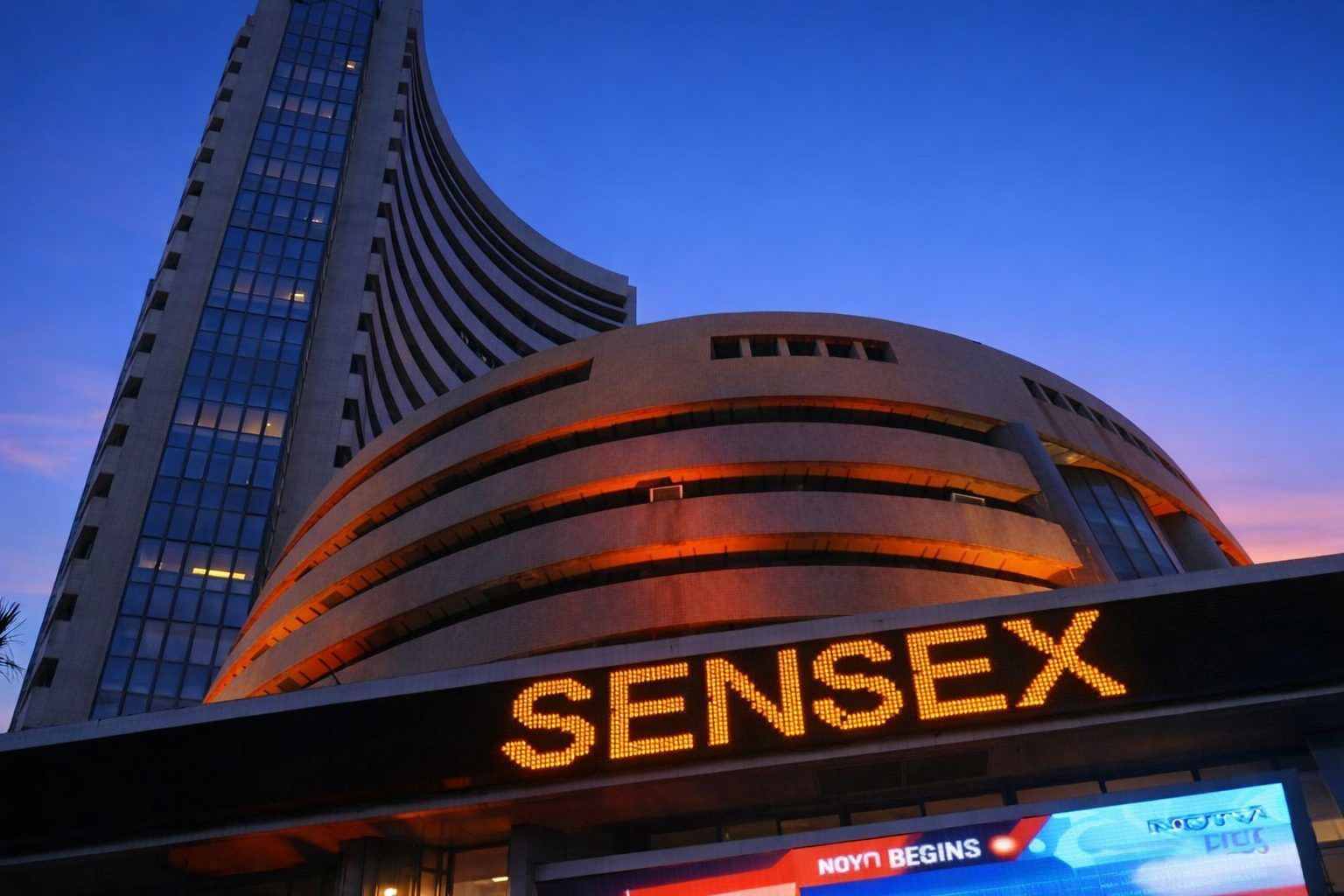

Mumbai, Feb 20, 2026, 15:53 IST — After-hours

- Nifty 50 finished 0.46% higher, while the Sensex added 0.38% following a turbulent session.

- Benchmarks got a lift from Reliance, ICICI Bank, and L&T, though IT stocks trailed.

- Crude hung around its recent highs, with the rupee sticking near 91 per dollar—traders watched both closely.

Indian equities posted gains on Friday, recouping some of Thursday’s steep declines as major names bounced and buyers hunted for deals before the weekend. The Nifty 50 closed 0.46% higher at 25,571.25. Sensex rose 0.38% to end at 82,814.71. (business-standard.com)

The rebound carries weight after Thursday’s drop—the sharpest in over two weeks—just as oil prices climbed amid heightened U.S.-Iran tensions. That’s a headache for India, the world’s third-biggest crude importer. “For India, this is worrisome because we are a major crude importer and any sustained rise in oil prices feeds straight into market sentiment and the economy through imported inflation,” said Aishvarya Dadheech, founder and chief investment officer at Fident Asset Management. (Reuters)

Naveen Vyas, who heads the family office at Anand Rathi Global Finance, called out a “tactical bounce” in Nifty 50, highlighting the 200-day simple moving average near 25,300 as the key technical line in play. By the middle of the session, Reliance Industries added 0.9%, ICICI Bank was up 0.7%. Volatility has been on the move too, with the index hitting 14.36 this week. IT lagged, dropping 0.5%, the only major sector trading in negative territory. (Reuters)

L&T and Reliance lent just enough support to prop up the benchmarks, which finished in the green despite a drag from tech stocks. (The Economic Times)

The rupee weakened 0.3% to 90.9825 per dollar, marking its sharpest weekly drop in a month as traders cited central bank interventions to prevent a move beyond 91. ING analysts noted the dollar’s “more efficient” safe-haven appeal when geopolitical tensions push up crude, with Brent last seen near $71.5 a barrel. (Reuters)

Novartis India shares surged almost 20% after its Swiss parent, Novartis, struck a deal to offload a 70.68% stake to a consortium led by private equity, a transaction valued at roughly $159 million. The group of buyers rolled out a mandatory open offer for another 26% of the company, pricing shares at 860.64 rupees in line with Indian takeover regulations. (Reuters)

That uptick hardly moved the needle on India’s broader market standoff. Investors are still weighing oil shock risks while some buyers keep snapping up major banks and index leaders on the dips.

Still, the rally looks shaky. Another uptick in crude prices or a firmer dollar might trigger more of the selling seen Thursday. IT names remain jittery, their earnings outlook clouded by chatter around artificial intelligence.

Attention shifts to Friday’s U.S. personal consumption expenditures price report, the Fed’s go-to inflation measure, as traders look for fresh signals on rate-cut timing and dollar direction. (Bureau of Economic Analysis)

Indian markets will be closed for the weekend, leaving Monday’s session to react to any developments in Middle East risk or the latest U.S. inflation data.