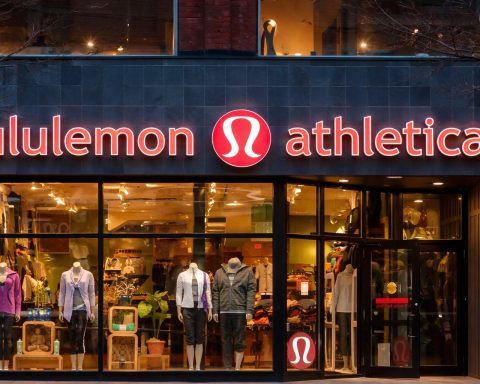

10% yield play on Lululemon draws options interest as SM Energy tops investor search lists

Trefis outlined a put-options trade on Lululemon targeting a 10.5% annualized yield as shares trade near $210, about 50% below their 52-week high. TheStreet Pro noted Lululemon’s forward valuation now trails the S&P 500. Founder Chip Wilson is backing new board nominees, signaling a proxy fight. Zacks reported SM Energy as heavily searched, with earnings estimates down 4.8% in 30 days.