- Roller-Coaster Price: Bitfarms Ltd. (NASDAQ: BITF) shares are trading around $4.10 on October 24, 2025 after a volatile weekts2.tech. The stock hit a 52-week high near $6.20 on Oct. 14 amid crypto euphoria, then plunged about 40% in the following sessions, dropping to $3.94 by Oct. 22ts2.techts2.tech. Despite recent swings, BITF remains up roughly +148% year-to-datets2.tech, dramatically outperforming the broader market.

- Bitcoin Boom (and Pullback): A Bitcoin rally underpinned Bitfarms’ surge. BTC’s price spiked to an all-time high around $125,000 in early Octoberts2.tech, fueled by nearly $6 billion of inflows into new Bitcoin ETFs in one week. Higher Bitcoin prices directly boost miners’ profit margins, lifting stocks like Bitfarms. However, crypto volatility resurfaced – mid-month, Bitcoin slipped from ~$122K to ~$104K in a sharp correction on macro jittersts2.tech, and BITF’s stock “extended its losing streak to a 5th session” on Oct. 22, falling 12% that day to $3.94insidermonkey.com.

- Strategic Moves: Bitfarms is pivoting beyond mining with major expansion plans. This month it raised $500 million (upsized from $300M) via convertible senior notes due 2031 at a low 1.375% rateinsidermonkey.cominsidermonkey.com. The fully subscribed offering (total $588M including overallotment) will fund Bitfarms’ push into high-performance computing and AI data centersinsidermonkey.cominsidermonkey.com. Management calls the financing a “tremendous success” providing the “financial firepower” for a 350 MW HPC/AI campus under construction in Pennsylvaniats2.techts2.tech.

- Leadership Change: Alongside its tech pivot, Bitfarms announced a C-suite shakeup. Longtime CFO Jeff Lucas will retire on Oct. 27, to be succeeded by veteran investment banker Jonathan Mir (formerly of Lazard)ts2.tech. CEO Ben Gagnon says the leadership move positions Bitfarms to “execute on our HPC/AI growth strategy” as the company rebrands itself as a broader “digital infrastructure” provider, not just a Bitcoin minerts2.tech.

- Analyst Sentiment: Wall Street is cautiously bullish on BITF. 7 out of 8 analysts rate the stock a “Buy,” yet the average 12-month price target is only about $4.35 – roughly 10% above the current pricets2.tech. Some bulls have issued higher targets (Northland Capital recently went as high as $7.00) citing Bitfarms’ “disciplined finances and [the] HPC pivot” as key strengthsts2.tech. However, skeptics warn the “fundamentals still lag” the stock’s meteoric risets2.tech – Bitfarms remains unprofitable (Q2 2025 revenue was $78M with a net loss of $29M)ts2.tech, and one independent ratings firm even slapped a Sell rating (D–) on shares, deeming the rally overextended.

- Mining Sector Surge: Bitfarms isn’t alone – crypto mining stocks broadly soared during 2025’s crypto boom. Rivals Riot Platforms (RIOT) and Marathon Digital (MARA) have rallied in tandem with Bitcoin’s spike to record highs. Marathon’s stock leapt almost 10% in a single day last week (now trading near $22), and Riot’s market capitalization swelled past $7 billion amid the frenzyts2.tech. Even smaller miners like Hut 8 and Cipher notched double-digit gainsts2.tech. But the tide can turn quickly: miners slid during Bitcoin’s mid-October pullback, underscoring the sector’s vulnerability to crypto volatility.

- Crypto Market Context: Bitcoin is still up about +15% in 2025ts2.tech and many industry observers remain bullish on its trajectory. For instance, Standard Chartered recently projected BTC could reach $135,000–$150,000+ in the near future if current trends persistts2.tech. Marathon’s CEO Fred Thiel is even more optimistic, predicting Bitcoin could approach $200K by late 2025ts2.tech. Such forecasts, if realized, would further boost miners’ fortunes. However, caution abounds – renowned investor Robert Kiyosaki warned of a potential 50% crypto crash before the next big rallyts2.tech, and analysts note that after the initial ETF-driven euphoria, a “lack of new catalysts” could stall crypto’s momentum in the short termts2.tech. Bitfarms’ ability to sustain its stock gains may hinge on Bitcoin’s stability and the company’s execution of its new AI-centric initiatives.

