Bangkok, Feb 22, 2026, 14:46 ICT — Market shut for the day

- Thai shares are back in action Monday, with investors zeroing in on the central bank’s Feb. 25 policy meeting.

- Economists and traders are at odds over near-term rate cuts after unexpectedly robust GDP data threw forecasts into disarray.

- Single-stock action is being pushed around by earnings and dividend news from banks and consumer companies.

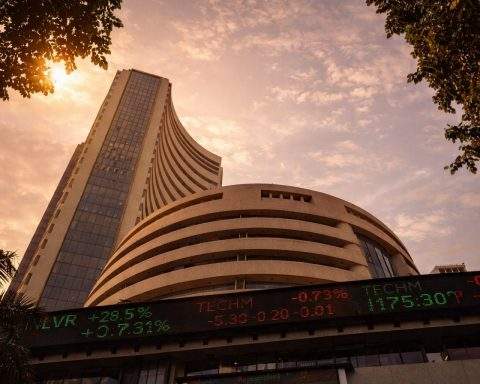

The Stock Exchange of Thailand is set to resume trading Monday, with the SET Index facing uncertainty ahead of the central bank’s Feb. 25 rate call. Investors have been digesting a mix of stronger growth indicators and renewed doubts about how much more easing might be ahead. (BOT)

Friday’s session saw the SET Index end at 1,479.71, dropping 14.20 points. Trading volume clocked in around 90.49 billion baht, according to exchange data. (Stock Exchange of Thailand)

The weekend saw another twist: Kasikorn Securities pointed to a surprise jump in GDP, cautioning this might dampen hopes for a rate cut anytime soon. Thailand’s economy expanded 2.5% in the fourth quarter from a year earlier, outpacing the 1.3% that the market was looking for, according to state figures cited by the firm. KResearch also bumped its 2026 growth forecast up to 1.9% from 1.6%. (Kasikorn Securities)

Rate expectations remain tangled. UOB’s Enrico Tanuwidjaja and Sathit Talaengsatya, in a note picked up by FXStreet, see the Bank of Thailand trimming its key rate by 25 basis points—down to 1.00% from the current 1.25%—when policymakers gather on Feb. 25. A basis point equals one-hundredth of a percentage point. (TMGM)

The divide carries weight for Thai stocks, with banks and other rate-sensitive names shouldering much of the index’s movement. Lower rates help by making loans cheaper and trimming funding expenses. Still, if deposit rates don’t keep pace, bank margins may get squeezed.

Krung Thai Bank posted a fourth-quarter profit of 10.8 billion baht and wrapped up the year at 48.2 billion baht, analysts heard, according to a Feb. 22 note from Kasikorn Securities. The company flagged a net interest margin target of 2.35%–2.5% for 2026, easing off from 2.82% in 2025, and projected loan growth staying flat to up 2%. (Kasikorn Securities)

Dividends are back in focus at the single-stock level, a shift for yield-seekers facing slow growth. Ichitan Group posted a 1.6% year-on-year net profit increase for FY2025, but core profit dropped 13.0%, according to a Feb. 20 note from Finansia Syrus analyst Sureeporn Teewasuwet. The company announced a 0.60 baht dividend for 2H25, with March 9 set as the ex-dividend date. After shares hit Finansia Syrus’ 15 baht target, Teewasuwet moved the rating to HOLD, suggesting investors wait for a dip: “We downgrade to HOLD or wait for a pullback.” (FNSYrus)

Currency swings don’t always make headlines in Bangkok, but exporters and tourism stocks feel every tick. On Feb. 20, the USD/THB dropped 0.41% to roughly 31.0510, according to Trading Economics data. (Trading Economics)

Still, the risks are hard to ignore. Should the central bank keep rates steady when markets expect a cut — or deliver a cut despite the GDP surprise suggesting a hold — banks could see big swings, dragging the baht along. Traders point out that dividend plays tend to unravel fast when shares drop around XD dates.