New York, Feb 1, 2026, 04:55 EST — The market has now closed.

- BMNR dipped during the last session, with volatile crypto prices drawing focus ahead of Monday’s open.

- Ether and bitcoin dipped over the weekend, adding strain to U.S. stocks linked to crypto.

- Traders are reacting to a fresh SEC filing that highlights changes in the company’s leadership team.

BitMine Immersion Technologies (BMNR) slid nearly 6% Friday, ending the day at $25.10. Shares traded in a range from $24.56 to $26.52, with about 45.5 million changing hands, market data shows.

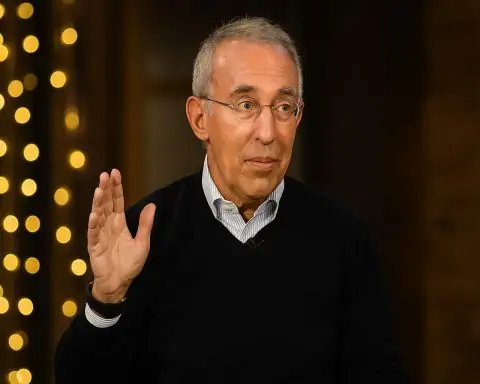

Here’s why it matters: the company is doubling down on Ethereum, the blockchain behind many tokenized assets, with ether as its native token. On Jan. 26, BitMine revealed it held 4.243 million ether as of Jan. 25, plus 193 bitcoin and $682 million in cash. The firm is preparing to ramp up staking—locking tokens to validate transactions and earn yield. Chairman Thomas “Tom” Lee said, “Wall Street has embraced crypto and blockchain assets,” noting, “In the past week, we acquired 40,302 ETH.” (PR Newswire)

Ether fell about 8.5% since Sunday’s close, hovering near $2,422. Bitcoin slid roughly 5.2%, changing hands around $78,747. These moves mark the mood ahead of U.S. markets reopening Monday.

Crypto-linked stocks delivered mixed results on Friday. Riot Platforms tumbled about 8.7%, Marathon Digital Holdings slipped 3.4%, while Strategy Inc. rose close to 4.6%.

BitMine revealed in a Jan. 28 SEC filing that president Erik Nelson parted ways with the company without cause, effective Jan. 22. The separation agreement includes $20,000 in notice pay and $585,000 in severance. The company made a point to clarify that Nelson’s departure wasn’t tied to any conflicts over operations, policies, or practices.

BitMine focuses on bitcoin mining using immersion technology, cooling its computers by submerging them in a special fluid. The firm also sells equipment and offers hosting services. (Reuters)

That said, the stock remains vulnerable to sharp swings. A steep fall in ether prices would cut the value of token holdings and could spark fresh worries about dilution if the company returns to the market for additional funding.

Traders are focused on crypto prices once markets open Monday, keeping an eye on any fresh updates about token holdings or staking. They’ll also be watching closely for any signs of further leadership changes within the company.

Outside crypto, the week kicks off with the ISM manufacturing report due Monday (Feb. 2) at 10:00 a.m. EST. Then Friday (Feb. 6) at 8:30 a.m. EST brings the U.S. employment report. Both releases could sway risk appetite and spill over into crypto-linked stocks like BMNR. (ismworld.org)