- Apple (AAPL) closed at $252.29 on Oct. 17, 2025 historicalstockprice.com, hovering near its all-time intraday peak (~$260). Year-to-date 2025 the stock is up only ~2% ts2.tech, far lagging tech giants like Nvidia (+35% YTD) and Microsoft (+23% YTD) ts2.tech.

- In mid-October Apple surprised markets with new M5-chip devices: a refreshed 14″ MacBook Pro, updated 11″/13″ iPad Pros, and a Vision Pro Gen 2 headset. Notably, Apple kept prices flat on these upgrades ts2.tech ts2.tech. Meanwhile, iPhone 17 sales are running ~10–15% ahead of last year’s iPhone 16 cycle ts2.tech, fueling talk of a long-awaited “iPhone supercycle.”

- Leadership changes are afoot. Longtime COO Jeff Williams will retire by end-2025 ts2.tech, and Apple has quietly tapped hardware chief John Ternus (50) as Cook’s likely successor ts2.tech ts2.tech. A new CFO (Kevan Parekh) was installed in early 2025 ts2.tech. Apple calls these moves “careful succession planning” to ensure continuity ts2.tech ts2.tech.

- Wall Street remains split. Bulls like Wedbush’s Dan Ives have raised their AAPL price target to ~$310 (citing booming iPhone 17 demand) ts2.tech, and Bank of America reiterated a Buy with a ~$270 target ts2.tech. Bears are cautious – Jefferies downgraded Apple to Underperform (~$205 target), warning that “excessive expectations” are already baked into the stock ts2.tech. Consensus 12-month targets hover in the mid-$250s ts2.tech ts2.tech.

- Apple’s recent earnings were strong. In July (Q3 fiscal 2025) Apple reported $94.0 billion in revenue (+~10% year-over-year) and EPS $1.57, beating estimates ts2.tech. Every major business segment grew double-digits, and management raised guidance for mid-to-high single-digit growth in the current holiday quarter ts2.tech. Investors will be watching the late-October earnings report closely.

- Macro and regulatory factors matter. A broad tech rally (Nasdaq +0.7% on Oct. 15) has buoyed stocks like Apple ts2.tech, but new U.S.–China tariffs remain a wild card. Apple’s stock actually “proved surprisingly resilient” on Oct. 14, closing flat (~$248) despite sudden tariff threats – helped by Federal Reserve hints of future rate cuts ts2.tech ts2.tech. Still, higher China tariffs could shave ~$1 billion from near-term margins, given Apple’s supply-chain exposure ts2.tech. Longer-term, EU regulations (e.g. the Digital Markets Act forcing third-party app stores) and stiff competition (from Samsung in phones and Nvidia/Google in AI) pose additional headwinds ts2.tech.

Apple’s stock is trading near record levels as of mid-October 2025. Last week (Oct. 13–17), AAPL shares oscillated in the $247–$252 range, closing at $252.29 on Oct. 17 historicalstockprice.com. That is only a few dollars below the all-time intraday high (~$260) set in late September ts2.tech historicalstockprice.com. Technically, AAPL is above both its 50-day and 200-day moving averages ts2.tech, signaling positive momentum. However, the stock’s 2025 performance has been muted: it is up only about 1–2% on the year ts2.tech. This flatness contrasts sharply with many other mega-cap tech stocks: for example, Nvidia is +35% YTD, Microsoft +23%, and Alphabet +29% ts2.tech. Apple’s more modest gain reflects its already-lofty valuation and the market’s shift toward hyper-growth AI names ts2.tech ts2.tech. Nonetheless, with roughly a $3.8 trillion market cap, Apple remains a cornerstone holding known for its stable cash flows.

New Products Drive Optimism

Investor enthusiasm has been reignited by Apple’s latest product announcements. On October 15, Apple quietly rolled out several devices powered by its next-generation M5 chip ts2.tech ts2.tech. The biggest news was a revamped 14-inch MacBook Pro (base model) with the in-house M5 processor – a 3nm chip boasting 10-core CPU/GPU and AI accelerators. Apple also updated the 11″ and 13″ iPad Pro and introduced Vision Pro Gen 2 (a mixed-reality headset) with the M5 chip. Unusually, Apple kept pricing flat: for example, the 14″ M5 MacBook Pro still starts at $1,599 and the iPad Pros at $999/$1,299 ts2.tech.

