- First-Day Stock Price Volatility: Aptera Motors Corp. (NASDAQ: SEV) began trading on October 16, 2025 via a direct listing. The stock opened around $20.42 per share, spiked to an intraday high of $22.43, then plunged to a low of $3.63 before stabilizing near $9.00 by middaykraken.comkraken.com. At ~$9, Aptera’s market capitalization is roughly $300 million. Co-CEOs Chris Anthony and Steve Fambro celebrated the milestone by ringing the Nasdaq Closing Bell in Times Square on debut dayts2.tech.

- Direct Listing (No IPO Proceeds) & Funding Moves: Aptera went public via direct listing, meaning no new shares were issued and no capital was raised in the listing itselfgurufocus.com. To fund its plans, Aptera arranged a separate $75 million equity line of credit with New Circle Capital announced on Oct. 14aptera.us. This facility allows Aptera to sell up to $75M in stock over timeaptera.us – a critical lifeline given the company had only ~$13 million in cash as of mid-2025electrek.co. An online roadshow for investors was held on Oct. 15 ahead of the Nasdaq debutaptera.us.

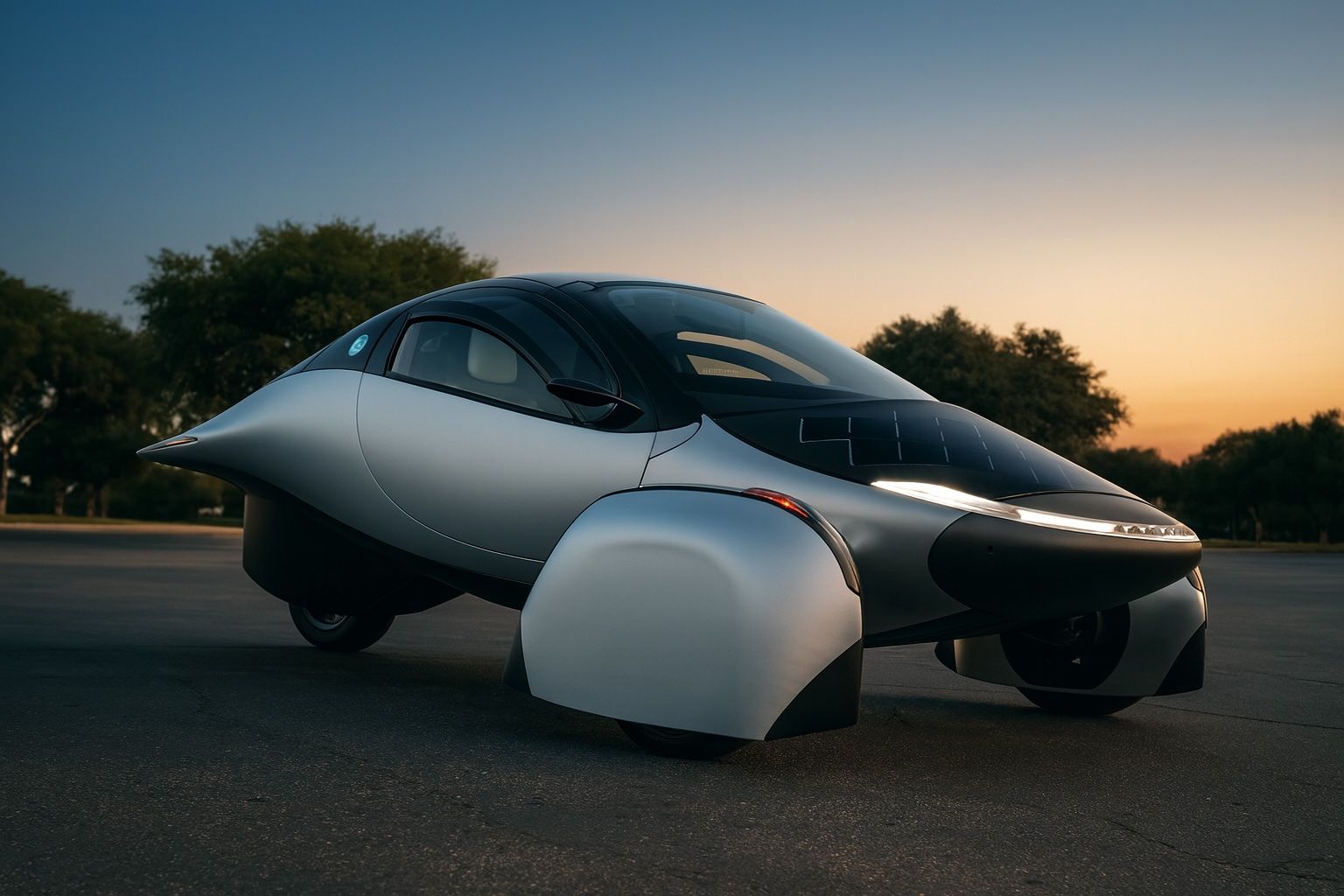

- Company Profile – Solar-Powered EV Pioneer: Aptera is a California-based startup developing a three-wheeled, ultra-efficient solar electric vehicle (sEV). Its two-seat EV is clad in solar cells and hyper-aerodynamic; the company claims it can deliver up to 400 miles of range on a full charge, with solar panels adding up to ~40 miles of free driving per dayaptera.us. Aptera, a public benefit corporation, aims to revolutionize sustainable transportation by offering a vehicle that requires little to no charging for many users. It has amassed a passionate community of early adopters with tens of thousands of reservations (preorders), though no vehicles have been delivered yet.

- Financials – Pre-Revenue and Loss-Making: Aptera has reported no revenues to date and remains in R&D modegurufocus.com. The company posted a net loss of $22.9 million in the first half of 2025gurufocus.com, reflecting ongoing development costs. With limited cash (~$13M mid-year) and negative earnings, Aptera’s financial viability hinges on raising additional funds and eventually scaling vehicle production. Key financial metrics like P/E, P/B, or positive cash flow are not available, underscoring that investors are betting on future potential rather than current fundamentalsgurufocus.com.

