D-Wave Quantum stock rises on earnings as bookings surge; what QBTS traders watch next

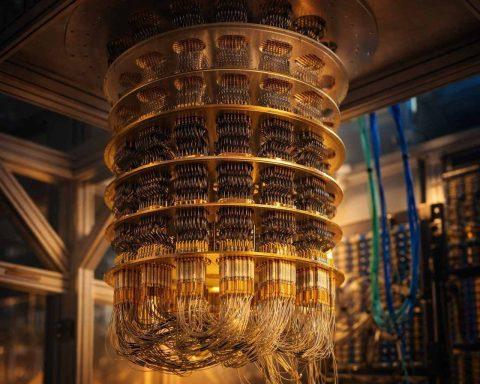

D-Wave Quantum Inc shares closed up 2.4% at $20.13, rising further after hours as the company reported 2025 results and strong 2026 bookings of over $32.8 million through Feb. 25. Fourth-quarter revenue reached $2.75 million, with a net loss of $42.33 million. Cash and marketable securities totaled $884.5 million. Quantum peers IonQ, Rigetti, and Quantum Computing Inc also gained.