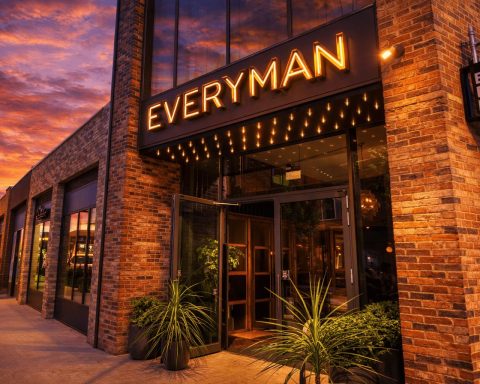

Everyman CEO exits with immediate effect as board taps interim boss after profit warningNEW YORK, December 29, 2025, 07:30 ET

Everyman Media Group said on Monday its chief executive, Alex Scrimgeour, has stepped down with immediate effect and non-executive director Farah Golant will take over as interim CEO. Investegate The move lands weeks after the AIM-listed — London’s junior stock