- Market Reception & Valuation Gap: Early private-market valuations for Aptera were significantly higher than where the stock is now trading. In Q2 2025, small batches of Aptera shares changed hands privately at a ~$40.85 per share average (implying a ~$1.3 billion valuation)renaissancecapital.com. By contrast, public trading has valued Aptera at only about 25% of that – roughly $300M at $9/sharekraken.com. This gap suggests public investors are far more cautious, pricing in execution risks that early backers perhaps overlooked. The first-day selloff indicates many existing shareholders (including crowdfunders with no lock-up period) may have seized the chance to cash out, contributing to high volatilityelectrek.coelectrek.co.

- EV Sector Context – Competition and Sentiment: Aptera’s debut comes amid a mixed climate for EV stocks. Tesla (TSLA), the industry leader, trades around $400+ per share (it closed at $413.49, down 5.1% on Oct. 13)simplywall.st and commands a massive market cap, but even Tesla’s stock has been volatile on shifting market sentiment. Rivian (RIVN) and Lucid (LCID) – high-profile EV startups that went public in recent years – have faced their own struggles. Lucid, for example, just reported record Q3 deliveries (4,078 vehicles) and a major 20,000-vehicle partnership with Uber, yet simultaneously cut its production guidance due to supply issues and expiring EV creditssimplywall.st. Rivian’s stock, while bolstered by actual truck deliveries, still hasn’t convinced value investors – a recent Graham-style analysis gave RIVN only a “57%” value score, citing concerns about growth and high book value multiplests2.tech. In this landscape, investor appetite for pre-revenue EV startups is cautious. Solar-EV peers have struggled: Germany’s Sono Motors went insolvent after failing to fund its Sion solar car projectreuters.com, and Dutch startup Lightyear declared bankruptcy in 2023 after producing only a handful of its solar carselectrek.co. Aptera’s journey to market will be closely watched as a bellwether for the solar-EV niche.

Aptera’s Wild Nasdaq Debut and First-Day Performance

Aptera Motors made a splashy entrance onto the Nasdaq Capital Market on October 16, 2025 – and the stock’s first trading day was anything but ordinary. The company’s Class B common shares (ticker SEV) opened around $20.42 and initially jumped to $22.43, but that early enthusiasm quickly gave way to intense selling pressurekraken.comkraken.com. Within hours, SEV plummeted to an intraday low of $3.63, triggering shock among market watchers at the nearly 80% swing from peak to trough. By midday, the stock had rebounded and stabilized near $9 per share, where it hovered into the afternoonkraken.com. At that price, Aptera’s market capitalization stood at roughly $308 million, a far cry from the unicorn-level valuation some early investors once anticipated.

Such extreme volatility is uncommon even for IPOs, and it underscores the uncertain sentiment around Aptera. The company went public via a direct listing, meaning no underwriters set an initial price or provided stabilization – the market was left to determine the value, and it did so in dramatic fashiongurufocus.com. The huge swing suggests that a wave of early shareholders (many of whom acquired stock through Aptera’s crowdfunding rounds) seized the first opportunity to sell, even as other investors jumped in hoping for a piece of the next big EV story. Trading volume was heavy (several million shares exchanged hands on Day One), and the bid-ask spread at times was wide – signs of limited liquidity and price discovery chaos in the absence of a traditional IPO book-build.

To mark the milestone, Aptera’s leadership literally put themselves in the spotlight. Co-CEOs Chris Anthony and Steve Fambro appeared at Nasdaq’s MarketSite in New York to ring the Closing Bell on October 16, celebrating Aptera’s transition to the public marketsts2.tech. The ceremonial bell ringing, broadcast from Times Square, underscored what a significant moment this was for a company that has spent years in development. “Listing on Nasdaq represents a pivotal chapter in our journey,” Anthony said in a statement, framing the event as a validation of Aptera’s mission to deliver a solar-powered futureaptera.us. Yet, behind the celebratory tone, Day One’s rollercoaster stock chart was a reminder of how much work remains to win over Wall Street’s confidence.

Investor reactions to Aptera’s debut have been a mix of excitement and caution. On one hand, Aptera’s unique story – a solar-powered EV that in some cases might never need to plug in – is compelling and helped the company build a devoted fanbase. This enthusiasm was evident in early trading when the stock surged over $20, suggesting some traders were eager to buy into the solar EV hype. On the other hand, the swift collapse in price to single digits signals that many insiders and early backers decided to cash out immediately, and that the broader market is highly uncertain about Aptera’s valuation. It’s not unusual for new listings to be volatile, but a swing of this magnitude hints at disagreements on what Aptera is truly worth. By the closing bell, SEV had lost over half its initial value, a stark outcome that may give pause to momentum investors. The closing price (around the $9 mark) will be the starting point for Aptera’s second day and beyond – and it leaves the company with a much smaller public valuation than it likely hoped for.

In short, Aptera’s first day on Nasdaq was volatile and eventful: a celebratory media moment for the company, accompanied by a reality check from the market. The immediate challenge for Aptera will be to manage this volatility and try to establish a stable trading range in the days ahead. Early, anecdotal sentiment from retail investors on forums and social media ranged from hopeful (“finally, a chance to invest in this visionary company”) to skeptical (“the stock tanking right out of the gate is a bad omen”). Some long-time EV industry followers even joked that they had to double-check that Aptera’s news headline wasn’t “files for bankruptcy” instead of “files for Nasdaq listing,” reflecting lingering doubts about the company’s prospects. While tongue-in-cheek, such comments highlight the skepticism Aptera must overcome to prove it’s not another cautionary tale in the EV startup space.

