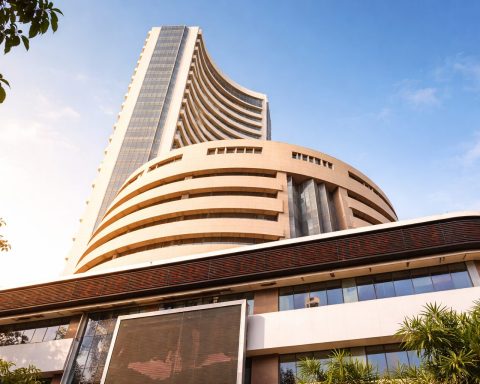

India stock market today: Nifty tops 25,900 again as foreign inflows and trade deal buzz linger

The Nifty 50 closed up 0.26% at 25,935.15 and the Sensex gained 0.25% to 84,273.92, marking a third straight session of gains led by autos and metals. Foreign investors bought 22.55 billion rupees in shares Monday. The rupee strengthened to 90.58 per dollar. Traders await inflation data later this week.