 500's decline. The company's Zacks Rank remains Hold (#3), signaling expected performance in line with the market. Future stock movements will hinge on forthcoming earnings estimates and industry outlook in the Building Products – Wood sector.

Builders FirstSource Q4 Earnings Miss Estimates, Shares Up Despite Weak Revenue

February 17, 2026, 9:11 AM EST. Builders FirstSource (BLDR) reported Q4 earnings of $1.12 per share, missing Zacks consensus of $1.30, marking a 13.86% negative earnings surprise. Revenue came in at $3.36 billion, 2.29% below estimates and lower than last year's $3.82 billion. Despite the misses, BLDR shares have gained about 11.5% year-to-date versus a flat S&P 500. The company's prior quarter beat failed to carry over, and analyst sentiment remains cautious with a Zacks Rank #4 (Sell) rating due to recent unfavorable earnings estimate revisions. Consensus expects next quarter EPS of $0.64 on $3.29 billion revenue and $6.01 EPS on $14.93 billion for the fiscal year. Investors will watch management's earnings call commentary and industry dynamics closely for guidance on future performance.

US Stock Futures Slide on AI Concerns Ahead of Shortened Week

February 17, 2026, 9:10 AM EST. US stock futures declined Tuesday as technology shares led losses amid ongoing fears over artificial intelligence's (AI) impact on various industries. Nasdaq 100 futures dropped 0.8%, S&P 500 futures fell around 0.5%, and Dow Jones futures slid 0.3%, reflecting investor anxiety about AI-driven disruptions. The Dow and S&P 500 have fallen in four of the past five weeks. Earnings season resumes with reports from Constellation Energy, Energy Transfer, Medtronic, and Palo Alto Networks ahead of major retail earnings from Walmart on Thursday. Warner Bros Discovery's rejection of a bid for Paramount Skydance also moved markets. General Mills' shares tumbled 3.3% premarket after lowering its 2026 sales outlook, citing weak consumer sentiment and volatility. Economic data and Federal Reserve policy minutes this week will add further direction amid ongoing rate-cut debates.

Oppenheimer Cuts DraftKings Price Target to $35, Signals Cautious Outlook

February 17, 2026, 9:08 AM EST. Oppenheimer downgraded its price objective for DraftKings (NASDAQ:DKNG) from $50 to $35, citing a more cautious outlook despite maintaining an "outperform" rating. The new target still implies a potential 60.85% upside from the current price of $21.76. Analyst sentiment remains mixed, with 23 Buy ratings, seven Hold, and one Sell, averaging a Moderate Buy consensus and a $42.59 target price. DraftKings's market cap stands at $10.83 billion with a P/E ratio of -544, reflecting ongoing losses. Insider selling was notable, with R Stanton Dodge offloading 52,777 shares at around $32 each, reducing holdings by 9.55%. Hedge funds continue adjusting positions amid volatility. DraftKings's stock has swung between a 12-month low of $21.01 and high of $53.61, underscoring current market uncertainty.

Market Dip Opens Buying Window in AI and Cybersecurity Stocks

February 17, 2026, 9:04 AM EST. The stock market has seen volatility, creating buying opportunities in key sectors like artificial intelligence (AI) and cybersecurity, which is gaining importance as AI expands. Investors are eyeing stocks such as CrowdStrike, Amazon, Broadcom, Nvidia, AbbVie, Meta Platforms, and SoFi Technologies. Market commentator Mark Roussin highlights these names as attractive buys amid the dip, with a focus on cybersecurity's growing role alongside AI. Prices referenced are based on January 19, 2026, data, with insights shared via a video published on January 20. Disclosure notes include holdings by Mark Roussin and The Motley Fool's positions and recommendations, emphasizing transparency around affiliations and compensation.