BITF Stock Price on Oct. 24 and Recent Performance

As of midday October 24, Bitfarms stock trades around $4.10, rebounding modestly after a steep sell-off in recent daysts2.tech. The current price is up roughly +5% from Wednesday’s close of $3.94ts2.tech, suggesting some stabilization following a volatile week. On Oct. 22, BITF plunged 12.3% in a single session to $3.94ts2.tech – marking its fifth straight daily declineinsidermonkey.com. That drop capped a rapid slide from the stock’s 52-week high near $6.20 reached just over a week earlier on October 14ts2.tech. In total, Bitfarms shed about 40% of its value in the span of five trading days after that peak, mirroring a pullback in the broader crypto market.

Despite the recent turbulence, Bitfarms’ overall 2025 performance remains striking. Year-to-date the stock has skyrocketed approximately +148%ts2.tech, rising from around $1 in January to the $4–$5 range by mid-October. It was one of the market’s hottest stocks during the late summer and early fall crypto rally. For the week of Oct. 13–17 alone, BITF surged nearly +19%, making it the top-performing financial stock over $2B in market cap for that weekts2.tech. Such outsized gains have come with equally intense swings – the stock’s beta is estimated around 4–5, indicating Bitfarms is about four to five times more volatile than the overall marketts2.tech. In practical terms, BITF often moves in big leaps: it’s not uncommon for the share price to jump or drop by 5–10% (or more) in a single day when crypto news hitsts2.tech. This high volatility was on full display in October: for example, Bitfarms surged nearly +9% on Oct. 14 to an intraday high of ~$6.20, then within days slid back under $4ts2.tech. Traders attribute this roller-coaster behavior to Bitfarms’ tight correlation with Bitcoin prices and shifting investor sentiment – optimism can turn to profit-taking overnight.

