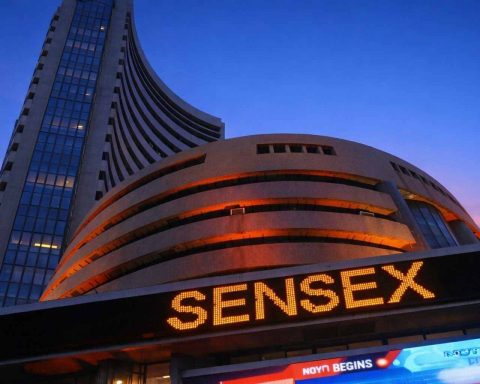

Sensex today: Nifty ends above 25,480 after late fade; IT, metal stocks bounce

Nifty 50 rose 0.23% to 25,482.50 and Sensex edged up 0.06% to 82,276.07 in Mumbai on Wednesday, trimming earlier gains. IT and metal stocks rebounded, while Reliance Industries dropped 2.1% and state-run banks slipped. Tata Steel hit a 52-week high. Investors await GDP data due Feb. 27.