Major Recent Developments: From Listing Approval to a $75M Lifeline

Aptera’s public listing wasn’t a spontaneous leap – it was preceded by a series of deliberate steps to prepare the company financially and publicly for life on the stock market. In late August 2025, Aptera filed an S-1 registration statement with the SEC for a proposed direct listing (as noted in regulatory filings), and by October 10, 2025, the company announced it had secured Nasdaq approval to listaptera.us. The planned first trading date of Oct. 16 was set, and Aptera’s communications ramped up accordingly. On Oct. 14, Aptera hosted an online investor roadshow – essentially a webcast presentation by the CEOs and team – to pitch its story to prospective shareholders ahead of the debut. This roadshow gave Aptera a platform to articulate its vision, strategy, and progress to date. Observers noted that Aptera emphasized its status as a “solar mobility” innovator and a public benefit corporation committed to sustainability, likely to position itself as more than just another EV maker.

Crucially, Aptera also moved to bolster its financial runway right before going public. On October 14, just two days before the Nasdaq listing, the company announced it had executed a $75 million equity line of credit (ELOC) with affiliates of New Circle Capitalaptera.us. Under this arrangement, Aptera has the right (but not the obligation) to issue and sell up to $75M of its Class B common stock to New Circle over timeaptera.us. In simple terms, it’s an on-call stock sale facility: whenever Aptera needs cash (and meets certain conditions), it can tap the facility to sell shares to New Circle at a formula-determined price. This type of financing is often used by pre-revenue companies to raise chunks of money as needed, rather than taking one large dilution hit up front.

For Aptera, the ELOC was timely and essential. Because the company chose a direct listing rather than a traditional IPO or SPAC merger, it did not raise any money from the listing itselfgurufocus.com. Going public via direct listing allowed existing shareholders to trade their stock and gain liquidity, but left Aptera’s coffers untouched. Meanwhile, Aptera’s cash balance was perilously low – around $13 million remaining as of June 30, 2025 according to its SEC filingselectrek.co. By Aptera’s own estimates, that is not nearly enough to complete the tooling, testing, and production ramp for its first vehicles. The $75M equity line, therefore, provides a critical lifeline to fund operations in the coming year. Proceeds from the ELOC are earmarked for “production readiness, including tooling and other activities required to bring Aptera’s Launch Edition vehicles to market,” the company statedelectrek.coelectrek.co. This implies the money will go toward factory equipment, supplier tooling, and final engineering – all prerequisites to actually deliver cars to the thousands of waiting reservation holders.

However, the effectiveness of this financing tool depends heavily on Aptera’s stock price. As EV news outlet Electrek observed, Aptera’s ability to tap the full $75M “without unreasonable dilution” will require the share price to hold up in the coming weekselectrek.co. If SEV shares trade too low, selling tens of millions worth of stock would mean issuing a very large number of shares, which can itself put downward pressure on the price (a dilution spiral). In an ideal scenario for Aptera, positive news or steady demand will keep the stock at a healthy level, allowing the company to draw on the ELOC in stages and raise funds gradually as milestones are metelectrek.co. The worst-case scenario would be a severely depressed share price that either limits Aptera’s ability to use the facility or forces it to flood the market with cheap shares to raise needed cash – harming existing shareholders. Striking that balance will be a key focus for management and investors alike as Aptera transitions into a public reporting company.

Beyond financing, Aptera’s recent to-do list included more investor outreach and transparency. Alongside the listing, the company has begun releasing regular updates via its Investor Relations site and media room. On Oct. 10, Aptera formally issued a press release confirming the Nasdaq listing plan and highlighting the significance. “Our transition to a public company is intended to empower us to scale our operations and advance the cause of solar mobility,” said co-CEO Steve Fambro, framing the listing as a means to an end – the end being mass production of Aptera vehiclesaptera.us. Aptera has also been sharing progress videos of its beta vehicles and testing on social platforms to maintain public interest.

One notable development in Aptera’s favor is that it finally locked in a major manufacturing partner in late 2024 (just prior to the listing window). Aptera signed a deal with CPC Group, an Italy-based composites manufacturer, to produce the body structures for its vehicles – a crucial supply-chain piece given Aptera’s unique molded carbon fiber shell design. This partnership, while announced earlier in the year, was likely emphasized to investors as it lends credibility to Aptera’s production plans. Likewise, Aptera touts that it has over 40,000 reservations for its vehicle, representing potential future revenue of hundreds of millions (if those convert to sales). These points were surely part of the roadshow narrative aimed at convincing investors that, with fresh funding and a clear plan, Aptera can turn its decade-plus of R&D into a viable business.

In summary, the days around Aptera’s IPO have been eventful: approval to trade, a last-minute financing arrangement, outreach to the investor community, and the theatrics of a Nasdaq bell-ringing. Each move was geared toward setting Aptera up for success as a public entity. Yet, as the initial trading volatility showed, investors remain keenly focused on whether the company’s financial cushion and execution strategy are sufficient. The $75M equity line is a positive step but also a double-edged sword – it provides runway, but only if the market maintains faith in Aptera’s prospects. This dynamic will play out in real time as the company issues updates and, hopefully, hits development milestones that can boost confidence in its timeline.

The Solar EV Vision: Aptera’s Unique Proposition and Challenges

Aptera’s story captures the imagination: a lightweight, spaceship-like car that can run on sunshine and use a fraction of the energy of a typical electric vehicle. The startup’s flagship product – often simply called “the Aptera” – is a two-seat, three-wheeled electric vehicle that is so aerodynamically slick and efficient that it can achieve the same speeds and acceleration as a normal car while using far less battery capacity. The vehicle’s most distinguishing feature is its skin embedded with solar cells. Aptera says the highest-end solar package (which covers the hood, roof, and hatch) can gather up to 40 miles of range per day from sunlight alone under ideal conditionsaptera.us. In practical terms, many drivers with average commutes could go days or weeks without ever plugging the vehicle in. This concept of a “never-charge” EV is Aptera’s chief selling point and has earned it a devoted following among tech enthusiasts and eco-conscious drivers.

