Singapore, Feb 22, 2026, 15:45 SGT — The market has closed.

OUE Real Estate Investment Trust and United Overseas Bank are gauging buyer appetite for One Raffles Place, a central office-and-retail property tipped to fetch between S$2.3 billion and S$2.4 billion. The move brings Singapore REITs back into focus as the SGX gears up for Monday. OUE REIT units notched a 4.2% gain to close at S$0.37 on Friday. United Overseas Bank finished the week at S$38.60, slipping 0.2%. (The Business Times)

That’s significant, given how rare major office transactions have been. The price on a prime CBD block often sets the tone for valuations across listed landlords. REITs—publicly traded property trusts known for distributing most of their income—typically move with shifts in financing costs and risk appetite.

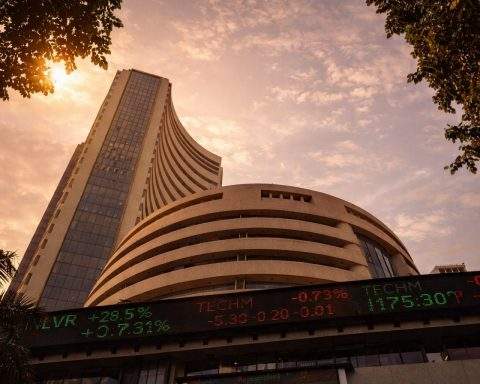

Markets remain perched close to record highs, but investors are left searching for fresh triggers after an extended rally. The Straits Times Index edged up 0.3% on Friday to close at 5,017.60. The three big local banks were split, as traders sized up U.S.-Iran tensions and the chance of sharper swings in commodity prices. “Market reactions from a risk scenario would include a rise in commodity prices including gold, and more volatile equity markets,” said Dr Nannette Hechler-Fayd’herbe of Lombard Odier. (The Business Times)

OUE REIT’s manager said an exercise is underway at One Raffles Place, with OUB Centre—holder of 81.54%—teaming up with UOB, which owns the other 18.46%, to gauge buyer interest. The Edge cited a S$1.93 billion valuation for OUB Centre’s stake as of Dec. 31, 2025, or S$2,745 per square foot. The office cap rate on that number: 3.35% to 3.55%. (The Edge Singapore)

Oil’s been the clearest signal for risk appetite abroad. Brent finished Friday at $71.76 per barrel, jumping over 5% for the week. Investors are factoring in possible U.S. strikes on Iran and the hazards surrounding the Strait of Hormuz—crude’s main thoroughfare. (Reuters)

Trade policy remains a wild card. The U.S. Supreme Court tossed out President Donald Trump’s broad tariffs, which had been imposed using a national-emergency statute. Trump, for his part, has pledged to try a new round of tariffs—a move traders warn could once again alter the world’s growth and inflation equation. (Reuters)

Singapore’s Department of Statistics has its first big macro data drop on Monday, Feb. 23, when it posts January’s consumer price index figures. That’s the number investors pore over for a read on whether inflation might be cooling off, or picking up pace again. (Base)

Earnings could drive the market’s next move, with a batch of major players reporting toward week’s end. According to an SGX-based earnings calendar, City Developments, ComfortDelGro, and ST Engineering all have results or updates packed into Friday, Feb. 27, along with a business update from SATS. UOL, plus a mix of REITs and industrial names, are lined up to report earlier in the week. (SG Investors)

Corporate moves haven’t let up. On Friday, Keppel picked up 200,000 shares in an on-market buyback, paying between S$12.85 and S$12.93 apiece. It’s just the latest in a series of modest but consistent buybacks propping up several big-cap counters. (SG Investors)

Investors have turned Singapore Exchange Ltd into something of a proxy for market mood. The bourse operator’s shares slipped 1.21% to S$17.90 on Friday, with traders watching to see if the heightened trading volumes stick around following the benchmark’s recent climb. (MarketWatch)

This week isn’t without its pitfalls for bulls. A hotter-than-expected CPI print? That could rattle rate-sensitive sectors. Trouble brewing in the Middle East would threaten to send energy prices higher, pressuring consumer and transport stocks. And as for the One Raffles Place deal — it’s still in motion, so there’s always the chance it wraps up with no sale at all.