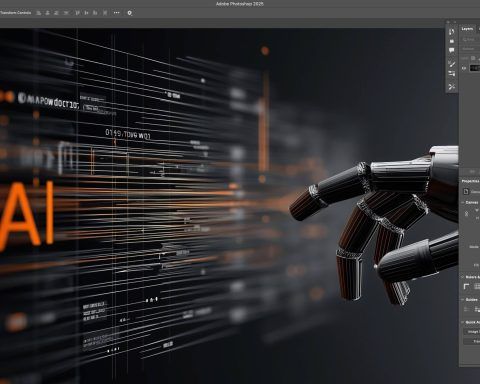

Photoshop vs Lightroom vs GIMP: The Ultimate 2025 Showdown for Photo Editors

Photoshop offers advanced AI features, Creative Cloud integration, and costs $20.99/month solo or $9.99/month with Lightroom. Lightroom Classic provides non-destructive editing and batch processing but can slow with large catalogs. GIMP is free, open source, runs natively on Linux, and will add a GTK3 UI and live layer effects in 2025. RAW processing is built into Adobe apps; GIMP needs external plugins.