Another key to Aptera’s efficiency is its aerospace-inspired design. The car’s body is teardrop-shaped with an extremely low drag coefficient (around 0.13, significantly better than any other production car). It rides on three wheels (two in front, one in back), which classifies it as an autocycle in many jurisdictions. The three-wheel architecture reduces weight and rolling resistance, and Aptera extensively uses lightweight composites for the body. All of these design choices allow Aptera to do more with less: the vehicle’s planned battery pack options (ranging from 25 kWh to 100 kWh) would yield ranges from roughly 250 miles up to 1,000 miles for the largest pack – far beyond traditional EVs in that battery sizeaptera.us. The company has touted that its top model will be the most efficient road vehicle in the world, with energy usage on the order of 100 Wh/mile or lower (about 10x more efficient than some EV SUVs). If achieved, this would indeed be a paradigm shift for electric mobility, potentially enabling long trips with minimal charging and significantly lower operating costs and carbon impact.

However, turning this bold vision into reality has been a long and rocky road for Aptera. The company’s history shows how challenging hardware startups – especially in the automotive realm – can be. Aptera Motors was originally founded in 2006 and developed early prototypes of a hyper-efficient car, but ran out of money and actually filed for bankruptcy in 2011 (effectively pausing operations)gurufocus.com. The dream didn’t die, though. Chris Anthony and Steve Fambro, the original founders, re-formed Aptera in 2019, bringing the concept back just as EVs were gaining mainstream traction. This time, they leveraged new technologies (like improved solar cells and batteries) and a fervent online community to drive development. Aptera’s resurrection was structured as a crowd-supported effort: the company is a public benefit corporation and leaned heavily on equity crowdfunding campaigns to raise capital throughout 2020–2022. Thousands of individual investors collectively poured tens of millions of dollars into Aptera via platforms like Republic and Aptera’s own site, motivated by the company’s promise of a sustainable transportation breakthrough.

Those efforts allowed Aptera to produce a series of functional alpha and beta prototypes, test core systems, and refine the design. By early 2023, Aptera had unveiled a production-intent prototype of its vehicle, and it started to seem like the company might be nearing the finish line to production. The Aptera vehicle’s specs – such as optional all-wheel drive, 0-60 mph in as fast as 3.5 seconds, and a price tag starting around $25,000 for the 250-mile range version – generated plenty of buzz in the EV world. The company accumulated a large number of reservations (pre-orders): by some accounts around 40,000 people globally have reserved an Aptera with a (refundable) deposit. If all translated to actual sales, that would represent over $1 billion in potential revenue. This indicates a significant pent-up demand for Aptera’s product, at least among early adopters who are excited by the idea of a super-efficient, solar-topped commuter EV.

Yet, Aptera still faces major challenges before any of those reservations become delivered cars. Manufacturing an automobile at scale is an enormously complex and capital-intensive endeavor, and Aptera – unlike bigger EV startups – is essentially starting from scratch. The company does not own a large factory; instead it plans to outsource a good portion of production. Aptera’s strategy is to have key components made by suppliers (for example, bodies by CPC in Italy, and perhaps final vehicle assembly in California). Even so, coordinating the supply chain, setting up assembly operations, and ensuring quality can be very difficult for a small company. The timeline has repeatedly slipped: Aptera originally hoped to begin production in 2022, then pushed to 2023. As of late 2025, Aptera has not commenced production or generated any revenuegurufocus.com, and the target for first customer deliveries has moved into 2026. In an SEC filing, Aptera cited that it “aimed to bring its vehicle to production this year [2025], but that goal was delayed due to ongoing funding issues”electrek.co. Indeed, lack of sufficient funding has been the main bottleneck – without enough capital to purchase tooling and parts in bulk, progress stalled at the “development” stage for much of 2023 and 2024.

Another challenge is regulatory and market acceptance. Aptera’s three-wheeled vehicle is technically classified as a motorcycle or autocycle in many U.S. states, which affects safety regulations and licensing. The company has lobbied for reasonable autocycle regulations, but it still may face a consumer perception issue: some buyers might be wary of a three-wheeler’s stability or crash safety compared to a four-wheeled car. Aptera insists its vehicle will meet stringent safety standards (it has a Formula 1 style passenger safety cell and airbags), but it won’t undergo the exact same crash tests as a normal car due to its classification. Additionally, Aptera’s distinct look and limited seating/cargo may relegate it to a niche market – not everyone will find a two-seater pod car practical as their primary vehicle, especially in markets like the U.S. where larger vehicles dominate. Aptera is betting that a segment of consumers are willing to trade size and maybe some comfort for extreme efficiency and low operating cost. That remains to be proven.

On the competitive front, Aptera’s vehicle is quite unique – at the moment, no major automaker offers a solar EV that compares. Tesla, for instance, has experimented with small solar add-ons (like a solar tonneau cover for the Cybertruck), but Elon Musk has noted that adding meaningful range via solar on a normal car is challenging due to limited surface area. Aptera’s design maximizes that surface area and efficiency specifically to make solar charging viable. There are a few small competitors in the fringe EV space (for example, ElectraMeccanica’s Solo was a three-wheel EV commuter, but without solar; it saw limited adoption). Potential competition could arise if Aptera proves the market – larger companies might produce their own ultra-efficient city EVs or incorporate solar roofs (Hyundai and Toyota have offered solar roof options on some models, but only adding a few miles of range). For now, Aptera’s main competition is the status quo: convincing consumers to opt for its radical vehicle instead of a conventional EV or hybrid. Given the vehicle’s motorcycle-like quirks and futuristic appearance, Aptera will likely attract early adopters first – tech enthusiasts, environmentalists, and perhaps fleet operators for whom efficiency is paramount.

In summary, Aptera’s value proposition is high-risk, high-reward. The company offers a potentially groundbreaking product that could redefine efficiency standards in the auto industry and fulfill a sci-fi-esque promise of a car powered by the sun. This vision has carried Aptera through a long development journey and earned it a zealous fan base (many of whom are now shareholders as well). However, the execution risks are substantial: Aptera must navigate manufacturing, supply chain, and regulatory hurdles with far less capital and experience than established automakers. It must also educate the market and carve out a customer segment for an entirely new category of vehicle. After nearly two decades (counting its first incarnation) of development, the pressure is on for Aptera to finally deliver in the next 1–2 years. Going public adds both opportunity – access to new funding – and pressure, as the company’s progress (or setbacks) will be scrutinized quarter by quarter. How Aptera manages this next phase will determine whether its solar-powered dream can become a profitable reality, or whether it joins the list of promising EV startups that faltered before reaching the finish line.

