- Oct 22, 2025: Bitfarms (NASDAQ: BITF) closed at $3.94, down about 12.3% on the daymarketbeat.com. (In pre-market trading Oct. 23 it was up slightly to ~$4.02.) The stock has been extremely volatile this month, hitting a 52-week high around $6.20 on Oct. 14 before pulling backts2.techstockanalysis.com.

- Year-to-date: BITF is up roughly +148% in 2025ts2.tech, one of the strongest rallies in the market. The run began from a ~$1 price in January and accelerated in September and early October, in line with a crypto market resurgence.

- Bitcoin Surge: Bitcoin’s price recently soared to an all-time high (~$125,000) in early Octoberreuters.com. Analysts attribute this to massive demand – reportedly nearly $6 billion flowed into Bitcoin ETFs in one weekts2.tech – which in turn lifted miner stocks like Bitfarms. (For context, Bitcoin is up about +15% year-to-date.nasdaq.com)

- Corporate Moves: Bitfarms announced major strategic initiatives. On Oct. 14 it revealed CFO Jeff Lucas will retire, with veteran banker Jonathan Mir (ex-Lazard) named successorts2.tech. It also launched a $500 million convertible note offering (up from an initially proposed $300M) at 1.375% interest, due 2031 – convertible into shares at ~$6.86 each (about a 30% premium)investor.bitfarms.com. The deal was fully subscribed (including an $88M overallotment) and closed Oct. 21investor.bitfarms.com. CEO Ben Gagnon hailed it as a “tremendous success” that gives Bitfarms the “financial firepower and flexibility” to expand its North American HPC/AI data center plansinvestor.bitfarms.com.

