Nuburu, Inc. (NYSE American: BURU) — the blue-laser specialist racing to reinvent itself as a defense and security platform — is trading quietly today, as investors digest a flurry of recent deals, a deep quarterly loss, and fresh funding for its key Italian partner Tekne.

As of Monday afternoon, BURU is changing hands around $0.21 per share, up roughly 3% on the day, after trading in a range of roughly $0.205 to $0.214 on volume just above 25 million shares, versus a 20‑day average volume of about 52 million shares. StockAnalysis+3StockAnalysis+3Investing.co…

Year to date, Nuburu is still up more than 60%, but over the last 12 months the stock has fallen more than 50% and trades near the bottom of its 52‑week range between about $0.12 and $0.99 — a classic high-volatility penny stock profile. Yahoo Finance+2StockAnalysis+2

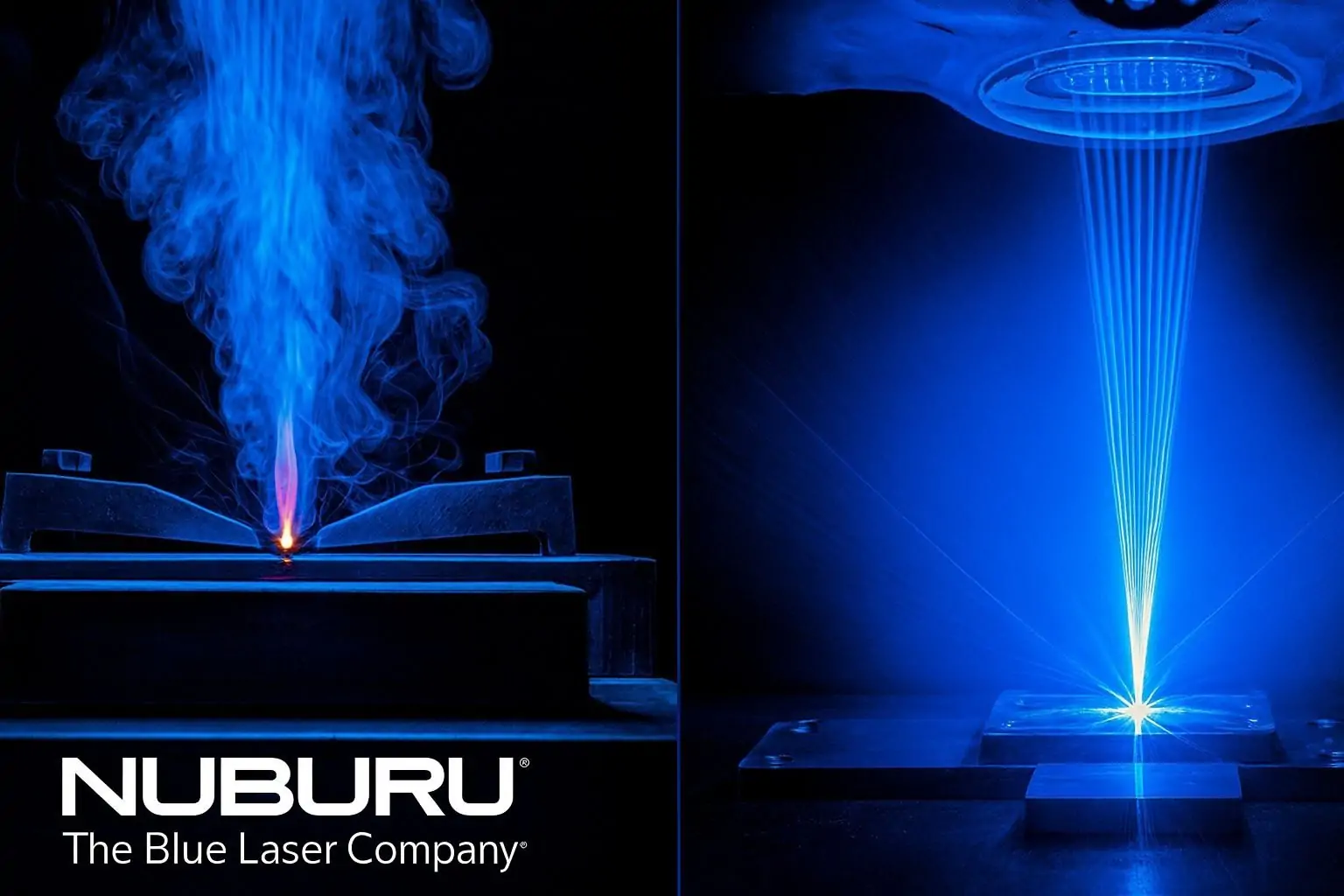

What Nuburu (BURU) Actually Does

Nuburu built its name on high‑power blue laser technology used in industrial welding, additive manufacturing and related applications. ChartMill Under new leadership and a formal “Transformation Plan,” the company is pivoting hard into a “Defense & Security Hub” strategy that combines: Nuburu Investor Relations+1