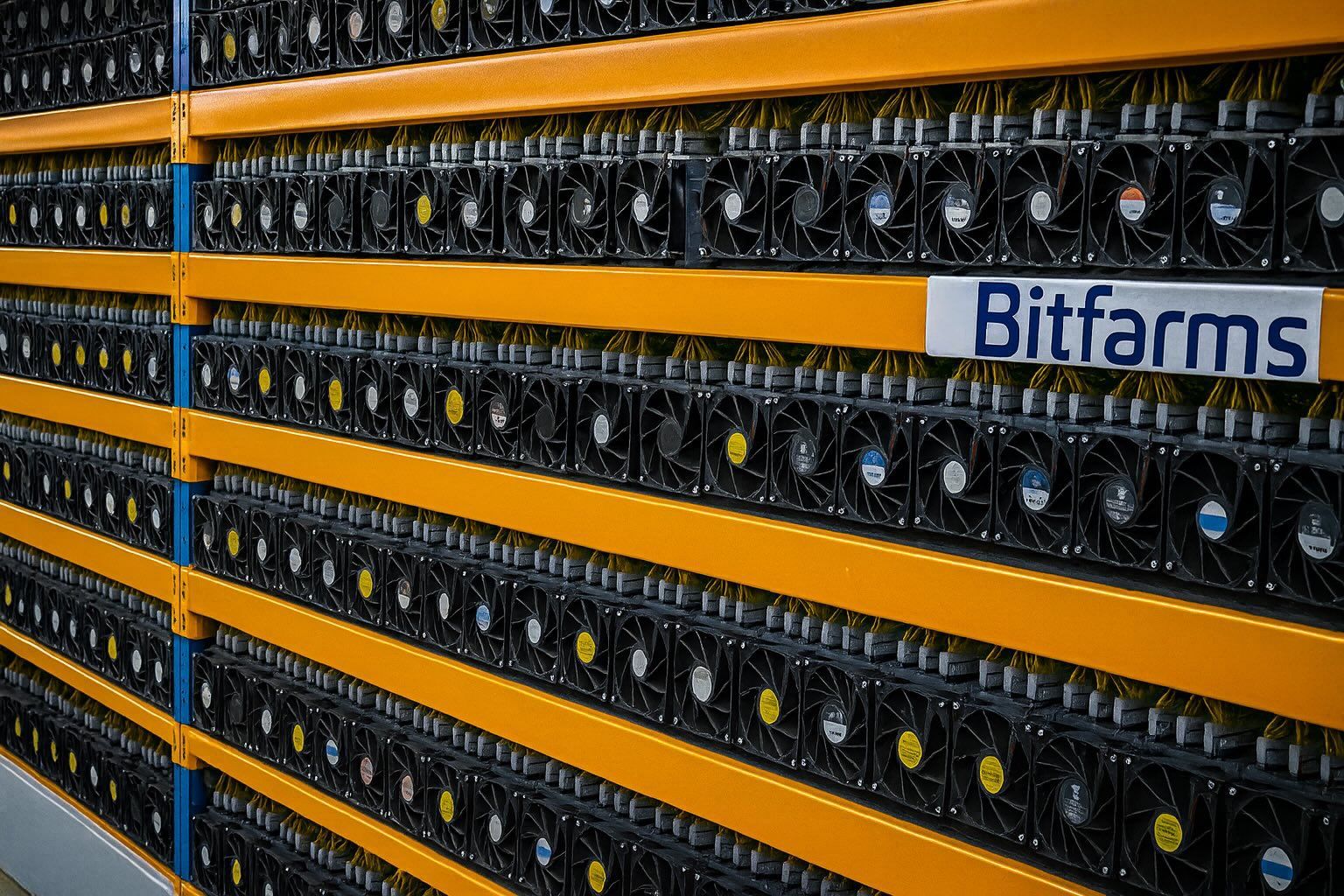

A Bitfarms cryptocurrency mining facility housing rows of high-powered mining computers. The company’s stock has swung wildly alongside Bitcoin’s price, and it is now channeling freshly raised funds into building large-scale data centers for AI and cloud computing.

Notably, Thursday Oct. 23 saw Bitfarms shares trying to find a floor. After the 5-day losing streak, BITF opened higher on Thursday and traded up as much as +5–6% intradayaaii.com, roughly tracking a brief bounce in Bitcoin. By Friday Oct. 24, the stock is hovering just above $4 – still well below its recent highs, but no longer in freefall. This choppy action reflects a broader consolidation in crypto-related stocks: after a blistering rally through mid-October, miners like Bitfarms have pulled back and are now seeking direction. Whether Bitfarms stock can regain upward momentum may depend largely on upcoming news catalysts (like its earnings report expected in a few weeks) and the next moves in Bitcoin’s price.

Recent Developments: Expansion, AI Pivot, and Leadership Changes

Bitfarms’ wild stock ride comes amid significant corporate developments that have transformed the company’s trajectory in recent weeks. In mid-October, Bitfarms unveiled a series of strategic moves aimed at expanding its business beyond Bitcoin mining:

- $500M Capital Raise: On Oct. 15, Bitfarms announced a $300 million convertible note offering, which was quickly upsized to $500 million due to strong investor demandts2.tech. The notes carry a low 1.375% interest rate and mature in 2031, with an option for holders to convert to equity at an initial price of about $6.86 per share (a ~30% premium to BITF’s market price at issuance)insidermonkey.com. The offering – which included an additional $88M overallotment, bringing total proceeds to $588 million – was fully subscribed and closed successfully on Oct. 21insidermonkey.cominsidermonkey.com. Bitfarms’ CEO Ben Gagnon hailed the financing as a “tremendous success,” saying it gives the company the “financial firepower and flexibility” to execute its growth plansts2.tech. Importantly, this cash infusion greatly boosts Bitfarms’ balance sheet: with the new funds, the company now has over $1 billion in liquidity (combining cash, Bitcoin holdings, and credit availability), according to managementts2.tech. The capital is earmarked primarily to expand Bitfarms’ foray into high-performance computing (HPC) and AI infrastructure, a venture the company sees as key to its future.

- AI Data Center Ambitions: Bitfarms is aggressively pivoting into the AI/cloud computing space, leveraging its expertise in running energy-hungry data operations. The company has begun construction of a 350 megawatt “Panther Creek” campus in Pennsylvania that will host HPC and AI data centersts2.tech. To finance this, Bitfarms restructured an existing $300M credit facility with Macquarie into a dedicated project loan and even drew an extra $50M to accelerate the build-outts2.tech. The first phase (50 MW) of Panther Creek is expected to come online in 2026, with the campus scaling to 300–350 MW by 2027ts2.techts2.tech. Bitfarms aims to offer cloud providers and tech clients low-cost, reliable computing power – essentially repurposing its mining infrastructure to serve the booming demand for AI supercomputing. Management emphasizes that this move diversifies revenue streams ahead of challenges like bitcoin mining reward cuts. “We are becoming a digital infrastructure company,” CEO Gagnon said, underscoring that Bitfarms doesn’t want to be seen as just a crypto miner anymorets2.tech. The strategy reflects a broader trend: GPU-powered AI data centers are in high demand – evidenced by a recent OpenAI–AMD partnership to deploy 6 gigawatts of new AI chips in coming years, a deal that boosted sentiment for firms in the HPC spacenasdaq.com. Bitfarms is betting its power capacity and experience in managing large-scale computing farms will let it carve out a niche in this competitive field.