Investor Sentiment and Market Outlook: Cautious Optimism vs. Hard Reality

How are experts and investors viewing Aptera now, and what do they expect in the coming months and years? The sentiment around Aptera’s stock and business outlook can best be described as cautious optimism mixed with realism. On one hand, Aptera’s Nasdaq listing and financing deals are seen as positive steps that give the company a fighting chance to achieve production. On the other hand, there is broad acknowledgment that Aptera faces an uphill battle and that the stock could be extremely volatile and speculative until the company proves itself.

Short-term, analysts and commentators are focusing on Aptera’s cash burn and stock performance. EV industry veteran Fred Lambert of Electrek noted that Aptera “had only $13 million left by the end of June” and that the direct listing provided no new funds, so the $75M equity line was basically Aptera’s only shot to raise money for productionelectrek.coelectrek.co. He pointed out a major risk: because there was no lock-up period preventing insiders and early investors from selling at the listing, there was fear of a flood of selling pressureelectrek.co. In Lambert’s view, Aptera’s “only chance” to succeed is to keep its stock price high enough post-listing to utilize the new equity facility without crippling dilutionelectrek.co. That, in turn, would require insiders and crowdfund investors to hold onto their shares rather than dump them immediately, which he described as “a tall order”electrek.co. Indeed, the first-day plunge suggests many did sell, which has already made Aptera’s funding situation more precarious. Early investors may have been looking to recoup whatever gains they could after years of illiquid holdings – a dynamic that can hurt a newly listed stock like SEV as it tries to find its market footing.

Because of this overhang, many market watchers expect continued volatility in SEV’s stock price in the short term. The share price could swing significantly on any news or rumors. For instance, if Aptera announces a delay or problem (say, a supply issue or a need for additional funding beyond $75M), the market reaction could be severe given the tenuous confidence. Conversely, if Aptera can hit a positive milestone – perhaps unveiling a production prototype, starting beta deliveries to internal users, or securing a large strategic partner – that could boost the stock sharply. At this stage, trading in SEV is driven more by news and sentiment than by fundamentals, since fundamentals (revenue, earnings, etc.) are basically nonexistent. Some investors may treat SEV as an option-like bet on Aptera’s future: willing to risk volatility for the possibility of large upside if Aptera succeeds in rolling out its vehicles.

No major Wall Street analysts have initiated coverage on Aptera yet, which is unsurprising for a company at this stage. The absence of analyst price targets or earnings forecasts was noted in GuruFocus’s briefing – there simply isn’t the typical coverage one would have for a more mature companygurufocus.com. This means the stock will trade without the “guide rails” of consensus estimates or institutional rankings in the near term. However, as a publicly traded entity, Aptera will likely report financial results quarterly now and hold earnings calls, which could start to shape a narrative for investors. In these early quarters, analysts and investors will be looking at metrics like cash burn rate, updates on capital expenditure (tooling spend), reservation conversions, and any timeline projections management can provide.

One medium-term concern is whether $75 million is enough to reach a meaningful production milestone. Automotive manufacturing typically requires a lot of capital; by comparison, other EV startups that made it to production often raised hundreds of millions or more (Rivian, Lucid, Fisker, etc., all raised large sums via IPOs or SPACs). Aptera’s relatively lean funding plan may only carry it through initial production of a few thousand units unless things go perfectly. Some observers expect that Aptera will have to seek additional funding in 2026 – this could take the form of another stock offering, debt financing, or perhaps a strategic investment from a larger company in the automotive or tech space. The direct listing path means Aptera doesn’t have big-name underwriters championing the stock, so the company will need to proactively court investors if more capital is needed. In an optimistic scenario, if Aptera’s stock performs well and the company hits its targets, raising more capital at a higher valuation becomes easier (success breeding success). But in a pessimistic scenario, a sagging stock could force Aptera to raise money at unfavorable terms, heavily diluting shareholders or leaving the company underfunded.

Looking at the broader EV market outlook, Aptera is launching into a sector that is both growing and fiercely competitive. Global EV sales continue to rise, and governments are pushing policies to encourage electric and efficient vehicles. This macro environment is a tailwind for Aptera – for instance, high gasoline prices or strengthened emissions regulations could indirectly boost demand for a product like Aptera that offers energy security (solar charging) and ultra-high efficiency. There are also potential subsidies: as a lightweight three-wheeler, Aptera won’t qualify for standard U.S. EV tax credits (which currently apply to four-wheeled vehicles), but as a solar technology it might attract other incentives or state-level programs for innovation. Investors bullish on Aptera might argue that if the car performs as advertised, there could be significant niche demand (commuters in sunny climates, fleet usage for last-mile delivery or rideshare, etc.) that is currently unmet by other EVs.

However, it’s impossible to ignore the cautionary tales in the EV startup space, especially for those trying something radically new. As mentioned, Sono Motors and Lightyear – both of which were attempting to commercialize solar-integrated EVs – ran into fatal financial trouble before reaching mass productionreuters.comelectrek.co. Sono Motors actually went public on Nasdaq (under ticker SEV, coincidentally the same symbol Aptera now uses) in late 2021 and raised some money, yet by early 2023 it had to pivot away from making the Sion solar car due to lack of funds, ultimately undergoing insolvency proceedingsreuters.comreuters.com. Lightyear, a high-end Dutch solar car project, hand-built a few extremely expensive vehicles and then filed for bankruptcy in 2023 when it couldn’t raise more capitalelectrek.co. Both cases underscore a simple fact: developing a solar EV is technically feasible, but commercially very challenging. Even Aptera itself nearly didn’t survive; Electrek’s January 2023 analysis titled “The future of solar EVs dims” pointed out that Aptera was “on the brink”, urgently needing millions in funding to avoid the fate of its peerselectrek.co. That funding eventually came (via crowdfunding and late investment rounds), allowing Aptera to hang on and make it to this public listing. The question now is whether Aptera can break the pattern and actually reach the milestone that has eluded the others: mass production and delivery of a solar electric vehicle at scale.