Allegion Q4 Earnings Miss Estimates Despite Revenue Beat

February 17, 2026, 8:52 AM EST. Allegion (ALLE) reported Q4 earnings of $1.94 per share, missing the Zacks Consensus Estimate of $2.01, marking a 3.60% earnings surprise miss. The security device maker posted revenues of $1.03 billion, slightly above estimates by 0.38%. This follows a strong prior quarter where earnings surpassed expectations by 4.07%. The company has exceeded earnings estimates three times over the last four quarters. Allegion shares have risen about 12.7% year-to-date, outperforming the S&P 500's 0.1% decline. The stock holds a Zacks Rank #3 (Hold), projecting near-market performance. Forward consensus estimates anticipate $1.93 EPS and $1.01 billion in revenues next quarter. Investors are advised to watch for earnings revisions and management commentary, especially given the Security and Safety Services industry's relatively weak Zacks Industry Rank in the bottom 46%.

Leidos Q4 Earnings Beat Estimates, Shares Edge Lower in 2025

February 17, 2026, 8:51 AM EST. Leidos (LDOS) reported fourth-quarter earnings of $2.76 per share, exceeding the Zacks Consensus Estimate of $2.57. This marked a 7.6% earnings surprise and represented growth from $2.37 a year earlier. Revenue came in at $4.21 billion, missing estimates by 1.07% and down from $4.37 billion in the previous year. The company's shares have declined about 2.3% year-to-date, trailing the S&P 500's 0.1% drop. Leidos has beaten earnings estimates in each of the last four quarters but faces mixed outlook sentiment, reflected in its Zacks Rank #3 (Hold). The Computers – IT Services sector is ranked in the top 36% of industries by Zacks. Future stock movement will hinge on upcoming earnings revisions and company guidance.

Eagle Point Institutional Income Fund Declares Q2 2026 Preferred Share Distributions

February 17, 2026, 8:50 AM EST. Eagle Point Institutional Income Fund announced distributions for its 8.125% Series A Term Preferred Shares due 2029. The Fund declared a distribution of $0.169271 per preferred share payable on April 30, May 29, and June 30, 2026, reflecting an annual rate of 8.125% on the $25 liquidation preference. The preferred shares trade on the NYSE under ticker EIIA. The Fund primarily invests in equity and junior debt tranches of collateralized loan obligations, targeting high current income and capital appreciation. Forward-looking statements in the announcement caution about risks and uncertainties affecting future performance.

iFOREX Resumes London IPO Process with Target Listing in February 2026

February 17, 2026, 8:49 AM EST. iFOREX Financial Trading Holdings Ltd. has restarted its initial public offering (IPO) process, aiming for a late February 2026 listing on the London Stock Exchange. The announcement follows a delay revealed in June 2025. The firm has yet to reveal the offer size, valuation, or share issuance details, which will be outlined in the upcoming prospectus. Founded in 1996, iFOREX operates an online platform specializing in foreign exchange and contracts-for-difference (CFD) trading, historically under Cyprus regulation and privately held by founder Eyal Carmon. Investors will focus on the company's revenue mix, especially exposure to European clients impacted by regulatory leverage caps, and the impact of market volatility on earnings. The prospectus will provide insight on client concentration, capital adequacy, and risk management ahead of the UK listing.

Dharan Infra-EPC Ltd NSE Stock Drops 5.88% on Heavy 96M Volume Amid Volatility

February 17, 2026, 8:48 AM EST. Dharan Infra-EPC Ltd (DHARAN.NS) closed at ₹0.16 on February 17, 2026, down 5.88%, with unusually high volume of 96.4 million shares traded, more than double its average. The stock hovered near its 52-week low of ₹0.16, well below its 52-week high of ₹0.67. Heavy volume on a falling price indicates selling pressure and short-term volatility. Financial metrics reveal operating losses, with a negative PE ratio of -0.94 and a market cap of ₹936 million. The price-to-book ratio at 0.10 contrasts sharply with the real estate sector average of 2.47, reflecting valuation risk. Meyka AI grades the stock `C+` with a HOLD recommendation. Traders should monitor liquidity events and sector dynamics, with potential catalysts including contract wins and profitability improvements.

Cemex Executes Share Buyback on Euronext Dublin, February 13, 2026

February 17, 2026, 8:44 AM EST. Cemex S.A.B. de C.V. repurchased shares on February 13, 2026, on the Euronext Dublin exchange. The move reflects the company's ongoing capital management strategy amid fluctuating market conditions. Share buybacks typically aim to boost shareholder value by reducing the number of outstanding shares. This transaction was reported in regulatory filings, signaling Cemex's commitment to returning value to investors.