- CFO Transition: Along with the growth initiatives, Bitfarms announced a leadership change in its finance team. Longtime Chief Financial Officer Jeff Lucas will step down (effective October 27) after over three years in the role. Taking his place is Jonathan Mir, an industry veteran with 25+ years in investment banking (including stints at Lazard and Bank of America focused on energy and infrastructure)ts2.techts2.tech. The CFO succession plan was revealed on Oct. 14 and framed as part of Bitfarms’ evolution. CEO Gagnon praised Mir’s capital markets expertise, saying it will help Bitfarms “execute on our HPC/AI growth strategy in Pennsylvania, Québec and Washington” (areas where the company operates data centers)ts2.tech. Outgoing CFO Lucas will remain as an advisor through Q1 2026 to ensure a smooth handoff. The leadership shuffle comes on the heels of other shareholder-friendly moves earlier in 2025 – Bitfarms initiated a stock buyback program over the summer (authorizing repurchases of up to 10% of shares) as a signal of confidence in its valuationts2.tech. The company also recently adopted U.S. GAAP accounting and opened a New York office, reflecting its shift from a small Quebec mining outfit toward a more diversified, globally-oriented tech infrastructure firmts2.tech.

- Regulatory & Legal Update: One cloud on the horizon has been a shareholder lawsuit filed against Bitfarms in mid-2025. The class-action suit alleges that the company made misleading statements regarding its financial reporting and internal controls, including how it classified certain cash flows and crypto assetsts2.techts2.tech. The complaint suggests Bitfarms might even need to restate some financials, though the company has not indicated any wrongdoing. This litigation is in early stages and so far hasn’t materially impacted the stock (investors have been far more focused on Bitcoin’s price and Bitfarms’ expansion news). Still, it’s an “unresolved background issue to watch,” according to analyststs2.tech. Bitfarms has said little publicly about the case, but any developments will bear monitoring as they could affect investor confidence if they reveal internal missteps.

In sum, Bitfarms spent October executing a dramatic pivot – raising a war chest of capital and refocusing the business toward AI and cloud computing – even as its core crypto mining operations rode the ups and downs of Bitcoin’s price. The company’s bold bets and changes in leadership signal an intent to transform for the future, but they also introduce new variables for investors to digest.

Bitcoin & Crypto Market Backdrop

Bitfarms’ fate is closely intertwined with the broader cryptocurrency market, especially the price of Bitcoin, which remains the primary source of the company’s revenues (Bitfarms mines and holds BTC). The surge and slide of BITF stock in October can be understood in the context of Bitcoin’s own roller-coaster month.

Early October Crypto Euphoria: The month began with a powerful bitcoin rally. By October 10, BTC had smashed through its previous all-time high, reaching about $125,000 per coints2.tech. This represented a roughly +15% gain year-to-date for Bitcoin pricests2.tech, a remarkable recovery considering BTC languished under $30K as recently as mid-2024. Fueling the spike was a wave of positive developments – most notably, the launch of several Bitcoin spot ETFs in the U.S. attracted nearly $6 billion of inflows in just one week, signaling robust institutional demandts2.tech. At the same time, macroeconomic trends like expectations of Federal Reserve rate cuts and a weakening U.S. dollar added tailwinds for crypto assetsnasdaq.comnasdaq.com. The result was a classic “risk-on” frenzy: as Bitcoin ran up to record levels, crypto-mining stocks soared in tandem, often amplifying BTC’s moves. Bitfarms, being a pure-play Bitcoin miner, nearly quintupled its share price from summer to mid-October, largely riding on this crypto market optimism.

Mid-Month Volatility: However, even “Uptober” (as crypto fans dub October bullishness) had its hiccups. The crypto market reminded everyone that volatility cuts both ways. Around Oct. 10–11, geopolitical and economic headlines (including rumors of new U.S.–China tariffs) spooked investors, and Bitcoin abruptly plunged from ~$122K down to ~$104K within 48 hoursts2.tech. This ~15% pullback in BTC reverberated to mining stocks: “all bets are off if macro conditions suddenly shift,” one market watcher notedts2.tech. Indeed, Bitfarms shares, which had been hitting new highs, tumbled during that dip before rebounding. A similar pattern occurred the following week: on Oct. 16, Bitfarms announced its large convertible debt issuance, which initially rattled shareholders and coincided with another downtick in Bitcoin’s price. BITF stock fell 18% intraday on Oct. 16 amid dilution fears and broader profit-takingts2.tech. By Oct. 22, Bitcoin was hovering in the $110K-$115K range (off its peak), and Bitfarms’ stock had slid back to earth around the mid-$3sinsidermonkey.com.

