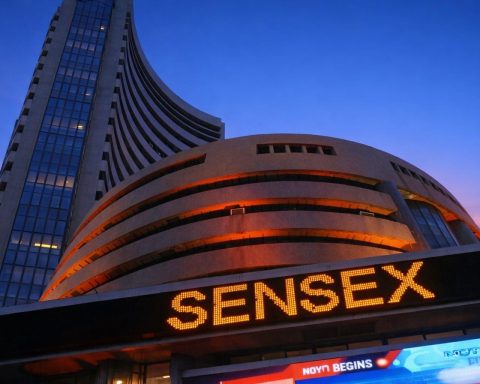

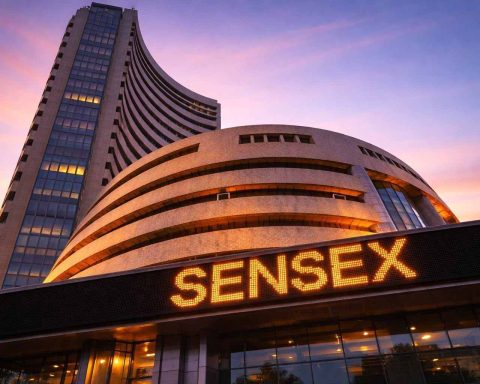

Why Sensex fell today: Reliance, ICICI and Wipro drag Indian stocks as Trump’s Greenland tariff threat bites

The Sensex fell 0.39% and the Nifty 50 slipped 0.42% on Monday, pressured by weak earnings from Reliance, ICICI Bank, and HDFC Bank. Wipro tumbled nearly 10% after a soft revenue forecast. Fresh U.S. tariff threats targeting Greenland and continued foreign investor selling added to the decline.