US Prediction Markets Face Legal Challenges Over Gambling Classification

February 17, 2026, 8:43 AM EST.Prediction markets, which allow trading on outcomes from sports to elections, face increasing legal pushback in the US. At least 20 federal lawsuits challenge whether platforms like Kalshi and Polymarket are financial exchanges regulated by the Commodity Futures Trading Commission or unlicensed gambling operations. These platforms have surged recently, with Kalshi seeing nearly $10 billion in January trading volume. Unlike sportsbooks regulated by states with age limits and compliance rules, prediction markets operate nationally under federal rules and lack similar safeguards. State regulators argue these markets blur lines between investing and gambling, leading to cease-and-desist orders and calls for stricter oversight. Experts warn the conflict may escalate to the Supreme Court, with significant implications for regulation and taxation of this fast-growing sector.

Portland General Electric Q4 Earnings Miss Estimates Despite Revenue Beat

February 17, 2026, 8:42 AM EST. Portland General Electric (POR) reported Q4 earnings of $0.47 per share, falling short of the Zacks Consensus Estimate of $0.66, representing a 28.24% earnings surprise miss. Revenue rose to $889 million, surpassing estimates by 2.09% and up from $824 million year-over-year. The utility has beaten earnings estimates twice in the last four quarters. Portland General Electric shares have gained about 12.5% in 2025, outperforming the S&P 500's 0.1% decline. Investors will watch management's commentary closely for future guidance. The stock holds a Zacks Rank #2 (Buy), signaling potential outperformance based on recent favorable earnings estimate revisions. The consensus for the next quarter is EPS of $0.94 on $950.9 million revenue, and $3.36 on $3.77 billion revenue for the fiscal year, amid a mixed outlook for the Utility – Electric Power industry.

Knife River Q4 Earnings and Revenue Beat Estimates, Shares Gain 14.8% Year-to-Date

February 17, 2026, 8:41 AM EST. Knife River (KNF) reported Q4 earnings of $0.56 per share, surpassing consensus estimates of $0.41, marking a 37.42% earnings surprise, and revenues rose to $755.1 million, beating projections by 4.67%. Despite these strong results, the stock holds a Zacks Rank #4 (Sell) due to unfavorable earnings estimate revisions ahead of the report. The company's shares have gained 14.8% since January, outperforming the S&P 500's slight decline. Consensus EPS for the next quarter is at -$1.35, with $372.85 million in revenues expected. KNF operates in the Building Products – Miscellaneous industry, which currently ranks in the bottom 3, potentially impacting future stock performance. Investors will watch upcoming earnings guidance and industry trends closely.

Gold.com (GOLD) Stock Doubles in a Year but Faces Overvaluation Concerns

February 17, 2026, 8:40 AM EST. Gold.com (GOLD) surged 125.7% over the past year, driven by renewed interest in gold-related retail stocks. The share price closed at $60.91, reflecting a 45.3% gain in the last 30 days. However, a recent 2.7% weekly decline hints at shifting investor sentiment amid risk concerns. Despite strong returns, valuation checks place Gold.com at 0/6, signaling potential overvaluation. A Discounted Cash Flow (DCF) model estimates intrinsic value at $27.59 per share-120.7% below the current price-marking the stock as richly valued. Analysts expect a decline in free cash flow to $70.3 million by 2027 from $307.45 million recently, contributing to valuation caution. Investors should weigh the robust price gains against underlying financial metrics and growth prospects before making decisions.

Euronext Dublin Updates on Kazakhstan Withholding Tax Disputes Involving Zhaikmunai LLP

February 17, 2026, 8:38 AM EST. Euronext Dublin issued a further update on the ongoing Kazakhstan withholding tax disputes related to Zhaikmunai LLP. The update follows regulatory requirements to inform investors. Withholding tax refers to tax withheld at source on income paid to foreign entities. The disclosure aims to clarify the status of these tax matters amidst growing investor scrutiny. Details remain limited, but the market remains alert to any impact on Zhaikmunai LLP's financial standing or shareholder returns.

Euronext Dublin Announces Call Option Notice for Alternatifbank A.S.