The M5 chip promises big performance gains. Apple claims it delivers roughly 4× the AI processing power of last year’s M4 chip and about 15% faster multi-core CPU speeds ts2.tech. In practice, this means the new MacBook Pro can even run large language models and advanced AI apps locally ts2.tech. Apple CEO Tim Cook emphasized these AI upgrades during the launch. As one market summary notes, Apple’s stock “got a small bump after the M5 announcement, as investors saw it aligning with the broader AI trend” ts2.tech. In other words, the market cheered Apple’s push into AI-capable silicon to help it keep pace with competition from Intel and Qualcomm ts2.tech.

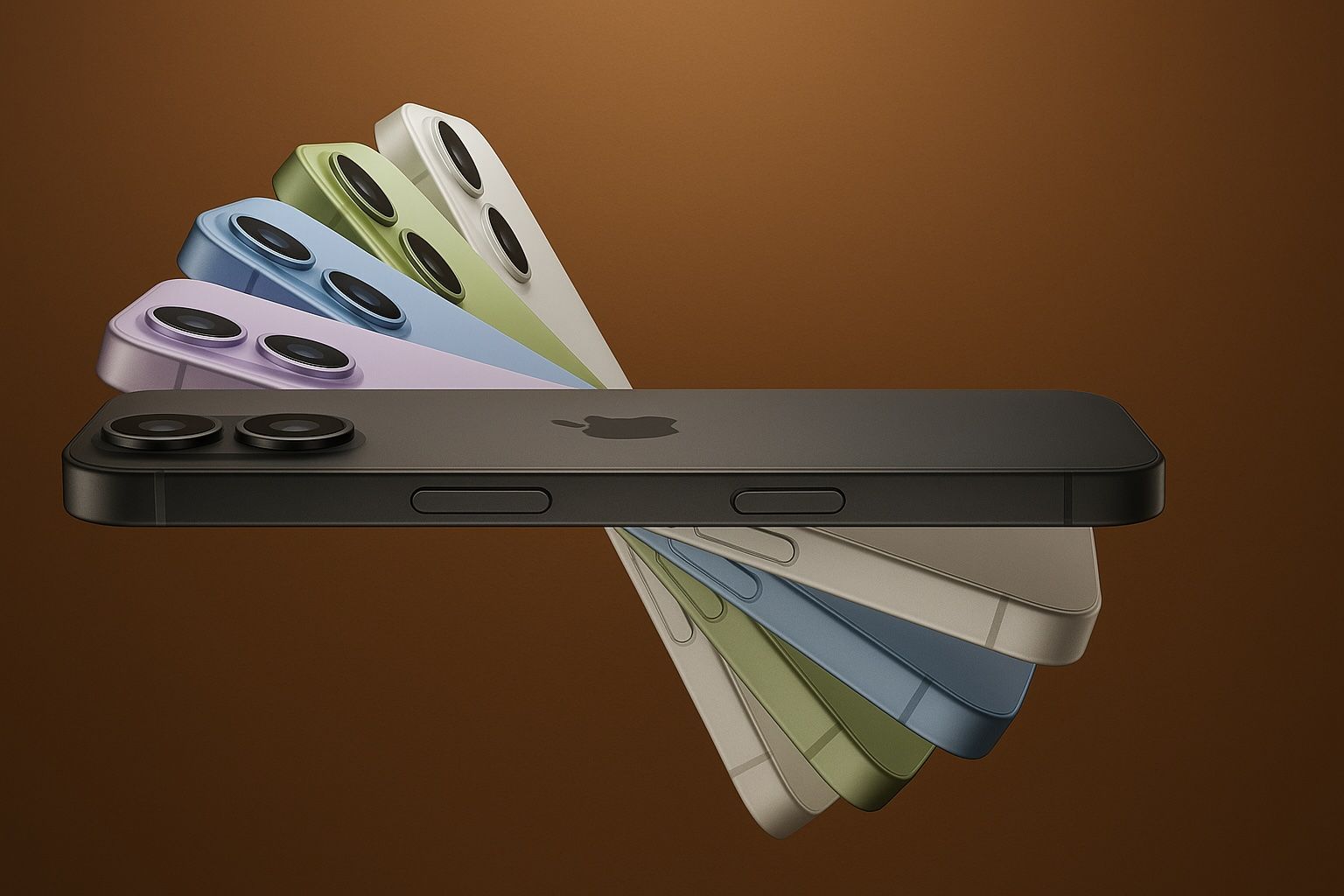

Besides chips, Apple is seeing strength in its iPhone business. In early September, Apple launched the iPhone 17 lineup (standard, Pro, and a new mid-range “iPhone 17 Air”) along with Watch Series 11 ts2.tech. Crucially, Apple held phone prices steady despite higher costs and tariffs: for example, the iPhone 17 Pro still starts at $1,099 (256 GB), the same as last year ts2.tech. (Apple even dropped the old $999/128 GB tier.) Early sales data look very promising – industry reports suggest iPhone 17 demand is running 10–15% above last year’s pace ts2.tech. Analysts call this a potential “pent-up supercycle” of upgrades. As Paolo Pescatore of PP Foresight puts it: “This new device will bring a sense of newness to the iPhone … the much-improved iPhone lineup looks impressive,” setting Apple up well for different customer segments ts2.tech.

These product developments have bulls and bears clashing on Apple’s outlook. On the bullish side, Wedbush’s Dan Ives sees a “golden era” ahead – he just raised his 12-month price target to $310, betting on record iPhone 17 sales ts2.tech. Bank of America, likewise, reiterated a Buy rating with about a $270 target after observing stable iPhone lead times ts2.tech. Even Morgan Stanley is optimistic, forecasting an iPhone recovery by 2025 (per media reports). On the bearish side, Jefferies cautions that Apple’s expectations may be “excessive” and cut its rating to Underperform (~$205 target) ts2.tech. Overall, analysts’ average 12-month forecast sits in the mid-$250s ts2.tech ts2.tech – only a few percent above today’s levels. This split sentiment is encapsulated in one warning: Apple’s rich valuation (P/E ≈38) means “upside is modest” unless new catalysts emerge ts2.tech.

