New York, February 8, 2026, 14:05 EST — Market’s done for the day.

- Basic materials funds ended Friday up, following the wider risk-on bounce.

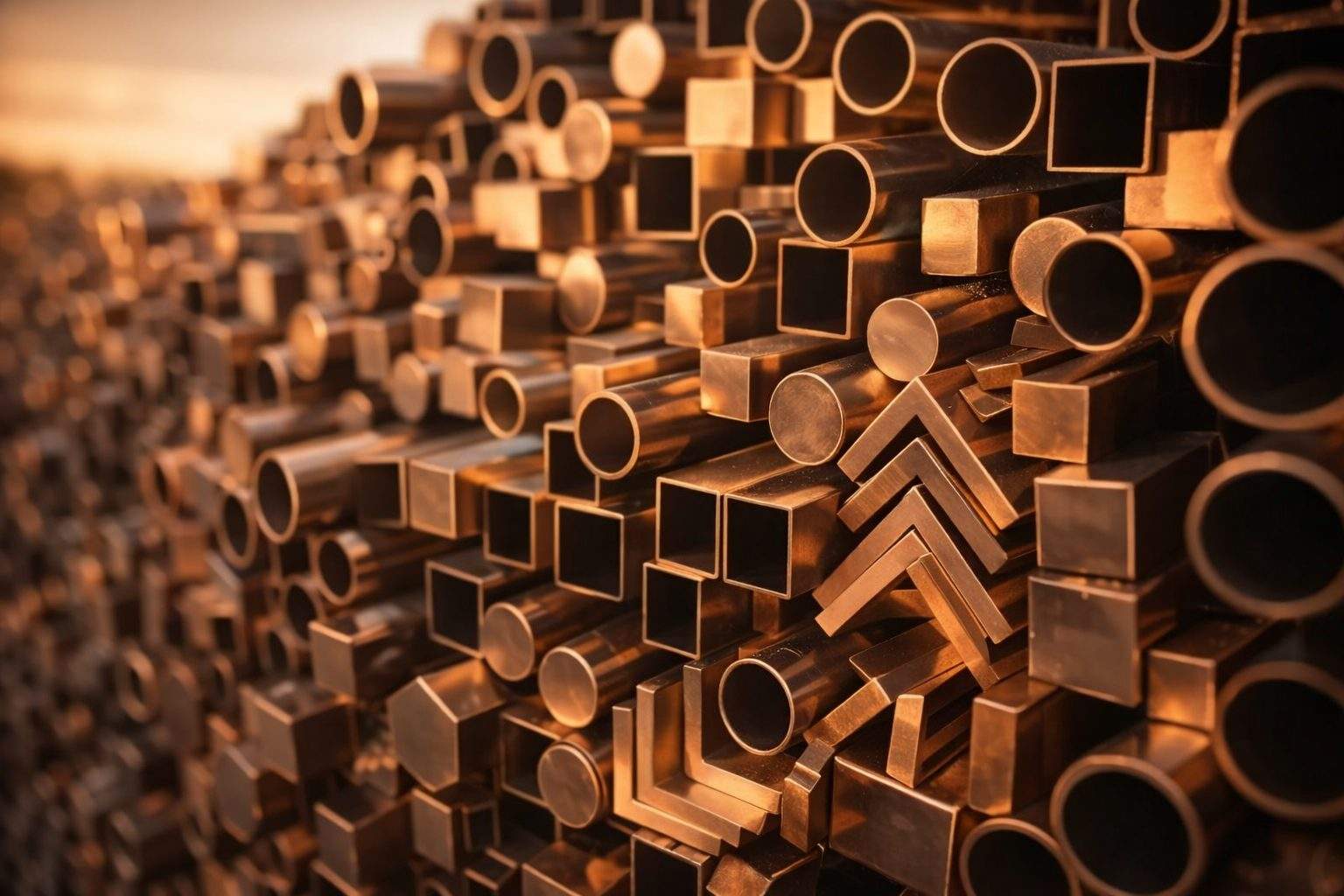

- Metals markets swung back and forth, copper and precious metals drawing trader focus.

- Eyes now turn to upcoming U.S. employment and inflation numbers due out later this week.

The iShares U.S. Basic Materials ETF (IYM) finished Friday up 2.3% at $176.81, trimming the gap to its 52-week peak to about 1.6% as U.S. stocks staged a strong rebound to end the week. Yahoo Finance

This shift matters: basic materials shares often move quickly when growth or inflation expectations change, and lately investors have been moving cash into “old-economy” names after tech’s rough run. “Rotation is the dominant theme this year,” said Angelo Kourkafas, senior global investment strategist at Edward Jones, with eyes now on the U.S. monthly jobs data out Wednesday and Friday’s CPI numbers. Reuters

Materials trade closely with the macro backdrop. When the economy picks up, that tends to bump up demand for industrial inputs. Sharper inflation, though, can shift the outlook for rates and the dollar. Those two, in turn, move commodity prices.

The S&P 500 materials sector jumped 1.77% on Friday, pushing its year-to-date gain to 12.45%. That’s a sharp turnaround after the swings in metals prices. SP Global

That tailwind mattered. The Dow finished Friday above 50,000 for the first time ever, rising 2.47% as traders rotated back into sectors tied closely to the economy. Reuters

Gold bounced back 3.9% to $4,954.92 an ounce on Friday, while silver surged 8.6% to $77.33. Both moves followed a period of dramatic price swings for precious metals. Jim Wyckoff, senior analyst at Kitco Metals, cautioned that gold’s rally might not last without a significant geopolitical spark. Reuters

Copper futures pushed higher as well, most recently advancing 1.14% to $5.8875 per pound. Industrial metals remain in the spotlight going into Monday’s cash-session open. CME Group

Bargain-hunters aren’t just sticking to the U.S. market. “Today seems a little bit of a relief rally,” Philip Petursson, the chief investment strategist at IG Wealth Management, told Reuters, commenting on Friday’s bounce in metal-related stocks. Reuters

Freeport-McMoRan climbed 2.45% to $60.67 on Friday, standing out among U.S. materials stocks. Newmont shares jumped higher, up 6.26% at $115.32. MarketWatch

Construction materials shares moved higher as well. Vulcan Materials picked up 4.17%, closing at $323.72. Martin Marietta Materials tacked on 2.84% to finish at $690.00, both stocks riding the broader surge in cyclicals. MarketWatch

Materials-focused funds also joined the rally. Vanguard Materials ETF (VAW) finished Friday at $234.69, up 2.24%, while Fidelity MSCI Materials Index ETF (FMAT) closed 2.25% higher at $60.05. Yahoo Finance

Yet metals markets remain choppy. CME Group has lifted margin requirements on COMEX gold and silver futures for the third time since mid-January, aiming to clamp down on risk as prices whip around; margin refers to the cash traders must put up to maintain their bets. Reuters columnist Andy Home also pointed out that China’s metal exchanges have been busy tightening rules and hiking margins over the past several months—dozens of tweaks, reflecting how speculative forces can push in either direction. Reuters

The stage is set for the next moves: The U.S. Employment Situation report for January drops Feb. 11 at 8:30 a.m. ET, with January CPI numbers landing just two days later, Feb. 13, also at 8:30 a.m. ET. Either release could jolt market expectations for rates—and with them, basic materials stocks. bls.gov