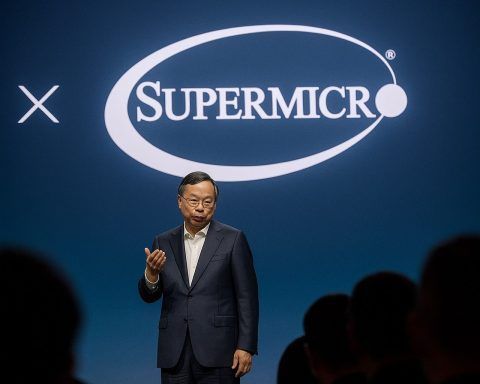

Super Micro Computer (SMCI) Stock on December 1, 2025: AI Server Star Caught Between Growth and Margin Squeeze

Published: December 1, 2025 – This article is for informational purposes only and does not constitute investment advice. SMCI stock today: price action and context Super Micro Computer, Inc. (Supermicro, NASDAQ: SMCI) opened the first trading day of December under pressure as investors continued to digest a messy earnings season, a revenue guidance cut and growing worries about margins. By the close of U.S. trading on Monday, December 1, 2025, SMCI was changing hands around $33.40, down roughly 1.3% on the day, with more than 11 million shares traded. In early trading, Super Micro Computer had already “edged lower” alongside