Late October and Outlook: As of Oct. 24, Bitcoin appears to be stabilizing in the low $120K’s after its mid-month volatility. Crypto analysts are divided on what comes next. Bulls argue that the structural forces driving Bitcoin’s rally – institutional adoption (via ETFs and corporate treasuries), limited supply, and macroeconomic hedging – remain intact, and that this could be just the beginning of a larger uptrend. For example, banking giant Standard Chartered recently projected that Bitcoin could climb to $135,000–$150,000 or higher in the near future if current momentum continuests2.tech. Some even see much bigger milestones on the horizon: Fred Thiel, CEO of Marathon Digital, has publicly predicted BTC could reach $200,000 by the end of 2025ts2.tech, citing accelerating mainstream interest and the potential of another halving-cycle bull run. Such outcomes would be game-changing for miners like Bitfarms – higher Bitcoin prices directly translate to fatter mining profit margins and increased asset values on their balance sheets.

On the other hand, bears and skeptics warn that the crypto market may be overextended in the short term. They point out that Bitcoin’s rapid surge has outpaced any immediate fundamental catalyst now that ETF approvals are largely priced in. “After the initial ETF excitement, the lack of new catalysts could cause crypto gains to stall,” notes Ruslan Lienkha, a crypto strategistts2.tech. Additionally, concerns about the broader economy persist – if inflation flares or global conflicts intensify, risk assets like crypto could retreat. Famous investor Robert Kiyosaki recently cautioned that Bitcoin could even see a 50% crash from its highs before the next major rally, as bull markets often face gut-wrenching correctionsts2.tech. Furthermore, the 2024 Bitcoin halving (which took place in April 2024, cutting mining rewards in half) has made the mining business less immediately profitable unless prices stay high. This halving effect was one factor that squeezed Bitfarms’ mining margins earlier in the year and partly prompted its diversification into HPC/AI servicesnasdaq.com. In short, the crypto backdrop carries both promise and risk: Bitfarms benefits enormously when Bitcoin is booming, but it remains exposed if the crypto tide goes out.

Crypto Mining Stocks Rally: Bitfarms vs. Peers

The fortunes of Bitfarms are closely tied to its peers in the crypto mining sector, which has seen a broad rally in 2025. The same forces lifting BITF – primarily Bitcoin’s strength – have boosted other mining companies, making the group a standout performer in the market this year.

Two of the largest U.S.-listed miners, Riot Platforms (NASDAQ: RIOT) and Marathon Digital Holdings (NASDAQ: MARA), have experienced similar surges:

- Marathon Digital (MARA): Marathon’s stock has climbed significantly this year, recently trading around $22 per share. Just last week, MARA popped nearly +10% in a single day as Bitcoin hit record levelsts2.tech. Marathon has been aggressively expanding its mining capacity and, notably, accumulating Bitcoin on its balance sheet as a long-term investment. The company now holds over 52,850 BTC (worth ~$6.5 billion at current prices), one of the largest stashes among public minersts2.tech. Marathon’s CEO Fred Thiel is extremely bullish on the industry – as mentioned, he envisions Bitcoin potentially reaching $200K within a yearts2.tech. Marathon’s strategy of hodling BTC means its stock is almost like a leveraged bet on Bitcoin itself: when BTC rises, Marathon’s asset value and book value swell. This helped Marathon’s share price rocket alongside Bitfarms’ in 2025’s rally. Conversely, Marathon also felt the pain of the recent pullback, and its stock has been similarly volatile week-to-week.

- Riot Platforms (RIOT): Riot’s stock has likewise benefited from the crypto boom. Riot’s market capitalization has now exceeded $7 billion after its shares rallied strongly through mid-Octoberts2.tech. The company has differentiated itself partly via its energy strategy – Riot invested heavily in its Texas mining facilities and even earns revenue by selling electricity back to the grid during peak price periods, a nifty side business that buffered it during past crypto downturnsts2.tech. Riot was actually an early strategic investor in Bitfarms, holding a sizable stake in the Canadian company. Interestingly, recent filings revealed Riot trimmed its Bitfarms stake below 10% during BITF’s big run-up, taking some profit off the tablets2.tech. Some analysts took that as a sign that even an industry insider felt Bitfarms’ valuation had grown rich in the near termts2.tech. In any case, Riot remains a heavyweight in the sector and often trades as a proxy for U.S. mining activity at scale. Its stock is up sharply year-to-date, and it continues to expand operations (while pocketing extra income from power curtailment programs).

