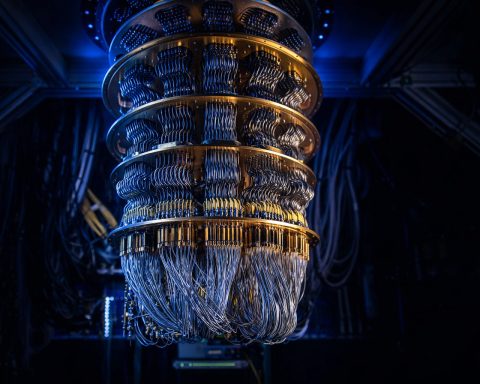

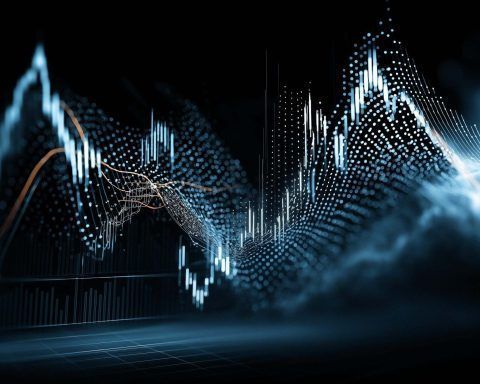

Quantum Computing Stocks Week Ahead (Dec 22–26, 2025): IonQ, D-Wave, Rigetti and QUBT Face a Holiday-Shortened Test After Fresh Wall Street Calls

Quantum computing stocks face volatile trading in the holiday-shortened week of December 22–26, 2025, as Wall Street coverage and price targets increase. U.S. markets close early December 24 and remain shut December 25. Thin liquidity and new analyst reports could trigger sharp moves in IonQ, D-Wave, Rigetti, and Quantum Computing Inc. Key macro data releases may also sway sentiment.