From an investor sentiment perspective, these examples have injected a degree of skepticism. Many institutional investors prefer to adopt a “wait and see” stance – they might be impressed by Aptera’s prototype and mission, but they want to see tangible progress (like a production line running or at least a completed factory build-out) before committing capital or upgrading their view on the stock. Retail investors, who fueled Aptera’s crowdfunding, are often emotionally invested in the company’s success but may not have infinite patience either. Now that a public market exists for Aptera shares, even some true believers might decide to take profit or cut losses if they sense trouble ahead, whereas previously their money was locked in. Sentiment can turn quickly in such scenarios, so Aptera will need to deliver frequent positive updates to maintain goodwill.

As for forecasts, since Aptera has no revenue yet, any financial projections are highly speculative. The company likely has internal targets (for example, perhaps producing a few hundred vehicles in late 2024 was an earlier goal, now sliding into 2025/2026). One can attempt to frame potential outcomes:

- In a bull case, Aptera successfully starts low-volume production by late 2025 or early 2026, delivering the first vehicles to customers. This could unlock some revenue (albeit modest initially) and demonstrate proof of concept. If those early Aptera owners become evangelists for the product – showcasing real-world solar mileage and efficiency – it could spur more reservations and possibly attract a strategic partner or larger investment. The stock in this scenario could respond very positively, as the narrative would shift to Aptera being a leader in a new category of EV. Medium-term (next 2–3 years), Aptera could scale up production to thousands of units per year, perhaps expand to international markets, and even consider additional models (the company has floated ideas like a 4-wheel version or other body styles down the road). Some optimists compare Aptera’s potential to Tesla’s early roadster phase, arguing that while Aptera serves a niche, it could evolve or inspire technology that becomes mainstream (for example, if solar charging on EVs proves viable). Under this optimistic outlook, Aptera’s stock would likely be multiples higher than today’s price, reflecting growth prospects (though it would almost certainly require more capital raises to reach that point).

- In a bear case, Aptera might struggle to ever reach production in a sustainable way. Perhaps technical hurdles or supply chain delays continue to push out timelines, burning through the $75M and forcing Aptera to seek more funding under duress. If the stock stays depressed (say well under the private $40 share levels, or even below the current ~$9), raising significant new equity could be highly dilutive or not possible, creating a cash crunch. In this scenario, Aptera could be forced to drastically downscale, seek a buyout, or in the worst case, face insolvency like its peers. The competitive pressure from other EVs (even if not solar, just conventional EVs getting cheaper and more efficient) could also erode Aptera’s value proposition over time – for example, if in 2–3 years a used Tesla or Chevy EV is available for a similar price with proven reliability, some potential Aptera buyers might opt for that instead. Under these conditions, SEV shares could languish in penny-stock territory or even be delisted, delivering losses to investors.

Most observers see the outcome for Aptera as highly dependent on execution in the next 12–18 months. The company must hit critical milestones, such as starting test builds, crash testing the vehicle, and beginning deliveries to actual customers. Each step forward will build credibility (and likely be accompanied by press releases and fanfare). The market will be parsing those announcements closely. One early indicator to watch: Aptera’s ability to convert reservations into firm orders once the vehicle is ready. Reservation holders only put down small deposits; when it comes time to finalize a purchase, some may back out or delay. If Aptera reports a strong conversion rate and backlog of confirmed orders, that will be a bullish sign. Conversely, if reservations don’t translate into sales, that could spell trouble (it would mean the initial excitement didn’t carry through to actual demand).

It’s also worth noting macro-economic factors in the medium term. Interest rates are higher now than during the EV SPAC boom of 2020–21, which makes investors less tolerant of unprofitable companies and makes financing more costly. If the economy were to enter a recession, speculative ventures like Aptera could find it harder to raise money or attract buyers (though high gas prices often accompany geopolitical or economic turmoil, which can sometimes increase interest in efficient vehicles). Government policies by 2025 are generally EV-friendly, but Aptera might lobby for inclusion of autocycles in EV incentive programs – success or failure on that front could affect its pricing competitiveness.

Investor sentiment right now is tempered: many are in “show me” mode. The fact that Aptera’s stock settled around $9 on day one (about one-quarter of the price some private investors paid) indicates that public markets are valuing Aptera with a heavy discount for risk. This doesn’t mean the stock can’t rise – it certainly can if Aptera surprises to the upside – but it reflects a prudent wait-and-see approach. Online EV communities are filled with both supporters (“I believe in Aptera’s mission and I’m holding my shares long-term”) and skeptics (“I love the idea, but I fear this will end like Sono or Lightyear – I sold my stake”). Expert EV analysts often express hope that Aptera succeeds – as it would be a win for innovation and sustainability – but they pair that hope with warnings. As one Electrek writer put it after covering the string of solar EV setbacks: “We will see, but a lot of things need to go right for this to happen, and only a few need to go wrong for the whole thing to come crumbling down”electrek.coelectrek.co. That statement encapsulates the asymmetry of risk for Aptera at this stage.

Competing in a Crowded EV Landscape

While Aptera occupies a novel niche, it inevitably draws comparisons to other companies in the electric vehicle space – both the giants and the fellow startups. For investors evaluating Aptera, it’s instructive to consider how it stacks up against these peers and what the competitive landscape means for its future.

