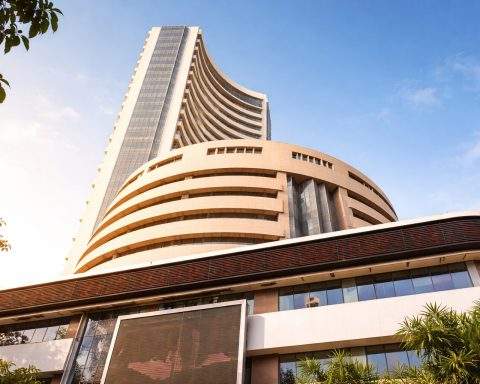

Sensex, Nifty hit three-month lows again as rupee sinks to a record — what to watch next

Indian stocks fell Wednesday, with the Nifty 50 down 0.3% and Sensex off 0.33%, as foreign investors sold $3.23 billion in January. The rupee hit a record low of 91.7425 per dollar. HDFC Bank dropped to a nine-month low, while Reliance Industries and ICICI Bank slid after weak earnings. Ola Electric named Deepak Rastogi CFO and cut its 2026 revenue forecast.