- Hardware

- Blue‑laser systems for defense and industrial uses

- Special‑mission and electronic‑warfare vehicles via Italian partner Tekne S.p.A. Nuburu Investor Relations+1

- Next‑generation military and commercial drones via a planned joint venture with Maddox Defense Nuburu Investor Relations

- Software

- Orbit S.r.l., an Italian SaaS provider for operational resilience and crisis management, which Nuburu is acquiring in stages to integrate into its defense platform. Nuburu Investor Relations+1

Management is trying to stitch these pieces together into a vertically integrated defense‑tech ecosystem targeting NATO and allied markets — a big narrative for a micro‑cap that still generates minimal revenue and heavy losses.

Today’s Move in BURU: A Quiet Session After Noisy Weeks

Compared with recent spikes and selloffs, today’s action in BURU looks relatively calm:

- Price: ~$0.21, up about 3% vs. Friday’s close Barchart.com

- Intraday range: roughly $0.205–$0.214 Investing.com

- Volume: ~25M shares, well below the ~52M 20‑day average Market Chameleon+1

For context, Nuburu has seen far more dramatic stretches this fall. In early October, the stock jumped roughly 78% in a single week, helped by news of a $12 million capital raise, a new defense unit and a $6.6 million contract, briefly spiking from about $0.12 to $0.34. Stock Titan+1

More recently, shares have whipsawed on a steady drumbeat of press releases about acquisitions, joint ventures, regulatory updates and a NYSE compliance scare that was later resolved. Parameter+2Nuburu Investor Relations+2

Today’s modest gain suggests traders are catching their breath and reassessing the story rather than reacting to a fresh headline.

The Big Drivers Behind BURU Right Now

1. Tekne: €15 Million Support Package and a Deeper Defense Alliance

On November 12, Nuburu announced an “Updated Tekne Agreement” that significantly expands its partnership with Tekne S.p.A., an Italian defense and special‑mission vehicle company. Nuburu Investor Relations+1

Key elements:

- A new industrial framework under Italian “Network Contract” law (Contratto di Rete) to formalize joint R&D, manufacturing, and go‑to‑market work.

- Exclusive distribution rights for Tekne’s products in the Americas, and joint pursuit of NATO, MENA and APAC defense contracts.

- Integration of Nuburu’s laser and Orbit’s resilience software into Tekne’s vehicle programs, including planned drone solutions with Maddox Defense. Nuburu Investor Relations+1

To back that up, Nuburu committed a €15 million financial support package for Tekne, including a €2 million inventory‑monetization tranche and up to €13 million in a convertible shareholder loan tied to Nuburu acquiring an initial 2.9% equity stake. Nuburu Investor Relations+1

On November 19, Nuburu disclosed that it had executed the first €2 million of that support via the Tekne Financial Program, marking the first phase of the €15 million commitment and reinforcing that the alliance is moving from talk to capital deployment. Nuburu Investor Relations+1

For investors, Tekne is one of the core pillars of the BURU bull case: if the partnership unlocks sizable NATO‑aligned vehicle and systems orders, Nuburu could evolve from a tiny laser maker into a meaningful defense integrator. But the financial commitment also tightens the company’s reliance on additional capital and regulatory approvals (including Italy’s “Golden Power” review). Nuburu Investor Relations+2Semiconductor T…

2. Orbit Acquisition: Adding High‑Margin Defense SaaS

On October 7, Nuburu’s defense subsidiary signed a binding agreement to acquire 100% of Orbit S.r.l., a software firm whose “Orbit Open Platform” helps mission‑critical organizations manage operational resilience, continuity and crisis response. Nuburu Investor Relations+2Barchart.com+2

Highlights from that deal:

- Two‑phase transaction: up to $5 million in capital injections for an initial stake (starting with a 10.7% share), followed by full acquisition at a $12.5 million valuation by the end of 2026. Nuburu Investor Relations+1

- Orbit’s own plan projects revenue rising from about $3.2 million in 2026 to $19.3 million in 2028, implying a potentially attractive, recurring SaaS revenue stream if executed. Nuburu Investor Relations+1

Nuburu has already completed the first phase of the Orbit acquisition, and updated commentary suggests it aims to exceed 20% ownership and exert early control ahead of a full buyout. Semiconductor Today+2Nuburu Investor Relat…

In the market’s eyes, Orbit is the software brain of Nuburu’s envisioned Defense & Security Hub — designed to mesh with Tekne’s vehicles and future Maddox drones to provide a “sense–decide–act” loop for defense customers. Nuburu Investor Relations+2Nuburu Investor…

3. Maddox Defense Drone JV: Big Numbers, Early Days

On October 22, Nuburu announced a strategic framework agreement with Maddox Defense to create a joint‑venture drone company controlled by Nuburu Defense. Nuburu Investor Relations+1

The JV aims to:

- Build export‑compliant military UAVs for NATO and allied forces, plus commercial/civilian drones.