Tesla (NASDAQ: TSLA) is the undisputed leader in EVs and serves as a benchmark for the entire industry. With a market cap measured in the hundreds of billions (recently around or above the $1 trillion mark) and profitable operations, Tesla represents what success in EVs looks like. Aptera is not directly competing with Tesla’s main products (sedans, SUVs, and soon trucks) in terms of vehicle category – an Aptera is more of a hyper-efficient commuter vehicle, whereas Teslas are high-performance luxury-leaning cars. However, Tesla’s influence looms large. Investors often ask: Why would someone buy an Aptera instead of a used Tesla Model 3? It’s a fair question – the Model 3 is a proven, safe, full-featured car, and used prices have been coming down. Aptera’s answer lies in its efficiency and solar capability (the fact you might not need to charge an Aptera for routine drives). There is also a philosophical difference: Aptera is targeting customers who prioritize efficiency above all else, potentially a different demographic than Tesla’s tech-centric performance enthusiasts. Nonetheless, if Tesla (or another automaker) decided to release a super-efficient city car or a vehicle with significant solar charging, it could encroach on Aptera’s turf. For now, Tesla’s focus is elsewhere (on scaling Model Y, Cybertruck, etc.), so Aptera has a window where it’s offering something truly distinct.

From an investment viewpoint, Tesla’s stock has been volatile but remains a growth favorite – it ended Oct 13 at $413.49, down 5.1% that day amid broader tech stock swingssimplywall.st. By Oct 16, Tesla was trading around the mid-$400ssimplywall.st. It’s worth noting that Tesla itself went through periods of extreme volatility and near-death experiences in its early years; bullish Aptera investors sometimes draw parallels and argue that while Aptera is far smaller, it could similarly overcome early skepticism. Still, Tesla had delivered tens of thousands of cars before it achieved a sustained positive cash flow, something Aptera is far from doing yet.

Rivian (NASDAQ: RIVN) and Lucid (NASDAQ: LCID) are two U.S.-based EV startups that, like Aptera, caught investor imagination in the last few years. Rivian focuses on electric trucks and SUVs; Lucid on luxury sedans. Both have had massive capital injections (Rivian through an IPO and backing by Amazon/Ford, Lucid through a SPAC and backing by Saudi Arabia’s PIF). They have delivered actual vehicles – Rivian is producing thousands of R1T trucks and R1S SUVs per quarter, and Lucid has delivered a few thousand of its Air sedans. Despite this progress, both companies’ stocks have underperformed initial expectations, as Wall Street grew impatient with their steep losses and production hurdles. Lucid, for instance, once traded above $50 but was around the low $20s by late 2025simplywall.st. It recently announced a record quarter of 4,078 deliveries and a major 20k vehicle autonomous fleet deal with Uber, showing promise, but also had to cut its full-year production outlook due to supply chain issues and the looming loss of certain EV tax creditssimplywall.stsimplywall.st. This kind of mixed news – big partnerships on one hand, operational challenges on the other – has kept Lucid’s stock in check. Rivian, similarly, has been lauded for a great product and solid engineering, but it has burned through cash quickly to scale up, and its stock in October 2025 was well below its IPO peak. A value-investing analysis gave RIVN a middling score (57%) on a Benjamin Graham framework, citing that while Rivian has a decent balance sheet and some value signals (cash, not insane debt), it fails traditional metrics like P/E and P/B because it’s still losing money and trading above book valuets2.tech. In other words, even relatively successful EV startups are struggling to be viewed as true value or profit-generating companies.

What does this mean for Aptera? It underscores that the market’s tolerance for EV startups is not what it used to be. During the 2020–2021 SPAC craze, pre-revenue EV companies often saw sky-high valuations on promise alone. Now, in 2025, investors have been chastened by the difficulties Rivian and Lucid faced, not to mention outright failures like Lordstown Motors (bankrupt in 2023) or Nikola’s troubles. Aptera is pitching a story in an environment where investors ask much tougher questions about execution, unit economics, and path to profitability. The upside is that Aptera’s current public valuation (~$300M) is much lower than where Rivian or Lucid started trading, so in theory there may be more room for upside if Aptera beats the odds (the bar of expectations is lower). The downside is that Aptera won’t be given a long leash – any serious missteps could lead to a sharp sell-off, as investors have alternatives (they could put their money in more proven EV names or other sectors entirely).

Global competitors also play a role. Chinese EV companies like NIO, XPeng, and BYD are expanding and innovating. NIO, for example, has flirted with solar add-ons (like a solar spoiler option) and is known for battery-swap technology. In the Simply Wall St EV update, NIO’s stock was noted to be lagging – it was down over 10% on a day when others were up, closing around $6.71simplywall.st, perhaps due to specific news or general Chinese market concerns. BYD has a vast scale in EVs and could theoretically look at ultra-efficiency segments too. While Aptera is not likely on the radar of these giants yet, if its concept proved popular, it could face competition from well-funded players copying the idea (for instance, a major automaker launching a solar-roof option on a small EV, or a Chinese startup producing a similar 3-wheeler cheaply). Aptera’s best defense is its head start in development and the IP (intellectual property) it holds in composite structures and solar integration. The company would likely seek patents and try to establish a brand moat among eco-enthusiasts. But automotive is a domain where fast followers can sometimes outrun pioneers (consider how many EV models emerged to challenge Tesla after it proved the market).

The next 6–12 months will be telling for Aptera’s competitive positioning. If Aptera can demonstrate tangible progress – say, showing off a production line, or even delivering the first units to a few celebrity customers or fleet partners – it will gain credibility that sets it apart from vaporware. At the same time, Aptera will need to convince consumers that its product is not just a quirky gadget but a reliable mode of transportation. Companies like Tesla and Rivian have built extensive charging networks or service networks; Aptera will need creative solutions for service (perhaps partnering with existing auto shops or mobile service vans, given its simpler design). Any news of partnerships in these areas (charging, service, distribution) could be a catalyst for the stock, as it would reduce execution risk.