Beyond these two, an array of smaller crypto miners have also seen their stock prices skyrocket in 2025’s crypto renaissance. Companies like Hut 8 (HUT) – which recently merged with US Bitcoin Corp and saw its shares (post-consolidation) approach C$50 – Bitdeer (BTDR), Cipher Mining (CIFR), and Iris Energy (IREN) all notched double-digit percentage gains in recent weeksts2.tech. The entire mining sector has been riding the rising tide of Bitcoin’s price. This sector-wide momentum has been a boon for Bitfarms: as a smaller cap miner, BITF sometimes outpaces even its larger peers on the way up (thanks to its lower base and high beta). Indeed, Bitfarms’ ~400%+ rise over the past six months far exceeds the performance of the crypto index or larger tech benchmarksnasdaq.com.

However, the intense correlation with Bitcoin means mining stocks also tend to fall in unison when sentiment sours. We saw this in mid-October – news of macro risks and Bitfarms’ dilution event dragged down most mining shares simultaneously. It’s a reminder that while Bitfarms has unique elements (like its AI pivot) that could set it apart long-term, in the day-to-day markets it often trades in a basket with names like Riot and Marathon. For investors, diversification within the crypto mining space provided little shelter from the recent downdraft; the whole group remains at the mercy of Bitcoin’s next move.

Going forward, industry dynamics will also be shaped by the Bitcoin “halving” that occurred in April 2024 and its aftermath. The halving cut the block reward for miners from 6.25 BTC to 3.125 BTC, instantly reducing mining revenue per hash. This has pressured miners to improve efficiency and scale to maintain profitsts2.tech. Companies with lower costs of power and newer mining rigs (higher hash-rate per energy unit) are better positioned. Bitfarms has managed to grow its hash rate significantly and reported solid gross mining margins (~45% in Q2) despite the halvingts2.tech, but sustaining that will require continued investment. Rival miners are in a race to expand capacity – many ordered new fleets of ASIC miners for delivery through 2024–2025. Bitfarms’ decision to diversify into hosting AI computing is partly a hedge against these mining economics: if pure crypto mining becomes less profitable, having a foot in the data center business could give it a more stable revenue stream. In contrast, companies like Marathon and Riot remain almost entirely focused on Bitcoin mining (and accumulation), essentially doubling down on crypto. Time will tell which model pays off more in the next few years.

Analyst & Expert Views on BITF

The dramatic rise of Bitfarms’ stock has attracted a mix of optimism and caution from analysts and industry experts. Here’s a look at what the bulls and bears are saying about BITF as of late October 2025:

Bullish Optimism: Most Wall Street analysts covering Bitfarms have a positive view of the company’s prospects, especially applauding its strategic expansion beyond mining. According to MarketBeat data, 7 of 8 analysts currently rate BITF as a “Buy”ts2.tech. Bulls argue that the company’s moves to strengthen its finances and pivot into high-growth areas could unlock significant value. “Disciplined finances and the HPC pivot are key strengths,” says Martin Toner, an analyst with ATB Capital Marketsts2.tech. He notes that Bitfarms has assembled a large pipeline of energy capacity (~1.3 GW across sites in Québec, Washington, and Pennsylvania) that can be harnessed for next-gen computing infrastructurets2.tech. By leveraging cheap power and its operational expertise, Bitfarms could become a notable player in the booming AI/cloud hosting arena. Bulls also highlight Bitfarms’ improved financial position after the fundraising and its commitment to shareholder value (citing the stock buyback program as evidence that management sees the shares as undervaluedts2.tech). Some have raised their outlook accordingly – for example, Northland Capital initiated coverage on BITF recently with a $7.00 price target, one of the highest on the Street, implying confidence that the stock has further upside as the company executes on its plansts2.tech. Bitfarms’ own leadership echoes the bullish case: departing CFO Jeff Lucas stated the firm has “never been better capitalized” and has “a long runway of growth” ahead with over $1 billion in liquidity to deployts2.tech. CEO Gagnon has outlined an ambitious vision to “capture significant market share” in the emerging AI infrastructure market, leveraging Bitfarms’ background in managing power-hungry operationsts2.tech. This narrative – that Bitfarms can ride two high-tech waves (crypto and AI) at once – has clearly resonated with many investors, as evidenced by the stock’s hefty rally. Proponents believe that if Bitcoin stays strong and the AI pivot yields new revenue streams by 2026, Bitfarms could transition from a money-losing miner into a diversified digital infrastructure provider with much higher valuation potential.