Executive Transition on the Horizon

While product momentum is a key driver, Apple is also reshaping its leadership. Tim Cook (64) remains CEO and stressed he’s “firmly at the helm,” but investors have spotted a succession plan unfolding. The leading internal candidate to take over one day is John Ternus, Apple’s SVP of Hardware Engineering. Gurman and others report that Ternus (50) is widely viewed as Cook’s likely heir apparent ts2.tech ts2.tech. Notably, Ternus has been prominently featured in recent product unveilings – a classic grooming move. Bloomberg’s Mark Gurman comments that “all signs point to an upcoming CEO transition,” though he expects Cook to stay on for a few more years during the handover ts2.tech.

Meanwhile, other C-suite changes are underway. Longtime COO Jeff Williams (Cook’s longtime #2) will retire by the end of 2025 ts2.tech, after 24 years at Apple. His operations responsibilities are passing to Sabih Khan, a 30-year veteran who now heads Apple Operations. Apple has branded Williams’ departure as “long-planned succession,” praising him as a supply-chain legend while smoothly promoting Khan ts2.tech ts2.tech. Earlier in 2025, Apple quietly swapped in Kevan Parekh (formerly head of corporate finance) as its new CFO (replacing Luca Maestri) ts2.tech. All told, this is the biggest executive shake-up in Apple’s recent history, but management emphasizes continuity. Investors have generally viewed it positively so far – the prevailing view is that Apple is ensuring the transition will be smooth ts2.tech ts2.tech.

Earnings, Financials and Outlook

On the fundamentals, Apple is delivering robust results. In late July (fiscal Q3 2025, ended June), Apple beat Wall Street forecasts. Revenue was $94.0 billion (up ~10% YoY) and earnings per share were $1.57 ts2.tech, easily topping expectations of ~$1.43. Growth was broad-based: iPhone, Mac, and Services all expanded by double digits. Margins were strong (~46%), and Services revenue hit an all-time high. Encouraged by these results, Apple raised its guidance for the current quarter: management now sees mid-to-high single-digit growth in Q4 (holiday season) ts2.tech, up from the previously-cautious outlook. Those strong figures helped fuel the stock’s summer rebound.