- Combine Nuburu’s lasers, Orbit’s software and Tekne’s mobility platforms into integrated drone systems. Nuburu Investor Relations+2Semiconductor T…

- Target about $100 million in annual revenue by 2028, with cumulative revenue of roughly $165 million from 2026–2028, if its plan is met. Nuburu Investor Relations+1

A definitive JV agreement is expected by December 15, 2025, subject to standard closing conditions and regulatory approvals. Nuburu Investor Relations

For BURU holders, this JV is a high‑upside but long‑dated catalyst: it won’t rescue the 2025 income statement, but it underpins management’s growth story in the second half of the decade.

4. Balance Sheet Moves and the Blue-Laser Business Revamp

On November 6, Nuburu outlined progress on its Transformation Plan and said it had strengthened the balance sheet through selective drawdowns under a $100 million Standby Equity Purchase Agreement (SEPA), reductions in legacy payables, and funding for acquisitions. Nuburu Investor Relations+1

The same update flagged:

- Continued work on acquiring a blue‑laser business that would bring engineering staff, manufacturing facilities and customers under one roof. Nuburu Investor Relations

- Rapid progress across its acquisition pipeline (Tekne, Maddox, Orbit) with a view to consolidating hardware and software into a single defense-tech platform. Nuburu Investor Relations+1

In September 2025, Nuburu also priced and later closed a $12 million public offering to fund this defense transformation and provide working capital. Stock Titan+1

These moves have given the company more runway — but at the cost of dilution and an increasingly complex capital structure.

5. NYSE Compliance Drama (and Resolution)

In October, Nuburu received a warning from NYSE American related to a technical issue with the timing of a press release, triggering a sharp pre‑market wobble in BURU. Parameter

By October 16, the company announced it had restored full compliance, emphasizing that the matter was administrative, not financial or operational. Nuburu Investor Relations+1

For a micro‑cap penny stock, listing risk is always on investors’ radar. The swift clean‑up helped ease immediate fears, but it’s a reminder that Nuburu is operating under the watchful eye of regulators while juggling multiple deals and financings.

Q3 2025 Earnings: Heavy Losses, Minimal Revenue

Nuburu’s latest quarterly numbers, released November 14, highlight how early‑stage this transformation still is.

According to an integrated summary of the Q3 2025 10‑Q: Quartr+1

- Q3 2025 revenue: essentially zero

- Nine‑month 2025 revenue: about $142.8K, down from roughly $360K a year earlier

- Q3 2025 net loss: about $22.4 million, versus $4.3 million in Q3 2024

- Nine‑month 2025 net loss: roughly $51.3 million, vs $22.7 million the prior year

- Cash and cash equivalents (Sept. 30, 2025): ~$5.9–6.8 million, with total debt around $32–33 million, implying net debt of roughly $26 million

- Equity (book value): deeply negative, with working capital estimated around –$30 million

Trailing‑twelve‑month data compiled by StockAnalysis show: StockAnalysis

- Revenue of only $9,300

- Net loss of about $55.8 million

- Negative book value and a current ratio of 0.27, indicating short‑term obligations far exceed near‑term assets

Management itself acknowledges “substantial doubt” about Nuburu’s ability to continue as a going concern without additional capital, and expects to rely on further equity or debt raises and its SEPA facility. Quartr

From a fundamentals standpoint, BURU is firmly in high‑risk, capital‑hungry start‑up territory, despite trading on a major U.S. exchange.

Trading Profile: Volatile Penny Stock With Thin Coverage

A few key stats help frame BURU as a trading vehicle: StockAnalysis+2Investing.com+2

- Share price: ~$0.21 (penny stock)

- Market cap: roughly $80–90 million, depending on intraday price and share‑count assumptions

- 52‑week range: about $0.12 to $0.99

- 20‑day average volume: ~52 million shares

- Short interest: about 17.3 million shares, roughly 4% of shares outstanding

Technical services such as ChartMill assign BURU a very low technical rating (1/10), noting that the stock has significantly underperformed the broader market over the past year and continues to trade in the lower portion of its 52‑week band. ChartMill+1

On the analyst side:

- Zacks and Nasdaq show no formal 12‑month price target for Nuburu. Zacks+1

- TipRanks currently lists no Buy or Hold ratings and a cluster of Sell recommendations, but still reports no average target price, reflecting very thin and inconsistent Wall Street coverage. TipRanks

In practice, most of the “coverage” on BURU today comes from retail traders, quant screens and automated news tools, not traditional research desks.