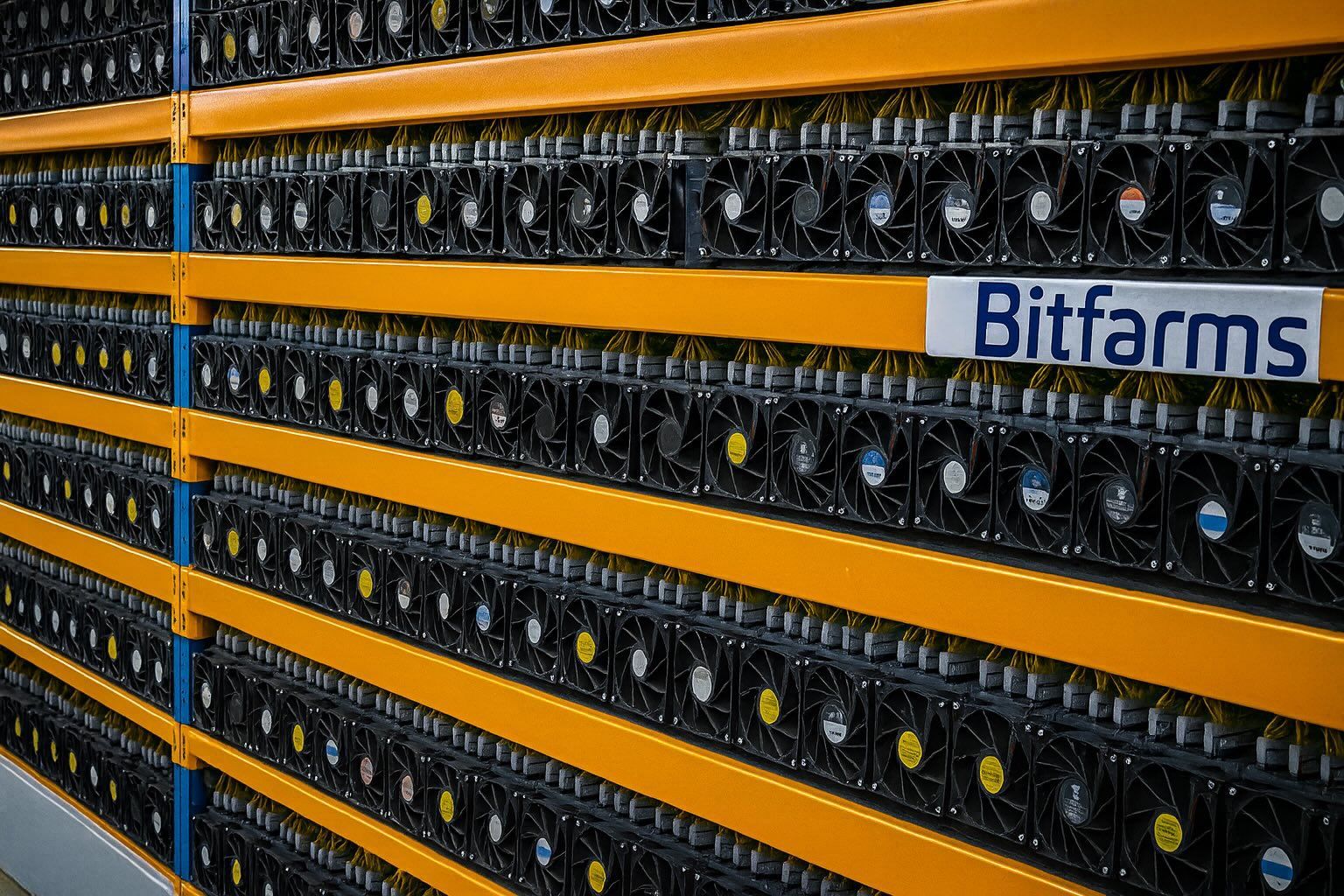

- AI/HPC Pivot: Bitfarms is aggressively pivoting beyond Bitcoin mining. It converted a $300M debt facility with Macquarie into a project loan to finance its 350 MW “Panther Creek” AI/HPC campus in Pennsylvania, even drawing an extra $50M to accelerate constructioninvestor.bitfarms.com. CEO Gagnon said this move “accelerates our construction timelines” for the HPC/AI campusinvestor.bitfarms.com. Management emphasizes Bitfarms is becoming a “digital infrastructure” firm focused on high-performance computing, not just crypto miningts2.techinvestor.bitfarms.com.

- Analyst Outlook: Wall Street sentiment is cautiously optimistic. 7 of 8 analysts covering BITF rate it a “Buy”marketbeat.com. The average 12-month price target is about $4.35 (roughly 10% above the current ~$3.94)marketbeat.com. The highest target is $7.00marketbeat.com, reflecting bullish views of Bitfarms’ strategy, while the lowest is $2.00. Bulls praise the AI/HPC pivot and aggressive buybacks; bears note Bitfarms is still unprofitable. As one analyst warned, “fundamentals still lag” this stock’s meteoric risets2.tech. (Indeed, Bitfarms reported Q2 revenue $78M but a net loss of $29Mts2.tech.)

- Insiders & Valuation: Bitfarms has used recent cash inflows to buy back stock (authorized for up to 10% of float) – the CFO stated the buyback shows management believes the market is “significantly undervaluing” the sharesinvestor.bitfarms.com. Short interest is modest (about 9% of floatfintel.io), suggesting relatively few investors are betting against the stock right now.

- CEO/CFO Commentary: Leadership is upbeat. CEO Gagnon says Bitfarms now has over $1 billion in liquidity (cash, Bitcoin and available credit) and is “moving forward at full speed” on its AI/HPC projectsinvestor.bitfarms.com. Outgoing CFO Lucas – reflecting on his tenure – noted Bitfarms has “never been better capitalized” with “a long runway of growth” aheadts2.tech.

The bottom line: Bitfarms is riding a double tailwind of an explosive Bitcoin rally and its own strategic shift into AI data centers. Its stock is highly volatile (beta ~4–5) and swings with crypto prices. After a furious multi-month rally, BITF has paused and retraced from its mid-October highs (reflecting classic overbought conditionsts2.tech). Whether the rally continues hinges on Bitcoin staying strong and Bitfarms executing its expansion. With record BTC prices boosting mining margins and a huge war chest from recent financings, Bitfarms may deliver outsized gains if it can turn its plans into profits.

However, investors should note risks: Bitfarms is still loss-makingts2.tech, Bitcoin’s price could reverse, and the AI data center business is highly competitive. At current levels (~$4), many analysts feel the stock already prices in most positives. As one industry watcher put it, “the fundamentals need to catch up” to justify the hypets2.tech.

Sources: Bitfarms press releases and investor updatesinvestor.bitfarms.cominvestor.bitfarms.com; market analysis by TechStock²ts2.techts2.techts2.tech; major news outlets (Reuters, Nasdaq/Zacks)reuters.comnasdaq.com; and financial sites (MarketBeat)marketbeat.commarketbeat.com. All information is current as of Oct. 23, 2025.