D-Wave Quantum stock slides 5% as share-resale filing hangs over QBTS trade

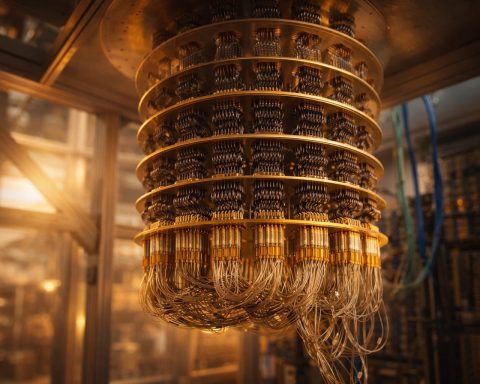

D-Wave Quantum Inc shares fell 5.4% to $25.94 early Friday after a prospectus registered the resale of over 10.4 million shares linked to its Quantum Circuits acquisition. Trading volume topped 23 million shares. D-Wave closed the Quantum Circuits deal this week, adding gate-model technology to its offerings. Venture investors including Sequoia and ARCH are among those eligible to sell shares.