Key Catalysts to Watch After Today

Looking beyond today’s relatively muted trading, here are the milestones likely to matter most for BURU in the coming weeks and months:

- Tekne Network Contract & Golden Power Decision

- The Tekne “Network Contract” is expected by November 30, 2025, formalizing shared operations and R&D. Nuburu Investor Relations+1

- Italy’s Golden Power review will influence whether Nuburu can move from minority support to a larger strategic stake in Tekne. Nuburu Investor Relations+1

- Further Tranches of the Tekne Financial Program

- Investors will watch whether Nuburu can safely fund the remaining €13 million of promised support without overly straining its own balance sheet. Nuburu Investor Relations+2Nuburu Investor…

- Orbit Integration and SaaS Revenue Traction

- Concrete proof that Orbit can win defense and critical‑infrastructure contracts — and approach the multi‑million‑dollar revenue projections cited in the acquisition announcement — would help validate the software side of the story. Nuburu Investor Relations+1

- Maddox Defense JV Signing and Initial Orders

- A definitive JV agreement by mid‑December and early NATO or allied‑customer wins would support management’s 2026–2028 drone revenue ambitions. Nuburu Investor Relations+1

- Blue‑Laser Business Acquisition

- Closing the targeted blue‑laser acquisition by year‑end, as hinted in Nuburu’s November 6 update, would give the company a more complete operational base and possibly new revenue streams. Nuburu Investor Relations+1

- Next Earnings Report (Q4 2025)

- External calendars currently point to late February 2026 — around February 20 — as the tentative window for Nuburu’s next results. Quartr+2Market Chameleon+2

- Investors will be looking for any signs of actual revenue ramp, cash‑burn trends, and updated guidance on acquisitions.

BURU Stock: Opportunity or Value Trap?

Whether BURU looks tempting after today’s move depends largely on your risk tolerance and time horizon.

Bullish investors may focus on:

- Exposure to fast‑growing defense themes: NATO‑aligned drones, special‑mission vehicles, and resilience software. Nuburu Investor Relations+2Nuburu Investor…

- A pipeline of deals (Tekne, Orbit, Maddox, blue‑laser business) that, if executed, could transform Nuburu into a niche defense platform with recurring software revenue layered on top of hardware. Nuburu Investor Relations+2Nuburu Investor…

- The optionality embedded in a sub‑$1 stock with a multi‑year transformation story and high trading liquidity.

Cautious or bearish investors, however, will point to:

- Severe losses, near‑zero current revenue and negative equity, with management openly disclosing going‑concern risks. Quartr+1

- Ongoing dilution risk, given Nuburu’s reliance on equity offerings and a large SEPA facility to fund acquisitions and operations. Stock Titan+2Nuburu Investor Relations+2

- Execution and regulatory risks around multiple cross‑border deals, including Italian Golden Power approvals and complex JV structures. Nuburu Investor Relations+2Nuburu Investor…

- Skewed sentiment from data providers showing no Buy ratings and several Sell ratings, even if the sample size is small. TipRanks+1

For traders, BURU remains a high‑beta, news‑driven penny stock. For long‑term investors, it’s essentially a speculative bet that Nuburu’s ambitious defense‑tech roll‑up can survive the cash burn and evolve into a sustainable business.

Bottom Line

On November 24, 2025, BURU is trading near $0.21, modestly higher on the day but still far below its speculative peaks earlier this year. Behind the quote is an aggressive — and risky — attempt to stitch together blue‑laser hardware, defense vehicles, drone systems and resilience software into a single transatlantic defense platform.

If you’re watching BURU, the next phase is less about day‑to‑day price swings and more about execution:

- Does Tekne funding translate into real orders?

- Does Orbit start generating meaningful SaaS revenue?

- Does the Maddox JV secure concrete contracts rather than just a slide‑deck forecast?

- And can Nuburu extend its financial runway without crushing existing shareholders?

Until those questions are answered, BURU is likely to remain exactly what today’s tape suggests: volatile, speculative, and tightly tethered to every new headline.

This article is for informational purposes only and does not constitute investment advice, a recommendation, or a solicitation to buy or sell any security. Always do your own research and consider consulting a licensed financial adviser before making investment decisions.