From an investment strategy perspective, Aptera (SEV) is undeniably a high-risk, high-reward play. Short-term traders might be attracted by the volatility – the stock could see quick jumps on news like government incentives for solar tech or drops on any delays. Long-term investors who believe in Aptera’s mission might view current prices as an attractive entry, essentially betting that Aptera could be a multi-bagger if it survives and thrives as a niche EV manufacturer. But even the most bullish will acknowledge that Aptera is a speculative position, likely suitable only as a small part of a portfolio given the binary outcomes possible.

It’s also not lost on observers that Aptera’s ticker symbol “SEV” ironically once belonged to Sono Motors (which stood for “Solar Electric Vehicle” presumably). Sono’s Nasdaq journey was short-lived, as mentioned. Aptera will strive to ensure that this time, “SEV” on the ticker boards represents a success story in solar mobility rather than a footnote. To do that, Aptera’s management will have to execute almost flawlessly in the coming year – hitting funding milestones, technical milestones, and maintaining transparency and trust with its investors (many of whom are also its customers). Every quarterly report and shareholder update will be crucial in managing expectations and sentiment.

Conclusion: Cautious Optimism for a Revolutionary Gamble

Aptera’s arrival on the public markets is a landmark moment for the company and a rare case of a truly novel automotive concept being tested in the crucible of investor sentiment. The company offers a bold promise – a car that can drive on sunshine and radically reduce the energy and cost required for personal transportation. This promise resonates in an era seeking sustainable solutions, and it has attracted a devoted community who have effectively willed Aptera into existence through crowdfunding and support. The Nasdaq debut, complete with a celebratory bell-ringing, symbolizes that Aptera has survived long enough to get a shot at the big leagues, a feat in itself given the fate of similar startups.

However, the market’s initial reaction – swinging Aptera’s stock from euphoric highs to precipitous lows – underscores the uncertainty ahead. Investors are clearly intrigued by Aptera’s potential but are also hedging against the substantial risks. In the coming weeks, the key things to watch will be: Can Aptera’s stock price find stability? Volatility could hamper its ability to draw on that $75M lifeline effectively. Will Aptera share positive development news to build confidence? Regular progress updates (for example, “we’ve begun building validation prototypes” or “crash testing is complete and passed”) could buoy the stock and silence some doubters. How will the broader EV market conditions affect Aptera? If EV stocks rebound and sentiment improves, Aptera might ride that wave; if there’s an EV sector slump or bad news (like a major EV company failure or falling demand), Aptera could be unfairly punished along with others.

For now, many analysts and EV experts advise a careful approach. One strategy floated is that Aptera might be best suited for patient, risk-tolerant investors who understand the binary nature of the investment. The stock could multiply in value if Aptera succeeds (given the low starting market cap), but it could also erode if milestones are missed. Due diligence is crucial – prospective investors should keep an eye on Aptera’s SEC filings, which will detail its cash flow and any material changes, and on industry news that might signal headwinds or tailwinds for solar mobility (such as technological breakthroughs in solar panels, or changes in autocycle regulations).

Despite the challenges, Aptera’s leadership remains outwardly optimistic. “We are building more than just a car; we are building a movement,” co-CEO Fambro said, emphasizing the mission-driven aspect of Aptera’s journeyaptera.us. That ethos – of advancing clean transportation and “true energy freedom” – is likely what keeps many investors and reservation holders rooting for Aptera. In an age where EVs are becoming mainstream, Aptera represents the next frontier: pushing efficiency to its limit and reimagining how vehicles get their energy. If Aptera can turn that vision into a driveway reality for customers, it may very well carve out a sustainable business and reward those who believed early on.

In conclusion, Aptera (SEV) has embarked on a new chapter as a public company with significant fanfare and significant challenges. The coming days and quarters will test whether its solar-powered ambition can withstand the harsh glare of the public markets. For now, Aptera remains a story of promise – one that blends innovation in engineering with the uncertainties of a startup – and investors would be wise to keep both the upside and downside firmly in view. The world will be watching to see if this futuristic three-wheeler can defy the odds and drive into a successful, sun-lit future.

Sources:

- Aptera Motors press release – “Aptera Motors Approved for Nasdaq Listing, Set to Trade Under Ticker ‘SEV’” (Oct 10, 2025)aptera.usaptera.us

- Aptera Motors press release – “Aptera Motors Executes $75 Million Equity Line of Credit Facility…” (Oct 14, 2025)aptera.usaptera.us

- TS2.tech News (Oct 16, 2025): Aptera Motors rings Nasdaq Closing Bell on SEV debutts2.tech

- GuruFocus News: “Aptera Motors (SEV) Debuts on Nasdaq via Direct Listing” (Oct 16, 2025) – company net loss, direct listing detailsgurufocus.comgurufocus.com

- Kraken.com: Real-time stock data for SEV (Oct 16, 2025) – first-day price range, open price, market capkraken.comkraken.com

- Electrek: Fred Lambert, “Aptera secures access to $75 million to bring its solar car to production” (Oct 14, 2025) – commentary on funding, insider lock-up, cash remainingelectrek.coelectrek.co

- Simply Wall St News: “Electric Vehicles Update – Aptera Motors Joins Nasdaq…Solar Focus” (Oct 13, 2025) – context on EV stocks (Tesla, NIO)simplywall.stsimplywall.st

- Simply Wall St – Lucid analysis: Sasha Jovanovic, “Lucid… Uber Ambitions With EV Policy Hurdles” (Oct 10, 2025) – Lucid Q3 deliveries and Uber partnership, production cutsimplywall.st

- TS2.tech market analysis: Validea guru check on Rivian (Oct 16, 2025) – value investor perspective on RIVNts2.tech

- Reuters: Victoria Waldersee, “Struggling for funds, Sono Motors abandons plans for solar-powered car” (Feb 24, 2023) – Sono Motors insolvency and solar EV industry contextreuters.com

- Electrek: Scooter Doll, “The future of solar EVs dims: Lightyear is bankrupt… Aptera on the brink” (Jan 26, 2023) – solar EV startups’ challenges, Aptera’s situation in early 2023electrek.co

- Electrek: Electrek’s Take commentary on Aptera’s outlook (Oct 2025)electrek.coelectrek.co.