Bearish Caution: Not everyone on the Street is convinced, however. A minority of analysts and some independent researchers urge prudence, pointing out that Bitfarms’ fundamentals have yet to catch up to its soaring stock price. The company is still operating at a net loss – in Q2 2025 it lost $29 million, following a pattern of negative earnings in recent yearsts2.technasdaq.com. One analyst bluntly cautioned that “fundamentals still lag” BITF’s valuation, noting that even around $4–$5 per share, Bitfarms’ market cap (now ~$2.4–2.8 billion) implies very high multiples on any near-term earningsts2.tech. In other words, the stock is pricing in a lot of future success. If either Bitcoin prices falter or Bitfarms’ AI investments don’t generate expected profits, the disconnect could lead to a sharp correction. In fact, Weiss Ratings, an independent investment research firm, recently reiterated a “Sell” (D–) rating on Bitfarms in early October, arguing the rally looked overdone and investors were ignoring ongoing operational risksts2.tech. There are also signs that insiders and industry players are taking some money off the table: as mentioned, Riot Platforms quietly sold a portion of its Bitfarms stake during the stock’s peak runts2.tech. And while Bitfarms’ convertible debt raise was ultimately a success, the initial announcement of that $300M note offering spooked the market – the stock tanked nearly 18% intraday on Oct. 16 on fears of dilution and the company taking on debtts2.tech. Only after details emerged that Bitfarms had entered a “capped call” hedge (to offset potential dilution up to a higher stock price) did shares stabilizets2.tech. This episode is a reminder of how fickle market sentiment can be toward BITF. The moment confidence wavers – be it due to crypto market jitters, unexpected expenses, or dilution worries – the stock can swoon in a hurry. Bears argue that until Bitfarms proves it can generate consistent profits (or at least positive free cash flow) from its operations, the stock will remain speculative and vulnerable to swings.

Analyst Price Targets: The divergence in views is reflected in price targets. The consensus 12-month target for BITF is around $4.30–$4.50 per sharets2.tech, roughly where the stock trades now, suggesting limited upside based on current estimates. Many analysts set their targets when Bitfarms was much lower, and the stock’s rapid ascent overshot some of those forecasts. For instance, H.C. Wainwright had a $4.00 target (Buy) earlier in 2025 – a level that Bitfarms blew past by Octoberts2.tech. Some have since boosted targets (as noted, Northland’s bullish $7 call), but others are staying conservative. The highest targets in the market (around $6–$7) come from those most optimistic about Bitfarms’ growth plans and crypto outlookts2.tech. The lowest target (~$2) reflects a view that Bitfarms could retrace significantly if things go awryts2.tech. This wide range – from $2 to $7 – underscores the uncertainty around a stock like BITF. It essentially trades as a leveraged bet on Bitcoin plus execution of a new business venture. That means higher risk, but potentially higher reward.

To put numbers in perspective, even at ~$4/share Bitfarms is valued at roughly 3.5 times its annual revenue (using the first half of 2025 run-rate) and is not yet profitablets2.tech. Bulls counter that forward-looking investors are valuing the future hybrid mining–HPC company Bitfarms aims to become, not the trailing financials. Bears retort that competition in both bitcoin mining and cloud computing will remain fierce – established tech giants and countless startups are all chasing the AI data center opportunity, and Bitcoin mining margins can evaporate if BTC’s price slips or network difficulty rises. In short, Bitfarms has a lot to prove. The company will need to execute well on its expansion and show a path to profitability to fully justify the enthusiasm surrounding its stock. Until then, analyst opinions on BITF are likely to remain split down bullish vs. cautious lines.

Near-Term Forecasts and Outlook

Looking ahead, what’s in store for Bitfarms stock in the near to mid term? The consensus among market watchers is that BITF’s trajectory will continue to be heavily influenced by macro-crypto trends – chiefly Bitcoin’s price direction – as well as the company’s progress on its new initiatives. Here are the key factors to watch:

- Bitcoin Price Momentum: As the single biggest driver, Bitcoin’s performance will arguably make or break Bitfarms’ stock moves in coming months. If BTC extends its bull run and sustains six-figure price levels or climbs even higher, miners like Bitfarms stand to reap windfall profits. Some forecasts remain extremely bullish on crypto; apart from the rosy targets from Standard Chartered and Marathon’s CEO (>$150K BTC)ts2.techts2.tech, there’s also a general optimism that U.S. ETF adoption and increasing mainstream investment could push Bitcoin into a long “supercycle.” Under such a scenario, Bitfarms’ mining revenues would likely surge to record highs, potentially allowing the company to achieve profitability for the first time if costs are kept in check. Moreover, a strong Bitcoin would make it easier for Bitfarms to fund growth internally (through mining cash flow) rather than relying on debt or equity raises. Upside case: Bulls say BITF could revisit its highs or move beyond if Bitcoin roars ahead to new records and the company’s quarterly results start reflecting improved margins.