The next major catalyst is Apple’s upcoming earnings report (fiscal Q4 2025) due in late October. Investors will be watching closely whether the iPhone 17 launch and the new products carry through into a year-end sales surge. If Apple can repeat the broad-based beats of Q3, it could justify higher valuations. Conversely, any hiccup – say in China demand or Mac sales – might raise concerns. Either way, analysts note that Apple’s fundamentals are solid, but the bar for “surprising on the upside” is high given the stock’s current price and recent run-up.

Market and Macro Environment

Apple’s recent run has occurred amid a mixed macro backdrop. On the positive side, broader tech stocks have rallied. For instance, strong earnings in the banking sector and optimism about AI chips sent the Nasdaq Composite higher last week ts2.tech. Apple’s own M5 chip launches and AI positioning tapped into that mood. On the cautionary side, the U.S.–China trade conflict is heating up again. In mid-October, President Trump announced hefty tariffs on Chinese imports, and China retaliated in kind. Apple, with many iPhones and components tied to China, initially fell sharply on Oct. 10. However, by Oct. 14 the stock recovered to close flat (~$248) for the day ts2.tech ts2.tech. One market commentator observed that Cupertino’s flagship remained “surprisingly resilient amid the crossfire” as Fed Chair Powell’s comments about possible rate cuts helped calm investors ts2.tech.

Still, the tariff threat is real: a 100% tariff on iPhones could knock roughly $1.1 billion off Apple’s quarterly margins if fully implemented ts2.tech. Apple has been hedging by shifting production to India and Vietnam ts2.tech, but its cost structure and sales could feel the pain if tensions escalate. On the monetary policy front, Powell’s recent dovish tone (hinting that cooling labor data might allow rate cuts) has generally supported growth stocks, including Apple. In the very short term, this broader liquidity backdrop – along with general market volatility – may dictate Apple’s intraday swings. But the overriding story, for now, is that Apple’s product lineup and leadership news remain the main catalysts.

Regulatory and Competitive Challenges

Looking beyond near-term market forces, analysts point to longer-term risks. In Europe, the Digital Markets Act (DMA) will soon force Apple to allow third-party app stores and payment systems on iOS by 2026 ts2.tech. This could erode some of Apple’s control over its ecosystem and compress services profits in the future. In the U.S., regulatory scrutiny of Big Tech continues (e.g. app store policies), though Apple has skirted the brunt of legal action so far. Still, Apple must navigate an increasingly complex regulatory environment in its major markets.

Competition is another factor. Apple’s products face stiff rivals: Samsung remains the world’s top smartphone seller and continues to innovate on hardware. In the broader tech arena, Apple is ramping up its own AI and chip efforts just as companies like Nvidia, Google (via Tensor chips), and Intel make strides in AI processing. Moreover, Apple’s push into augmented/virtual reality (with Vision Pro 2) pits it against Meta’s Quest and others. These competitive pressures mean Apple cannot rest on its laurels – it must keep innovating to justify its valuation. On the plus side, Apple’s ecosystem moat (over 1.5 billion active devices) and massive R&D budget give it advantages that many competitors lack ts2.tech.

Outlook: In summary, Apple stock is at a critical juncture. It is trading near record highs on the back of strong product momentum and solid earnings, but it already carries a sky-high valuation. The next few quarters will reveal whether the current catalysts are sustainable. Many analysts are optimistic – the consensus view remains a moderate Buy – but some urge caution. As one analyst put it, with AAPL’s P/E near 38, “upside is modest” unless new catalysts emerge ts2.tech. For now, investors and pundits are glued to every Apple announcement and sales report, split between visions of a new Apple “golden era” and reminders that the company’s current success is already largely priced in.

Sources: We compiled recent market data and analyst commentary from financial news outlets and industry reports. Key sources include market trackers (e.g. historical stock data historicalstockprice.com), press coverage of Apple’s product launches and earnings ts2.tech ts2.tech, and expert analyses and forecasts ts2.tech ts2.tech from reputable tech and finance publications. All cited data are current as of Oct. 18, 2025.