- Crypto Volatility/Risks: On the flip side, any significant pullback in crypto would almost certainly pressure Bitfarms’ stock. Crypto markets remain highly volatile and sentiment-driven. A sudden regulatory blow (for example, unfavorable SEC actions or international crackdowns) or a risk-off turn in broader markets could send Bitcoin tumbling, as history has shown. Even a dip back toward the $80K–$100K range for BTC – while not disastrous for miners’ economics – might cool the speculative fervor that propelled stocks like BITF up multiple-fold. Some veteran investors are preparing for exactly that: “Current prices already reflect a lot of good news,” one strategist noted, suggesting crypto could consolidate or even correct sharply (~20–50%) before the next leg upts2.tech. Downside case: If Bitcoin were to retrace or languish, Bitfarms’ stock could continue drifting down from its highs. In such an environment, focus would shift to how well Bitfarms can weather a crypto winter – its cash on hand, cost-cutting, and non-crypto revenue would be scrutinized.

- Execution of AI/HPC Pivot: Investors will be closely watching Bitfarms’ execution on its new high-performance computing ventures. The company has bold plans to stand up a large AI data center footprint by 2026–27, but delivering on those plans is the real test. Key milestones will include: the construction progress at Panther Creek (meeting timelines and budget), signing up anchor clients or partnerships for its data center capacity, and evidence that this business can generate substantial revenue. Any positive news – e.g. Bitfarms securing a major AI cloud customer, or completing the first 50 MW phase on schedule – could significantly boost confidence in the pivot and thus support the stock. Conversely, setbacks like construction delays, cost overruns, or trouble filling the new capacity with paying customers could raise doubts. The good news is Bitfarms now has a financial cushion (hundreds of millions in cash/BTC) to invest patientlyts2.tech. Unlike smaller competitors, it doesn’t need to dilute shareholders or turn a profit immediately to survivets2.tech. This flexibility gives management some breathing room to get the AI project right. Still, the clock is ticking – by late 2025 and into 2026, investors will want to see concrete results from this strategy, not just promises.

- Industry Competition & Events: The broader competitive and regulatory landscape will also shape outcomes. On the mining side, network hash rate (competitors’ combined computing power) continues to hit new highs, meaning miners must keep scaling just to maintain market share of bitcoin rewards. Any edge Bitfarms has in low-cost power or efficient mining will be important to preserve margins. On the tech side, the AI infrastructure arena pits Bitfarms against giants like Amazon (AWS), Microsoft (Azure), Google Cloud, and specialty firms with far deeper pocketsts2.tech. While Bitfarms doesn’t aim to compete head-on with Big Tech, it will need to find a niche (perhaps offering cheaper hosting in secondary markets) to attract clients. Additionally, external events such as the outcome of the SEC’s Bitcoin ETF decisions, macroeconomic shifts, or even the next Bitcoin halving (expected in 2028) can influence sentiment over the mid-term horizon. One nearer-term event every miner is eyeing is the potential for the Fed to cut interest rates in 2026 if inflation cools – which could weaken the dollar and boost alternative assets like crypto. Such macro shifts are hard to predict but could be catalysts.

Bottom Line: Bitfarms enters late 2025 as a company at a crossroads of two dynamic sectors – crypto and AI – offering both huge opportunity and significant uncertainty. In the bullish scenario, Bitcoin remains elevated (or climbs further), providing strong mining cash flows, while Bitfarms successfully launches its HPC data center business, thereby unlocking a second growth engine. In that case, BITF stock could see renewed upside, potentially retesting its highs or beyond, as investors reward both its crypto leverage and diversification. However, in a bearish scenario, if Bitcoin stumbles or if the AI pivot disappoints, Bitfarms might struggle to justify its current market value, and the stock could retrace more of its 2025 gains. Given the high volatility, even staunch bulls tend to temper their optimism with caution. As one industry observer put it, right now Bitfarms is “riding two of 2025’s biggest tech narratives – the Bitcoin boom and the AI revolution”ts2.tech. The company’s challenge is to prove it can straddle both successfully. If it can execute and the external environment cooperates, Bitfarms may well extend its remarkable run. If not, investors could be in for more of the wild swings that have characterized BITF’s journey so far. In the coming weeks and months, keep an eye on crypto market indicators and Bitfarms’ own operational updates – those will likely dictate where this high-flying stock heads next.

Sources: Financial disclosures and press releases from Bitfarms; real-time market data and analysis from TechStock² (ts2.tech)ts2.techts2.tech; industry commentary from Zacks, Nasdaq, and Reutersnasdaq.comts2.tech; and cryptocurrency market insights from Coindesk and Yahoo Financets2.techinsidermonkey.com. All information is current as of Oct. 24, 2025.